Futures Rebound Amid New Burst Of Trader Optimism Ahead Of FOMC Minutes

Yesterday's market selloff is a distant memory this morning, with US equity futures sharply higher tracking European stocks which rose as much as 1% and ignoring earlier weakness in Asian markets as hopes for more monetary and fiscal stimulus helped ease fears about global recession, political turmoil in Italy and endless trade wars. Treasury yields ticked higher after retreating Tuesday, while the sharp move higher in German 30Y bonds resulted in the failure of a much anticipated 30Y bond auction with a negative yield, a historic first.

Still, with key Fed announcements looming, in the form of today's FOMC minutes and Friday's Jackson Hole meeting, volumes subdued. The Euro STOXX 600 was 0.8% higher, rising earlier as much as 1.1%, while the FTSE MIB rises as much as 1.8% following a rout on Tuesday after the resignation of Italian Prime Minister Giuseppe Conte. The Stoxx autos sector index lead gains, up 2.2%, with Renault surging 4.2% and Fiat Chrysler up 4% after Italian daily Il Sole 24 Ore cited people familiar with the matter as saying the carmakers remain in contact on potential tie-up after publicly abandoning efforts. That put the STOXX 600 Autos Index on track for its best day in a month.

GEA Group, a German food-processing-machinery company, and outsourcing group Capita gained more than 5% after Goldman Sachs upgraded its rating on the stocks.

Asian stocks were fractionally lower, with Japanese and Australian stocks down, while shares rose in Hong Kong and Seoul and were little changed in Shanghai. Chinese shares were effectively unchanged even though the yuan rose for the first time a week after a "friendly fix" by the central bank which set the daily reference rate slightly stronger than expected, and higher than yesterday. After a “market-friendly fixing,” the bias has been to sell dollars Wednesday morning, Stephen Innes, managing director for VM Markets Ltd. in Singapore, wrote in a note. “With small volumes going through, it’s beginning to feel more like your typical August as the markets don’t seem to have much of an axe to grind one way or the other,” Innes added that there’s some pre-risk event position-squaring ahead of PMI data and Federal Reserve Chairman Jerome Powell’s speech in Jackson Hole later this week. “We could be back in the frying pan quickly if the yield curve inverts or Jay Powell reiterates his mid-cycle view of things,” he wrote.

The yield on 10-year government bonds edged higher for a second day, hitting its highest in two weeks. Treasuries underperformed bunds and gilts, while German bonds pared declines after the country sells new 30-year debt at negative yields for the first time. Italian bonds rise amid optimism that fresh elections will be averted. Bunds trimmed declines as 30-year sale sees underbidding of 6c and tail of 3c; these are similar to the July sale of benchmark long bond that met underbidding of 5c and tail of 1c; this is even as oversubscription falls on Wednesday to 1.05x from 1.07x prior and is technically undersubscribed at 0.43x versus 0.86x previously after accounting for retentions.

Italian bond yields steadied after falling on Tuesday, as Italian President Sergio Mattarella begins two days of talks that will lead either to formation of the country’s 67th government since World War Two or to early elections.

Investors will be watching policy makers and world leaders as they convene at the latest G7 meeting to consider the weakest global growth since the financial crisis. The Group of Seven leaders, with Trump among them, will gather in France from the weekend as the ECB prepares to cut interest rate.

And while the Fed minutes due Wednesday may provide some clarity on officials’ views, they’re likely to be overshadowed by Chairman Jerome Powell’s address at Jackson Hole in Wyoming on Friday in the wake of Trump’s latest attack on the central bank according to Bloomberg. Much depends on what the Fed does with U.S. interest rates, making markets hyper-sensitive to the minutes - due later on Wednesday - of its last meeting.

“People are looking ahead to Jackson Hole later this week and the message that Jerome Powell may or may not give us on the direction of monetary policy. That is the highlight of the week and we are waiting with baited breath,” said Andrew Milligan, head of global strategy at Aberdeen Standard Investments.

The sentiment was confirmed by Tuuli McCully, head of Asia-Pac at Scotiabank, who told Bloomberg that "the key thing this week is the Jackson Hole speech by Fed Chair Powell. It will be interesting to hear if he sticks to the mid-cycle adjustment tone or if he will promise more."

