GameStopped For Now

The GameStop frenzy which caused the markets to end January lower than when the month started has ended, despite its having left Robinhood's C-suite team frantically looking to raise cash. Yesterday the S&P 500 closed at 3,774, up 60 pts., the Nasdaq Composite closed at 13,403, up 332 pts. and the Dow closed at 30,212, up 229 pts. Currently morning futures for all 3 indices are trading in the green.

In a TalkMarkets exclusive titled, High Short Interest Stocks: What Are They, Who Are They, And How To "Play" Them, Lorimer Wilson explains in layman's terms what it means to short a stock and how to do it. He also, explains what is a "short squeeze" and gives a current list of "short" stock targets in light of the GameStop (GME) frenzy.

"Why Do Speculators 'Short' Stocks?

When someone shorts a stock, they’re trying to sell something that they don’t actually own because they think they can make money later by buying it back at a lower price.

How Do You Short A Stock?

If you believe a stock’s value will increase over time, you want to buy it and hold it, which is known as taking a “long” position but, if you anticipate that a stock’s price will decrease, you could take a “short” position. To do this, you would:

- borrow shares of the stock and sell them to another investor (even though you don’t own them).

- If you can sell the stock to someone else for a higher price than what it will cost you to purchase the shares from the original owner to cover your borrowing, you will profit from short-selling.

- If the stock’s price keeps rising, though, the short seller will have to rebuy the borrowed shares at a higher price than they sold the shares for.

What’s a Short Squeeze?

A short squeeze is when there is strong demand for a stock that also has a lot of short-sellers that forces short sellers to buy the stock in an attempt to cut their losses. When this happens - when both the long buyers and the short sellers are buying - it drives the price up even further."

If that short FinEd lesson has not quaffed your thirst for shorting here's Lorimer Wilson's list of current quenchers:

"A percentage of short-sales to total shares available for trading of over 30% is considered outrageously high and below is a list of such stocks that with their % appreciation during the month of January in brackets:

- GME: 102% (1625%)

- BBBY: 64% (38%)

- FIZZ: 63% (70%)

- LGND: 62% (86%)

- SPWR: 57% (111%)

- MAC: 54% (47%)

- SKT: 48% (56%)

- AXDX: 45% (298%)

- OTRK: 43% (28%)

- BYBD: 43% (42%)

- CLVS: 42% (65%)

- AMCX: 39% (38%)

- ESPR: 39% (21%)

- IRBT: 37% (50%)

- BGS: 37% (37%)

- PLCE: 36% (47%)

- M: 35% (37%)

- SRG: 35% (21%)

- PETS: 33% (20%)

- SFIX: 33% (63%)

- ZYXI: 32% (34%)

- PRTS: 31% (27%)

- VXRT: 31% (110%)

- DDS: 31% (39%)

- VIR: 30% (141%)

- FLGT: 30% (112%)"

Read the full article for a quick how to, but as Wilson writes:

TalkMarkets contributor Robert P. Balan is of the opinion that the GameStop mania will create fall-out that will have major implications for the market in the short term. In his article, Further GameStop Momentum Makes Russell Outperform, But Now Look Out For A Major Market Peak, Balan details what investors should be on the lookout for to happen. His summary takes are as follows:

- "The GME momentum higher will probably continue for some more days, even weeks. The Russell 2000 will continue to outperform in that case.

- This GME story is unlikely to morph into a Lehman style of market dislocation. More likely, some type of LTCM rescue/bail-out will be engineered by the Federal Reserve.

- Some of the short-selling hedge funds will disappear - bankrupted or bought out (likely pennies on the dollar). When that happens, the GME rally/momentum will break.

- If a GME resolution happens within the next two weeks, it will coincide with the peak in liquidity flows, and the subsequent, seasonal liquidity drought will weaken equities and long bond yields until late March (we will reappraise as more liquidity data comes in).

- Global liquidity, especially that coming from China, is set to go sideways to lower until late 2021 at least. That will crimp the evolution of cryptos/bitcoin, which will probably end the year lower from the highs we have seen several weeks ago."

Somehow I don't think there are any Long-term Capital Management style bailout plans included in the $1.9 trillion Biden stimulus plan. On the other hand that might something that could bring Republicans on board (not!).

In another TalkMarkets exclusive Kelsey Williams discusses the threat of cryptocurrencies. Writing in Janet Yellen Re: Cryptocurrencies And Terrorists Williams gives his take on who is threatened and who is doing the threatening.

Here is some of what he has to say:

1. "Here are the statements she (Janet Yellen) made in response to a question from Sen. Maggie Hassan, who asked Yellen during her confirmation hearing on Tuesday about the dangers of terrorists using cryptocurrencies:

"You're absolutely right that the technologies to accomplish this change over time, and we need to make sure that our methods for dealing with these matters, with terrorist financing, change along with changing technology," Yellen said.

"Cryptocurrencies are a particular concern. I think many are used - at least in a transaction sense - mainly for illicit financing.

