GBP/USD Price Analysis: British Pound Testing Downtrend Support

GBP/USD testing structural support ahead of key event risk- updated intraday trading levels

The British Pound has been in free-fall for the past few days with the price down more than 2% since the start of August trade. While the immediate threat remains weighted to the downside, the decline is now approaching long-term structural support with key UK &US event risk on tap tomorrow. Here are the updated targets and invalidation levels that matter for GBP/USD heading into the releases. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

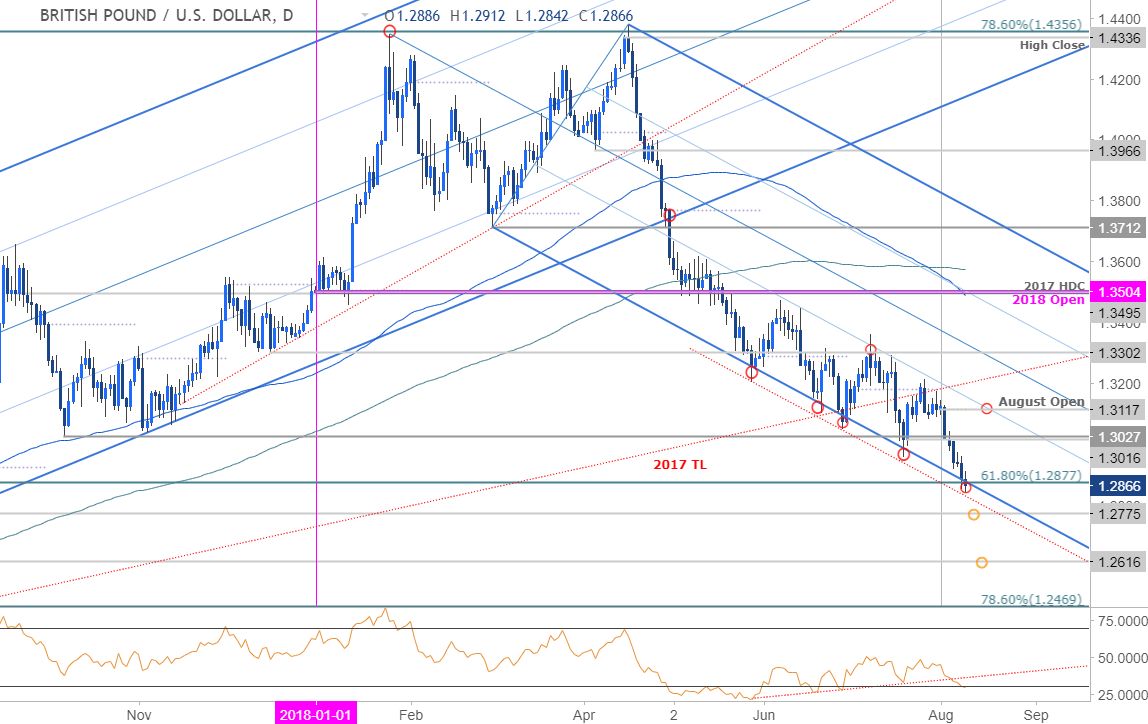

GBP/USD DAILY PRICE CHART

(Click on image to enlarge)

Technical Outlook: In my Weekly Technical Perspective on the British Pound, we noted that the broader short-bias in Sterling was, “vulnerable heading into key confluence support around 1.2877. From a trading standpoint, the risk is lower but I’ll be on the lookout for possible exhaustion / long entries on a stretch into the lower parallel.” Note that a sliding parallel (red) of the dominant pitchfork extending off the May lows has seen this slope range catch every subsequent low in price. It’s make-or-break here for Cable.

