GBP/USD: Brexit, Powell And Nonfarm Payrolls Promise A Hectic Start To December

An exit from the pandemic is more powerful than a Brexit deal – at least in unleashing late November’s rally. EU-UK negotiations remain significant, but also, the calendar is making a welcome comeback, with a full slate of US economic indicators.

This week in GBP/USD: Vaccine optimism outweighs Brexit

Brexit: The word “imminent” received a new meaning, as reports of upcoming trade deal failed to materialize. Investors seemed to be aware that 95% of the details are already agreed – as one headline suggested – and wanted to see white smoke on the remaining 5% of thorny issues, including fisheries and governance.

At the time of writing, negotiators continue talking online, due to a positive coronavirus test of one of the members. At one point, officials suggested an interim deal that would prevent the gap between reaching an accord and the lengthy ratification process needed. Markets seemed unaffected by another Brussels-made can-kicking exercise.

Vaccine: Another Monday, another vaccine breakthrough – and this time a British-grown one. AstraZeneca and the University of Oxford reported an average efficacy rate of 70% and 90% when a lower dosage regimen was applied.

While the confusing preliminary findings cause a jittery reaction at first, markets eventually saw the glass half-full – Astra’s immunization works, needs only normal refrigerating temperatures, and is set to be mass-produced. The news turned into a win-win situation for GBP/USD bulls as the UK secured a large number of doses – boosting sterling – and the safe-haven dollar was on the back foot.

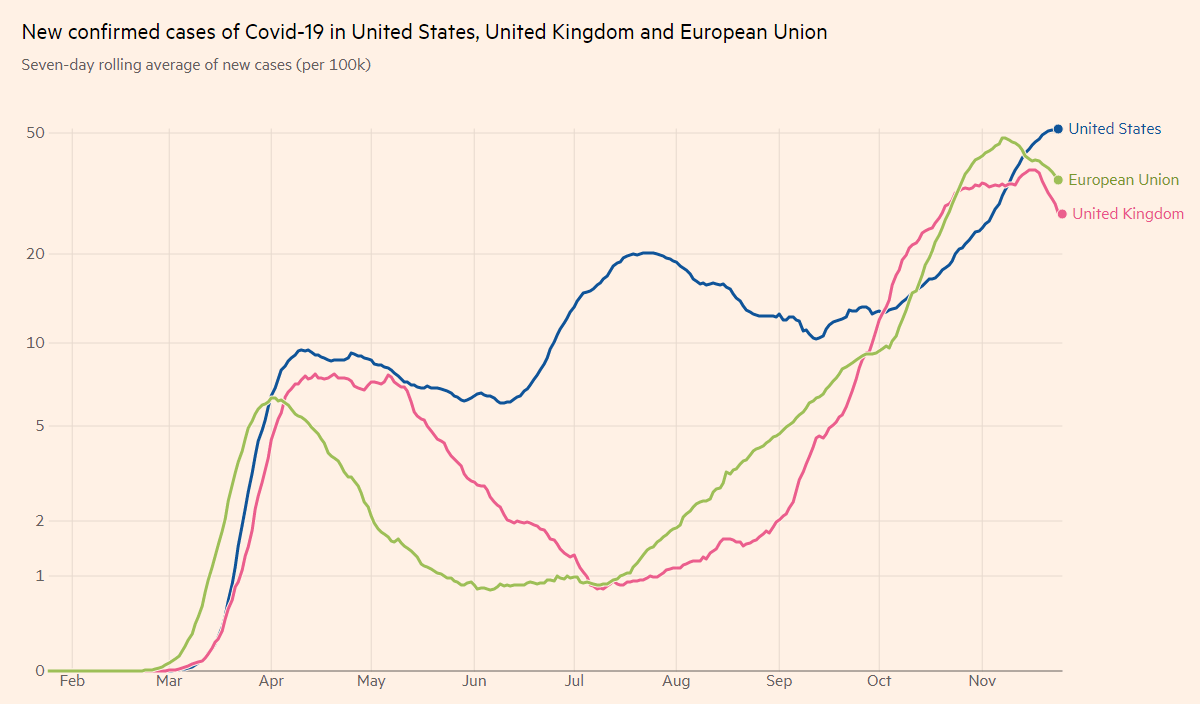

In the meantime, COVID-19 cases resumed their decline in Britain while rising in America.

