GDP Growth - Only 1.08% Expected In Q1

GDP Growth - Citi Economic Surprise Index Crashes

In this article, we will review some top-down analyses of the economy.

As you can see from the chart below, the Citi Economic Surprise index fell 31.1 points in one day which is the biggest one day drop since January 2006. The Citi surprise index measures how economic reports do, compared to expectations.

Clearly, economists didn’t foresee the economic slowdown in the past few months. The stock market saw this coming in real time as it fell in Q4 when the economic deceleration picked up steam.

(Click on image to enlarge)

Some sentiment reports weakened in January and February because of the shutdown and stock market volatility. But those don’t matter. They will be reversed because the government made a deal to stay open. And also because the stock market has gained back most of its Q4 losses.

This index was also hurt by the December retail sales report, the November business inventories report, and the January industrial production report. The index isn’t as much of a leading indicator as some think it is if results from November and December are still affecting it.

This decline negatively impacted Q1 GDP tracking estimates. I previously used various global economic surprise indexes to show how America is outperforming.

It might still be outperforming if Europe continues to plummet. It’s worth noting that the big crash in January 2006 didn’t mean much as there wasn’t a recession until December 2007. If there’s a recession in March 2021, it doesn’t mean stocks need to fall now. It’s likely that time frame won’t repeat. I’m just explaining how this doesn’t mean the economy is crashing.

GDP Growth - Weekly Leading Index Falls Slightly

As you can see from the chart below, the ECRI leading index is down 4.3% year over year. That's worse than the 4% decline it showed last week.

Even with the easier comparison, the growth rate fell as the index was down 0.7. This indicator seems to have followed the stock market recently as it fell in the fall and increased since January.

However, that’s looking at it too closely. The takeaway here is that the economy will still slow in the next 6 months because it is negative. But it never got as bad as it did in the past two recessions. I expect the early January growth bottom to hold because comps will be getting much easier.

Stocks shouldn’t be rallying if growth is going to slow for the whole year. That makes this indicator extremely contrarian.

(Click on image to enlarge)

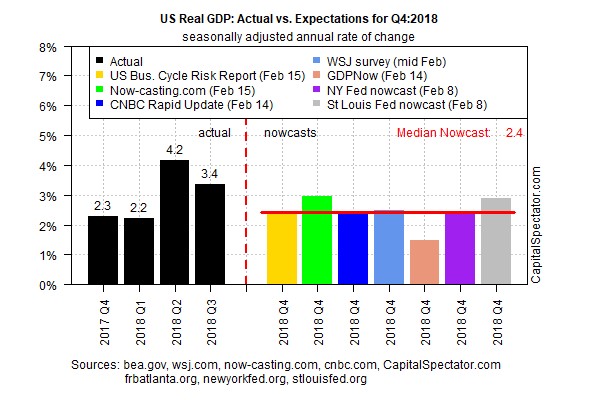

GDP Growth - Latest Forecasts

As of mid-February, it seems like the slowing growth trend that started in Q3 will continue into Q4 and Q1. I wouldn’t be surprised if Q1 is the bottom for growth. But that goes against what ECRI suggests.

Personally, I think the stock market rally will boost optimism in the spring and I think home sales will pick up. Furthermore, Q2 will get a boost from the government shutdown, while Q1 is being hurt by it.

We may see a bit of the post-shutdown bounce in March. It’s probably too early for one in February because government workers were anticipating another shutdown starting on February 15th.

As you can see from the chart below, the median Nowcast is 2.4% which is much below the 3.4% growth in Q3. I have the updated stats from the St. Louis Fed and NY Fed Nowcasts which slightly alter the average. The St. Louis Fed expects 2.84% growth as of February 15th.

That’s slightly below what’s shown in this chart. The Q4 NY Fed Nowcast took a big tumble from 2.41% to 2.23%. Industrial production and retail sales reports are responsible for over 100% of the negative change.

The industrial production report wasn’t even in Q4 as it was from January.

The estimate for Q1 growth cratered just like the tracking estimates made by private banks which I reviewed in the article on the retail sales report. It fell from 2.17% to 1.08%. I haven’t seen the NY Fed Nowcast predict negative growth since I’ve been following it.

We might get close to that if the February data is weak. This estimate also fell because of the retail sales and industrial production reports. Retail sales report was in Q4, so this change in the tracking estimate is far from permanent. It’s possible the weak retail sales report was a temporary blip.

(Click on image to enlarge)

GDP Growth - What Jobless Claims Mean

4 week moving average of jobless claims bottomed in September as the stock market topped. Lately, the negative correlation has waned as the 4-week average is up, while stocks are up.

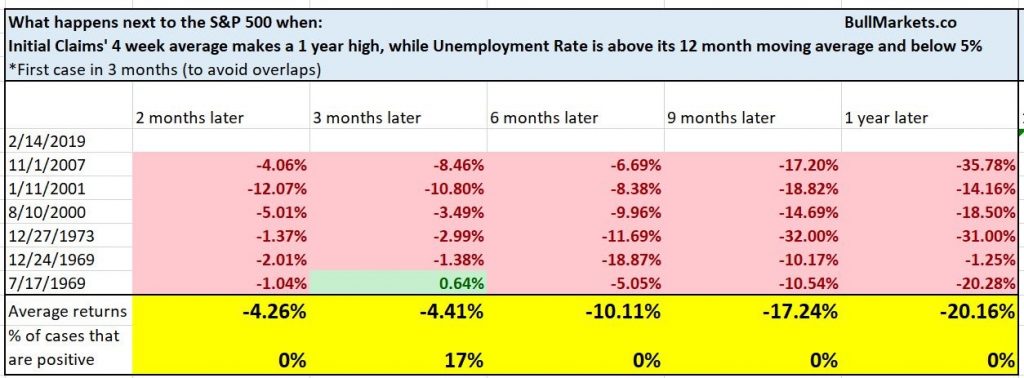

The table below shows the stock market’s performance when the 4-week average makes a 1 year high, while the unemployment rate is above its 12-month average and below 5%. That first case in 3 months is used to avoid overlaps.

Currently, the jobless claims are at their one year high (250 above the nearest week). Unemployment rate is below 5% (at 4%). And the unemployment rate is 0.1% above its 12-month moving average.

As the table shows, out of the 6 examples, they all have negative performance 2 months later, 6 months later, 9 months later, and 1 year later.

Each subsequent period has a lower average as the 1-year average performance is -20.16%. Hopes for the stock market are that the government shutdown boosted jobless claims temporarily and that the unemployment rate only increased because more people came off the sidelines into the labor market because it is so strong.

(Click on image to enlarge)

GDP Growth - Conclusion

This article included a bunch of negative indicators. Recently economic reports have been missing estimates. GDP estimates for both Q4 and Q1 have fallen. This potentially makes for a 3 quarter streak where growth slows.

When the jobless claims and the unemployment rate rise at the end of the cycle, it almost always is bad news for stocks. This indicator can easily be reversed if the claims fall slightly in the next couple of weeks. So beware of shorting with reckless abandon.