Futures Rebound Despite Trump's Huawei Ban, Yuan Slides For Record 12th Day

It has been a session of two halves. Early on European and Asian stocks fell, government bond yields slipped and the Japanese yen firmed after the U.S. government hit Chinese telecoms giant Huawei with severe sanctions, further straining Sino-U.S. trade ties, with Beijing warning that the Huawei restrictions won't be seen as a goodwill gesture and that China will take "all necessary measures" to defend its companies. Amid fresh trade war concerns, the European Stoxx 600 index fell as much as 0.5% in early European trading with the German DAX down 0.4%, while U.S. equity futures were initially down 0.4%.

The broad early weakness in European markets was offset by small gains in Chinese and Hong Kong stock indexes leading to only marginal losses on a global stock index as investors expected - what else - state authorities to step in to support the market and stabilize sentiment.

“Chinese stocks are up as markets expect authorities to intervene to support sentiment but this kind of activity is not sustainable and unless we see a clear resolution in the China-U.S. trade conflict, overall sentiment will remain weak,” said Neil Mellor, an FX strategist at BNY Mellon.

The initial weakness, however, reversed shortly after the European open, when with no fundamental reason, a wave of buying lifted the Emini, and US Treasuries erased a gain while European stocks also reversed a drop as a rally in chemicals and mining companies helped drive up the rebound.

S&P futures, trading at session lows of 2,840 at the Europen open, have jumped 25 points in a few short hours, with US equity futures now trading at session highs, even as China is expected to announce a response to yesterday's executive order by Trump which effectively banned Chinese telecom companies from operating in the US.

Officially closing Q1 earnings season, Walmart shares rose in early trading after the company reported its best first quarter in nine years while warning that higher import tariffs can boost consumer prices.

Yet even as equities rebounded, German government bond yields continued to flirt with their lowest level in nearly three years while Dutch bond yields were about to dip into negative territory, a phenomenon not seen since October 2016.

The big overnight event, for anyone who missed it, was announced late on Wednesday when the U.S. Commerce Department said it was adding Huawei Technologies and 70 affiliates to its “Entity List", effectively banning the company from acquiring components and technology from U.S. firms without government approval. The move took global markets by surprise as sentiment had steadied somewhat in the previous session on news that U.S. President Donald Trump was planning to delay tariffs on auto imports after a swathe of weak U.S. and Chinese economic data.

“Depending on how long this standoff with China lasts, that impacts growth for longer and might force the Fed’s hand,” Natixis strategist Esty Dwek told Bloomberg TV in Singapore. “I wouldn’t expect any big change in the short term, but the possibility of a cut much later in the year has risen.”

In rates, yields on 10-year U.S. Treasury bonds eased as low as 2.35%, near a 15-month low of 2.340% touched on March 28, however, just like stocks, they have since rebounded sharply, and were last seen rising as high as 2.39%. According to Bloomberg, treasuries were under pressure in early New York trading after a $630k/DV01 block trade in 10-year futures; they were mostly underpinned in Asia session and London morning as Europe outperformed, notably France following solid auctions. As a result, yields were cheaper by 0.5bp to 2.5bp across the curve with short end leading the sell-off after 2-year and 5-year yields closed at year-to-date lows on Wednesday; 10-year yields higher by ~1bp at 2.385%, 2s10s and 5s30s flatter by around 1.5bp. Looking at the short-end of the curve, Fed funds rate futures continue to fully price in a rate cut by the end of this year and more than a 50% chance of a move by September.

“The markets are inching step by step in pricing in a rate cut. That is a sea change from a year ago when the consensus was three to four rate hikes a year,” said Akira Takei, bond fund manager at Asset Management One.

