Futures Slide, Global Rally Fizzles; Oil Set For Longest Rally On Record

"Powell seems to have improved at the art of Fedspeak, using many words but not saying anything substantively new"

Deutsche Bank

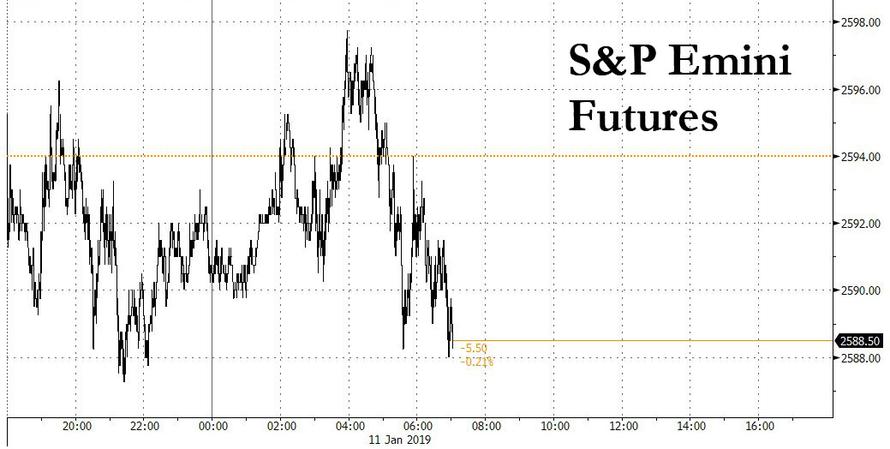

For the second day in a row, the S&P's recent torrid post-Christmas rally which has seen the S&P up +10.44% over the last 11 sessions, the best such stretch since October 2011, is in danger of ending as U.S. stock futures edged lower 0.3%, while European shares were mixed and Asian markets rose at as sentiment was bolstered by continued dovish tone from the Federal Reserve and hopes for a breakthrough on trade. The dollar slide continued even as Treasuries finally advanced and the oil rally continued for a record 10th day, while the US government shutdown tied the longest ever, as it entered its 21st day.

With renewed promises of patience from Federal Reserve, as Fed vice chair Clarida followed Powell on Thursday evening saying the central bank should be ready to adjust monetary policy if headwinds to the economy from financial markets or global growth prove persistent, suggesting caution about moving ahead with interest-rate increases, while the ECB was mulling another dump of cheap money in the form of TLTRO and news that trade talks between Washington and Beijing are moving to higher levels, the Friday feeling was in full effect, even if it appeared to peak in the US where futures initially rose then dropped to session lows.

The Fed’s dovish stance also pushed down the dollar and nudged Treasury yields lower after five days of gains again. That cheered emerging markets and confidence more generally having been flattened during the brutal end to 2018: “Equities are having a good run after a pretty horrible end to last year,” said Rabobank quantitative analyst Bas Van Geffen. “It is the changing wording of the Fed, it seems to be making more and more room for an eventual pause (in the rate hike cycle)”.

Asia had crawled to a 5-week high overnight as shares rose in Shanghai, Tokyo, Seoul and Hong Kong while European stocks were on the edge of fourth straight day of gains and longest winning streak since September. S&P 500 futures and Nasdaq indexes pointed to a slightly softer open in New York after jumping early in the session after Steven Mnuchin said Chinese Vice Premier Liu He will “most likely” visit Washington on Jan. 30 and 31 for further trade talks. China’s yuan, which slumped last year as trade tensions worsened, is heading for its best week since 2005, back when the country dropped a fixed peg to the dollar.

A pause to the recent massively overbought rally is to be expected: the S&P 500 is now up more than 10% from its Dec. 26 low - one day after Steven Mnuchin spoke to the Plunge Protection team. The S&P is also up on 6 out of the 7 sessions in 2019 so far and each of the last 5. That’s the best streak since September and if it rises again today, it will achieve in the second week of the year a feat that only occurred twice in all of 2018. The index is now up +10.44% over the last 11 sessions, the best such stretch since October 2011.

In Asia, the ASX 200 (-0.3%) and Nikkei 225 (+1.0%) were mixed with the initial upside in Australia clouded by weakness in the key financials and mining-related sectors, while the Japanese benchmark outperformed as it coat-tailed on the recent USD/JPY moves. Elsewhere, Shanghai Comp. (+0.7%) and Hang Seng (+0.5%) conformed to the overall positive risk tone following the recent trade-related optimism with Vice Premier Liu He said to possibly visit the US later this month and amid hopes of further supportive measures as China may adopt more tax cuts for the manufacturing sector.

