GBP/USD Set To Suffer From Biden Going Big Again, Upbeat US Jobs Data

All hail King Dollar – the greenback has been building on infrastructure plans to rise, and more details are due in the upcoming week alongside the all-important Nonfarm Payrolls report. In the UK, extending the vaccination campaign remains critical and GDP is also of interest.

This week in GBP/USD: Dollar finds new reasons to rise

Yields are down but the dollar is up – the correlation that has dominated trading has faded away, but the greenback remains strong. The world’s reserve currency has been benefiting from two major factors.

First, US President Joe Biden is set to unveil a massive $3 trillion infrastructure program that would boost the economy and perhaps push inflation higher. In turn, that could cause the Federal Reserve to raise interest rates sooner than later – even though Chair Jerome Powell sees price rises as temporary.

The drop in yields can be explained by the plan’s funding – partially via tax hikes. An increase in revenue means less debt issuance and a slower supply means higher prices for Treasury and thus lower returns on them.

A potential increase in the tax bill is already dampening investors’ mood on Wall Street and the drop in equity prices results in a risk-off mood. The safe-haven dollar is a beneficiary.

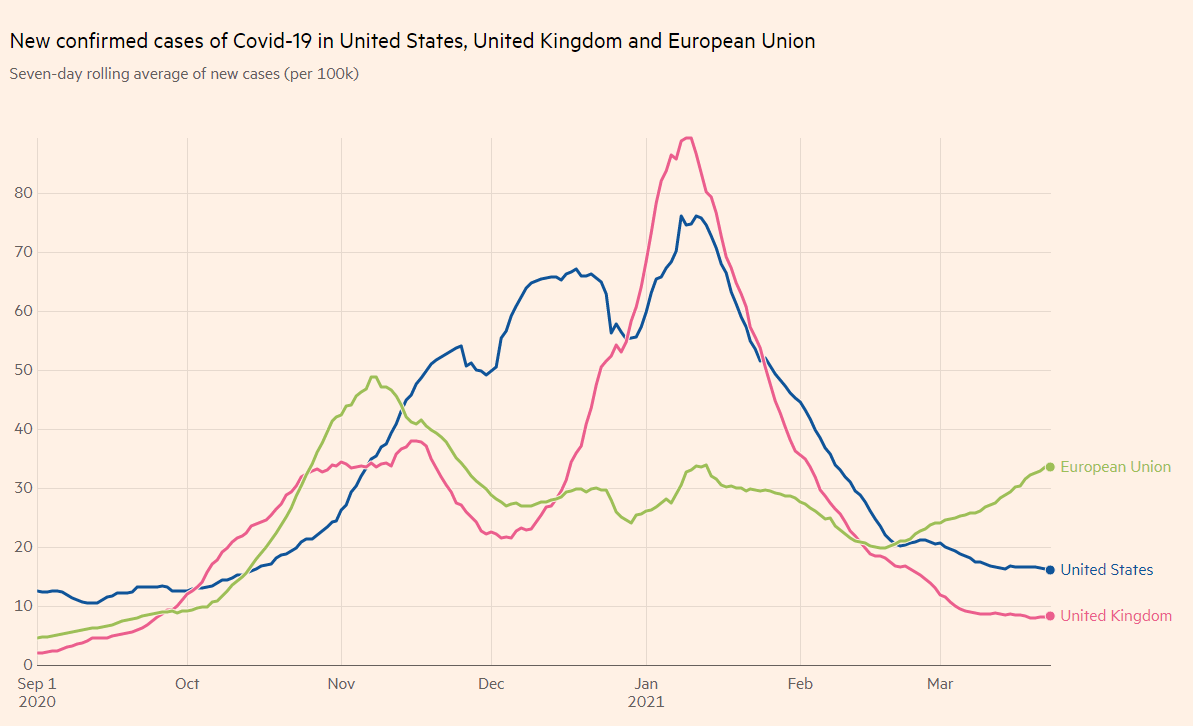

The gloomier market mood is also fueled by growing concerns about global growth due to Europe’s sluggish vaccination campaign, which is partially fueling another wave of COVID-19 cases in the old continent. EU leaders are venting frustration at British-based AstraZeneca and the UK. Britain’s cases continue falling.

Covid infections in the US, the EU, and the UK

(Click on image to enlarge)

Source: FT

At the time of writing, Brussels and London seem to be nearing a compromise that would not jeopardize shipments and manufacturing of vaccine doses. However, a slowdown in deliveries to the UK – by India and not only the EU – has been weighing on sterling.

The pound also suffered from mostly disappointing British economic figures. While the Unemployment Rate dropped to 5% in January, jobless claims leaped by 86,500, far worse than expected. Inflation also missed estimates with 0.4% YoY in February, while the only solace came from Markit’s Purchasing Managers’ Indexes for March, which showed better growth prospects. The Services PMI’s jump to 56.8 is especially encouraging.

