GBP/USD: Three Reasons For The Big Breakout Above 1.40, Next Levels To Watch

The triple-top has been breached – finally – and GBP/USD is now trading above the psychological barrier of 1.40 and at the highest February 25, roughly ten weeks ago. There are three main upside drivers for the currency pair, which could continue underpinning its rally.

1) Scotland

The Scottish National Party (SNP) won the regional elections north of the border but fell short of an absolute majority. While it continues pushing for a new independence referendum – backed by the pro-plebiscite Greens – its lack of a sweeping victory has resulted in some relief for sterling.

Moreover, the ruling Conservatives won a closely watched by-election in Hartlepool, cementing their grip on power and providing additional political stability.

2) Reopening

UK Prime Minister Boris Johnson is set to deliver a statement announcing new measures related to Britain’s reopening. The vaccination campaign has dramatically cut COVID-19 cases and some speculate that the government could accelerate the timeline for reopening.

Over half of the population received at least one jab and roughly a quarter have been given the second dose as well. In the US, the pace has been slowing down. UK growth figures are awaited next week.

3) Nonfarm Payrolls shocker

American hiring fell far short of expectations – only 266,000 jobs were added in April, against nearly one million expected. While seasonal adjustments may have been skewed due to the pandemic, the markets’ verdict is clear – the Federal Reserve is in no rush to taper bond buying nor raise rates. The resulting sell-off in the dollar is extending to Monday.

Minnesota Fed President Neel Kashkari said the economy is still in “a deep hole.” His colleague Charles Evans of the Chicago Fed speaks later in the day, while investors await inflation and consumer statistics later this week.

Pound/dollar seems to have all the ingredients to extend its gains, at least fundamentally.

GBP/USD Technical Analysis

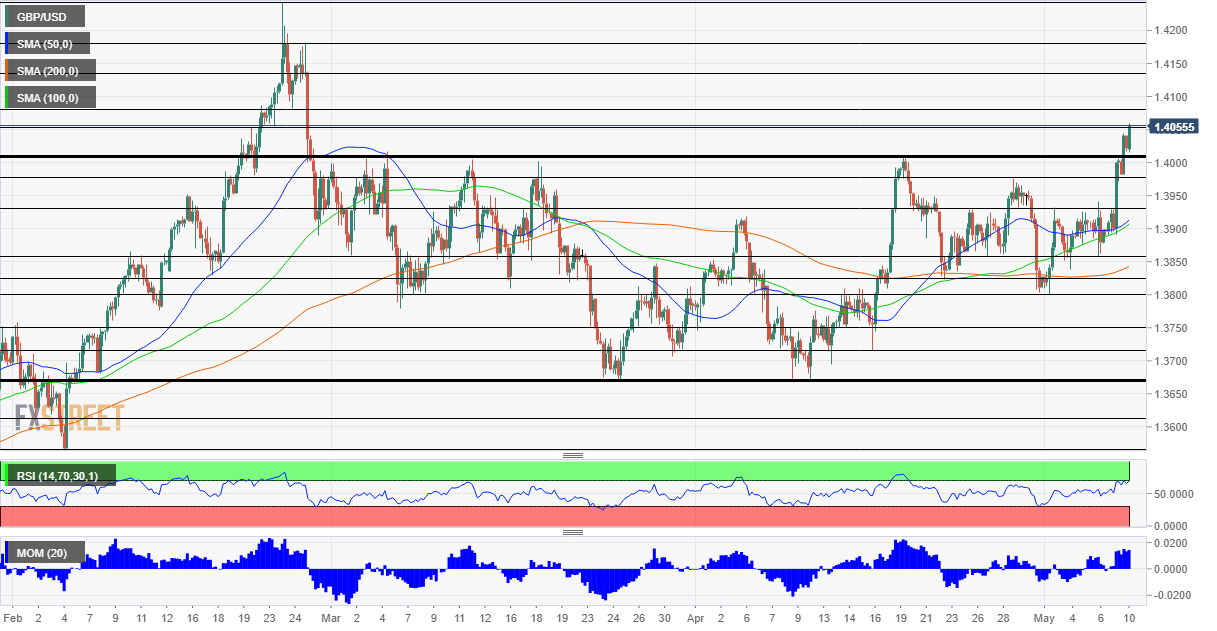

(Click on image to enlarge)

The currency pair is benefiting from upside momentum on the four-hour chart and trades well above the 50, 100 and 200 Simple Moving Averages. On the other hand, the Relative Strength Index is nearing the 70 level – representing overbought conditions.

The next level to watch on the upside is 1.4080, which provided support in late February. It is followed by 1.4140, a battle line, and then by 1.4180, a swing high before cable began its climbdown. The 2021 peak of 1.4240 is next.

Support is at 1.4010, the broken triple-top, followed by 1.3980, 1.3930 and 1.3860.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more