GBP/USD Forecast: Bears To Pounce 1.3800 Ahead Of US Retail Sales

The GBP/USD price forecast is neutral as the fundamental scenario is bullish but technical indicators yell for a sell.

Boris Johnson will restructure his cabinet on Thursday to help the government improve living standards during the COVID-19 pandemic.

The COVID-19 pandemic eclipsed Johnson’s goal of reducing regional inequality after the Conservative Party won its largest parliamentary majority since Margaret Thatcher after the 2019 election.

The UK’s inflation rate is one of the reasons sterling bulls hope for. In August, the consumer price index (CPI) was 3.2%, higher than expected and exceeds the range of 1-3% desired by the Bank of England. So, are we on the verge of an interest rate hike? A possible rise in interest rates could be signaled next week by the Bank of England.

The US inflation rate also failed to meet expectations in August – import prices fell unexpectedly by 0.3% m/m, contrary to expectations. The CPI on Wednesday beats Tuesday’s weak core CPI, which means the Federal Reserve is less likely to reduce bond purchases.

Others, however, believe a drop in inflation reflects a slowing economy and falling demand, giving the dollar some support and counteracting other reasons. US retail sales for August are expected to decline for the second consecutive month on Thursday. In contrast to intuition, this may pressure the dollar by decreasing demand for securities.

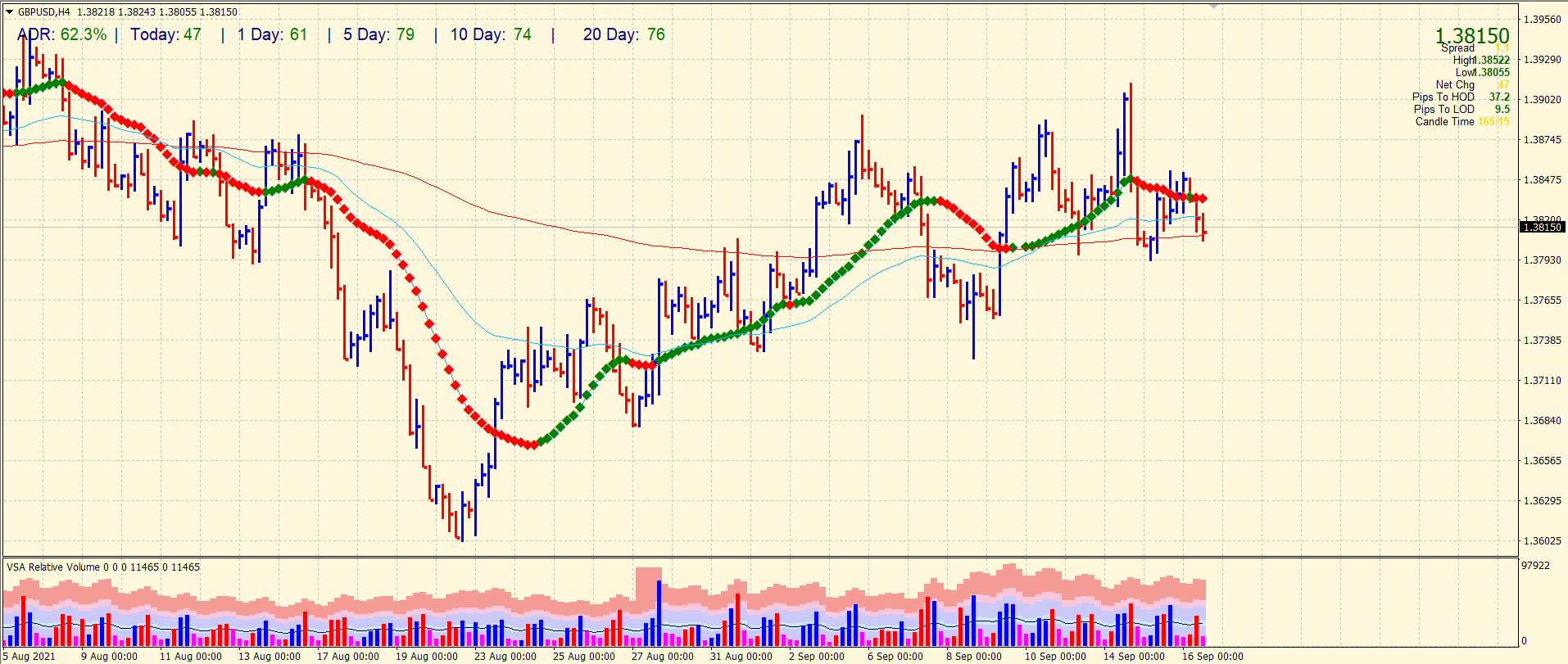

GBP/USD Price Technical Forecast: Bears Pouncing 1.3800

(Click on image to enlarge)

GBP/USD 4-hour chart forecast

The GBP/USD price is trading below the 20-period SMA on the 4-hour chart. However, the 200-period SMA has provided weak support to the pair. In addition, the volume is bearish, supporting further downside below the 1.3800 area.

-If you are interested in forex day trading then have a read of our guide to getting started-

The average daily range is 62% so far. It indicates further price action is due. Hence, we can expect to break the 1.3800 level and aiming for 1.3770 ahead of 1.3735. On the upside, the 20-period SMA may halt the rally near 1.3835 ahead of the quadruple top at 1.3910 area.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more