Failing to carry over Asian strength, European indices are mixed, having pared back some of the initial gains from the open. Some initial outperformance was seen in the FTSE 100 (+0.1%) jumped as much as 0.7 percent on the back of the latest slide in sterling against the euro on mounting Brexit uncertainty while UK housing names were higher after the sector was upgraded by BAML, with Persimmon (+4.4%), Taylor Wimpey (+4.8%) and Barratt Development (+2.6%) at the top of the index, however, the index was later pressured on currency effects as Sterling whipsawed on Brexit developments. Other notable movers include, Richemont (+2.3%) after the Co’s Q3 revenue of EUR 3.92bln was in line with the expected EUR 3.93bln and posting a 5% rise in constant currency sales for the October-December period.

The market's bullish mood was supported by Fed Chairman Jerome Powell who underscored the message of patience with further interest-rate hikes, while saying the central bank will keep shrinking its balance sheet. At the Economic Club of Washington on Thursday, Fed chief Jerome Powell reiterated the U.S. central bank would be patient about hiking interest rates.

“The word ‘patient’ is used often when the Fed’s policy direction is still tightening but its next rate hike can wait for a considerable time. So risk assets now enjoy support from what we can call Powell put,” said Tomoaki Shishido, economist at Nomura Securities. “Similarly, Trump also softened his stance on China after sharp falls in stock prices. He has offered an olive branch to China and there’s no reason China would not want to accept it,” he added.

In FX, the dollar was on course for its fourth straight weekly fall against other top world currencies having also hit a three-month low the previous day. The flip side was that the Japanese yen was a shade higher again at 108.29 per dollar and the euro was up at $1.1530 on course for its best week since August. But it is China’s yuan that has been the real mover though. Against the backdrop of the sensitive trade negotiations, the Chinese currency has risen 1.8 percent this week which is its biggest gain since July 2005 when Beijing abandoned the yuan’s peg to the dollar.

Yuan traders had started offloading dollars in their proprietary accounts on Thursday following the wrap-up of three-day U.S.-China trade talks in Beijing. Markets treated absence of any bad news from those negotiations as good news. “Some corporate clients were joining to sell their dollars,” said a trader at a foreign bank in Shanghai.

Bond markets have been turning too. U.S. Treasury debt prices erased early gains after a soft 30-year bond auction and in reaction to Powell’s comments on the Fed “substantially” reducing the size of its balance sheet. The 10-year U.S. Treasuries yield last stood over 2bps lower at 2.7168%.

Finally, in commodities, the notable mover was crude as oil rose for a 10th consecutive day, heading for its longest run of gains on record, as OPEC cutbacks reined in supply while the plunging dollar boosted demand. Futures returned to a bull market this week after recovering more than 20% from the lows reached in December. Saudi Arabia gave assurances on Wednesday that the production cuts by OPEC and its partners that came into effect this month will be deep enough to prevent any surplus.

“Sentiment in the oil market has turned around this week,” said Jens Naervig Pedersen, senior analyst at Danske Bank A/S in Copenhagen. The reversal “is on the back of a combination of OPEC+ production cuts taking effect, a stabilization in risk sentiment in equity markets and a weaker dollar. In addition, the oil market will be monitoring trade talks, which seem to progress slowly.”

In us political news, President Trump said he will most likely declare an emergency if there is no border deal but added should be able to make a deal with Congress, while there were earlier reports that US President Trump had been briefed regarding plan to use Army Corps of Engineers funding to border wall construction. Also commented that he has the absolute right to declare a national emergency and is not doing it yet but will do if shutdown carries on.

In the latest Brexit news, it is looking increasingly likely to be delayed beyond March 29th amid a backlog of essential bills, according to Cabinet Ministers cited by the Evening Standard. However, this has been dismissed by a UK PM May spokesperson. UK PM May launched an appeal to Britain’s biggest unions last night in an attempt to win Labour support for her Brexit deal.

The partial U.S. government shutdown threatens to extend into a fourth week with about 800,000 federal workers set to miss their first paychecks. Economic data include CPI inflation readings

