GBP/USD Price Outlook: Pound Testing Key Resistance Amid Brexit Talks

The British Pound has rallied more than 3.7% against the US Dollar off the monthly lows despite a steady stream of Brexit headlines. The advance takes price into a critical resistance zone that if broken, would shift the broader focus higher in Sterling. These are the updated targets and invalidation levels that matter on the GBP/USD charts.

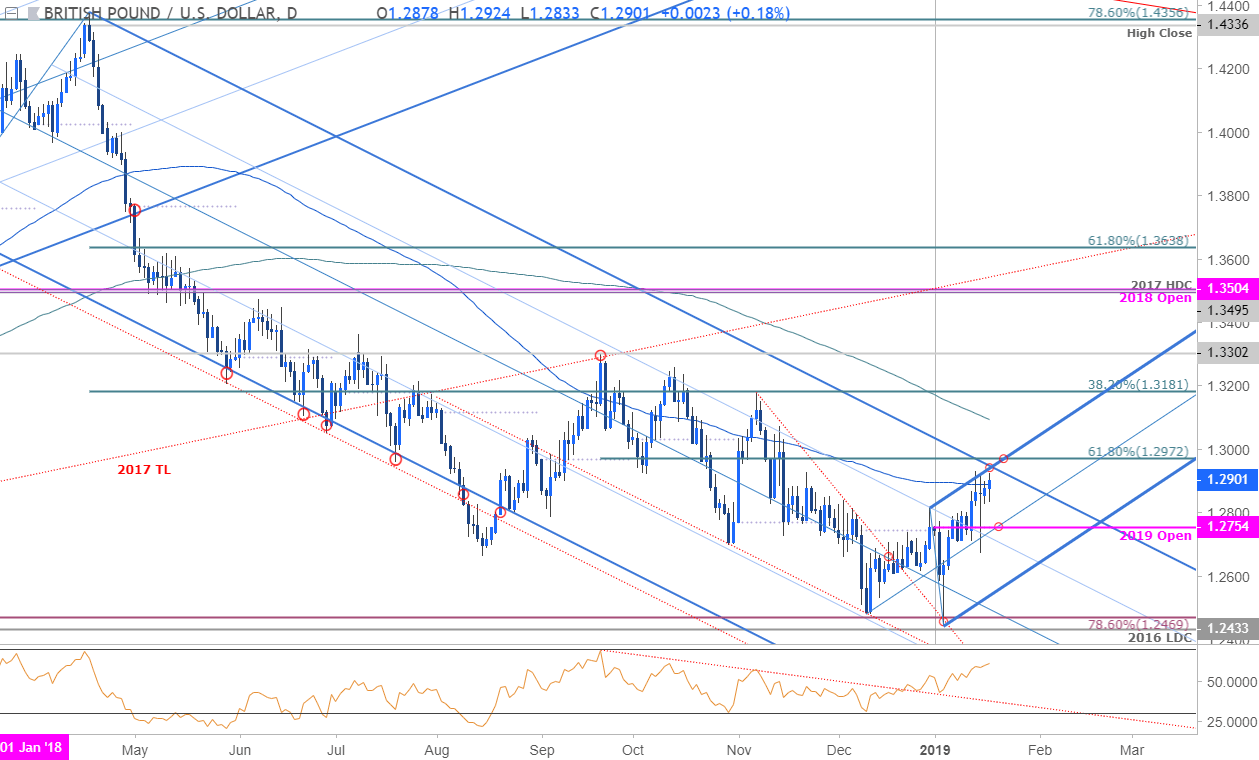

GBP/USD DAILY PRICE CHART

(Click on image to enlarge)

Technical Outlook: In my latest GBP/USD Weekly Technical Outlook our ‘bottom line’ noted that Sterling was, “losing steam just ahead of broader downtrend resistance and leaves the immediate recovery at risk while below 1.2972.” This level is defined by the 61.8% retracement of the September decline and converges on near-term uptrend & longer-term downtrend pitchfork resistance. A breach/close above this barrier is needed to validate the breakout and suggest that a more significant low was registered earlier this month. Yearly open support rests at 1.2754 with a break below the January opening-range lows needed to mark the resumption of the broader downtrend.

