GBP/USD: Last-Minute Brexit Crisis May Provide Buying Opportunity

The Brexit mood is getting darker – but is it the darkest hour before dawn rises? The latest headlines in the saga are in offer something for everybody.

UK Business Secretary Alok Sharma said that talks are in a difficult phase and there are still some tricky issues to be resolved. Charles Michel, the President of the European Council, said that the next hours or days are critical and added that a no-deal is possible. A French minister seemed to confirm reports earlier in the week that Paris reserves the option to veto a deal if it is dissatisfied.

On the other hand, an unnamed EU official told Reuters that a deal is “imminent” – barring any last-minute breakdown. That latest development triggered a recovery, yet traders remain hesitant amid the flurry of headlines.

Fisheries, governance and a level-playing field remain the sticking points, and some horse-bargaining and perhaps some “ambiguous creativity” to round corners. A deal would boost the pound, while a breakdown of talks would probably result in efforts to secure an interim accord or arrangement. One thing is certain – uncertainty remains high.

For broader markets, the main event of the day and the week is the US Nonfarm Payrolls report. Economists expect an increase of 469,000 jobs and a small drop in the unemployment rate. The pace of the recovery has moderated, but the scale is unclear. Indicators leading toward the event have leaned to the downside, but it has been hard to assess the NFP in the volatile times of the pandemic.

Optimism about a COVID-19 vaccine has somewhat waned after Pfizer said that it faces supply chain strains, and will likely produce only 50 million doses this year, down from 100 million originally anticipated. Dr. Anthony Fauci, America’s lead epidemiologist, criticized the UK’s rapid authorization process but later retracted his words.

US coronavirus statistics remain worrisome, with yet another record US fiscal stimulus still hangs in the balance, despite a seemingly promising breakthrough early in the week. This laundry list of American developments has allowed the safe-haven dollar to partially recover.

Overall, Brexit remains left, right and center, but the NFP and other events are also likely to shape the next moves in cable.

GBP/USD Technical Analysis

(Click on image to enlarge)

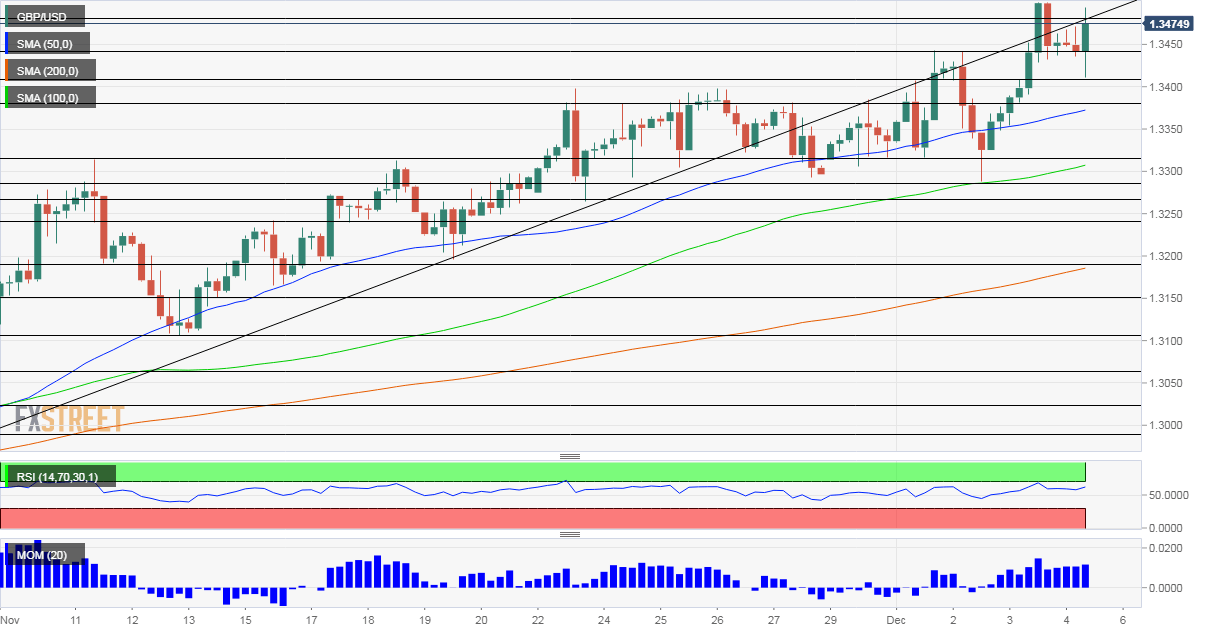

Pound/dollar continues riding on upside momentum on the four-hour chart. It also remains above the 50, 100 and 200 Simple Moving Average while the Relative Strength Index remains below 70, outside overbought conditions. Bulls have the upper hand.

Some resistance is at 1.3483, September’s high, followed by 1.35, the fresh peak recorded on Thursday. Close by, 1.3515 was a swing high in December 2019 and further above, 1.36 already dates back to 2018.

Some support is at 1.3440, a high point recorded early in the week. It is followed by 1.3410 and 1.3380.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more