Market Snapshot

- S&P 500 futures down 0.3% at 2,588

- STOXX Europe 600 up 0.3% to 350.07

- MXAP up 0.5% to 151.74

- MXAPJ up 0.4% to 491.54

- Nikkei up 1% to 20,359.70

- Topix up 0.5% to 1,529.73

- Hang Seng Index up 0.6% to 26,667.27

- Shanghai Composite up 0.7% to 2,553.83

- Sensex down 0.3% to 36,012.53

- Australia S&P/ASX 200 down 0.4% to 5,774.58

- Kospi up 0.6% to 2,075.57

- German 10Y yield fell 2.0 bps to 0.235%

- Euro up 0.2% to $1.1522

- Brent Futures up 1% to $62.30/bbl

- Italian 10Y yield rose 0.9 bps to 2.527%

- Spanish 10Y yield fell 2.4 bps to 1.427%

- Brent Futures up 1% to $62.30/bbl

- Gold spot up 0.5% to $1,293.34

- U.S. Dollar Index down 0.2% to 95.38

Top Overnight News from Bloomberg

- Chinese Vice Premier Liu He is said to be scheduled to visit Washington on January 30 and 31 for further trade talks

- Fed Vice Chairman Richard Clarida said the central bank should be ready to adjust monetary policy if headwinds to the economy from financial markets or global growth prove persistent, suggesting caution about moving ahead with interest-rate increases

- Japan’s Prime Minister Shinzo Abe told Theresa May the whole world wants to avoid a no-deal Brexit even as she faces likely defeat when Parliament votes on her plan next week

- The Trump administration was said to have directed the U.S. Army Corps of Engineers to examine whether the wall could be funded using money from emergency funding. Trump cancels trip to Davos gathering as shutdown grinds on

- The European Central Bank should wait until the spring before tweaking its policy and keep all options open amid economic weakness and a fragile global outlook, according to Governing Council member Francois Villeroy de Galhau

- Fast-money traders seem to have lost their stomach for betting on an interest rate lift-off in the heart of Europe. They entered 2019 with the smallest value of short wagers against German bunds in more than two years, according to exchange-traded product data

- A trader who wants BNP Paribas SA to pay him 163 million euros ($188 million) over a “fat-finger” mistake is betting that Paris judges will help him avoid having to give up most of the claim

- Emmanuel Macron next week launches a three- month national debate that he hopes will dissipate the anger displayed in the recent violent protests, without derailing the reforms he insists France needs

- An American military official tells AP the U.S.-led military coalition has begun the process of withdrawing troops from Syria

Asian equity markets traded mostly higher following the 5th consecutive session of gains on Wall Street as global sentiment remained underpined by perceptions of a more patient Fed approach. ASX 200 (-0.3%) and Nikkei 225 (+1.0%) were mixed with the initial upside in Australia clouded by weakness in the key financials and mining related sectors, while the Japanese benchmark outperformed as it coat-tailed on the recent USD/JPY moves. Elsewhere, Shanghai Comp. (+0.7%) and Hang Seng (+0.5%) conformed to the overall positive risk tone following the recent trade-related optimism with Vice Premier Liu He said to possibly visit the US later this month and amid hopes of further supportive measures as China may adopt more tax cuts for the manufacturing sector. Finally, 10yr JGBs were lacklustre on profit taking following recent gains and with demand also limited by the upside in riskier assets.

Top Asian News

- Nissan Shunned in Bond Market on Ghosn But Banks Seen Supportive

- Why Ghosn’s Still Jailed and What It Says About Japan: QuickTake

- What India’s Top Three Mutual Funds Bought and Sold in December

- Chinese Stocks Post Biggest Weekly Gain in Nearly Two Months

Major European indices are mixed [Euro Stoxx 50 Unch], having pared back some of the initial gains from the open. Some initial outperformance was seen in the FTSE 100 (+0.1%) which is lead by strong performances in UK housing names after the sector was upgraded by BAML, with Persimmon (+4.4%), Taylor Wimpey (+4.8%) and Barratt Development (+2.6%) at the top of the index, however, the index was later pressured on currency effects as Sterling whipsawed on Brexit developments. Sectors are similarly in the green with some slight outperformance seen in energy names. Other notable movers include, Richemont (+2.3%) after the Co’s Q3 revenue of EUR 3.92bln was in line with the expected EUR 3.93bln and posting a 5% rise in constant currency sales for the October-December period. Meanwhile, Suez (-3.1%), Veolia (-2.6%) and Sage Group (-2.6%) are all in the red after being downgraded.

Top European News

- Crispin Odey Says Believes Brexit Will Not Happen: Reuters

- Euro Bond Supply Avalanche Meets Wall of Cash From Fund Managers

In FX, the dollar session was choppy but ultimately on the backfoot after losing the 95.500 level in early Asia-Pac trade as the Fed signalled a more patient approach ahead of the US CPI release later today. Both Fed Chair Powell and Vice Chair Clarida noted the Central Bank has the ability to be patient and flexible on rates given the State-side inflation data. As such the DXY fell to an overnight session low of 95.322 (vs. high of 95.508) and currently hovers around the middle of the range with US CPI in sight. Lloyds notes that the sharp decline in energy will likely weight on the headline CPI as they forecast a fall to 1.9% from 2.2%, though they expect the core figure to remain steady at 2.2%.

