Gauging The Bounce

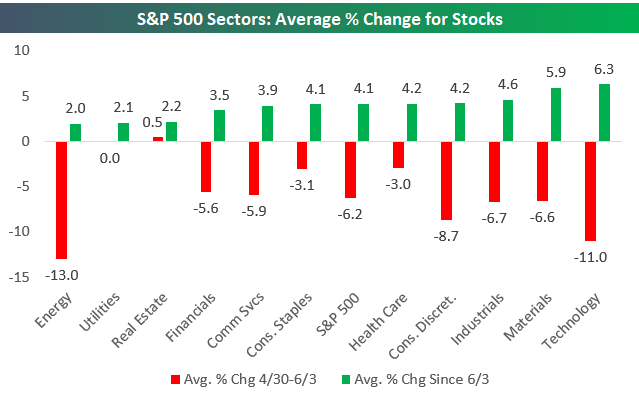

The average S&P 500 stock fell 6.2% from 4/30 (when the index made its last all-time closing high) through last Monday (June 3rd). Since the close, last Monday, the average stock in the index has bounced back 4.1%.

Below is a look at how stocks within sectors have performed recently. During the pullback from 4/30 to 6/3, Energy stocks fell the most of any sector at -13%. Energy stocks have also bounced back the least since 6/3 with an average gain of just 2%. Technology stocks fell the second most during the pullback with an average decline of 11%, but Tech has bounced back the most since 6/3 with an average gain of 6.3%.

Notably, some sectors have seen average gains since 6/3 that are bigger on an absolute basis than the declines they saw during the pullback. The average Utilities stock was flat from 4/30-6/3, but since then the average stock in the sector has rallied 2.1%. The average Real Estate stock actually gained from 4/30-6/3, and since then the sector has seen an average gain of 2.2%.

Consumer Staples and Health Care both saw average declines of roughly 3% during the 4/30-6/3 pullback, and they have bounced back by an average of just over 4% since 6/3.

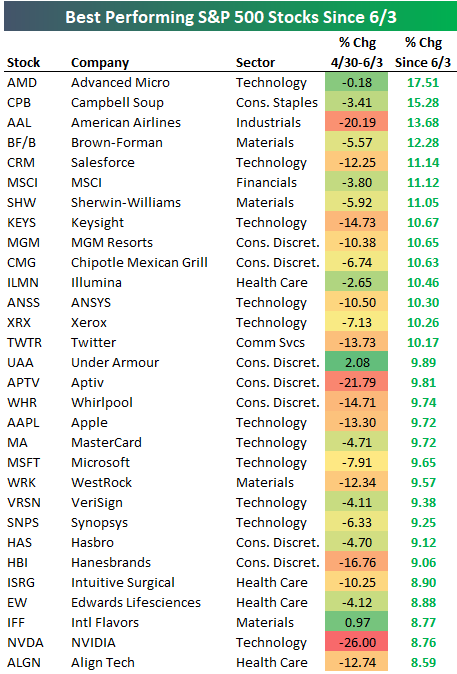

Below is a look at the best-performing stocks since the S&P’s recent closing low on 6/3. Advanced Micro (AMD) is up the most of any stock in the S&P with a gain of 17.51%. Campbell Soup (CPB) — a company that couldn’t be much more different than AMD — is up the second most since 6/3 with a gain of 15.28%. American Airlines (AAL), Brown-Forman (BF-B), and Salesforce (CRM) round out the top five with gains of more than 11% each. Other notables on the list of winners include Chipotle (CMG), Twitter (TWTR), Under Armour (UAA), Apple (AAPL), MasterCard (MA), Microsoft (MSFT), and NVIDIA (NVDA).

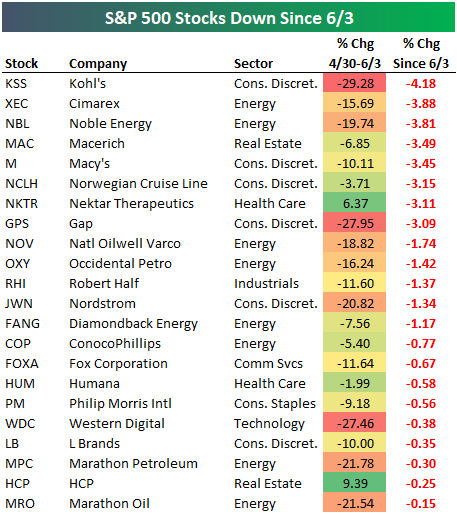

Below is a list of the 22 stocks in the S&P 500 that have the distinction of being down since last Monday. Kohl’s (KSS) is down the most with a decline of 4.18%, followed by Cimarex (XEC), Noble Energy (NBL), and Macerich (MAC). Other notables include retailers like Macy’s (M), Gap (GPS), Nordstrom (JWN), and L Brands (LB).

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more