GBP/USD Outlook: More Gains On Cards Albeit Delta Can Still Cap

The GBP/USD outlook on Thursday, July 22, continued a rather strong upward movement. This is not to say that this movement is based on something specific. Recall that a little earlier, the British Pound fell down by 250 pips, and the most logical reason was the increase in the number of coronavirus cases in Foggy Albion.

When the Pound Sterling was falling down, we said this is a rather strange reaction of the markets. Yes, an increase in the number of cases of the disease is very serious. There is now a full fourth wave in the UK. Still, markets usually react to macroeconomic indicators, long-term prospects, at worst, politics, but not to the pandemic situation.

Photo by Colin Watts on Unsplash

On the contrary, on Monday, July 19, all quarantine restrictions were lifted. That is, logically, the economy should continue to recover. Nevertheless, the Pound Sterling fell, and its current rise looks just like recovery after a not entirely logical fall.

The markets seem to admit that they made a mistake and are now levelling it out. We have also repeatedly said that the Pound Sterling, within the framework of the global correctional scenario, may fall to the 1.3600 – 1.3666 area, from which a new uptrend may begin to form.

At the moment, our forecast has been fulfilled. It was in the area of 1.3600 – 1.3666 that the GBP/USD pair eventually fell. We also said earlier that after a failed attempt to overcome the level of 1.4240, which is a three-year high, buyers could temporarily retreat from the market to take overclocking before trying again to overcome this level. However, the long-term outlook for the GBP/USD pair remains bullish, so we expect the pair to return to the 1.4240 level in almost any case.

Meanwhile, everyone who has already opened champagne on the possible completion of the fourth wave of the pandemic in the UK can close it back. The indicator only rolled back down a little from the maximum number of cases per day of 54k. On July 21, 44k new cases of infection were recorded, which, you see, is not much less than 54k.

Thus, so far, it cannot even be concluded that the pandemic is beginning to recede. Consequently, the situation could still worsen although already about 70% of the adult population in the UK have received both doses of the vaccine.

The British government continues to be mercilessly criticized but at the same time responds to all critics with low mortality rates. True, this can hardly console the British people. Because behind any low mortality rates, there are still human losses. About 100 people per day have been steadily dying from the “coronavirus” in the past few days.

GBP/USD technical outlook: More gains on cards

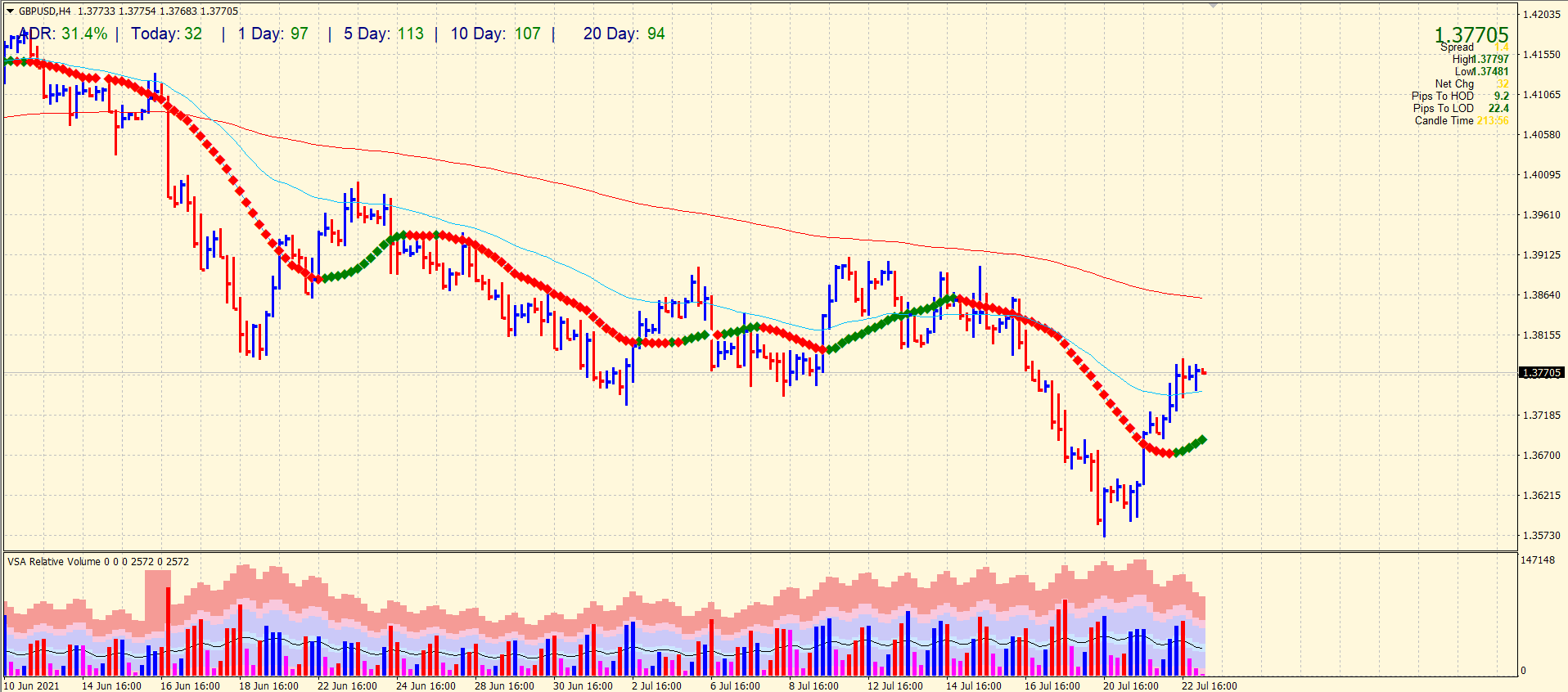

The GBP/USD outlook is broadly bullish. The earlier downtrend was actually a retracement of the broad uptrend. Nevertheless, the pair managed to jump beyond the 20 and 50 SMAs on the 4-hour chart. The volume data is also supportive of further gains. The next target could be the 200-period SMA at 1.3860s area.

(Click on image to enlarge)

GBP/USD outlook on 4-hour chart

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more