Further Selling Hits Markets

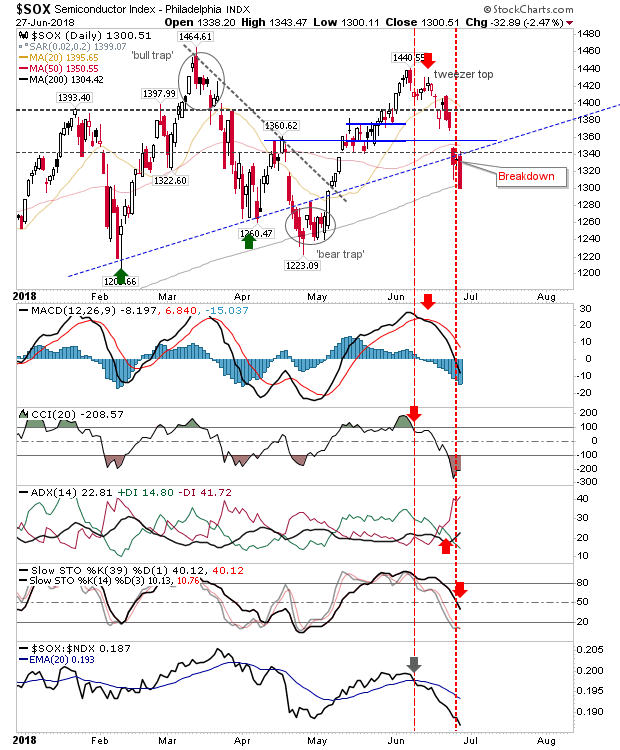

Yesterday's respite didn't lead to a bounce, instead, sellers took another swipe at the markets. The worst performer was the Semiconductor Index as it gave up near 2.5% on the day. Today's selling undercut the trendline and finished on its 200-day MA. Technicals are all net bearish but with intermediate stochastics not oversold there is still an opportunity for further losses. Relative performance also expanded on its losses.The 200-day MA may offer enough traction for a bounce, although given the nature of the sell-off some 'oversell' can be expected.

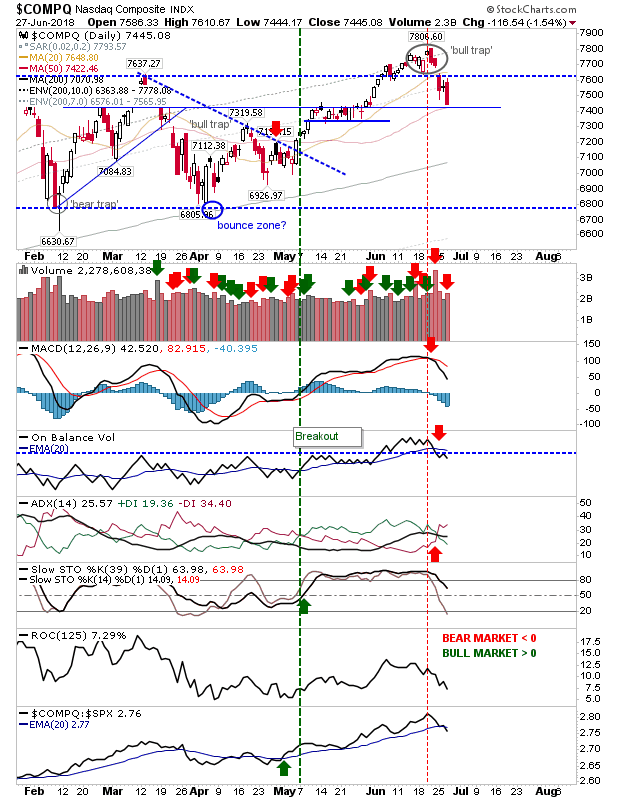

Not surprisingly, there was a knock-on effect on the Nasdaq and Nasdaq 100, both of which confirmed their 'bull traps'; next up for bulls are 50-day MAs. There is some support convergence to suggest buyers could come in here to buy 'the pullback'.

Large Caps also gave up on early rallies, closing at the very lows of the day. The S&P is looking at a 200-day MA test...

...but the 200-day MA was of little help to the Dow; channel support is next but there isn't much more support below that to help (23,500 perhaps?).

Traders have accelerated their profit taking from Small Caps but there are still plenty of support levels to work with; next is the 50-day MA.

For Thursday, look for bounce (buy) opportunities, perhaps after some morning follow-through lower. Tech and Small Caps have the internal strength to suggest their bounces could last the longest. Large Caps look lost at the moment.