Futures Slide As Global Rally Ends 7-Day Streak; Hong Kong Riots, Trade War Eyed

The torrid June rally finally fizzled overnight as stocks slipped around the globe on Wednesday alongside S&P futures, after a six-day rally in the S&P ended yesterday with a whimper amid signs the June revival in risk appetite may have overshot, with trade concerns returning to the fore.

The market mood soured after a protest in Hong Kong turned violent as police were unleashed to contain a "riot", compounding the negative sentiment, and Treasuries gained. An impending reading on U.S. CPI was set to further cement the Fed's decision whether to cut rates in June/July.

“I think we are in for a very nervous wait until next week’s FOMC meeting,” Saxo Bank’s head of FX strategy, John Hardy, said.

Europe’s main markets followed Asia by declining early on. London’s FTSE, the DAX in Frankfurt and CAC40 Paris were down 0.2% to 0.4% as traders trimmed some of June’s 4% gains. The Stoxx Europe 600 index headed for its first drop in four sessions.

The rebound in Asia stocks paused on Wednesday as traders stayed cautious amid lingering U.S.-China trade tensions and an escalating protest in Hong Kong. The region’s benchmark declined 0.5% snapping a three-day gain. Hong Kong was the worst-performing market in the region, with the Hang Seng Index falling as much as 2% after thousands of demonstrators converged on the city’s legislature Wednesday and blocked roads to protest a bill that would for the first time allow extraditions to China.

“The impact was short-lived in the past,” noted Alex Wong, director at Ample Finance Group in Hong Kong. “This time people will look at how the U.S. reacts to this kind of news. The U.S. attitude towards Hong Kong and China are also not the same.”

Japanese stocks halted their three-day advance as electronics makers were the heaviest drags on the index. Trading volume for the nation’s equities dropped almost 20%. Nintendo fell after delaying the release of Animal Crossing: New Horizons. Square Enix Holdings posted its worst two-day slump as investors took profits after the company announced new games at E3. Most of other major Asia markets also declined as the cautious sentiment spreading across the region. China’s Shanghai Composite Index retreated as much as 0.8%, and Jakarta Composite index fell 0.7%.

Then there was the ongoing trade war which has no resolution in sight: President Trump said on Tuesday he was holding up a trade deal with China and had no interest in moving ahead unless Beijing agrees to four or five “major points”, which he did not specify. He said interest rates were “way too high” and the Federal Reserve had “no clue”.

And speaking of the Fed, the FOMC will meet on June 18-19. With trade tensions rising, U.S. growth slowing and hiring in May declining, markets have priced in at least two rate cuts by the end of 2019. Futures imply around an 80% chance of an easing as soon as July. That may change depending on what U.S. consumer price data show later in the session. Headline inflation is expected to slow to 1.9%, with the core rate steady at 2.1%.

In FX, the euro rebounded initially to $1.1336, just short of the recent three-month high of $1.1347, despite Trump's recent tweet slamming the Euro as "devalued." The dollar fell against the yen to 108.36 and stalled on a basket of currencies at 96.608.

“The President’s tweets on the USD have the potential to have much more lasting impact in the coming election year,” said Alan Ruskin, global head of G10 FX strategy at Deutsche Bank. “Global conditions are nicely set for what has colorfully been described as a ‘currency war’ or a currency race to ‘the bottom’.”

China's yuan weakened against the dollar, a day after it climbed the most in two months following the central bank’s moves to shore up the currency. The PBOC set a slightly stronger-than-expected reference rate Wednesday, after showing the largest strong bias in its fix on Tuesday since Bloomberg began releasing fixing forecasts in 2017. The central bank on Wednesday resumed 28-day reverse repurchase agreements for the first time since January, a signal that it seeks to ensure market stability amid seasonal tightness and the aftermath of the Baoshang seizure, according to Qi Sheng, chief fixed-income analyst from Zhongtai Securities Co. In Hong Kong, stocks tumbled and the currency soared in its biggest gain in six months, as interbank interest rates jumped amid protests that closed roads in the city’s financial district.

Benchmark government bond yields fell as caution grew, with the 10Y Treasury down to 2.12%.

In commodities, oil prices dropped over 2% as concern about a global economic slowdown offset expectations that OPEC and its allies will extend their supply curbs. Hedge fund managers have been liquidating bullish oil positions at the fastest rate since late 2018 amid growing economic fears.