Futures are fully priced for a quarter-point cut in rates next month and cuts of more than 100 basis points by the end of next year. Morgan Stanley economist Ellen Zentner advised clients to watch for the use of the word “somewhat” when Powell describes future policy. “Acknowledgment that downside risks have increased with no characterization of ‘somewhat’ could be taken as confirmation that it is likely the Fed makes a larger cut in September,” Zentner wrote in a note.

Meanwhile, President Donald Trump showed no signs of backing down in his tussle with China, declaring on Tuesday a confrontation was necessary even if it hurt the U.S. economy in the short term.

Currency markets were mostly subdued as the euro struggled and was last down 0.1% at $1.1092. The dollar index initially rose 0.1% to 98.265 but has since given up gains. Sterling failed to overcome technical resistance and met leveraged selling while the yen came under pressure from Japanese names; it was down 0.3% at $1.2134 and 0.2% against the euro at 91.405 pence.

In commodities markets, U.S. crude rose 17 cents to$56.30 per barrel. Brent added 23 cents to $60.26. Spot gold was weaker at $1,498.15 an ounce.

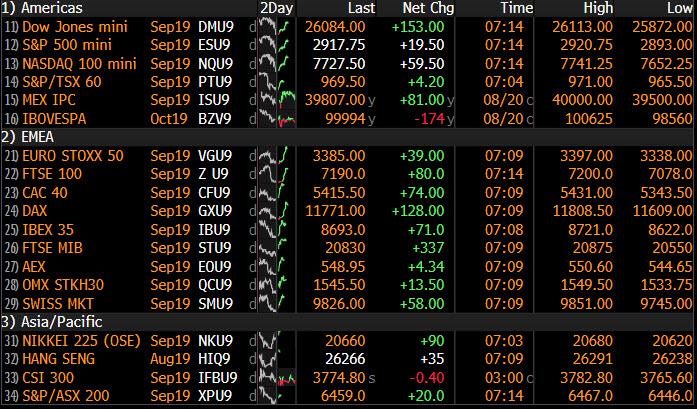

Market Snapshot

- S&P 500 futures up 0.7% to 2,918.75

- STOXX Europe 600 up 0.8% to 374.23

- MXAP down 0.3% to 152.50

- MXAPJ down 0.07% to 495.15

- Nikkei down 0.3% to 20,618.57

- Topix down 0.6% to 1,497.51

- Hang Seng Index up 0.2% to 26,270.04

- Shanghai Composite up 0.01% to 2,880.33

- Sensex down 0.5% to 37,133.03

- Australia S&P/ASX 200 down 0.9% to 6,483.27

- Kospi up 0.2% to 1,964.65

- German 10Y yield rose 3.1 bps to -0.659%

- Euro up 0.04% to $1.1104

- Italian 10Y yield fell 6.4 bps to 1.024%

- Spanish 10Y yield rose 3.3 bps to 0.129%

- Brent futures up 1.2% to $60.76/bbl

- Gold spot down 0.5% to $1,500.18

- U.S. Dollar Index little changed at 98.22

Top Overnight News from Bloomberg

- EU poured cold water on Boris Johnson’s attempt to renegotiate the Brexit deal, saying the so-called backstop to prevent a hard Irish border was a vital part of the divorce agreement

- Trump said he would be putting off a planned meeting with Denmark’s prime minister because she didn’t want to talk about a possible U.S. property deal to buy the island of Greenland. In Denmark, members of parliament responded with bewilderment and disbelief

- Central bankers and Group of Seven leaders will convene this week 8,000 kilometers apart with the same thing on their mind: What more stimulus do they need to support the weakest global growth since the financial crisis?

- China detained an employee of the U.K. consulate in Hong Kong under local law, the Foreign Ministry said, confirming earlier reports he was being held. The issue was an internal Chinese matter and not a diplomatic dispute, the ministry said, adding that detainee Simon Cheng is a Hong Kong citizen

- Germany saw weak demand for the world’s first 30-year bond offering a zero-coupon, after a global debt rally that has pushed yields across Europe into negative territory

- British exporters are to be enrolled in a key customs system so they can trade with the EU after the scheduled Brexit deadline on Oct. 31. The U.K. tax authority will automatically issue more than 88,000 companies with an Economic Operator Registration and Identification number over the next two weeks, the Treasury said in a statement on Wednesday

