GBP/USD: Bullish Breakout Hinges On Barnier’s London Trip

Will Michel Barnier board the Eurostar to London? Serling’s next moves seem to heavily depend on the travel plans of the Chief Brexit Negotiator for the EU. An agreement on future relations is mostly done, yet without conclusions on the thornier issues of fisheries and state aid, talks could collapse.

Barnier is set to end his quarantine – needed after a team member tested positive for coronavirus – and travel to the British capital for face-to-face talks. However, media reports suggest that he may call off his trip if the UK does not offer concessions. This acrimony followed public comments by European Commission President Ursula von der Leyen, who said she cannot be certain if a deal is possible.

Time is running out – the transition period expires at year-end and the UK may find itself in World Trade Organization terms if both sides fail to compromise. Investors need to see negotiations continue to remain hopeful.

London remains in focus for pound traders for another reason – the new tiers for coronavirus-related restrictions are set to be announced later in the day. The capital will likely return to the second level that it was at before the nationwide lockdown. If more significant limitations are imposed on the city, sterling could shiver.

In the meantime, the UK government is coming under criticism due to its intention to freeze pay raises for most public sector workers. The decision is incompatible with bond anti-austerity declarations and may also weigh on the economy. On the other hand, the generous and successful furlough scheme continues in full force, putting a lid on unemployment.

See US Thanksgiving Wrap: Consumers carry October, November starts to look dicey

On the other side of the pond, Americans are celebrating a relatively somber Thanksgiving, amid rising coronavirus cases, hospitalizations and deaths. Moreover, while the big bulk of data released on Wednesday can be characterized as mixed, the back-to-back increase in jobless claims is a cause for concern and weighs on the greenback.

Perhaps the most significant dollar downer came from the Federal Reserve. Minutes from the latest meeting showed that members actively discussed the bond-buying scheme, potentially readying an increase in its size.

With the greenback ceding ground, the major thing holding down the pound is Brexit.

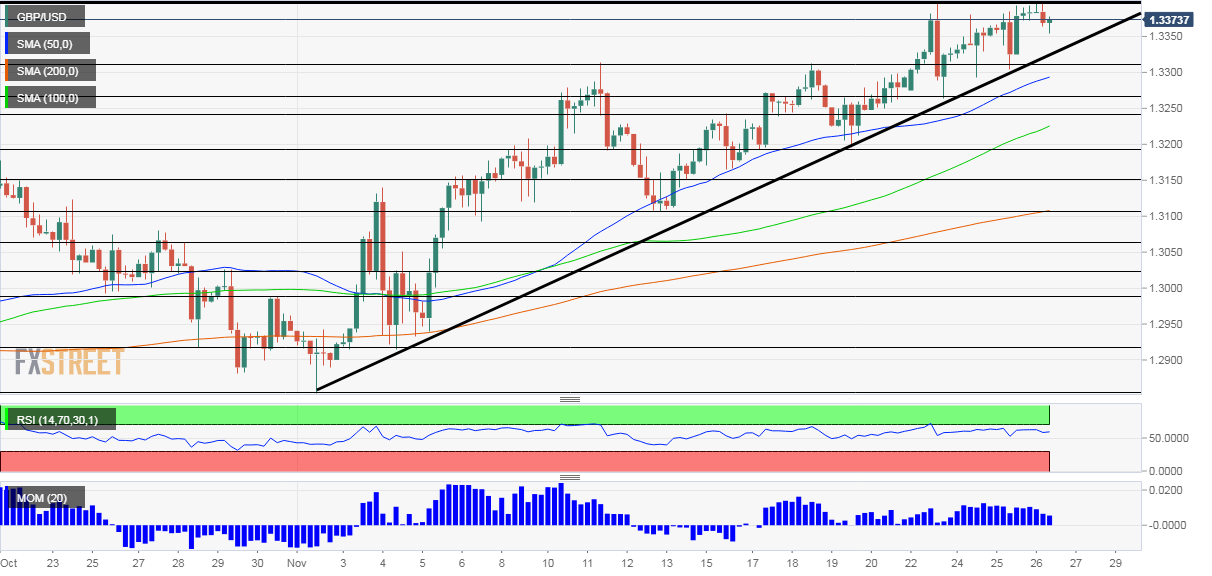

GBP/USD Technical Analysis

(Click on image to enlarge)

Pound/dollar continues trading in an ascending triangle – a bullish technical pattern. Attempts to break above the ceiling of 1.3397 have been unsuccessful, yet there is still room for a breakout. The Relative Strength Index is below 70, outside overbought conditions, and upside momentum prevails.

Above 1.3397, the next cap is 1.3420, followed by 1.350. Both lines played a role in the summer.

Support awaits at the daily low of 1.3350, followed by 1.3310, a resistance line from mid-November. Further down, 1.3260 and 1.3245 await the pair.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more