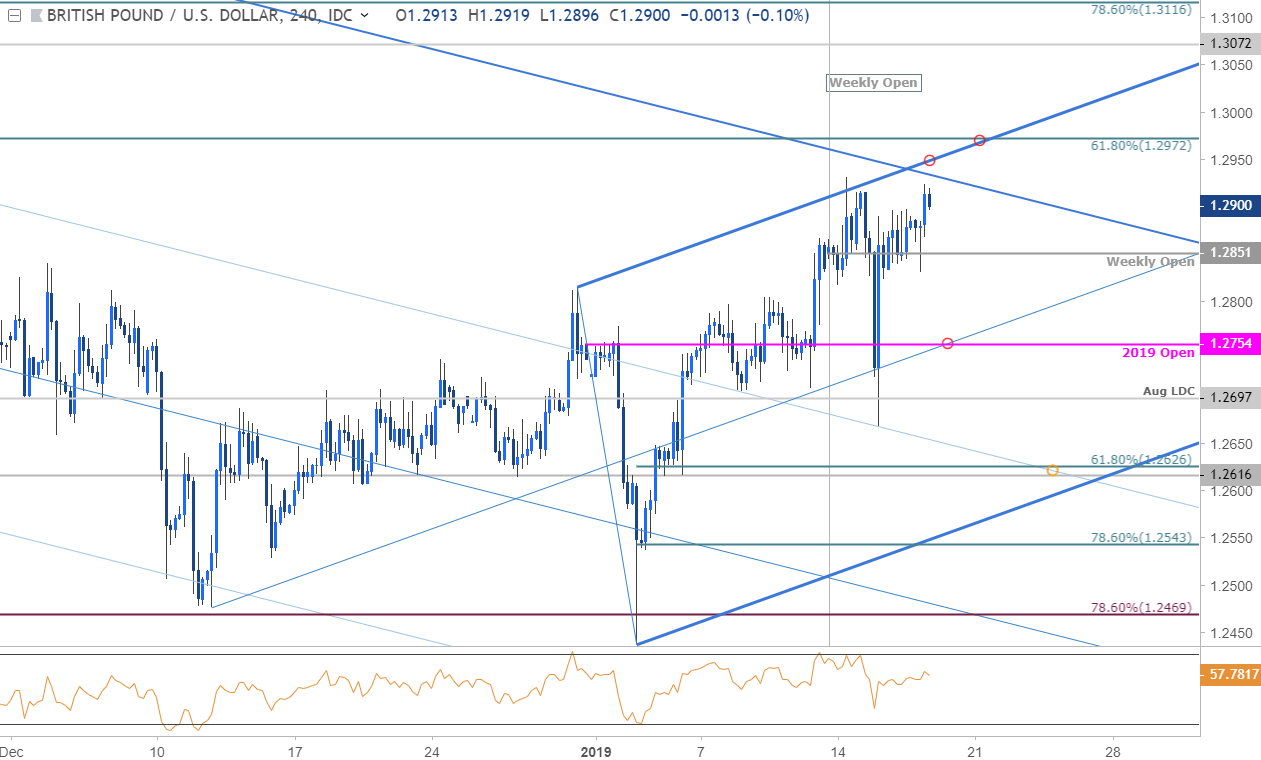

GBP/USD 240MIN PRICE CHART

(Click on image to enlarge)

Notes: A closer look at price action shows Sterling trading within the confines of a near-term pitchfork formation extending off the December / January lows with the upper parallel further highlighting the 1.2972resistance zone. Interim support rests with the weekly open at 1.2851 with near-term bullish invalidation at 1.2754- weakness beyond this threshold would risk a drop towards the lower parallel with such a scenario exposing 1.2697 and 1.2616/26- an area of interest for possible exhaustion / long-entries IF reached.

A topside breach targets subsequent resistance objectives at 1.3072 and the 78.6% retracement at 1.3116. Key resistance stands with the 38.2% retracement of the 2018 decline / November high at 1.3181.

Bottom line: The British Pound is testing long-term slope resistance with the trade outlook constructive near-term while above the yearly open. From a trading standpoint, the immediate focus is on a reaction on a move towards 1.2972 with a close above needed to keep the long-bias viable. Note that despite all the dire Brexit headlines, Cable is poised to close the fifth consecutive weekly advance- the point is, keep an eye on price action for guidance. IF price fails up at resistance, look for a break below the yearly open to expose a larger pullback in price.

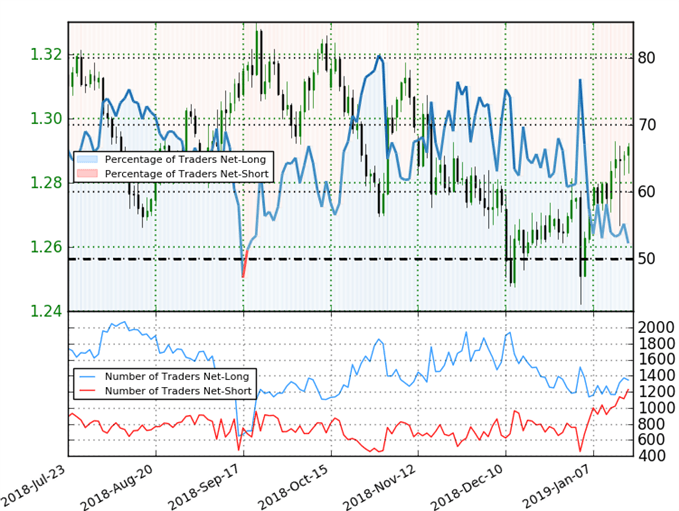

GBP/USD TRADER SENTIMENT

- A summary of IG Client Sentiment shows traders are net-long GBP/USD - the ratio stands at +1.1 (52.3% of traders are long) – neutral reading

- Long positions are2.2% lower than yesterday and 8.8% higher from last week

- Short positions are 1.8% higher than yesterday and 18.6% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Yet traders are less net-long than yesterday & compared with last week and the recent changes in sentiment warn that the current British Pound/ US Dollar price trend may soon reverse higher despite the fact traders remain net-long.

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more