Front-Running Easy Money

In a nutshell, this is what my models are telling at the moment: the three-month stock-to-bond ratios in the U.S. and Europe have soared, indicating that equities should lose momentum in Q2 at the expense of a further decline in bond yields. That said, the three-month ratios currently are boosted by base effects from the plunge in equities at the end of last year. They’ll roll over almost no matter what happens next. Moreover, the six-month return ratios are still favourable for further outperformance of stocks relative to fixed income.

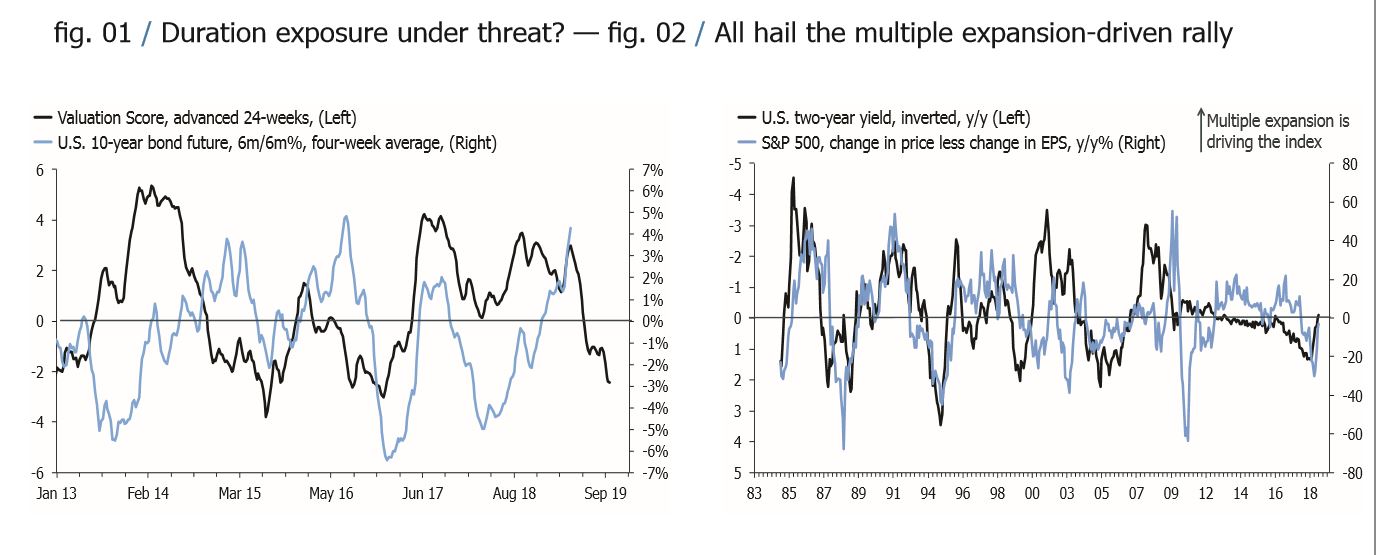

Looking beyond relative returns, my equity valuation models indicate that the upside in U.S. and EM equities is now limited through Q2 and Q3, but they are teasing with the probability of outperformance in Europe. Finally, my fixed income models are emitting grave warnings for the long bond bulls, a message only counterbalanced by the fact that speculators remain net short across both 2y and 10y futures. This mixed message from my home-cooked asset allocation models is complemented by a mixed message from the economy.

The majority of global growth indicators still warn of weaker momentum, but markets trade at the margin of these data, and the green shoots have been clear enough recently. Chinese money supply and PMIs showed tentative signs of a pick-up at the end of Q1, a boost reinforced by data last week revealing that total social financing jumped 10.7% y/y in March.

Apparently, the PBoC has resorted to the tried and tested stimulus boost, which has proven effective in lifting growth on many previous occasions. Meanwhile in Europe, survey data from the domestic economy were much better than the terrible manufacturing numbers in Q1, and the hard data were running well ahead of the soft data at the start of the year.

I agree with Simon Ward that equities are getting ahead of still-subdued global liquidity indicators, but the question is, can we blame them? Global central banks folded like cheap suits in response to the Q4 swoon in equities, and the associated evidence of slowing growth in global trade and manufacturing. I reckon this reaction was just about predictable, but it is accompanied by a cacophony of calls from politicians, economists and market observers that policymakers either should, or soon will be forced by the reality of a weak global economy, to do more. Simply put, if we consider the economic policy Narrative™ as a spectrum between a Volcker 2.0/Austrian economics framework and a Keynesian MMT/ looser for longer imperative, we are decidedly tilting towards the latter. I reckon that markets are now trading that shift, which, if true, has important implications.

For equities and credit, the global central bank put is now in operation, providing cover for markets to drive higher. This shift likely is the key reason for the dramatic reversal in multiple expansion, compared to last year’s collapse, even though EPS growth is slowing.

Meanwhile, if central banks are right that the global economy is weakening, this is more likely to be met with overwhelming stimulus-force by policymakers rather than the usual feet-dragging. In fixed income, this then means that the curve is just as like to re-steepen via a rise in long rates than via a col lapse in short-term rates as is usually the case when central banks are behind the curve. Perhaps then, markets are simply front-running easy money?

Disclosure: None