- Norway’s $1 trillion wealth fund, Norges Bank Investment Management, rose $28.5 billion in the second quarter ahead of market turmoil that drove equities lower over the past month and saw bond yields plunge further below zero

- Chancellor of the Exchequer Sajid Javid may wait to name a successor to BOE Governor Mark Carney until after Britain’s planned Oct. 31 departure from the EU, according to a person familiar with the process

- U.K. now plans to only participate in EU meetings where it has “significant national interests involved,” according to a letter signed by PM Boris Johnson’s EU Adviser David Frost

- U.S. economy doesn’t appear to be headed toward a recession, San Francisco Fed President Mary Daly said. “When I look at the data coming in, I see solid domestic momentum,” Daly she wrote in a post on Quora.com

- Just over a year after agreeing to front Italy’s oddball coalition as its prime minister, Giuseppe Conte handed his resignation in to President Sergio Mattarella Tuesday night, leaving his brief political career up in the air

- U.S. President Donald Trump said he can cut taxes by indexing capital gains to inflation without congressional approval, a move the White House has been considering for months

- Wall Street watchdogs handpicked by President Trump eased the Volcker Rule’s controversial ban on banks making a speculative investment

Asian equity markets traded subdued as the region conformed to the dampened global risk tone with markets cautious ahead of the looming FOMC minutes and the Jackson Hole Symposium. ASX 200 (-1.0%) underperformed with broad pressure across its sectors. Nikkei 225 (-0.3%) was also lower but with downside stemmed as exporters found some solace from a gradually weakening currency, while Hang Seng (+0.1%) and Shanghai Comp. (Unch.) traded indecisively after the PBoC’s quasi liquidity efforts resulted to another net daily drain and amid ongoing trade uncertainty as US President reiterated he is currently not ready to make a trade deal with China but suggested something will happen maybe sooner later. In addition, reports noted that outflows from funds focused on China investments recently widened to its highest since early 2017. Finally, 10yr JGBs returned flat as the initial upside from the cautious risk tone later faded after hitting resistance at the 155.00 level and near its record highs, while the BoJ were only in the market today for Treasury Discount Bills.

Top Asian News

- Hong Kong Protests Enter Crucial Period Before China Anniversary

- Cigarette Maker ITC Is Said to Mull Bid for India’s Coffee Day

- Yemen Vows to Confront U.A.E.-Backed ’Coup’ as Infighting Rages

- China Traders Bet Big on a Lagging Bank Stock in Hong Kong

European equities are higher across the board [Eurostoxx 50 +1.2%] despite a subdued Asia-Pac handover with some citing a possible market squeeze. Market participants note that stocks are driven by a couple of factors: 1) Today’s session commenced at a low base as stocks yesterday were pressured by Italian concerns. 2) low volumes heading into key risk events including FOMC/ECB Minutes (full previews available in the Research Suite) and the annual Jackson Hole Symposium, US volumes have also been low. Sectors are all in the green, with underperformance seen in defensive stocks as investors seek riskier equities. Consumer discretionary is the marked outperformer with gains led by Pandora (+13.6%) as its earning-led optimism continues, whilst Fiat Chrysler (+3.5%) and Renault (+4.9%) shares rebounded amid reports on continuing merger talks. In terms of other individual movers, GEA group (+5.1%) rests closer to the top of the Stoxx 600. On the flip side, Alcon (-2.5%) shares fell following earnings after-hours yesterday.

Top European News

- U.K. Steps Up Brexit Preparedness for Firms as Deadline Looms; U.K. Budget Deficit Soars as Britain Prepares for Brexit

- Norway’s Wealth Fund Delivers $28.5 Billion Gain Ahead of Plunge

- Eastern Europe Domestic Swine Fever Cases Climb Fivefold in July

- Berlin’s Fintech Wealth Is Attracting at Least One Private Bank

In FX, the Greenback has waned again, with the DXY fading just ahead of 98.500 and the more significant pinnacle reached at the start of the month when the index scaled fresh ytd highs (98.932). Usd/major pairings remain relatively mixed and rangebound in advance of potentially market-moving and game-changing events to come in the form of FOMC minutes, preliminary PMIs, ECB minutes and then the JC gathering that kicks off tomorrow and runs through to Saturday. In the interim, the US existing home sales may provide some impetus as the DXY meanders between 98.302-145.