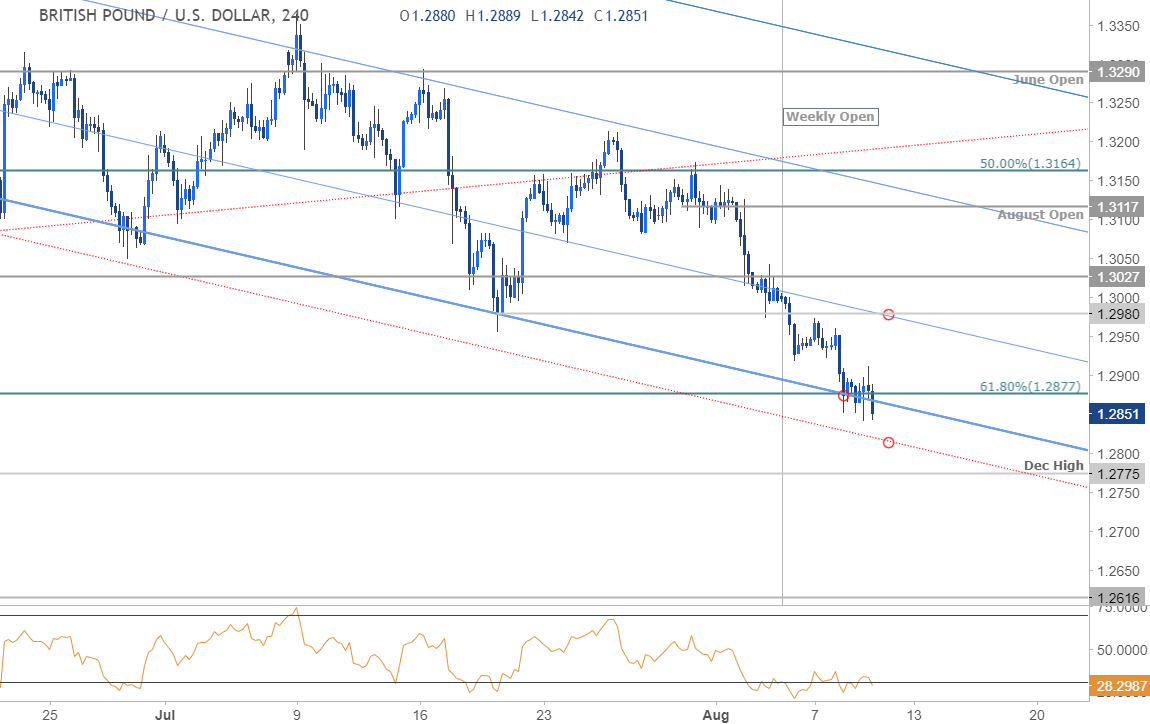

GBP/USD 240MIN PRICE CHART

(Click on image to enlarge)

Notes: A closer look at GBP/USD price action further highlights this slope range of support- shorts are vulnerable near-term into this region. Initial resistance stands a 1.2980 backed by 1.3027 with bearish invalidation now lowered to 1.3117. A close below this slope risks accelerated losses with such a scenario targeting 1.2775 backed by 1.2616 and the 78.6% retracement at 1.2469.

Bottom line: Its way too early to be considering the long-side, but fresh shorts from these levels are not advisable. Watch the weekly close – from a trading standpoint, Sterling price stabilization above 1.2877would be a good indication for a near-term exhaustion low. Keep in mind we get the second read on 2Q UK GDP and the US July Consumer Price Index (CPI) tomorrow- good timing for a final washout lower before the turn?

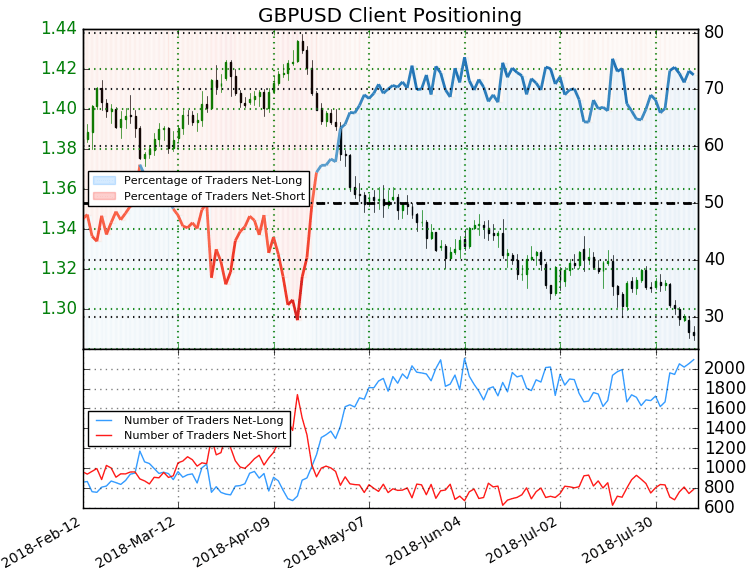

GBP/USD TRADER SENTIMENT

(Click on image to enlarge)

- A summary of IG Client Sentiment shows traders are net-long GBP/USD - the ratio stands at +2.64 (72.5% of traders are long) – bearish reading

- Traders have remained net-long since April 20th; price has moved 8.5% lower since then

- Long positions are3.7% higher than yesterday and 7.0% higher from last week

- Short positions are 4.5% higher than yesterday and 4.2% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Traders are less net-long than yesterday but more net-long from last week and the combination of current positioning& recent changes gives us a further mixed GBP/USD trading bias from a sentiment standpoint.

Check out our new 3Q projections in our Free DailyFX GBP/USD Trading Forecasts

Join Michael for ...

more