- AUD,NZD, CNY, CAD – The marked outperformers and major beneficiaries as the USD/CNY is poised for its best week since 2005 with aid from the dovish Fed and a sub-6.80 PBoC fix. AUD/USD currently resides north of 0.7200 (vs. low of 0.7183) and reached levels last seen mid-December as optimistic Australian retail sales also underpinned the Aussie currency. Meanwhile, the Kiwi stands at the G10 leader as tailwind from its antipodean counterpart boosted the NZD/USD above its 50 and 200 DMA at 0.6786 and 0.6799 respectively to test 0.6840 to the upside, with the DMAs also set to form a golden cross. Finally, the Loonie is on the front foot as it reaps its reward from the declining greenback and the rising oil price with USD/CAD now below 1.3200 (vs. high of 1.3245) ahead of its 100 DMA at 1.3169.

In commodities, Brent (+0.6%) and WTI (+0.8%) prices are in the green benefiting from the positive sentiment seen across US and Asian sessions after dovish comments from multiple Fed speakers. Russian oil output for January 1st-10th has dropped to 11.38mln BPD from 11.45mln BPD in December; additionally, Russian Energy Minister Novak is reportedly planning to attend the upcoming January 22nd-25th Davos summit. Gold (+0.5%) prices are just shy of USD 1295.2/oz, the sessions high, following dovish comments from the Fed applying downward pressure to the dollar. Copper prices are similarly higher on the positive market sentiment, in particular that Chinese Vice Premier He is to visit the US later on in the month. Elsewhere, India’s steel ministry is refusing to back down on tougher import rules on steel, pressuring automakers into using local steel instead.

US Event Calendar

- 8:30am: US CPI MoM, est. -0.1%, prior 0.0%; CPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%

- US CPI YoY, est. 1.9%, prior 2.2%; CPI Ex Food and Energy YoY, est. 2.2%, prior 2.2%

- 8:30am: Real Avg Weekly Earnings YoY, est. 1.2%, prior 0.54%;

- 2pm: Treasury monthly budget statement postponed by govt shutdown

DB's Jim Reid concludes the overnight wrap

Fortune continues to favor the brave in markets at the moment following another broadly positive last 24 hours for risk assets. It may have been a less convincing session on Wall Street last night compared to recent days with the S&P 500 for example passing between gains and losses no less than 19 times, however, a +0.45% closing move for the index does now mean it’s finished higher in 6 out of the 7 sessions in 2019 so far and each of the last 5. That’s the best streak since September and if it rises again today, it will achieve in the second week of the year a feat that only occurred twice in all of 2018. The index is now up +10.44% over the last 11 sessions, the best such stretch since October 2011.

There’s little doubt that sentiment over this period has been largely driven by communications from the Fed, and it’s no surprise that attention focused yesterday on Chair Powell’s public remarks. However, as we enter the 12th month of his Chairmanship, he seems to have improved at the art of Fedspeak, using many words but not saying anything substantively new. Markets were broadly unchanged during and immediately after his speech, and the S&P 500 rallied through the afternoon to ultimately close higher.

In terms of substance, Powell reiterated that the economy is “doing quite nicely” though he is attentive to “the financial markets expressing a view about the concern about downside risks associated with global growth and with trade.” To balance the divergent signals between strong data and tepid markets, Powell said he plans to “be patient and flexible and wait and see what does evolve.” So that’s consistent with our economists’ base expectations for two more rate hikes this year. Powell also repeated his guidance on the balance sheet runoff and the uncertainty over its terminal size, and he mentioned China as a key uncertainty to the global growth outlook.

After markets closed, Vice Chair Clarida presented a similar message. He referenced tighter financial conditions and global growth as key "crosswinds" affecting the US economy, and argued that "if these crosswinds are sustained, appropriate forward-looking monetary policy should respond." He said the Fed would change its balance sheet policy if necessary, though any policy shifts would have to be consistent with their mandate. So, another Fed official seemingly in support of a pause in the rate hike cycle.

Back to markets where the DOW and NASDAQ also gained +0.51% and +0.42%, respectively yesterday. The VIX also ended at 19.50 which was down about half a point while 2y and 10y rates +2.3bps and +3.2bps respectively, meaning the curve was about 1bp higher at +16.5bps. The USD strengthened +0.32% while WTI oil closed up +0.44% to take its remarkable run of daily gains to 9 and the longest since January 2010. The price is up +17.89% during this current run which is the most over 9 sessions since March 2016.