Economic data include mortgage applications and CPI, while Lululemon is among companies reporting earning

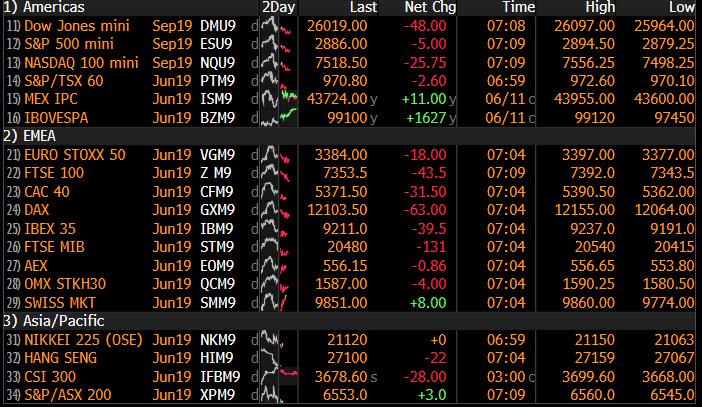

Market Snapshot

- S&P 500 futures down 0.3% to 2,879.75

- STOXX Europe 600 down 0.5% to 379.06

- MXAP down 0.5% to 156.57

- MXAPJ down 0.6% to 511.71

- Nikkei down 0.4% to 21,129.72

- Topix down 0.5% to 1,554.22

- Hang Seng Index down 1.7% to 27,308.46

- Shanghai Composite down 0.6% to 2,909.38

- Sensex down 0.6% to 39,713.77

- Australia S&P/ASX 200 down 0.04% to 6,543.74

- Kospi down 0.1% to 2,108.75

- German 10Y yield fell 0.2 bps to -0.234%

- Euro up 0.09% to $1.1336

- Brent Futures down 2.2% to $60.94/bbl

- Italian 10Y yield rose 3.4 bps to 2.025%

- Spanish 10Y yield rose 0.4 bps to 0.583%

- Brent Futures down 2.2% to $60.94/bbl

- Gold spot up 0.8% to $1,337.41

- U.S. Dollar Index down 0.05% to 96.63

Top Overnight Highlights from Bloomberg

- The dollar touched an eight-week low before U.S. inflation data that may back the case for Fed interest-rate cuts. The greenback is weaker against all its G-10 peers so far this month as markets have boosted pricing on Fed easing amid concern trade frictions will sap global growth.

- The yen led gains on Wednesday, strengthening for the first time in three days against the dollar

- The euro was little changed after Tuesday’s advance; the common currency was pressured after comments from ECB Governing Council member Francois Villeroy de Galhau who said the central bank could increase stimulus if needed

- European bond markets traded flat ahead of a large supply slate from Germany, Portugal, Italy and Spain; U.S. Treasuries advanced for a second day, the 10-year yield dropped 2bps to 2.12%

- U.S. index futures slipped, the Stoxx Europe 600 index opened lower for the first time in four sessions

Asian equity markets traded mostly subdued after the flat lead from Wall St where the relief rally stalled, and the major indices finished flat to snap a 5 and 6-day win streak for the S&P 500 and DJIA respectively. ASX 200 (U/C) and Nikkei 225 (-0.4%) were mixed with Australia kept afloat by mining names as iron prices in China surged to fresh record highs, while the Japanese benchmark mirrored the indecisiveness of its US peers amid a firmer JPY and with SoftBank among the laggards as a group of US states attempt to block the Sprint and T-Mobile merger. Elsewhere, Hang Seng (-1.7%) and Shanghai Comp. (-0.6%) were negative following another net liquidity drain by the PBoC and pessimism regarding the ability to reach a US-China trade deal at the G20, with underperformance in Hong Kong amid increases in money market rates and mass protests outside government buildings in opposition against the controversial extradition bill. Finally, 10yr JGBs kept rangebound with price action hampered by the indecisiveness in the region and amid a lack of BoJ presence in the market today.

