GBP/USD: Appetite For More Gains After Sunak’s Meal Deal, Investors Ignoring Coronavirus, Brexit

“Meal Deal, not a New Deal” – the opposition’s criticism against the scheme to grant a £10 voucher for eating out in August may have been ridiculed, but markets seem content with the government’s £30 billion stimulus package.

Chancellor of the Exchequer Rishi Sunak also presented a job retention plan to get people back to work, and retraining programs for the young. Perhaps more importantly for investors – he clarified that “the job is only beginning.” Perhaps after seeing the impact of the special stimulus – and the reaction in financial markets – he will come up with an even greater injection of funds.

Sunak is well aware of the high level of uncertainty, refusing to provide clear projections or shapes of the recovery. He clarified that it heavily depends on the development of the virus. The UK continues recording nearly 100 daily deaths on average – far below the peak, but significantly above its continental peers.

From one chancellor to another, Angela Merkel, Germany’s leader, repeated the need to prepare for a no-trade-deal Brexit. Talks – including a dinner between top negotiators – has failed to yield a breakthrough.

GBP/USD has taken advantage of the dollar’s weakness – the safe-haven asset is losing its shine as stocks, especially tech ones, continue rising. Ongoing efforts to discover a vaccine and develop a cure are underway, with the latest announcements of progress coming from Emergent BioSolutions and Moderna.

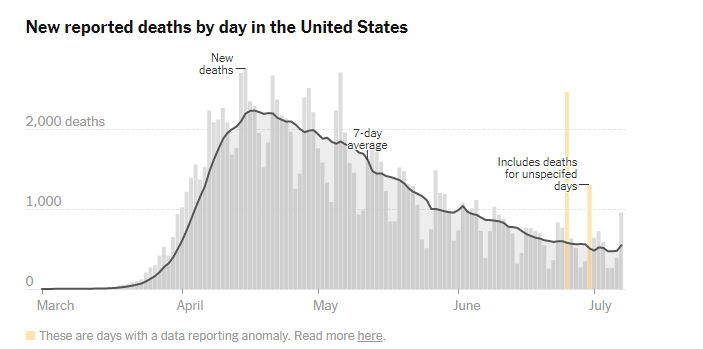

Nevertheless, a solution may take long months, and the US coronavirus situation continues deteriorating. Infections have officially topped three million while hospitals and laboratories are becoming overwhelmed in several states. Unfortunately, the death graph is also rearing its ugly head.

Source: New York Times

Has the recent coronavirus resurgence hit the labor market? The recent Non-Farm Payrolls report for June did not capture the uptick, but perhaps weekly jobless claims will show a change.

Overall, investors seem sanguine, supporting further pound/dollar gains – at least for now.

GBP/USD Technical Analysis

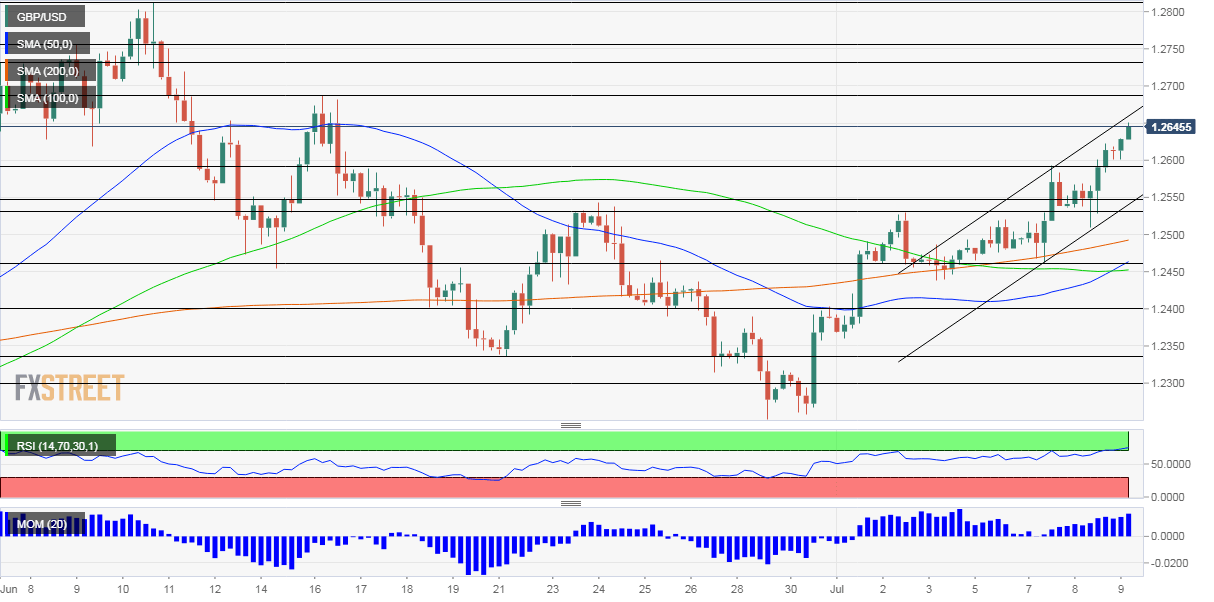

(Click on image to enlarge)

GBP/USD has entered overbought territory according to the Relative Strength Index on the four-hour chart – which is above 70. Cable continues trading above the 50, 100, and 200 Simple Moving Averages, and momentum remains positive.

Overall, technicals suggest a downside correction before the next move up.

Resistance awaits at 1.2680, a peak in mid-June. It is followed by 1.2730, a stepping stone on the way up earlier last month. Next, 1.2755 and 1.2815 await GBP/USD.

Support is at 1.2590, a swing high from earlier this week, followed by 1.2550, a peak in late June. The next lines to watch are 1.2530 and 1.2460.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more