COVID infections in the US, the EU, and the UK

(Click on image to enlarge)

Source: FT

Prime Minister Boris Johnson’s announcement regarding restrictions caused a mixed response. On one hand, the government is letting the nationwide lockdown to lapse on December 2. On the other hand, localized lockdowns are set to be tighter than beforehand, potentially curbing economic activity.

In the US, state governors have ramped up recommendations and restrictions ahead of Thanksgiving as hospitalizations continue climbing at an alarming clip. Outgoing President Donald Trump remains focused on contesting the elections rather than the virus, yet he finally authorized to transition to President-elect Joe Biden. The move came as more states certified the results and amid growing pressure from Republican lawmakers.

Markets were relieved by Trump’s tacit concession – reducing the chances of a bumpy transition. Moreover, US media reported that Janet Yellen would be the next Treasury Secretary, giving markets another reason to be cheerful and push the safe-haven dollar down. The former Fed Chair would support expansive policy yet without going too far toward left-leaning policies.

Economic data made a surprising comeback. Markit’s US Purchasing Managers’ Indexes beat estimates, pointing to sustained growth and sent the dollar higher. The greenback reacted with less fervor to a miss in the Conference Board’s Consumer Confidence gauge.

UK PMIs came out marginally above estimates.

All in all, optimism about an upcoming vaccine in the UK and a smooth US transition outweighed Brexit uncertainty and upbeat US data.

UK events: The Brexit countdown is banging loud

The Brexit saga: Deal or no deal? The eternal question may be finally answered as the page turns to December. Without an accord or an interim solution, the UK would revert to unfavorable World Trade Organization terms at the end of the month.

Markets are not fully pricing a deal, leaving sterling room to move higher. However, the risk is asymmetric, with an unexpected collapse in negotiations probably triggering a massive sell-off. A meeting between PM Johnson and European Commission President Ursula von der Leyen could seal an accord, and even setting such a summit would probably boost the pound.

Health Secretary Matt Hancock mentioned December 1 as the potential beginning of a wide vaccination campaign. While that goal will likely be missed, regulatory approval of any immunization scheme would likely support sterling. Vaccination will likely be prioritized for medical staff, caregivers, and vulnerable people.

COVID-19 statistics remain of high interest, especially those in London, one of the world’s financial capitals. Restrictions in the metropolis have an outsized impact on the pound.

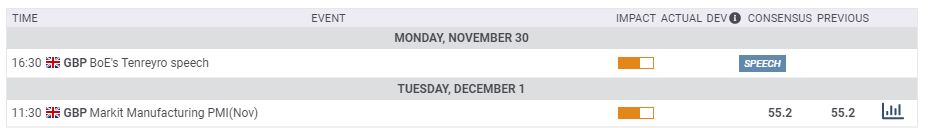

The British economic calendar is light, with final PMIs unlikely to significantly alter the original reads for November.

Here is the list of UK events from the FXStreet calendar:

(Click on image to enlarge)