In the US, the fall in Durable Goods Orders in February was partly due to the “deep freeze” storm.

UK events: Vaccine rollout, GDP figures

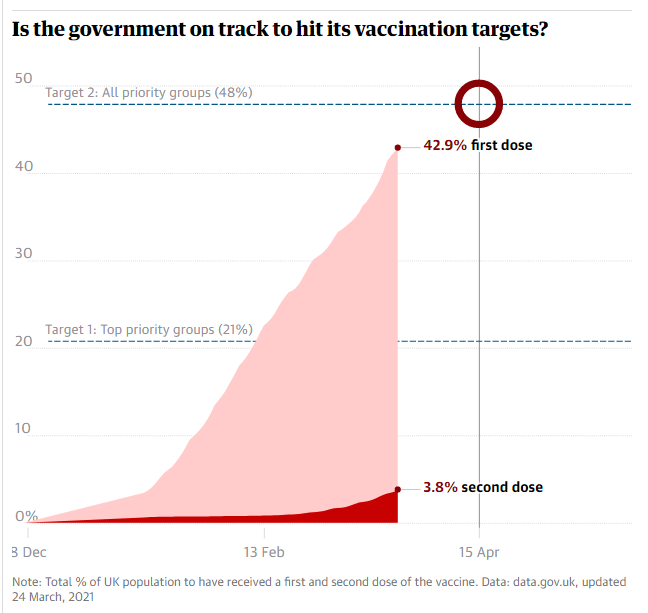

Over 50% of adult Brits have already received at least one vaccine dose – or 42.9% of the population. However, only around 4% have received their second dose and are on course to full immunization. This second jab remains at risk amid supply issues. Will enough inoculations arrive from India? Will Britain compromise with the EU over exports of vaccines? These remain open questions.

Source: The Guardian

If the vaccination campaign suffers only a minor setback and cases continue falling, sterling will likely remain supported. However, a major halt to the rollout and an uptick in cases could send the pound plunging. The currency has outperformed its peers in large part thanks to Brits’ rolling up their sleeves, and any change would risk this rally.

Brexit talks on services remain on the backburner for now, at least while the EU and the UK battle over vaccines.

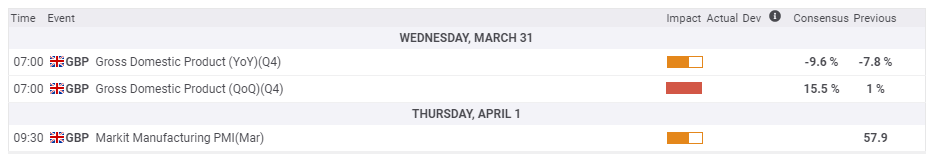

The economic calendar leading up to Good Friday is relatively light, but final GDP figures for the fourth quarter stand out. The UK was struggling with lockdowns through part of this period. The economy’s output at the end of 2020 serves as a base for the recovery. Markit’s final PMIs are also of interest.

Here is the list of UK events from the FXStreet calendar:

(Click on image to enlarge)

US events: New spending and Nonfarm Payrolls eyed

Three trillion dollars – that may be the new bill that the White House presents to Congress, but the timing of spending is critical. President Biden addresses the nation from Pittsburgh on Wednesday and is set to lay out details of his infrastructure spending plan.

The Commander-in-Chief and his advisers are contemplating splitting legislation into two pieces – spending on physical infrastructure first and then a separate bill that would include tax hikes and “human infrastructure.”

Waiting with the second, more controversial part for later in the year would make passing easier and would alleviate some pressure on the dollar. However, if Biden goes big again – like in the $1.9 trillion covid relief package – the greenback would have more reasons to rise.

Aides may release an excerpt of the speech ahead of time and rumors may move markets even before any official document comes out.

