GBP/USD Surrenders To Dollar Strength, Can The BoE Bail It Out?

No fewer than ten million Brits have received vaccines – yet sterling has been unable to weather the dollar’s strength. GBP/USD has reverted to levels seen in mid-January.

The dollar has been buoyed by rising US Treasury yields – as investors move away from bonds amid upbeat prospects for the world’s largest economy. While President Joe Biden continues negotiating with moderates in both parties, House Democrats passed another hurdle en route to passing a large stimulus bill without Republican support.

While the White House is unlikely to get its desired $1.9 trillion stimulus bill, it will likely be higher than expected. Apart from the economic boost, it means more debt issuance prompting a sell-off of US debt.

The picture also looks brighter for the US economy after ADP’s jobs report beat estimates with a gain of 174,000 private-sector jobs in January and the ISM Services Purchasing Managers’ Index beat estimates by 58.7 points. Both serve as leading indicators toward Friday’s Nonfarm Payrolls. On Thursday, weekly jobless claims are forecast to extend their decline from high levels.

Circling back to the UK, the main event of the day and the week is the Bank of England’s “Super Thursday.” Apart from probably leaving its policy unchanged, the BOE publishes its Monetary Policy Report. Will the bank upgrade its forecast given Britain’s robust vaccination campaign? Apart from ramping up immunization, coronavirus cases and hospitalizations have extended their decline. On the other hand, the recent lockdown – and Brexit – may have weighed on the economy.

Sterling traders will also watch Governor Andrew Bailey’s comments on negative interest rates. The BOE is set to conclude its review and may put an end to speculation about setting sub-zero borrowing costs – a specter that has been weighing on the pound.

All in all, despite considerable dollar strength, the pound has reasons to fight back.

GBP/USD Technical Analysis

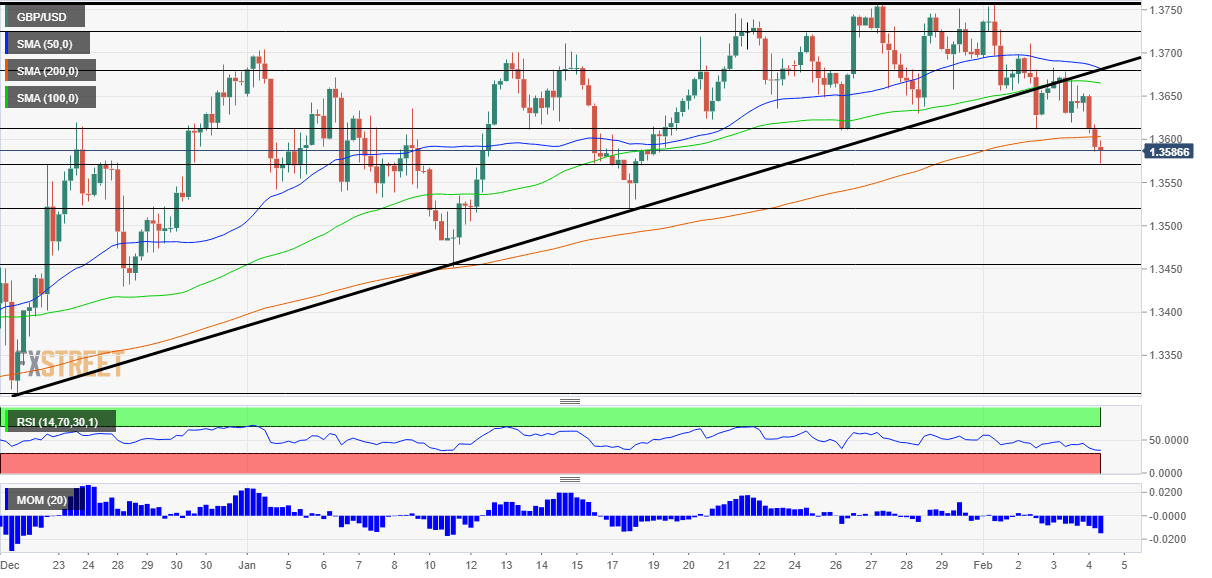

(Click on image to enlarge)

Pound/dollar’s break below the uptrend support line has proved significant, resulting in an extended fall to the downside. On its way down, cable broke below the 200 Simple Moving Average on the four-hour chart, a bearish sign. On the other hand, the Relative Strength Index is nearing 30 – about to enter oversold conditions.

Support awaits at 1.3570, the daily low, followed by 1.3530, a swing low in mid-January. It is followed by 1.3450.

Some resistance awaits at 1.3610, the previous trough, followed by 1.3680, a peak earlier in the week. The next level to watch is 1.3725.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more