GBP/USD Forecast: Sterling Ready To Rally On Vaccine Optimism, As Harsh Lockdown Locked Into Price

No more tiers – the whole of the UK has entered a severe lockdown reminiscent of the spring, which includes the shuttering of schools. Prime Minister Boris Johnson asked the nation to stay at home as hospitals are overwhelmed by the rapid spread of COVID-19.

There is growing evidence that the B.1.1.7 virus strain is responsible for the accelerated spread, also prompting many countries to ban travel to and from the UK. To add insult to injury, some worry that the South African variant could even be resistant to vaccines. Further information is needed.

GBP/USD dropped sharply ahead of Johnson’s announcement and seems to have stabilized afterward. One reason for the recovery is that the Chancellor of the Exchequer Rishi Sunak was quick to announce additional support to businesses, worth some £4.6 billion.

Another reason may be the trigger to exit the current restrictions. The presumed end-date is mid-February but the move leans on the vaccination campaign more than the disease developments. Johnson is trying to ramp up the relatively slow immunization campaign.

While Britain easily leads European countries, only some 1.4% have received the jabs so far. That could change now with Johnson’s emphasis on vaccines and the deployment of the homegrown University of Oxford/AstraZeneca inoculations.

Despite a somewhat lower efficacy rate than that of the Pfizer/BioNTech jab, AstraZeneca’s doses require only normal refrigeration and are produced at a rapid pace. The government aims to administer vaccines at a pace of two million per week. These aspirations – even if unachieved – can boost sterling.

GBP/USD is also rising on hopes that Democrats win both runoff races in Georgia. Recent opinion polls from the Peach State have shown that President-elect Joe Biden’s candidates have picked some steam in the run-up to the vote. If these surveys – which proved accurate in Georgia – turn into reality, Democrats would have effective control of the Senate.

On the other hand, Republican candidates received more support in the first round of votes in November, outperforming President Donald Trump who lost the state. The Commander-in-Chief has continued peddling conspiracy theories and aims to overturn his defeat. Tensions toward Congress’ ratification session on Wednesday have also weighed on markets, but are set to prove futile.

Covid and politics are set to dominate trading, but one data point stands out on Tuesday – the ISM MAnufacturing Purchasing Managers’ Index for December. An upbeat figure is likely as the industrial sector suffered less than the services one.

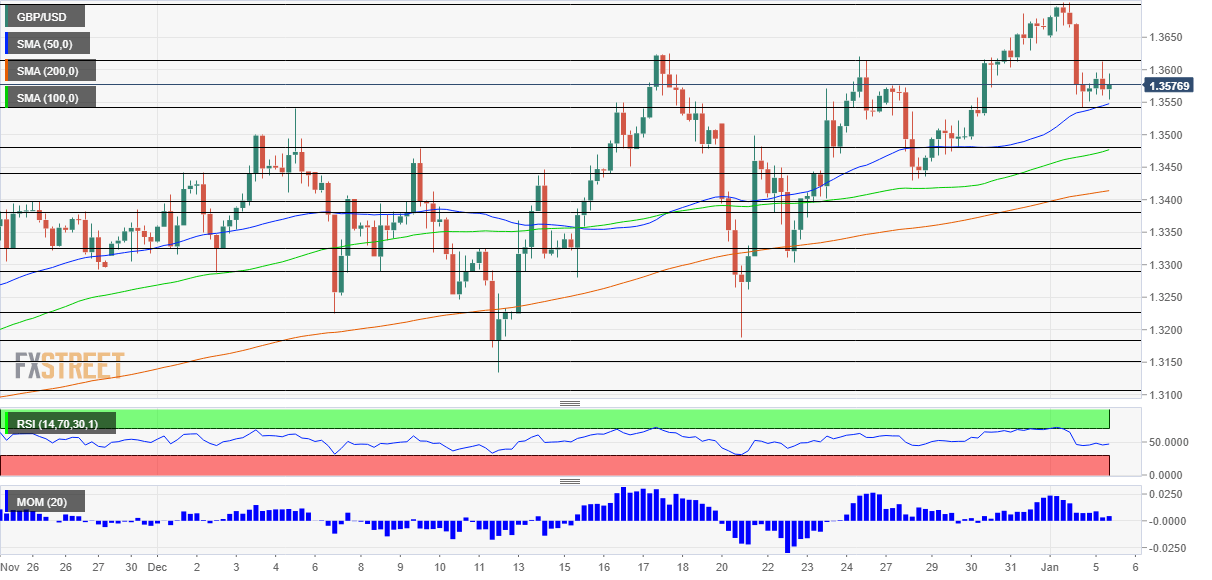

GBP/USD Technical Analysis

(Click on image to enlarge)

Pound/dollar continues benefiting from upside momentum on the four-hour chart despite the recent setback. It held above the 50 Simple Moving Average in another sign of strength and the Relative Strength Index dropped away from the 70 level – exiting overbought conditions.

All in all, bulls are in control.

Some resistance awaits at 1.3610, the daily high, followed by 1.3703, the 2021 peak. Further above, 1.3730 and 1.3810 await GBP/USD.

Support awaits at 1.3555, the daily low, followed by 1.3480 and 1.3440.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more