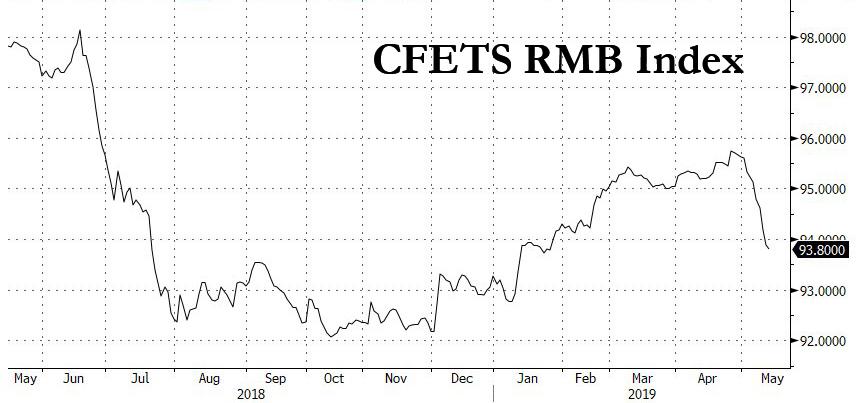

In FX, the notable mover was the Chinese currency because even as mainland stocks rose on expectations of more easing, the yuan extended its slump against its peers to a twelfth session, the longest in data going back to the start of 2015. While China’s currency was steady versus the dollar, the tumble in the Bloomberg CFETS RMB Index Tracker came after the yuan erased its gain for the year amid the China-U.S trade stand-off.

The offshore yuan has retreated about 2.5% this month as one of the world’s worst performers. Despite the yuan’s drop against the basket of 24 trading partners’ currencies, Khoon Goh, head of research at Australia & New Zealand Banking Group Ltd. in Singapore, said the index is still "within the range that is tolerable for the authorities." He added that there is only a small chance the onshore yuan will weaken past 6.9 per dollar because the government will take steps to support the currency.

Across the Pacific, falling U.S. yields initially eroded support for the greenback with the dollar down 0.1 percent against a basket of its rivals in early trading, however as futures and yields jumped, so did the greenback, and the Bloomberg dollar index was trading near session highs.

Elsewhere, the pound dropped for a ninth day versus the euro - the longest losing streak since 2000 - after news that UK PM May is to be warned that she faces the prospect of a confidence vote on June 12th if she does not agree to step down before summer, according to reports in the Telegraph. In related news, UK PM May will tell the executive of the 1922 Committee she needs several more weeks to pass key Brexit legislation in meeting tomorrow, according to FT's political correspondent Laura Hughes. ITV Political Editor Peston tweeted Labour MP Emily Thornberry said her party will vote against WAB and signaled cross-party talks may collapse as soon as tomorrow, while Conservative MPs Vaizey and Bridgen agree PM May will be out next month.

In commodities, oil prices gained on the prospect of mounting tensions in the Middle East hitting global supplies despite an unexpected build in U.S. crude inventories. Brent crude rose 0.3% to $71.99 a barrel, while U.S. West Texas Intermediate (WTI) crude fetched $62.26, also half a percent higher.