"And I think we really need to examine ways in which we can curtail their use and make sure that money laundering doesn't occur through those channels." "

2. "Cryptocurrencies offer a PRIVATE process for digital transfer of money...The privacy is attractive for tax and regulatory reasons. Is tax-avoidance an issue of concern for Ms. Yellen?The answer is probably yes. Although, at this point, the volume of financial transactions in all cryptocurrencies likely isn't large enough to justify excessive concern on her part...There must be another reason."

3. "The reason: lack of control. Financial transactions in Bitcoin (BITCOMP) and other cryptocurrencies are "off the grid" so to speak. That means that they are unreported and do not come under the purview of the regulators. Ms. Yellen's inference of terrorists using cryptocurrencies appears to be an attempt to justify curtailment or clampdown on financial activity that is currently not under the purview of those who are in control."

Recent polls show that President Biden has a 56% approval rating coming out of the gate as opposed to Former President Trump who had a 46% approval rate at the commencement of his term. That should bide well for the economy and two of our contributors round out today's column with just such good news.

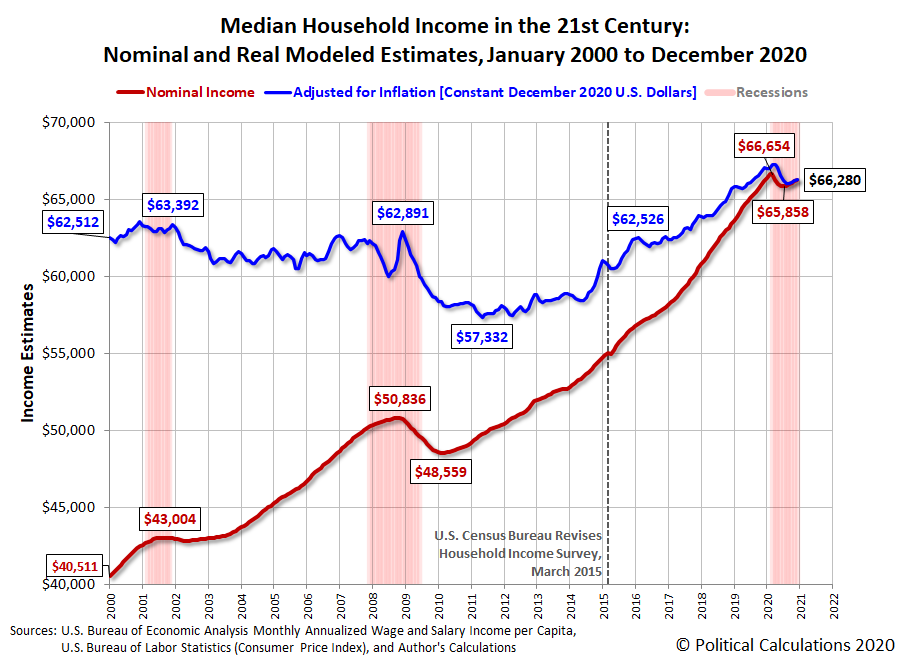

TalkMarkets contributor Ironman in Median Household Income In December 2020 reports that "median household income in December 2020 is $66,280, an increase of $113 (or 0.17%) above the initial estimate of $66,167 for November 2020."

Ironman includes the following chart which illustrates where the recovery is in terms of household income:

Ironman further notes:

"Median household income in the United States has been rebounding since July 2020, where revised data puts the bottom at $65,858. Through December 2020, the wage and salary income earned by a typical American household has increased by $422, or 0.6%. Median household income previously peaked at $66,654 in March 2020, just before state and local government COVID-19 lockdowns threw the U.S. economy into recession. December 2020's initial estimate of $66,280 indicates the median income-earning household has now recovered more the half the loss recorded during the early months of the coronavirus pandemic."

Good news, indeed.

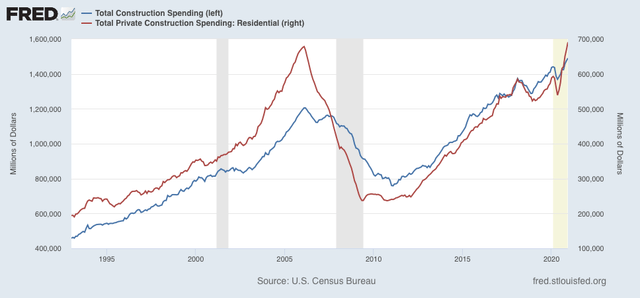

New Deal Democrat writing in The Two Most Leading Sectors Of The Real Economy - Manufacturing And Construction - Remain “On Fire” finds that both the manufacturing and construction sectors of the economy are strong and should be among the leaders pulling us out of the COVID recession of 2020. New Deal Democrat includes charts like the one below to make his case.

Total And Residential Construction Spending For The Past 25 Years

As he says:

" (The ISM manufacturing index and December construction spending) Simply put this morning’s two reports together show that manufacturing and housing, the two most important leading sectors of the real economy, continue to be “on fire.”

February is starting off cold in much of the U.S. this week. Despite that, William Cullen Bryant, the 19th century American poet and journalist, had this to say about the second month of the year:

"The February sunshine steeps your boughs and tints the buds and swells the leaves within."

Here's to the passing of a COVID-19 relief package that will do the same. See you next week.