- JPY/NZD/CHF/GBP - Another upturn in broad risk sentiment has pushed the safe-haven Yen, Franc and Gold back down from yesterday’s peaks towards 106.60, through 0.9800 and 1500 respectively, but the Kiwi and Pound have also lost ground against the Buck, with Nzd/Usd retesting 0.6400 and Cable retreating from circa 1.2175 to 1.2130. Note, technical resistance at the 21 DMA (1.2172) and ahead of 1.2200 (1.2197 Fib retracement) could have stymied Sterling again along with more clarification from EU officials that any alternatives to the Irish backstop would be facilitated via the PD not the WA.

- AUD/CAD/EUR - The G10 outperformers, or at least holding up better than the rest as the Aussie retains sight of the 0.6800 handle, Loonie pivots 1.3300 and Euro continues to straddle 1.1100, awaiting aforementioned highlights for the week (on paper at least). Aud/Usd remains supported in wake of RBA minutes underlining a wait-and-see approach after recent rate cuts, while Usd/Cad has retreated from Tuesday’s apex amidst a rebound in crude prices and looking for further direction from Canadian CPI data and the single currency is still showing resilience in the face of Eurozone political instability in Italy and Spain.

- NOK/SEK - The Scandi Crowns are benefiting from the latest revival in risk appetite and Eur/Nok has topped out ahead of 10.0000 despite weaker than forecast Norwegian unemployment, while Eur/Sek is drifting down from 10.7600+ towards 10.7100 in tandem.

- EM - A generally firmer tone across the region, with the Rand drawing encouragement from soft SA inflation even though this may prompt more SARB easing, as Usd/Zar breached key chart support around 15.2800 to probe under 15.2200 before returning to 15.2500 and consolidating.

WTI and Brent prices are firmer amid the improvement in risk appetite coupled with support from a larger-than-forecast drawdown in API crude stocks (-3.5mln vs. Exp. -1.9mln). Elsewhere, reports stated that Canada’s Alberta has decided to extend it current production curbs by a year, until the end of 2020 amid slow pipeline progress. Due to the extension, the base limit will increase to 20k BPD from 10k BPD per producers (effective Oct 1st), thus helping out the smaller producers as the first 20k BPD of production will be exempt from cuts. Turning to geopolitics where Fox News, citing sources, reported that an Iranian oil tanker (Bonita Queen) is heading to Syria and carrying around 600k barrels of crude, which would violate Western Sanctions. This comes just days after Iranian tanker Adrian Darya 1 (formerly Grace 1) was released from Gibraltar after being seized regarding suspected exports to Syria. On today’s docket, participants will be eyeing the widely followed weekly DoE inventory data for an immediate catalyst ahead of the FOMC minutes, with headline crude expected to drawdown of 1.889mln. Elsewhere, gold is lackluster and trades around the 1500/oz mark amid a seemingly improved risk tone and some potential profit taking ahead of the FOMC minutes later. Meanwhile copper moves in tandem with the current risk sentiment and trades higher on the day, albeit prices remain below 2.6/lb. Finally, Dalian iron ore futures declined to 10-week lows amid the ongoing supply/demand imbalance, with traders citing further downside in light of BHP’s bleak outlook for the base metal.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 21.7%

- 10am: Existing Home Sales, est. 5.39m, prior 5.27m; MoM, est. 2.3%, prior -1.7%

- 2pm: FOMC Meeting Minutes

- 2pm: FOMC Meeting Minutes

- 6:30pm: Fed’s Kashkari Speaks at Economic Conference in Minneapolis

DB's Craig Nicol concludes the overnight wrap

There may have been a slight lull in newsflow over the last 24 hours however the few scraps of news that we have been fed have left markets somewhat uninspired. By the close of play last night the S&P 500 ended -0.79%, with similar moves for the NASDAQ (-0.68%) and DOW (-0.66%). There was more political volatility in Italy and reports of new tax cuts in the US, but the dominant factor was again trade. US Secretary of State Pompeo told CNBC that Huawei remains a national security threat and also that he is concerned about “other Chinese companies.” That could portend expanded sanctions, though Pompeo did go on to say that he expects the US and China teams to resume trade talks in the short term. Later in the day, President Trump said that he’s “not ready to make a deal with China” and said that Europe would meet any demand if faced with the threat of tariffs on car imports. In sympathy, safe havens were well bid with 10y Treasury yields down -5.1bps and thus reversing Monday’s move, while Gold closed up +0.75%. The yield curve also flattened another 2.0bps to 3.9bps having started the day closer to 7.0bps.