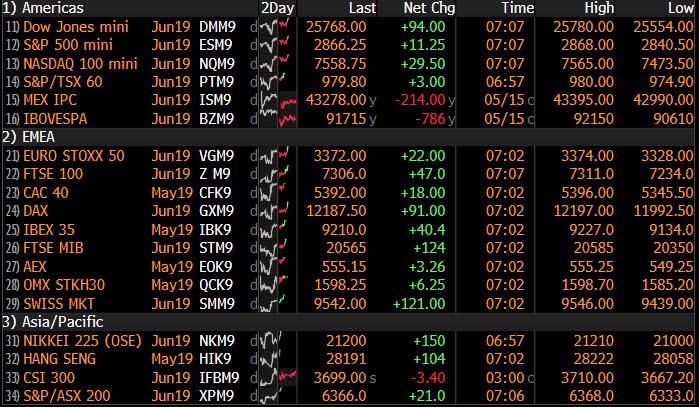

Market Snapshot

- S&P 500 futures up 0.3% to 2,864.50

- STOXX Europe 600 down 0.2% to 377.45

- MXAP down 0.3% to 154.86

- MXAPJ down 0.2% to 508.98

- Nikkei down 0.6% to 21,062.98

- Topix down 0.4% to 1,537.55

- Hang Seng Index up 0.02% to 28,275.07

- Shanghai Composite up 0.6% to 2,955.71

- Sensex up 0.3% to 37,221.67

- Australia S&P/ASX 200 up 0.7% to 6,327.84

- Kospi down 1.2% to 2,067.69

- German 10Y yield fell 1.7 bps to -0.115%

- Euro up 0.1% to $1.1215

- Brent Futures up 0.8% to $72.33/bbl

- Italian 10Y yield rose 1.8 bps to 2.373%

- Spanish 10Y yield fell 4.5 bps to 0.91%

- Brent Futures up 0.8% to $72.33/bbl

- Gold spot up 0.03% to $1,296.91

- U.S. Dollar Index down 0.07% to 97.50

Top Overnight News from Bloomberg

- Theresa May flies back to London on Thursday morning to once again face colleagues seeking to oust her, as she struggles to find a way to pass her Brexit deal. The executive of the 1922 Committee, representing Tory members of Parliament, will use a meeting at the premier’s office at 11:30 a.m. Thursday to urge her to quit as soon as possible, according to two of its members, speaking on condition of anonymity

- Donald Trump signed an order Wednesday that’s expected to restrict Huawei and fellow Chinese telecommunications company ZTE Corp. from selling their equipment in the U.S. The Department of Commerce said it had put Huawei on a blacklist that could forbid it from doing business with American companies. This campaign could disrupt 5G rollouts globally

- China cut its U.S. Treasuries holdings to the lowest level since 2017 in March amid the trade dispute between the world’s two biggest economies

- The U.S. ordered its non-emergency government staff to leave Iraq amid increasing Middle East tensions that American officials are blaming on Iran, as fears rise that the region may be heading toward another conflict

- Trump will also give the EU and Japan 180 days to agree to a deal that would “limit or restrict” imports into the U.S. of automobiles and their parts in return for delaying new auto tariffs, according to a draft executive order seen by Bloomberg

- Global funds are taking cover in defensive trades amid a widening U.S.-China rift, with yuan sovereign bonds emerging as the top pick in developing Asia

Asian equity markets were mixed as blue-chip earnings and the US blacklisting of Huawei as well as 70 of its affiliates overshadowed the positive lead from Wall St, where sentiment was underpinned by reports that President Trump plans to delay the decision on tariffs for auto imports by up to 6-months. ASX 200 (+0.7%) and Nikkei 225 (-0.6%) were mixed in which the commodity-related sectors led the intraday recovery in Australia and as a higher Unemployment Rate stoked calls for an RBA rate cut, while Tokyo trade was pressured by disappointing earnings including Japan’s megabanks Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group. Hang Seng (U/C) and Shanghai Comp. (+0.6%) were initially subdued with underperformance seen in tech and telecoms following US President Trump’s national emergency declaration on foreign companies posing threats to US telecommunications, although strength in property names after firmer Chinese House Price data helped reverse the losses. 10yr JGBs were initially supported as they tracked recent upside in T-notes and amid weakness in Tokyo stocks, although gains were capped after the 5-year JGB auction results were relatively inline with the previous albeit with a weaker b/c.

Top Asian News

- Philippines Cuts Large Banks’ Reserve Ratio by 2Ppt to 16%

- Moody’s Changes Outlook on Japan Banking System to Negative

- China Says It Will Take Necessary Measures to Defend Its Firms

- MUFG Shifts Asia Rates Trading to London From Hong Kong

European equities have been volatile [Eurostoxx 50 +0.3%] following on from a mostly positive lead in Asia. Sectors are mixed with outperformance in material names (amidst rising base metal prices) whilst consumer discretionary lags as EU auto names pare back some of yesterday’s tariff-spurred gains. In terms of individual movers, ThyssenKrupp (+6.5%) shares rose to the top of the DAX after reports that Finland’s Kone (+3.8%) are exploring the viability of a bid for ThyssenKrupp's EUR 14bln elevator division. Meanwhile, Thomas Cook (-18.4%) shares opened lower by over 20% after posting a Q1 pre-tax loss of EUR 1.465bln which came alongside a warning that “challenging” trading over the peak summer season would impact FY earnings, although the Co. did note that they have received multiple bids for all and parts of the group airline. Finally, Ubisoft (-12.4%) rests at the foot of the Stoxx 600 despite posting record sales figures, after a delay to its open-world game “Skull & Bones” into the next FY.

