GBP/USD Set To Resist Dollar Strength And Push Higher, Buy Opportunity?

“Nobody is safe until everybody is safe” – these words of unity from UK Prime Minister Boris Johnson and his colleagues in Germany and France have come after a cross-Channel row over vaccines and serve to calm nerves and supports sterling. Concerns about deliveries of inoculations have now subsided.

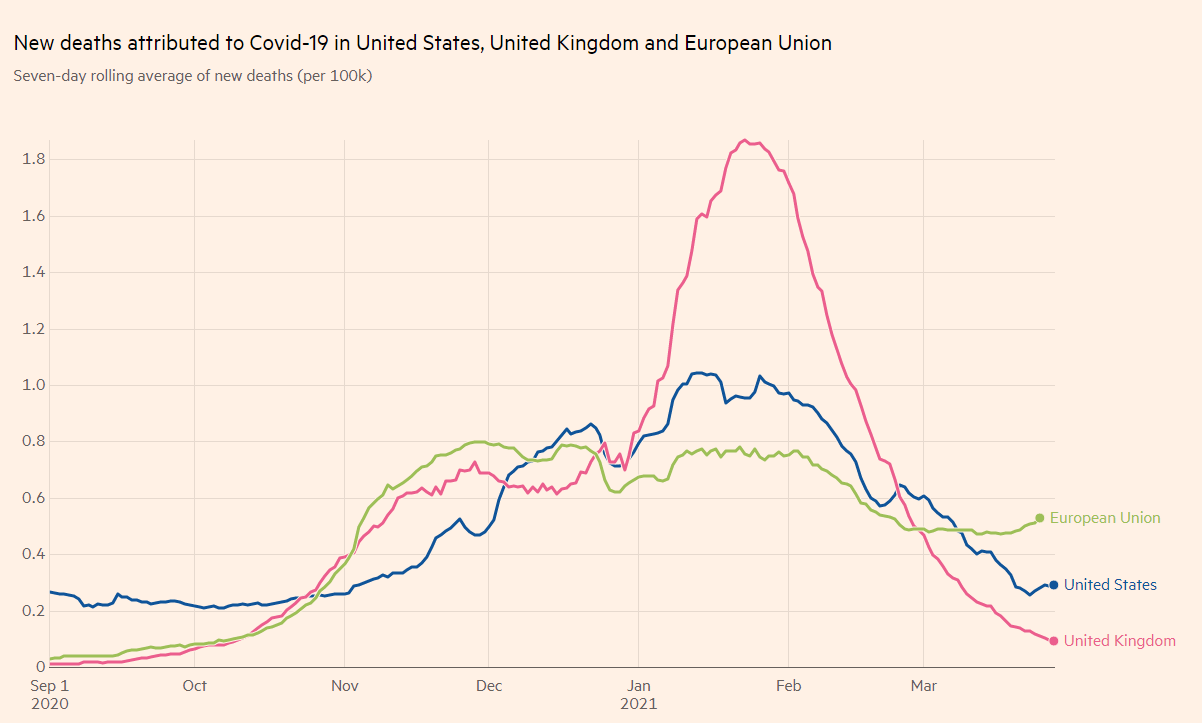

Even if the UK’s immunization campaign somewhat slows down, it has reached nearly 50% of the population with at least one dose and the results are clear – cases and hospitalizations are falling. Moreover, London recorded no COVID-19 deaths on Monday – the first such feat in 2021.

The comparison to continental Europe is overwhelming, but Britain is also beating the US –not only vaccinations but also in infections. America’s CDC warned of an “impending doom” despite the rapid immunization drive.

(Click on image to enlarge)

Source: FT

On the other hand, the dollar is on the move, gaining ground alongside higher bond yields. President Joe Biden is set to unveil his infrastructure spending plan on Wednesday and he may refrain from introducing new taxes in the first phase. That implies higher debt, more bond issuance, and therefore rising returns on Uncle Sam’s IOUs.

Moreover, the White House grand plans – which include huge wind farms and other green initiatives – may push inflation higher. If the Federal Reserve is forced to hike borrowing costs, that would also support the greenback.

A gauge of how Americans feel about the recovery comes from the Conference Board’s Consumer Confidence measure for March. An increase is on the cards.

All in all, the dollar has reasons to rise, but the UK may overcome such strength thanks to its virus/vaccine advantage.

GBP/USD Technical Analysis

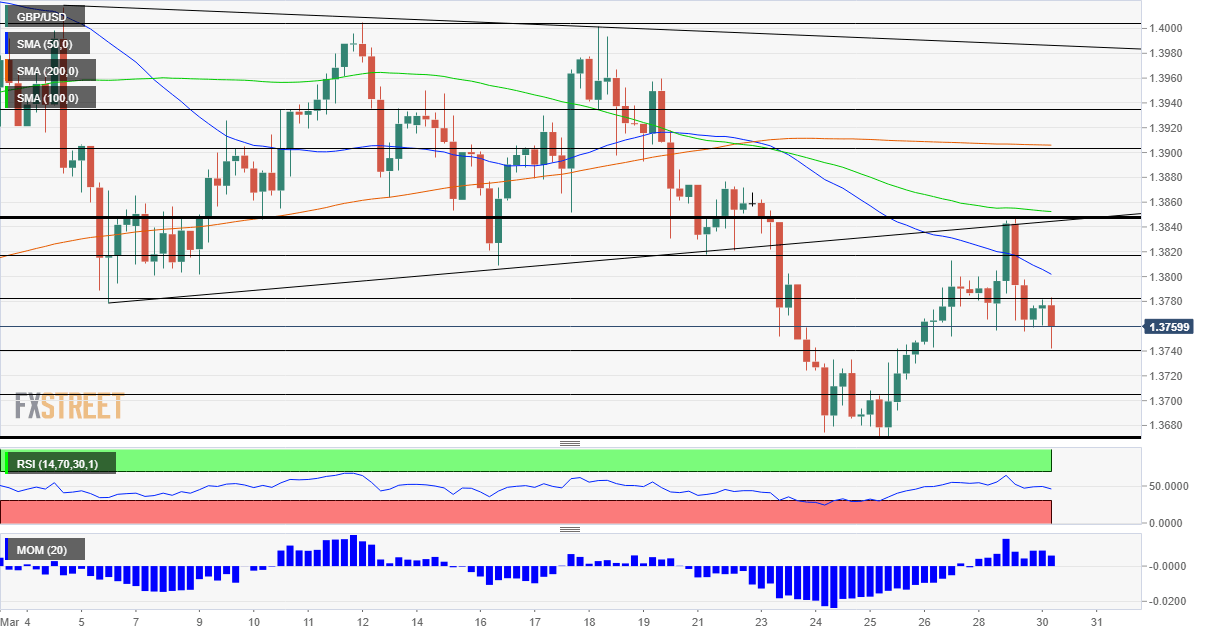

(Click on image to enlarge)

Pound/dollar is trading below the 50, 100 and 200 Simple Moving Average on the four-hour chart but is benefiting from upside momentum. The RSI is stable.

Support awaits at 1.3740, the daily low, followed by 1.37, a round number. The March low of 1.3670 is the next cushion to watch.

Some resistance awaits at 1.3780, a support line from early March. It is followed by 1.3820, a separator of ranges from last week, and then by 1.3845, which worked in both directions in recent weeks.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more