GBP/USD: Darkest Before Dawn Or Is A No-Deal Brexit Real? Sterling Suffering May Extend

“Strong possibility of exiting on Australian terms” – aka a no-deal Brexit – these words by UK Prime Minister Boris Johnson have been compounded by similar comments from European Commission President Ursula von der Leyen. The top-ranking EU official has told the bloc’s leaders that the probability of ending talks without an accord is higher than clinching a last-minute deal.

This pessimism follows a long meeting between Johnson and VDL on Wednesday that ended with yet another deadline – Sunday night. Brussels is not only talking but also seems to be acting – the EU published contingency plans on Thursday and decided to skip talking about Brexit on its second day of the summit.

The three thorny topics remain fisheries, governance and a Level-Playing Field (LFP). The latter topic is proving to be the hardest issue. The EU insists that Britain should not have the option to undercut the bloc on labor, environment and other regulations, while the UK is adamant that any limits to regulation violate its sovereignty.

GBP/USD’s suffering has exacerbated, dipping to a low of 1.3184 – the lowest since November 18. Andrew Bailey, Governor of the Bank of England, added fuel to the fire by saying that there are limits to what his institution can do to mitigate the fallout from a no-deal Brexit.

The question for traders is – time to sell ahead of an inevitable collapse of talks? Markets seemed to price in a last-minute deal, and if that fails to materialize, the pound has further room to plunge.

On the other hand, the 2019 Withdrawal Agreement was reached at the last moment – and there is nothing like a deadline to sharpen minds. Both sides may be putting a brave face for their local audiences before making hard concessions. In that scenario, the recent fall provides a buying opportunity.

The most likely scenario for Friday is further pressure during the day and a late short-covering ahead of the weekend. Sterling sell-off may have gone too far and there is an upside risk of a deal over the weekend.

Outside the Brexit bubble, fears of lockdown in London – perhaps from Wednesday – are marginally weighing on the pound. On the other hand, the FDA’s recommendation to approve the Pfizer/BioNTech vaccine is positive for risk assets and adverse for the safe-haven dollar. Similar to Brexit, US fiscal stimulus talks are also stuck amid Republican resistance to approving a larger package – but contrary to negotiations on the other side of the pond, there is no deadline.

The calendar features US consumer sentiment, which is set to remain stable on relatively low ground. It comes as US COVID-19 daily deaths surpassed 3,000 once again and after jobless claims jumped to 853,000 in the week ending December 4.

Overall, it is almost only about Brexit for pound/dollar.

GBP/USD Technical Analysis

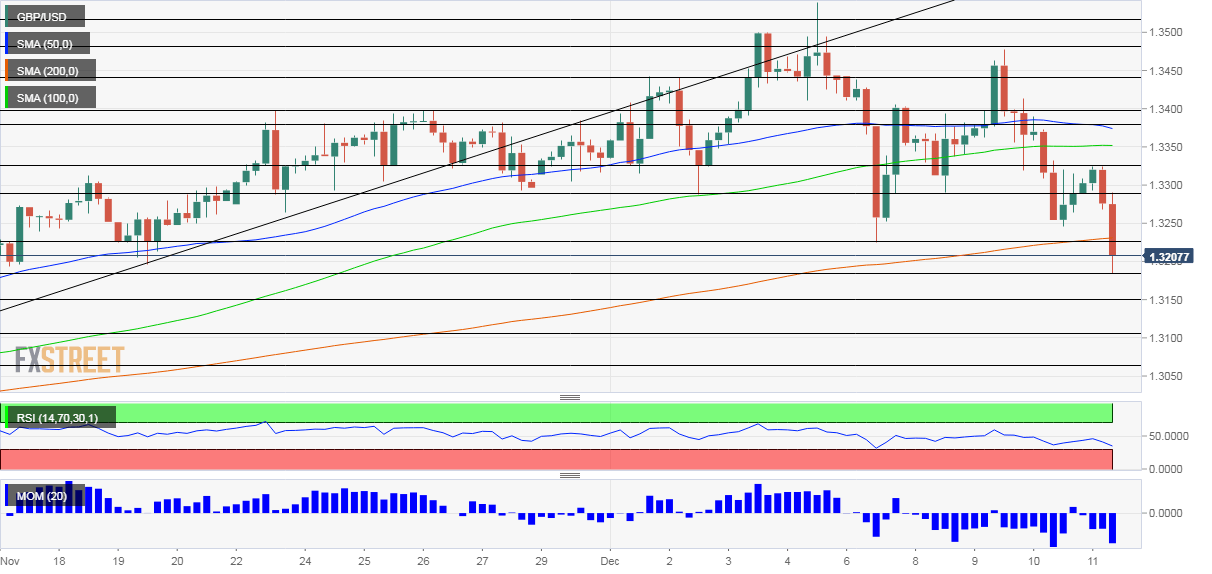

(Click on image to enlarge)

The recent downfall has been insufficient to push the Relative Strength Index on the four-hour chart to oversold territory. The RSI’s hovering above 30 allows for more falls. Bears also benefit from cable’s fall below the 200 Simple Moving Average, after losing the 50 and 100 SMAs.

Some support is at the new low of 1.3184. It is followed by 1.3150, 1.3105 and 1.3060, all levels that were in play back in November.

Resistance is at 13225, a swing low from early in the week, followed by 1.3290 and 1.3325.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more