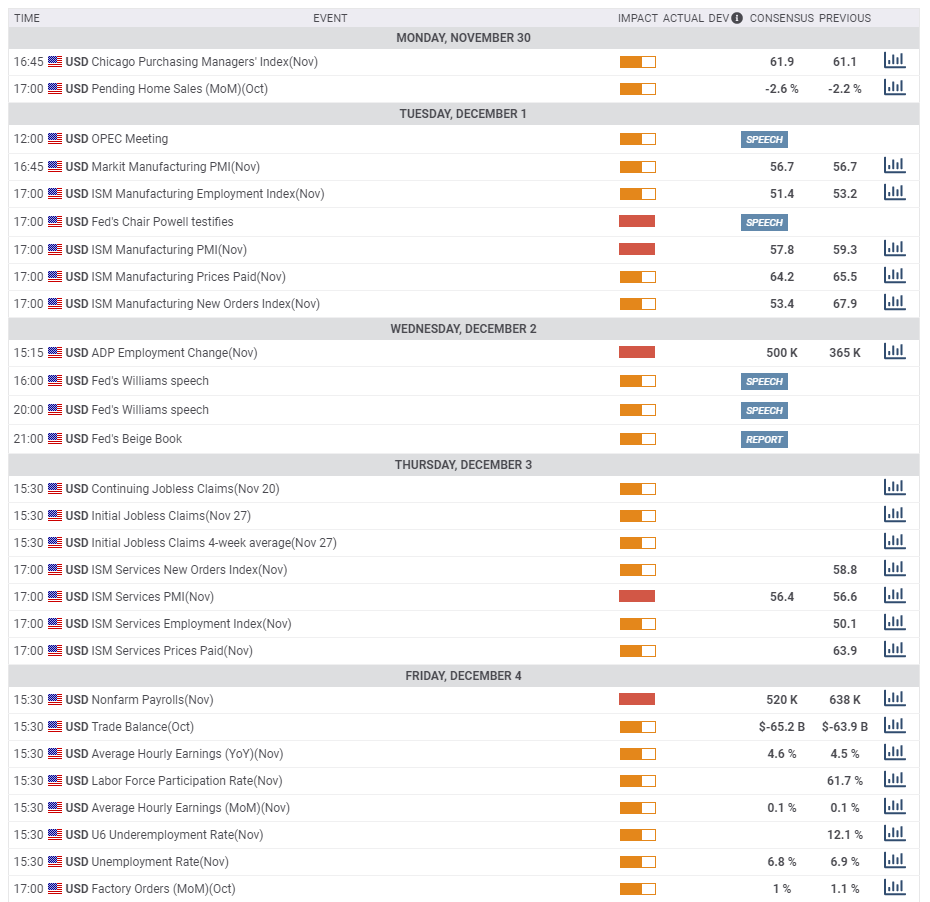

US events: Powell and a full NFP buildup promise action

How high will US COVID statistics go? While the impact of Thanksgiving travel will likely be reflected in statistics only, the rising figures may move markets later on. Investors will likely take note if average daily deaths surpass the previous peak or if hospitalizations top 100,000.

President-elect Biden will likely address the topic and any hint of a federal action to curb the spread could hurt markets and boost the safe-haven dollar.

On the vaccine front, there is a chance that the Food and Drugs Administration approves the Pfizer/BioNTech immunization for emergency use. While such a move is expected, it would likely provide a shot in the arm to markets and weigh on the safe-haven dollar.

As the dust is settling on the political scene after Yellen was nominated Treasury Secretary, the focus return to her successor at the central bank. Jerome Powell, Chairman of the Federal Reserve, will testify on Capitol Hill on Tuesday. Markets will try to assess if the Fed is on course to expand its bond-buying program in December or remain on the sidelines for longer. The dollar could drop if he hints at an imminent move and rises if Powell is reluctant to act.

The economic calendar is hectic, with a full buildup to Friday’s Nonfarm Payrolls. The first clue toward the jobs report comes on Tuesday with the ISM MAnufacturing PMI for November, projected to edge down from elevated levels. The employment component will be closely watched.

ADP’s private-sector labor statistics have been missing the mark in recent months, yet could move markets. A faster increase is on the cards in Wednesday’s publication.

Thursday is a busy day, including the ISM Services PMI and its employment component – relevant for most American jobs. Weekly jobless claims may steal the show after two consecutive increases, the worst since July. A jump above 800,000 could hit sentiment – even though the application’s data is for the period after the NFP surveys are conducted.

Finally, Friday’s Nonfarm Payrolls figures for November serve as a test to the recovery. Is it slowing down amid the increase in the virus, or does the US economy still have momentum? Expectations stand at 520,000 – which is slower than October’s rise of 638,000 but well above pre-pandemic averages.

The Unemployment Rate is set to extend its decline to 6.8% while wages carry expectations for edging up to 4.6%, still above 2019 levels.

Here the upcoming top US events this week:

(Click on image to enlarge)