Top Asia News

- Nintendo Moves Some Switch Production Out of China: WSJ

- Indonesia’s Jokowi Open to Gerindra Joining His New Cabinet

- Japan to Propose TPP-Level Tariff Cut on U.S. Farm Goods: Kyodo

- Rumors About China Military Going to HK Are Misinformation: Geng

European equities are mostly lower [Eurostoxx 50 -0.5%] in a continuation of the subdued lead from Asia in which Hong Kong’s stock index suffered heavy losses due to the mass protests against the controversial extradition bill. Sectors are mixed, with heavy underperformance across energy names (sector -1.2%) amid the slide in oil prices. Meanwhile, defensive sectors (utilities +0.3%, healthcare +0.4%) are in the green as investors flock to the ‘safer’ and more stable stocks. In terms of individual movers, shares in British American Tobacco (-6.0%) fell to the foot of the Stoxx 600 index as the cigarette maker expects global industry volume to fall by around 3.5%, although the Co. reiterated guidance despite its peer Imperial Brands (-1.8%) cutting guidance for their tobacco business yesterday. Elsewhere, shares in Axel Springer (+11.8%) rocketed after KKR’s Traviata confirmed that it is to make a takeover offer for the company for EUR 63/shr (vs. yesterday’s close at EUR 55.85/shr). Meanwhile, SMI’s LafargeHolcim (-3.1%) fell to the bottom of the index after a major shareholder cut his stake in the company.

Top European News

- Brexit Britain Contemplates Another Foreign Central Bank Boss

- Reckitt Benckiser Names Laxman Narasimhan as CEO From Sept. 1

- Britain’s Banking Upstarts Vulnerable to a Downturn, BOE Finds

- Drug to Replace Chemotherapy May Reshape Cancer Care

In FX, the Dollar is on the defensive ahead of US headline inflation data that could provide more justification for the Fed to consider a rate cut, with the index only just holding above chart support ahead of 96.500 in the form of the 200 DMA within a 96.578-722 range.

- JPY/GBP/EUR/CHF - All taking advantage of the softer Greenback, as the Yen rebounds towards 108.00 and into decent option expiry territory with 1 bn sitting between 108.40-25 before a further 1.2 bn from 108.10 down to the big figure. Note, Usd/Jpy has also pared gains on a partial retracement in global stocks as improving risk sentiment wanes, but the Franc has not regained as much safe-haven allure given Thursday’s SNB quarterly policy review and the likelihood of more NIRP and intervention iterations – check out the headline feed or Research Suite for a detailed preview. Usd/Chf and Eur/Chf remain above 0.9900 and 1.1200 respectively, with the single currency also consolidating above 1.1300 vs the Dollar and inching closer towards last Friday’s post-NFP highs circa 1.1348 where stops are anticipated, but could be countered by hedges for a 1.2 bn expiry at the 1.1350 strike. Meanwhile, Cable has retested yesterday’s post-UK data/BoE commentary peaks just shy of 1.2750 and Eur/Gbp is pivoting 0.8900 awaiting Tory leadership front-runner BoJo’s official campaign launch.

- NZD/CAD/AUD - Ongoing global trade concerns are undermining the non-US Dollars, as the Kiwi remains capped below 0.6600 and Loonie retreats further from best levels towards 1.3300, and perhaps takes heed of the more pronounced recoil in crude prices having decoupled somewhat in wake of supportive Canadian jobs data and the fillip from the US and Mexico clinching a deal to avert tariffs. However, the Aussie is underperforming in the run-up to tomorrow’s labor report and probing key Fib support circa 0.6945.

- EM - Usd/Try is back above 5.8000 amidst latest Turkish remonstrations about the US not adhering to the spirit of alliance on the missile front and reports that an official response to a letter from Washington is being prepared. Meanwhile, the Lira is also looking pressured ahead of the looming CBRT that could turn more dovish given recent inflation data showing a slowdown in CPI, weaker oil and Try appreciation from worst levels – for more see Ransquawk’s headline feed and/or Research Suite.

In commodities, another day of losses for the energy complex with WTI (-2.7%) and Brent (-2.8%) futures heavily pressured amid the latest surprise build in API crude stocks (+4.9mln vs. Exp. -0.5mln) coupled with risk aversion around the market, whilst the EIA’s downgrade in global oil demand forecast only adds to the bearish sentiment. WTI futures currently hover just above the USD 51.50/bbl level, having dipped below its 200 WMA (52.59) whilst its Brent counterpart briefly fell under the USD 60.50/bbl mark. News flow for the complex has been light thus far with participants now gearing up for the weekly DoEs to potentially reinforce the build in stockpiles seen in the APIs. Elsewhere, gold (+0.8%) resumes its climb as the recent relief rally dissipated. The yellow metal is comfortably above the USD 1325/oz level ahead of US CPI data. Turning to base metals, copper prices are sliding despite a weaker Buck amid the absence of risk appetite in the market, although it is worth noting from a supply point of view that Labour unions at Codelco’s Chuquicamata mine are set to reject the latest wage offer in a vote tomorrow, which could see a operations come to a halt at the largest open pit copper mine. Finally, given the recent supply-driven surge in iron ore prices, Chinese steel mills are facing a slump in profit margins and are reportedly seeking lower grade iron ore to cut costs, thus the spread between medium and low-grade iron ore in China has narrowed to two-and-half year lows.