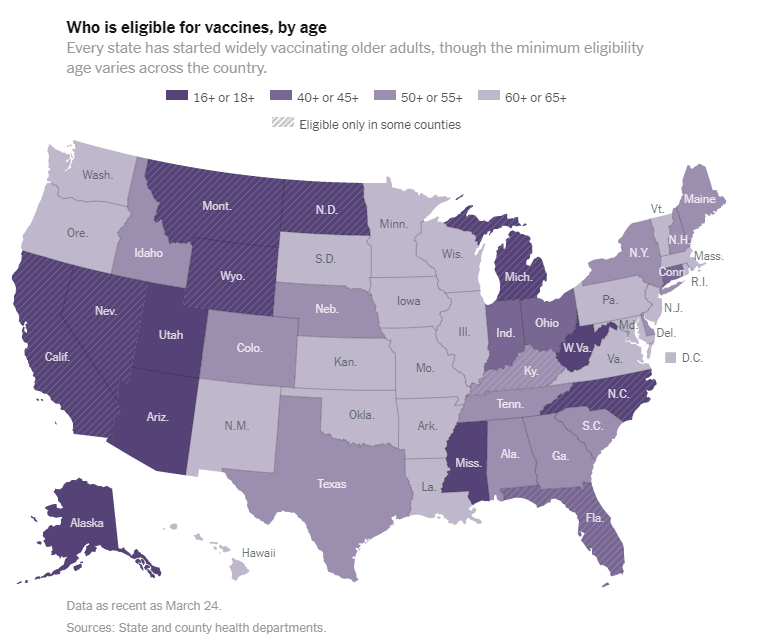

America’s vaccination campaign is on course to reach 50% of the population by mid-May after topping 25% in late March. The White House aims for states to offer jabs to all adults by May 1, and some have already opened up immunization to all. An increase in availability is due as the page turns to April. Any acceleration would be dollar-positive, while hiccups could weigh on the greenback:

Vaccine eligibility in the US:

(Click on image to enlarge)

Source: NYT

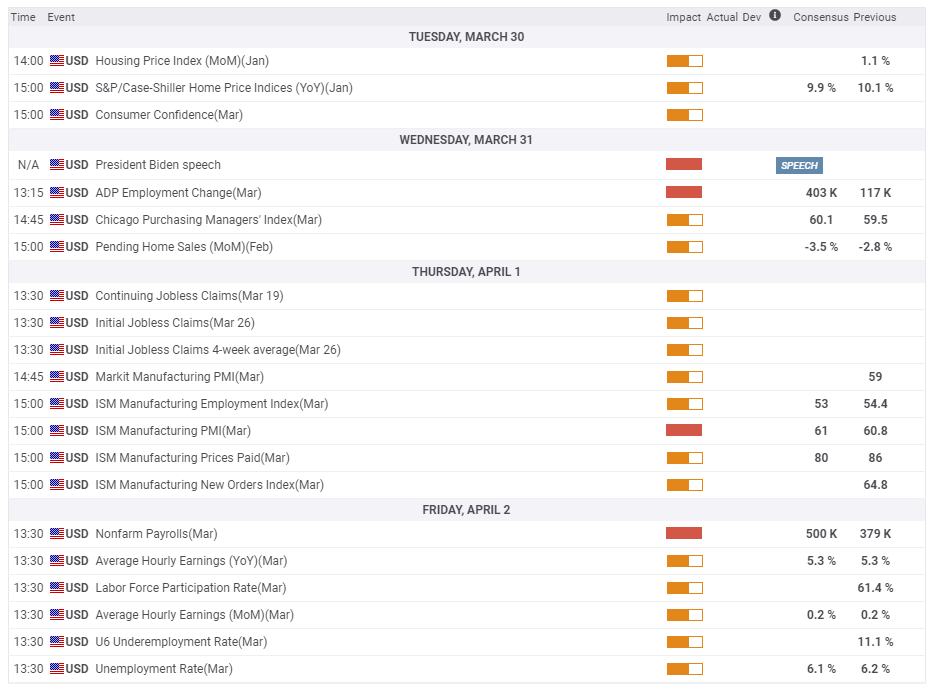

In the latter half of the week, the focus shifts to the Nonfarm Payrolls report for March. Economists expect an acceleration in hiring to 500,000 after 379,000 in February. As long as participation remains low, any decline in the Unemployment Rate will probably be disregarded by markets.

The Fed wants to see the current 9.5 million people out of work return to the workforce as soon as possible, making revisions to previous figures more significant than beforehand.

ADP’s jobs report and the ISM Manufacturing PMI figures for March will serve as a hint toward the NFP and will help shape expectations. However, perhaps the lack of liquidity could have a greater impact on the market reaction – the NFP is released on Good Friday.

Here are the upcoming top US events this week:

(Click on image to enlarge)

