French Central Bank And JP Morgan Team Up To Boost Gold Lending

The central bank gold lending market, centered in London, is probably the most secretive financial market in the world, with very little known about its transactions and market structure.

The gold lending market’s opacity is further supported by regulators who protect the secrecy of the central banks, and mainstream financial news agencies whose editorial policies seem to forbid any market investigations, in-depth or otherwise.

It is in the gold lending market that the central banks of the world lend out their gold holdings to commercial bullion banks, where the physical gold is sold and shipped out, and where the central banks then claim to hold interest-earning ‘gold deposits’ with the bullion banks. These gold-deposits (which are merely a claim on a bullion bank) then mostly roll over short-term, passed around indefinitely between the clubby LBMA cartel of bullion banks, in a totally opaque behind the scenes network.

The physical gold bars lent out are long gone to Switzerland and the Far East, and the central banks then deceptively claim that they still hold the gold on their balance sheets (due to an IMF accounting trick) when in fact all they have is a liability to the bullion banks. In the middle of this market sits the Bank of England, offering gold custody and storage to other central banks (in the vaults under the Bank of England headquarters in London) and offering gold accounts to the bullion banks concerned.

Look for gold lending market documentation on the London Bullion Market Association (LBMA) website and you won’t find it. Search for documentation and reports on the websites of the bullion banks, ditto. Talk to ex-traders who have worked in the gold lending area and they say they can’t talk about it. Ask the Bank of England and Bank of International Settlements (BIS) to explain how the gold lending market works and they characteristically go silent or answer a different question.

Within the myriad of central bank websites and reports around the world, there are a few glimpses into the gold lending market, such as a smattering of reports from some South American central banks, but these are the exceptions rather than the rule, the rule being utter secrecy to reveal anything about the extent to which gold is lent out and stays lent out i.e. the true size of outstanding central bank lent gold positions.

It is into this murky world of opacity and ‘no comment’ that the Banque of France claims to have recently entered with the aid of one of the giants of bullion banking, JP Morgan. How recently is the question, because the Banque de France was already known to be active in the gold lending market since at least 2013.

Gold Services – Active in the Gold Market

The first revelations of a Banque de France – JP Morgan tie-up came in an LBMA magazine article during October (Issue 91 The Alchemist) when the second deputy governor of the Banque de France, Sylvie Goulard, mentioned in an article that the French central bank is now facilitating access for other central banks to the gold lending market in a service its offering in conjunction with US-headquartered commercial bullion bank.

In her article, Goulard explained that in 2012, the Banque de France “began to extend its range of gold services” to central bank reserve asset managers, and as well as offering other central banks the services of gold custody (vault storage), it started offering gold transaction (buy and sell) services, gold for fiat swaps (for financing and collateral), and gold lending transactions for its central bank clients:

“It [the Banque] can also offer gold swaps either for the purpose of using gold as collateral for deposits… or for the purpose of raising foreign currency cash against gold.

Finally, foreign central banks can engage in gold lease transactions with the Banque de France as principal, in order to increase the return on their gold holdings without increasing their counterparty risk. Demand for gold deposits for maturities from one week to one year picked up when interest rates went below zero for a number of reserve currencies, thereby prompting central banks to look for alternative sources of return.

While these gold investment services have until now only been offered from London, it recently became possible for the Banque de France to offer them also from Paris, thanks to a partnership with a large commercial bank that is active in the gold market.“

While Goulard’s article was published in October, it wasn’t until 12 November that the identity of the ‘large commercial bank’ became known, when Reuters released an article naming the bank as JP Morgan. According to Reuters:

“JPMorgan said it had ‘opened an account with Bank of France‘ and declined to comment further. The Bank of France declined to comment.“

The wording of Goulard’s references to the Banque’s gold services is somewhat ambiguous as regards a) when exactly JP Morgan became involved as a partner with the French central bank and b) the exact range of gold services that JP Morgan is now providing to Banque the France and its central bank clients.

US Assay Office gold bars at the Banque de France gold vaults in Paris

Goulard says that the Banque de France began extending its range of gold services in 2012, but that the partnership with JP Morgan was recent(i.e. the service offerings from the partnership recently became possible). But how recent? It was only because of the LBMA Alchemist magazine article this October (2018) that Reuters followed up and found out the JP Morgan identity. But there is no indication as to when JP Morgan opened up a (gold) account at the Banque de France. It could have been some time ago.

While the partnership between Banque de France (BdF) and JP Morgan covers gold leasing/gold deposits, its not clear if it also covers gold swaps (collateral and financing). Goulard’s words are ambiguous. She mentions a list of gold custody (vault storage), gold transactions (trade execution), gold for fiat swaps, and finally gold lending transactions, then uses the phrase “these gold investment services” can now be offered from Paris “thanks to the partnership“. Reuters thinks the deal covers swaps also, saying that Goulard had written that the Banque de France “had partnered with ‘a large commercial bank’ to offer swaps, leases and gold deposits from Paris.”

BdF – Already involved in the gold lending market in 2013

Despite the recent news from Reuters about JP Morgan opening an account with the French central bank to facilitate gold lending, what's less well known is that the Banque of France (BdF) has been involved in facilitating gold deposits and gold swaps for central banks since at least 2013.