Early on in the day there was some damage done by the US retail sector with Macy’s grabbing much of headlines with shares plummeting -17.69% for its worst-ever loss, after cutting its annual earnings forecast. Kohl’s also dropped -4.81% after reporting disappointing holiday period sales while Barnes & Noble dropped -15.76% in the wake of also downgrading earnings guidance. Target’s (-2.85%) holiday sales actually appeared more in-line with estimates however the company failed to escape the wider sector carnage. It was a similar story for retail CDS with spreads +36bps wider for Macy’s, +16bps wider for Kohl’s and +12bps for Nordstrom. The broader CDX IG index did, however, finish 2bps tighter while US HY cash spreads also tightened 2bps for its fifth consecutive rally, over which it has narrowed a remarkable -87bps.

Speaking of earnings, next week we’re due to get Q4 reports from 35 S&P 500 companies including the banks. So this should give investors something else to focus on other than the repetitive trade-related headlines of late. As an early preview, Q4 earnings growth is expected to be 11.4% which compares to around 25% growth reported in each of the prior three quarters according to data from Factset. Still, if Q4 comes in in-line this would be the fifth straight quarter of double digits earnings growth. It’s worth also noting that over the past five years on average, actual earnings have exceeded estimated earnings by nearly 5%. So history would suggest that there is upside to forecasts.

The partial government shutdown in the US is also busy repeating and has now entered its 21st day, tying the longest-ever shutdown, with around 800k federal workers expected to not receive their paychecks today. Indeed, there was a big uptick in jobless claims in DC last week, as furloughed workers are entitled to unemployment benefits until the shutdown is resolved, so we’re beginning to see the effects of the standoff in the macro data. Another side-effect of the shutdown is the delay to some of the GDP-sensitive data releases which is making life harder for economists to get a comprehensive read of how the US is tracking in the last couple months. With the Fed emphasizing data dependency this is clearly proving an issue. Today’s December CPI report won’t be affected however with the consensus expecting a +0.2% mom core reading which should be enough to hold the annual rate at +2.2% yoy. Our US economists expect the same which should keep Fed rate hikes in play this year if various uncertainties are resolved.

To Asia now where markets are largely tracking Wall Street’s gains last night with the Nikkei (+0.97%) leading the way, followed by the Hang Seng (+0.18%), Shanghai Comp (0.16%) and Kospi (+0.61%). Sentiment has also been given a boost by an overnight tweet from a WSJ journalist confirming that China’s Vice Premier Liu He is scheduled to visit US for trade talks on Jan 30 and 31st. Meanwhile, China’s onshore yuan is up +0.58% to 6.7495, the highest since July 2018 with the weakness in US dollar (-0.19%) also contributing to the rise. Futures in the US are however slightly down as we type (S&P 500 -0.11%).

Back to yesterday where in Europe the STOXX 600 more than fought off an early decline at the open to close up +0.34%. There were gains also for the DAX (+0.26%) and FTSE MIB (+0.63%) although the CAC (-0.16%) underperformed not helped by a soft French industrial production print (-1.3% mom vs. 0.0% expected). Bonds were a touch stronger (Bunds -2.2bps) with the ECB minutes confirming that the board did discuss changing the communication on language to acknowledge economic risks as tilting to the downside, although holding fire at the meeting. There was also a reference to TLTROs, which may have helped an index of bank stocks to outperform, gaining +0.75%.

In other news, PM May confirmed late afternoon yesterday that the UK is still in talks with the EU over the backstop and that government is still seeking support for a deal across parliament. Yesterday Labour leader Corbyn said that he would take a confidence motion when it can succeed (so not necessarily immediately after next week’s vote, should May lose) and also that his party would not rule out an Article 50 extension should Labour come to power. Overall though there wasn’t much new in Labour’s policy on Brexit yesterday and Sterling nudged down -0.33% by the end of play. Across the pond it’s worth adding that President Trump said that he will not attend Davos later this month as a result of the government shutdown. An indication maybe that the shutdown will continue for a while longer, or alternatively perhaps the ski conditions aren’t up to scratch yet.

Finally, looking at the rest of the day ahead, this morning and shortly after this hits your emails we’re due to get the December Bank of France industrial sentiment reading followed later by a data dump out of the UK which includes November trade balance, industrial and manufacturing production, construction output and monthly GDP data. This afternoon in the US the aforementioned US CPI report will no doubt be the big highlight, especially with the monthly budget statement postponed due to the partial government shutdown. Meanwhile, we’ll finally get a rest from all the Fedspeak with no speeches due however over at the ECB we are due to hear from Mersch and Visco.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more