GBP/USD Ready To Rebound As Yields Fall, UK Reopening Nears, Bulls In Control

Two steps forward after one step backward? That has been cable’s pattern in recent weeks and there is no reason it cannot continue all the way to 1.40. The current downside correction has been the result of a strengthening US dollar which is driven by elevated stimulus expectations.

President Joe Biden has been working to pass his proposed $1.9 trillion coronavirus relief package and Democrats are reportedly planning to pass it by February 26. While there may be compromises on potential delays, it is clear that America will get a big fiscal boost. While stock markets continue cheering these prospects, concerns about massive debt issuance and potential inflation have driven investors away from bonds. The resulting surge in yields is making the dollar more attractive.

However, the dollar may fall back down due to three reasons. First, bargain-seekers may jump back into bonds at current prices, lowering yields back from levels seen before the pandemic.

Secondly, consumer prices are hamstrung by the still-struggling economy. Around 10 million Americans are still out of work due to the pandemic and that cripples spending. Economists expect US Retail Sales figures for January to bounce after two miserable months but that may be wishful thinking.

Third, and perhaps most importantly, the Federal Reserve is set to continue easing despite fears of higher inflation. The world’s most powerful central bank changed its policy last year and it is now prioritizing full employment, even at the expense of high inflation. The Fed previously acted too soon to chase the ghosts of price rises only to prematurely choke the recovery.

The FOMC Meeting Minutes published later in the day will likely confirm the Washington-based institution’s Laissez-faire approach to inflation – ensuring traders that the Fed is there to buy bonds, lower yields and support markets.

Across the pond in London, Prime Minister Boris Johnson is under growing pressure to bring as much economic activity as possible back to life. He is set to announce changes on Monday, following a sharp drop in COVID-19 cases, hospitalizations, and deaths.

Moreover, the UK has delivered jabs to around 23% of its population and continues its immunization campaign at a rapid pace. That ensures Britain’s economic edge for some time.

All in all, there is room for cable to recover and perhaps even attack 1.40.

GBP/USD Technical Analysis

(Click on image to enlarge)

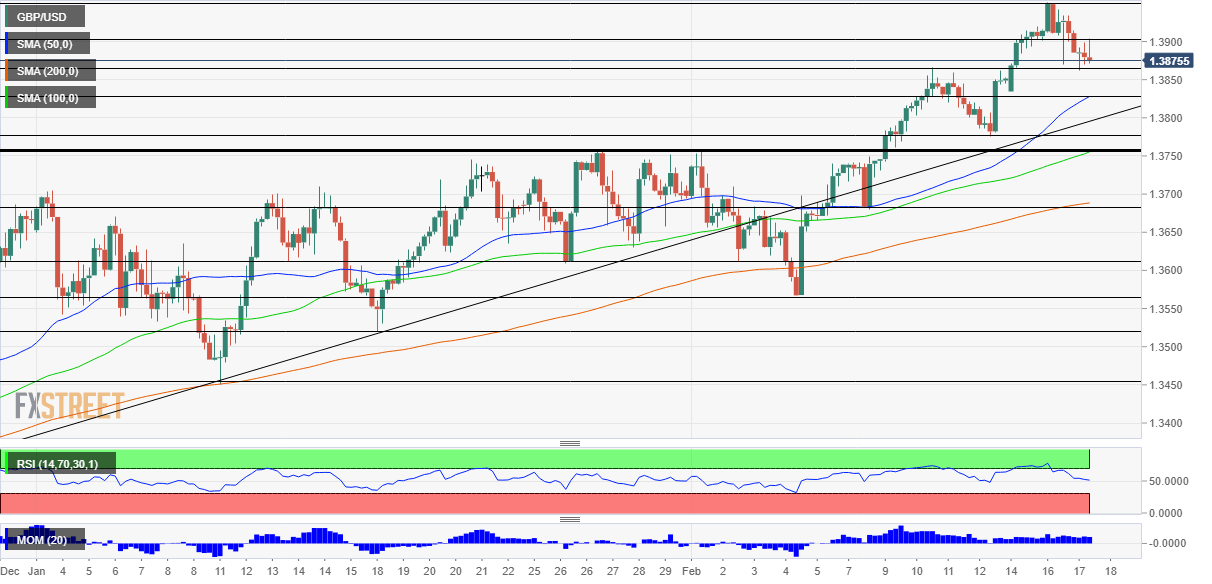

Pound/dollar continues benefiting from upside momentum on the four-hour chart and trades above the 50, 100 and 200 Simple Moving Averages. The Relative Strength Index has retreated from the 70 level – away from overbought conditions.

Support awaits at the daily low of 1.3860, followed by 1.3825, where the 50 SMA hits the price. The next levels to watch are 1.3770 and 1.3750.

Some resistance is at 1.39, the round number, and then by 1.3950, the 2021 peak. Further above, the psychologically significant 1.40 level looms.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more