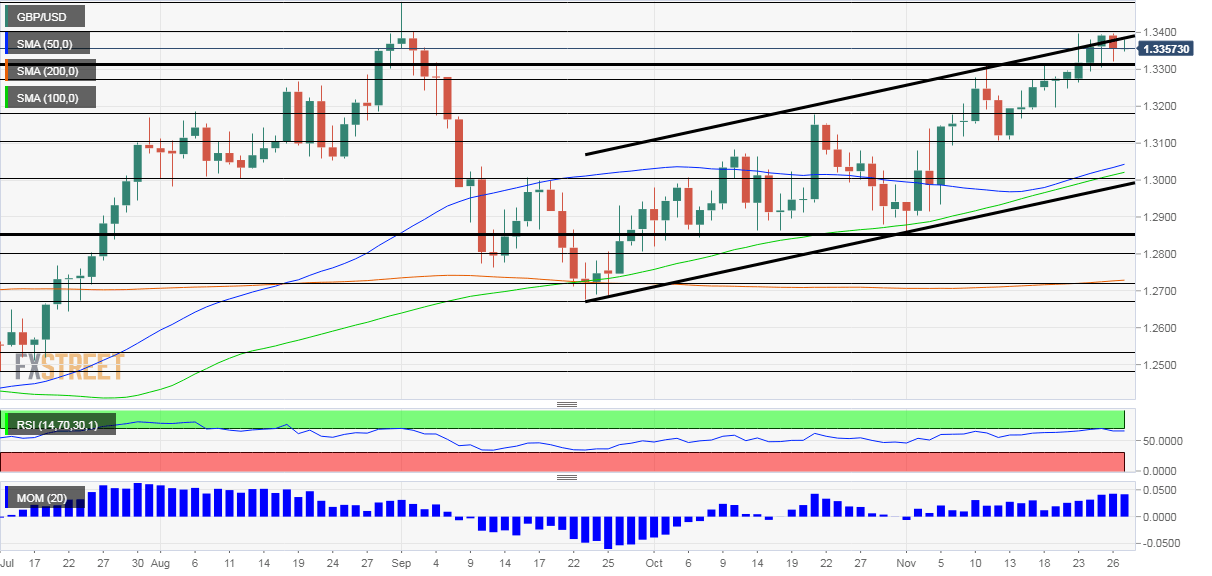

GBP/USD technical analysis

Pound/dollar is attempting to break above the uptrend channel that has been accompanying it since late September. Even without a decisive move higher, the broad trend remains bullish – upside momentum on the daily chart has strengthened and the Relative Strength Index is below the 70 level, thus outside overbought conditions. The price is well above the 50-day, 100-day, and 200-day Simple Moving Averages.

The recent two month high of 1.3397 is the immediate and stubborn resistance line. The next cap is 1.3495, which is the yearly high recorded in September, followed closely by the December 2019 peak of 1.3510.

Support is at the former double-top of 1.3310, followed by 1.3275, a peak in August and also a support line during November. The next considerable cushion is at 1.3180, which held GBP/USD down in October. It is followed by 1.31 and 1.30.

(Click on image to enlarge)

GBP/USD sentiment

Powell will likely push the dollar lower with hints of more dollar printing, yet that may be insufficient to keep the pound afloat without a Brexit breakthrough. Negotiations remain a wildcard.

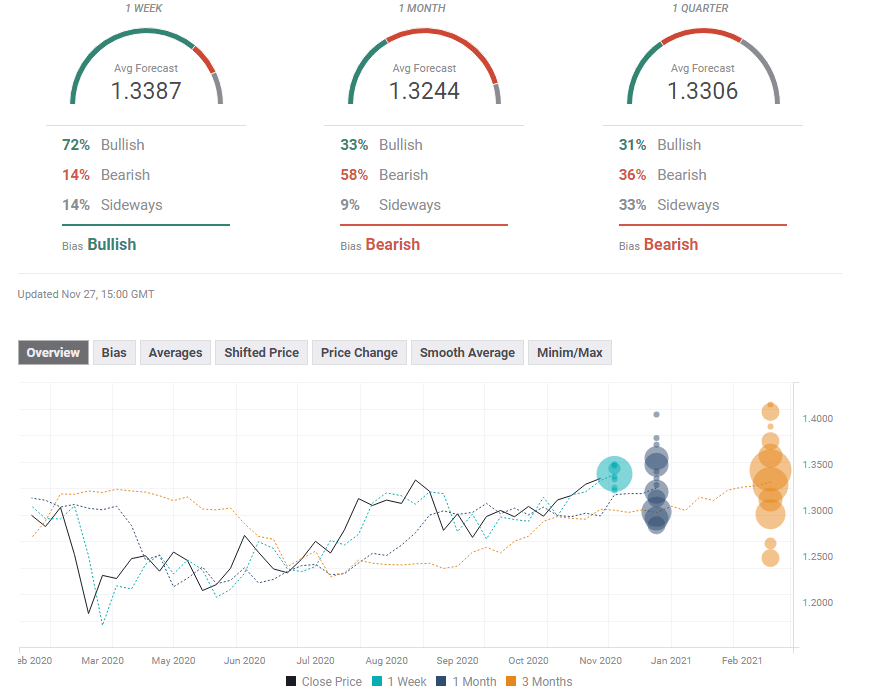

The FXStreet Forecast Poll is showing that experts are bullish on the short term, seeing additional small gains, but foresee a slide afterward, especially in the medium term. Average targets have been marginally upgraded in the past week.

(Click on image to enlarge)

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more