US Event Calendar

- 7am: MBA Mortgage Applications +26.8%, prior 1.5%

- 8:30am: US CPI MoM, est. 0.1%, prior 0.3%; CPI YoY, est. 1.9%, prior 2.0%

- CPI Ex Food and Energy MoM, est. 0.2%, prior 0.1%; US CPI Ex Food and Energy YoY, est. 2.1%, prior 2.1%

- Real Avg Hourly Earning YoY, prior 1.2%; Real Avg Weekly Earnings YoY, prior 0.92%

- 2pm: Monthly Budget Statement, est. $199.5b deficit, prior $146.8b deficit

DB's Jim Reid concludes the overnight wrap

According to the Oxford English Dictionary, today I venture into middle age as I turn 45. In some ways that’s quite a relief as I just assumed I had been there for some time. I’ll find out later if my dreams have been realized and I’ll be getting an eyebrow comb for my birthday (see last week’s EMRs for an explanation) and also what the children will be buying me with my own money. Wikipedia has this entry for middle age which makes me feel great. “The body may slow down and the middle-aged might become more sensitive to diet, substance abuse, stress, and rest. Chronic health problems can become an issue along with disability or disease. Approximately one centimeter of height may be lost per decade. Emotional responses and retrospection vary from person to person. Experiencing a sense of mortality, sadness, or loss is common at this age.” To commiserate my wife and I are having our first night out alone this year. Let’s hope my sensitivity to champagne hasn’t suddenly changed overnight.

The market’s champagne was put on ice last night though as a five-day party that had looked likely to extend into a sixth session started to fade. Despite opening as much as +0.83% and +1.09% higher, the S&P 500 and NASDAQ both faded throughout the day to end marginally lower at -0.04% and -0.01% respectively. The trade-related rhetoric from the White House continued to be somewhat negative, as President Trump said that “it’s me right now that’s holding up the deal” and suggested that he will not back down unless China makes new concessions. Two of his main lieutenants, Commerce Secretary Ross and Acting Chief of Staff Mulvaney, both separately downplayed the odds of an agreement at this month’s G-20, though they did say that talks could get back on track if Trump and President Xi can make positive progress. Despite the continued uncertainty, some of the most trade-exposed equity sectors performed well yesterday, with autos gaining +0.56% and Apple up +1.16%, as headlines circulated indicating that they are prepared to completely adjust their supply chain to avoid manufacturing iPhones in China for the US market.

President Trump complemented his trade remarks with a fresh broadside against the Fed, saying “they don’t have a clue” and that rates are too high. He also called “very low inflation” a “beautiful thing” so we’ll see if today’s CPI report changes that dynamic at all. The PPI data – which we’ll run through below – was at the margin slightly hawkish and helped push 2y Treasury yields higher. Indeed 2y Treasuries closed +2.6bps higher at 1.93% while 10y Treasuries ended -0.5bps lower, meaning the curve flattened-3.13bps to 22.1bps, albeit still above the range for much of the year. The DOW shed -0.05%.

Apart from the political noise, there wasn’t a great deal of new news with markets initially reacting to the China infrastructure spend headlines from this time yesterday. This helped Europe with the STOXX 600 finishing +0.69%. The DAX (+0.92%) was the big out-performer having been closed on Monday, while the FTSE 100 gained +0.31% despite the pound’s +0.30% rally on strong wage data.

This morning in Asia markets are largely heading lower with the Hang Seng (-1.50%) leading the declines as locals protest ahead of a legislative council debate on a controversial bill that would allow extraditions to mainland China. The Shanghai Comp (-0.57%) and Kospi (-0.13%) are also lower while the Nikkei (+0.04%) is trading flattish. Elsewhere, futures on the S&P 500 are trading a touch lower. Crude oil prices (WTI -1.52% and Brent -1.40%) are also falling this morning as a report from the American Petroleum Institute reported that the US crude stockpiles increased by a further 4.85mn barrels last week. In terms of overnight data releases, China’s May CPI and PPI both came in line with consensus at +2.7% yoy and +0.6% yoy, respectively. We also saw Japan’s April core machine orders come in at +5.2% mom (vs. -0.8% expected), the third consecutive monthly rise thereby marking the longest sequence of such gains in the past four years, while May PPI came out in line with expectations at +0.7% yoy.