Top European News

- Car Stocks Retreat as Trump Seen Seeking Industry Import Curbs

- Burberry Falls as China Weakness Hangs Over Tisci’s New Looks

- ECB’s Weidmann Says Rate Tiering Could Be Net Negative For Banks

- Italian Banks Expectations Remain Demanding, Goldman Sachs Says

In FX, the Dollar is holding above Wednesday’s post-US data lows but stands narrowly mixed vs G10 counterparts as the US-China trade dispute continues via recriminations over the cause of the derailment in talks that has sparked another round of reciprocal tariffs. However, the DXY is stuck in a narrow band either side of the 97.500 mark that has been pivotal for a while, and very close to the 30 DMA (94.428) between 97.565-438.

- NZD/EUR/CAD/JPY/AUD/CHF - All marginally firmer vs the Greenback, with the Kiwi outperforming or clawing back more losses than other so be precise from sub-0.6550 levels to circa 0.6580. Meanwhile, the single currency is holding above 1.1200 after reclaiming big figure+ status yesterday on the EU auto tax reprieve, but unable to breach the 30 DMA (1.1222) convincingly amidst increasingly dovish ECB market expectations and another potential clash between Italy and the EU on budget policy intentions. The Loonie has also rebounded from recent lows and a post-Canadian CPI dip to test resistance ahead of 1.3400 with some positive momentum coming from reports that the Canada, Mexico and the US are close to clinching a deal on steel tariffs (Peso paring losses as well as Usd/Mxn eyes 19.0000). Usd/Jpy continues to straddle 109.50 as the Yen retains a safe-haven bid, but also contends with more decent option expiry interest (1.55 bn from 109.15 to 109.25 and 2.2 bn between 109.40-55). Elsewhere, the Aussie has recovered from its latest slump in wake of more weak data on balance (labor report) and a dip through 0.6900 stops with the aid of underlying bids/short covering, and Aud/Usd has now absorbed supply said to be sitting around 0.6910 and above to trade back up around 0.6933. Lastly, funding for a proposed acquisition has been touted as a factor behind recent Franc strength, but Usd/Chf has bounced towards 1.0100 from a few pips above 1.0050 and Eur/Chf has crossed over 1.1300 again.

- GBP - Brexit and related UK political uncertainty is still haunting Sterling along with other global and geopolitical risk, with Cable retreating a tad further towards 1.2800 and Eur/Gbp inching close to 0.8750 as PM May meets the 1922 group in just under an hour.

- EM - The Rand is showing a degree of resilience in the face of somewhat negative reviews from Moody’s on SA’s credit outlook with Usd/Zar hovering at the lower end of 14.2650-1525 trading parameters and perhaps being drawn or attracted to an unusually large expiry at the 14.0000 strike (1.365 bn).

In commodities, a positive session thus far for WTI (+0.7%) and Brent (+0.5%) futures as tensions in the Middle East drift back into focus. The former remains above USD 62.00/bbl and in close proximity to USD 62.50/bbl whilst its Brent counterpart floats comfortably above the USD 72.00/bbl mark. On the Iranian front, ship tracking data showed that a tanker carrying Iranian oil (in violation with US sanctions) has unloaded its cargo of almost 130k tonnes of oil near Zhousan, in China. Iran will remain a focus as the JMMC convene this weekend in Jeddah, with ministers expected to discuss whether the supply gap from Iranian sanctions will need to be filled, and hence whether the output curb deal will need to be extended until the end of the year. In terms of technicals, analysts at PVM highlight resistance at 63.09 (21 DMA) in WTI and 72.60 in Brent (short-term DMA) which they believe will be tested today given the optimism emanating from Trump’s decision to delay EU auto tariffs, progress regarding the Canadian and Mexican aluminum and steel tariffs and concerns of supply disruptions from Middle Eastern tensions. Looking at metals, gold remains choppy below the 1300/oz level and flirts with its 100 DMA at 1296.82 ahead of its 50 DMA (1291.69). Elsewhere, copper prices are poised to notch a third day of gains amid a weakening buck and optimism surrounding Trump’s auto tariff delays with the red metal now back above 2.75/lb ahead of its 200 DMA at 2.7604.

