GBP/USD Braces For The Rally’s Side Effects, A Downside Correction

“You are being over-excitable” – one of former parliament speaker John Bercow’s phrases is relevant to GBP/USD, which has gone too high, too fast. Contrary to those endless Brexit debates which traders closely followed, work on the next US stimulus bill – the main dollar driver – are currently going on quietly, but perhaps not for long. That may change cable’s dynamics.

The US Senate kicked off ex-president Donald Trump’s trial for inciting an insurrection on Tuesday and the shift away from the large relief package allowed the dollar to take a breather alongside falling yields. While the process continues in Washington, Federal Reserve Jerome Powell speaks in New York. He is set to address the labor market, which continues struggling according to the latest figures.

Powell may provide a timely reminder that the world’s largest economy needs more help – and his call on lawmakers to act may refocus minds on stimulus. In turn, yields could begin rising, making the greenback more attractive.

It is also essential to remember that House Democrats continue drafting the stimulus package, undisturbed by the Senate’s proceedings. They may opt for an ambitious plan, closer to President Joe Biden’s desired $1.9 trillion plan.

In the UK, coronavirus cases and deaths continue falling, while the vaccination campaign continues at full speed – supporting the pound. Nevertheless, while sterling may be able to weather a potential greenback comeback better than some of its peers, it is not immune.

GBP/USD Technical Analysis

(Click on image to enlarge)

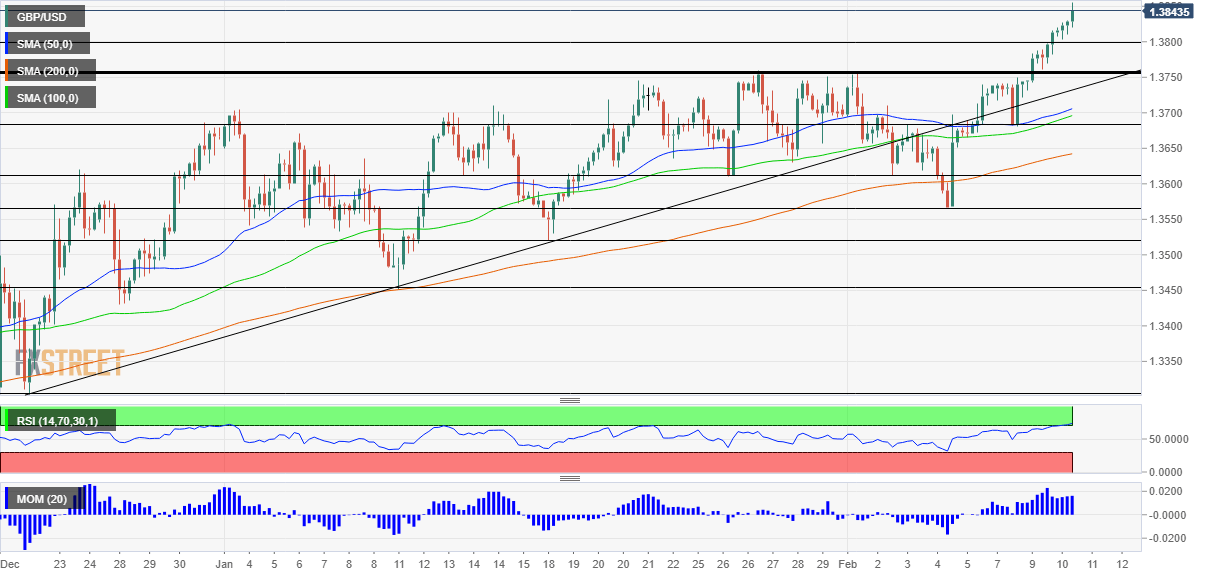

The Relative Strength Index on the four-hour chart is above 70, reflecting overbought conditions and signaling a downside correction. Other indicators such as momentum and the Simple Moving Averages remain positive for the pound.

Support awaits at the round 1.38 level, followed by the former 2021 peak of 1.3750, which is a critical cushion. Further down, 1.3680 provided support earlier in February.

The new 2021 peak of 1.3855 is the immediate line of resistance. It is followed by 1.39, and then by the all-important 1.40 level – all last seen in 2018.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more