GBP/USD Benefits From Dollar Weakness, Vaccines Critical To Surge Above 1.38

Donald Trump is back – the former president is returning to the spotlight as his trial for inciting insurrection begins. While that has no immediate impact on markets, it may delay efforts to pass a major fiscal deal stimulus worth as much as $1.9 trillion. Any postponement already triggers price action.

After several days of decline, investors have been returning to buying US debt, pushing yields lower and making the US dollar less attractive. How long will this continue? President Joe Biden will likely pass most of his desired coronavirus relief package – raising the need to issue more debt bonds, resuming the downtrend in returns and the greenback. However, the current distraction has been prompting a pause.

On the other side of the pond, the pound is well-positioned to take advantage of the dollar’s descent, thanks to Britain’s vaccination drive. The UK has already jabbed around 18% of its population and is on course to hit the government’s goal of reaching around 15 million people by February 15.

Prime Minister Boris Johnson conditioned an exit from the current lockdown on the rollout of immunizations. The economy is set to open up ahead of estimates – or at least before other major economies. Moreover, COVID-19 cases, hospitalizations, and deaths continue falling in the UK, with or without an impact of the vaccination campaign.

The Bank of England’s optimism is another positive factor for the pound. The BOE said that the economy weathered covid-related restrictions better than expected in the fourth quarter of 2020, serving as a higher basis for the recovery. The UK releases growth figures next week, and they expectations for robust figures are supporting sterling.

A light economic calendar on Tuesday makes way for vaccine and stimulus news to dominate trading.

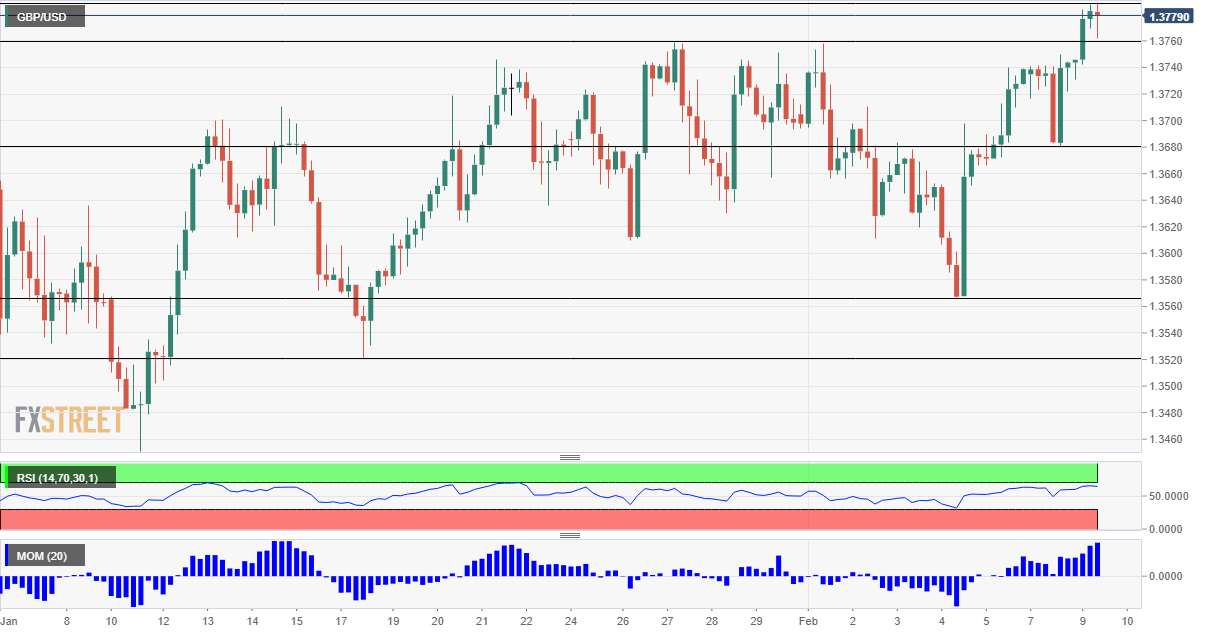

GBP/USD Technical Analysis

(Click on image to enlarge)

Pound/dollar has been trading in an uptrend, hitting the highest levels since 2018. Momentum on the four-hour chart is to the upside while the Relative Strength Index remains below 70 – outside overbought conditions. All in all, bulls are in control.

Immediate resistance is at 1.3798, the new 2021 peak. It is followed by 1.3830, 1.39 and 140 – all dating back to 2018.

Support is at 1.3760, a previous 2021 peak, followed by 1.3680 and 1.3565, which both served as cushions in recent days.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more