US Event Calendar

- 8:30am: Housing Starts, est. 1.21m, prior 1.14m; Housing Starts MoM, est. 6.15%, prior -0.3%

- 8:30am: Building Permits, est. 1.29m, prior 1.27m; Building Permits MoM, est. 0.08%, prior -1.7%

- 8:30am: Philadelphia Fed Business Outlook, est. 9, prior 8.5

- 8:30am: Initial Jobless Claims, est. 220,000, prior 228,000; Continuing Claims, est. 1.67m, prior 1.68m

- 9:45am: Bloomberg Consumer Comfort, prior 59.8

DB's Jim Reid concludes the overnight wrap

By the time you read this, I’ll be flying back from the US West Coast and hopefully blissfully asleep. At the conference I was attending there was a panel on US politics with a couple of Washington insiders and a couple of things struck me from the conversation. Firstly, virtually every market person I’ve spoken to over the last few months wants a deal, pretty much any deal. However, in listening to the panel it’s quite clear that China has few friends on the trade front in Washington across the political spectrum. Also, the view was that behind closed doors virtually all US corporates were supportive of being more aggressive with China on Trade. They may not say so publicly but the impression given was that in private they believed the current trading relationship made life tougher for them. So, working in markets it’s easy to focus on the price action negatives and assume a rational compromise at some point. However, there is a bigger story than this. What makes this challenging though is that Mr. Trump did everything to suggest he wanted a deal early this year and it looked like he was clearing the way for one regardless of the above support for more action. So second guessing the President’s next move is the hard part but don’t underestimate the support for a more aggressive stance politically and at a corporate level.

As discussed above though, markets have a very different view and given how fragile sentiment has become over the last 10 days, the last thing they needed was a string of soft data across China and the US. That was certainly the case until headlines hit in the mid-afternoon indicating that President Trump plans to delay the auto tariffs decision by up to six months. Even if that decision was broadly expected, there was always the chance that the President went ahead with them this week. More on the data later but the news about Trump’s auto tariffs delay ended up more than offsetting the weak China and US data with the NASDAQ (+1.13%) leading gains. The S&P 500 closed up a more modest +0.58%, however, was up +1.28% from the early lows while the DOW finished +0.45%. The STOXX 600 (+0.46%) also finished onside having spent the majority of the session in the red along with the DAX (+0.90%). Vol also abated with the VIX down -1.6pts to -16.4 and the V2X slipping -0.8pts to 16.7. It’s worth flagging that the European Autos sector rose +1.97% yesterday and +4.14% from the lows, while the S&P 500 Autos sector gained +1.00% and +2.70% off the lows.

Bond markets also witnessed a part reversal, however, yields were still broadly lower across the board which goes to show that fixed income markets are still biased towards risk-off more generally. Indeed there was a multi-year low for Bunds which touched -0.134% intraday and closed at -0.100% (-2.8bps) for the lowest closing level since September 2016. That’s just 9bps off their all-time low from their summer 2016 post-Brexit levels. OATs rallied -2.3bps and Gilts -3.7bps while Treasuries were down another 3.7bps to 2.374% and the lowest since March despite yields rising after the auto tariff news. This morning they are hovering around similar levels. At the short end, 2y yields fell to 2.161% and to the lowest since February 2018. The 3m10y curve flattened back into negative territory at -2.9bps while there are now 31bps of cuts priced into the January 2020 Fed Funds futures contract. The one bond market that failed to join the party was BTPs which rose +1.8bps with the spread to Bunds hitting 292bps intra-day, which would have been the highest level of the year, before retracing slightly. The move for Bunds appeared to reflect a combination of the wider risk-off move and further reaction to Salvini’s early week comments about letting Italy’s deficit rise above EU limits, which he reiterated yesterday.