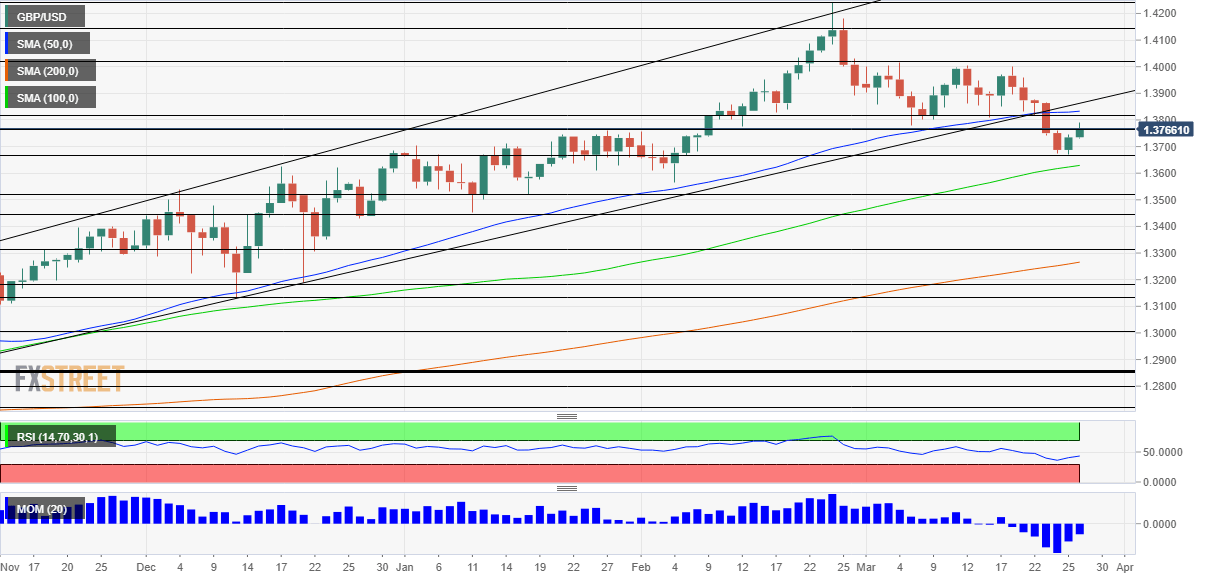

GBP/USD technical analysis

Pound/dollar has slipped below the uptrend support line that accompanied it since the autumn of 2020 and also dropped under the 50-day Simple Moving Average. And while momentum is off its lows, it remains to the downside. All in all, bears are gradually taking over.

Initial support is at the March low of 1.3670. It is followed by 1.3550, a stepping stone on the way up from February. Another such point is 1.3460, which dates back to January. Further down, 1.3300 is eyed.

Looking up, 1.3775 remains a battle line after separating ranges earlier in the year. It is followed by 1.3810, which provided support in March and nearly converges with the 50-day SMA. The next significant cap is 1.40 – a psychologically significant line of resistance.

(Click on image to enlarge)

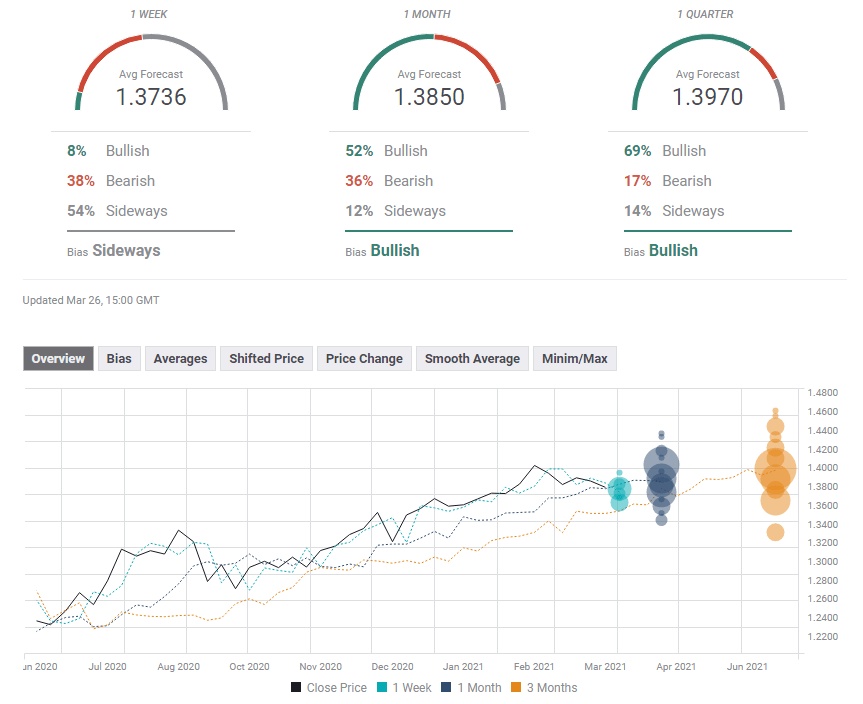

GBP/USD sentiment

Dollar strength will likely continue for another week and overwhelm any recovery in sterling – even if Britain’s vaccination campaign remains on track.

The FXStreet Forecast Poll is showing that the currency pair may wobble in the same lower range in the next week before staging a rally back to previous levels. The long-term average target underwent an upgrade.

(Click on image to enlarge)

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more