Back to the UK and yesterday saw the Labour Party table a cross-party motion to prevent a no deal Brexit. If such a bill were to pass, the tensions within Parliament would likely escalate towards a general election. On that theme, the Conservative party leadership contest kicks off with its first ballot tomorrow, where a hard Brexit-supporting candidate is likely to emerge victorious at the end of the process. This dysfunctional setup is outlined in more detail in Oliver Harvey’s latest note ( here ), which also updates his indicative probabilities of likely outcomes moving forward. He thinks the odds that a deal is successfully ratified by end-October are now 25%, while the odds of a no-deal Brexit are 25% as well. The remaining 50% is covered by his modal case for a general election, with 20% chance of a Conservative no-deal platform winning, 20% chance of a Labour/Liberal Democrat soft-Brexit platform winning, and 10% chance of no clear winner. The Brexit story and its consequences still have an enormous amount of runway to go but we are currently in the eye of the storm. This fresh parliamentary vote in a couple of weeks could shake things up again leaving a new PM little choice but to go to the country. ComRes published the first opinion poll overnight that I have seen with all the different potential Conservative leaders vs all the other parties. On this poll Boris Johnson is only one of the candidates that give the Tory’s a majority (140 seats) at the next election alongside a substantial 14% lead. He is the only candidate that reduces the Brexit party’s support enough (below 20%) to do this.

In other news from yesterday, the US May PPI report was at the margin slightly hawkish as we mentioned earlier with the ex-food and energy reading printing in line at +0.2% mom but ex trade at +0.4% mom (vs. +0.2% expected). In addition, the healthcare component rose +0.25% mom which, when combined with a bounce-back for the portfolio management component, suggests a stronger read-through for core PCE when we get the data at the end of this month. Holding everything else steady, today’s print implies around +7bps to the core PCE number due toward the end of this month.

That data dovetails nicely into today’s data highlight which is the CPI report in the US which should act as the next test for markets. The consensus expects a +0.2% mom core reading which would be enough to keep the annual rate at +2.1% yoy. Our US economists also expect a +0.2% mom reading and note that core goods should rebound slightly from the plunge in April which was the biggest monthly decline since 2006. That said, there are some downside risks from negative payback from shelter inflation. The data is due out at 1.30pm BST.

As for the other data yesterday, there was a decent jump in the May NFIB small business optimism reading of 1.5pts to 105.0 (vs. 102.0 expected). That reading had got as low as 101.2 back in January but has since risen every month. Meanwhile, here in the UK the latest employment data was mostly upbeat – in stark contrast to the April growth data we saw on Monday. The unemployment rate was confirmed as holding steady at 3.8% in April as expected, while 32k jobs were added which exceeded expectations. Regular wage growth also ticked up one-tenth to 3.4% compared to expectations for a small deceleration. So that keeps the hawkish labor market data versus BoE’s supply-side narrative still very much intact. It’s worth noting that we heard from a couple of different BoE policy makers yesterday. Vleighe – seen as a centrist – said that “news since May has been disappointing in data and downside risks have intensified” while Broadbent said that “I am not particularly exercised that the future path of interest rates in the market should be exactly the one that is in our forecasts,” and thus made little conscious attempt to try and reprice the market.

In other news, yesterday EU officials confirmed their endorsement of the EC’s decision that Italy had failed to take the necessary steps to reduce its debt load in line with the bloc’s fiscal rules. The EU, therefore, confirmed that a disciplinary process is warranted. BTPs were +3.4bps higher yesterday, lagging the broader European fixed income rally. Italian politicians continued to speak positively, with Finance Minister Tria saying Italy is committed to a dialogue with the EU over the debt censure and Prime Minister Conte announcing that the leaders of the Five Star Movement and the Northern League will meet over the next few days to decide on a plan that will satisfy the Commission since “we are all determined” to avoid an EDP. That said, the market seems to be at a place where actions will speak louder than words.

To the day ahead now, which is headlined by that May CPI report in the US this afternoon. Other than that we’ll get the May monthly budget statement in the US while the European diary is particularly sparse this morning with nothing of note. Away from the data, the ECB’s Draghi is due to speak this morning in Frankfurt where he is due to make welcome comments at a conference. The ECB’s Guindos will also speak.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more