In other markets, US HY credit widened 6bps yesterday – and therefore bucking the equity move - while in currencies EM FX was +0.07% stronger. Unexpected comments from Mnuchin about US, Mexico, and Canada being closer to a deal to remove metal tariffs helped the Mexican Peso and Canadian Dollar rally +0.54% and +0.18% respectively. USTR Lighthizer met with the Democratic House leadership team to discuss passing the NAFTA-replacement deal, the USMCA, and Speaker Pelosi’s aide said the meeting was “productive” and that the Democrats want to “get to ‘yes.’” Meanwhile, WTI oil prices rose +2.12% from their lows (+0.39% on the day) after US data showed a +5.43mn barrel crude inventory build, which was not as big as feared.

After US markets closed, President Trump signed an executive order to declare a national emergency regarding “threats against information and communication” systems. While it did not mention China, Huawei or ZTE (which is down 5% overnight) by name, the move is likely a step on the path toward fully banning the Chinese tech firm from doing business in the US. Our economists in China wrote this morning that they believe this could be highly damaging, as it could trigger more voices in China’s policy circle against US business interests in China.

Markets in Asia are a bit more mixed on the back of that news with declines for the Nikkei (-0.60%) and Kospi (-0.87%), and small gains for the Hang Seng (+0.24%) and Shanghai Comp (+0.20%) - the latter reversing earlier losses. The CNH is -0.10% weaker, trading at 6.911 – a level it has broadly hovered near for the last three days but failed to breach higher. Meanwhile, US equity futures are down around -0.35%. A data point worth flagging this morning also is China’s holdings of Treasuries which hit the lowest level since 2017 in March following data released last night. It was also the first drop since November. The more significant data will be this month’s however which we will still have to wait a while for.

Back to that data in the US where first up was the April retail sales report where both the core (-0.2% mom vs. +0.3% expected) and control group (0.0% mom vs. +0.3% expected) prints both fell short. There were some modest upward revisions to the previous month but not enough to shrug off the overall disappointment. Adding to the pain was the April industrial production print released shortly after which unexpectedly fell -0.5% mom (vs. 0.0% expected), albeit somewhat offset by a three-tenths upward revision to March. It’s worth noting that manufacturing production also fell -0.5% mom (vs. 0.0% expected) and capacity utilization slipped from 78.5% to 77.9% - the lowest since February last year. The Atlanta Fed GDP tracker nudged down -0.5pp to 1.1% following the above data.

The better news came in the latest manufacturing sector survey data where the May empire manufacturing print rose +7.7pts to 17.8, far exceeding expectations for a drop to 8.0. In fact, it was the highest reading since November 2018. However, with the bulk of the responses coming prior to the rise in trade tensions it’s next month’s reading which will garner more attention.

Prior to this, we had the preliminary Q1 GDP reading in Germany which matched expectations at +0.4% qoq. However, our economists in Germany now expect Q2 to be flat due to a negative payback for Q1 while the rise in trade tensions will also result in subdued growth for Q3. So the outlook appears less positive. For completeness, there was no change in the second revision for Q1 GDP for the Euro Area at +0.4% qoq while France’s April CPI was revised up one-tenth to +0.4% mom.

To the day ahead now, which this morning includes Q1 employment data in France, final April CPI revisions in Italy and the March trade balance for the Euro Area. In the US we’ll see April housing starts and building permits, the May Philly Fed PMI and the latest weekly initial jobless claims reading. Away from that the ECB’s Praet, Guindos, and Coeure are all speaking at various stages today along with the Bundesbank’s Weidmann. The BoE’s Haskel also speaks this evening. Over at the Fed, we’ll hear from Kashkari at 5.05pm BST when he is due to discuss monetary policy and the economy and then Brainard at 5.15pm BST who will be talking about a similar topic.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more