As for those developments in Italy, as expected Conte confirmed his resignation. Conte made it clear that the populist coalition of the League and 5-Star was over, calling Salvini’s decision to spark a political crisis “irresponsible’, although Salvini did try to make a last-ditch attempt to smooth things over with 5-Star in order to pass the 2020 budget before heading to the polls. The question now is what will be President Mattarella’s next move. Mattarella needs to assess if a new coalition is viable or whether elections need to go ahead, most likely in October. Of the outcomes, it’s likely that the market would view a PD/5-Star coalition as most favorable with 5-Star having adopted a less confrontational stance on Europe and a more responsible stance on public finances in recent times. Plus, if Mattarella allowed them to form a government, it’s likely that he would require assurances on the budget beforehand. However, the medium-term risk is that such a coalition is unstable and falls apart leading to an outright victory for the League.

In terms of markets, BTPs outperformed all other sovereigns yesterday, rallying -6.4bps to 1.367%. Bunds fell -4.2bps to -0.694% and while we’re on them, it’s worth noting that we will likely see the first-ever 30y Bund sold at a 0% coupon today when the auction is held this morning. Meanwhile, the FTSE MIB dropped -1.11% yesterday, slightly underperforming drops for the STOXX 600 (-0.68%) and DAX (-0.55%). Despite the selloff in equities, European HY credit spreads tightened -6bps, while they widened +2bps in the US.

Overnight, markets appear to be struggling for direction with the Nikkei (-0.33%), Hang Seng (+0.11%), Kospi (+0.33%) and Shanghai Comp (+0.02%) pulling in different directions but on fairly low volumes. Futures on the S&P 500 are up +0.30% while there’s not much to report in FX or bond markets.

Moving on and looking ahead to today we’ve got the FOMC minutes from the July meeting out tonight. It’s worth noting that there will be an element of staleness to these now given the tariff developments since then however our economists made the point that they may provide an important benchmark for Fed officials’ outlooks prior to the escalation of trade tensions. They note for example, if the minutes indicate officials’ existing economic views were largely predicated on a flare-up in trade tensions, as St. Louis Fed President Bullard (dove/voter) mentioned last week, this would be relatively hawkish as it would imply officials think they do not need to do much more easing than they have already foreshadowed. However, if trade tensions returning to a boil a day after the July meeting was actually a surprise, which would be implied by Powell saying they had "returned to a simmer" in his prepared remarks to open the press conference, this would be consistent with our economists’ call that more monetary policy easing than was built into the June dot plot is to be expected.

In other news, there was some focus on a NY Times article in markets yesterday which suggested that President Trump could abandon some of his tariffs if the US economy threatens to go into recession. It also mentioned a cut to payroll taxes, which would directly boost labor income. That is a somewhat progressive form of tax cut, so it could tempt Democrats into supporting it, but it remains to be seen if the House will want to hand Trump any legislate wins in an election year. Later in the day, President Trump acknowledged that there have been discussions about payroll tax cuts, though he emphasised: "whether or not we do it now, it's not being done because of recession." He also mentioned indexing capital gains taxes to inflation as another possible form of tax relief, which could be done with executive action, thus avoiding Congress, though legal experts are undecided on if that measure would survive court challenges.

Finally, there were a few Brexit headlines to digest yesterday, with the UK doing nothing to signal a change in their policy of insisting that the backstop be scrapped. Media outlets reported that Chancellor Merkel said “we will think about practical solutions,” which was viewed as a possible signal that the EU may be more willing to negotiate. We’re skeptical that her remarks signaled any change in policy, but the pound nevertheless gained +0.36% and +0.86% from the lows.

To the day ahead now, which this morning includes July public finances and net borrowing data in the UK, while this afternoon in the US we’ll get July existing home sales before the FOMC minutes are released. Away from that, the EIA crude oil inventory report will also be released.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more