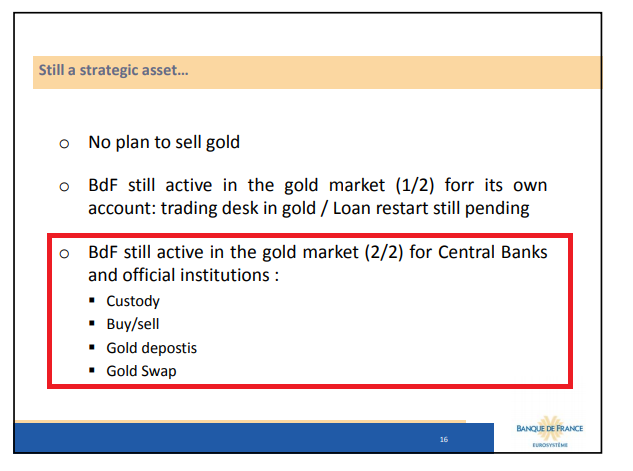

In a presentation to the LBMA conference in Rome in September 2013 titled ‘Gold and Reserve Management, The Banque de France experience‘, Alexandre Gautier, Director of Market Operations Department at the French central bank confirmed that the BdF was ‘still active in the gold market for central banks and official institutions, providing custody (gold storage), buy / sell (gold trade execution), gold deposits, and gold swaps. In fact, in a transcript of the speech of that same presentation, Gautier stated that the BdF FX and Gold desk in Paris was “in the [gold] market nearly on a daily basis”.

Therefore, as early as 2013, the Banque de France appears to have been providing gold storage services to bullion banks for the gold that these bullion banks were borrowing from central banks, and at the same time providing gold swap and gold deposit services to its client central banks. These gold swaps and deposits would require that the bullion banks that borrowed the gold maintain gold accounts at the Banque de France in the same way that gold deposit transactions are facilitated at the Bank of England in London where bullion banks maintain gold accounts.

Slide from an LBMA presentation by Alexandre Gautuer of the Banque de France. September 2013. Source here.

In some ways the news about a partnership between JP Morgan and the Banque de France is surprising. Why partner with an American bullion bank and not a French bullion bank such as BNP Paribas, Socgen or Natixis, all of which are LBMA members and all of which are active in the London Gold Market? However, just because one bullion bank has confirmed its involvement with the French central bank in the gold market, it doesn’t mean other bullion banks are not involved also. Indeed, there is evidence to suggest the Banque de France is engaging in gold lending / swapping with a number of bullion banks.

In a May 2012 article in industry publication Central Banking (subscription only), George Milling-Stanley, formerly of the World Gold Council, stated that the Banque de France was involved in gold swaps with a series of commercial banks (bullion banks):

“recently become more active in this space [mobilizing gold into the market], acting primarily as an interface between the Bank for International Settlements in Basel [BIS] and commercial banks requiring dollar liquidity. These commercial banks are primarily located in Europe, especially in France”

These gold swap transactions mentioned by Milling-Stanley also have a parallel to the series of gold swaps referenced by the Financial Times in July 2010 when it stated that:

“three big banks – HSBC, Société Générale and BNP Paribas– were among more than 10 based in Europe that swapped gold with the Bank for International Settlements in a series of unusual deals.”

So here we see that the large French bullion banks Société Générale and BNP Paribas, both of which are market-making members of the LBMA, were involved in gold swaps with the BIS as far back as 2010, and that Banque de France was at the same time “acting primarily as an interface between the Bank for International Settlements in Basel and commercial banks requiring dollar liquidity.” And also that these commercial banks were “primarily located in Europe, especially in France”.

Financial Times article about bullion bank gold swaps with the Bank for International Settlements. Source here.

There is further evidence that the Banque de France is not a novice when it comes to gold swaps and gold deposits. In November 2014, at the LBMA conference in Lima, Peru, Alexandre Gautier was back, this time with a presentation titled ‘Managing Gold as a Reserve Asset‘, which focused on the active management of the Banque de France’s own gold portfolio, and which highlighted the French central bank’s use of gold deposits and gold swaps.

Central Bank Gold at the Banque de France

As one of the most famous central bank gold vaults in the world, “La Souterraine” as its colloquially known, is a gold vault situated under the Banque de France headquarters in central Paris, eight basement levels down, 28 metres below ground level. Like all central banks with vaults, the Banque de France is secretive about how much gold is stored in these vaults, but it could be in the region of 3000 tonnes, belonging to the Banque itself, the IMF, the ECB, and a handful of other central banks with mainly historical French connections.

Overall, the Banque de France claims to hold 2435 tonnes of monetary gold reserves on behalf of the French nation, which would make it the world’s fourth-largest sovereign gold reserves. Within this total, there are 100 tonnes of gold coins and 2335 tonnes of large gold bars. The Banque stated in 2013 that 91% of its gold is held in Paris and 9% abroad. If this percentage split still holds, then there would be 2,116 tonnes of gold bars (about 170,000 large bars) in the Paris vaults and 100 tonnes of gold coins (assuming all of the gold coins are stored in Paris).

Gold bars in the Banque de France vaults in Paris

Famously, the German Bundesbank had 374 tonnes of gold in the vaults of the Banque de France but transferred all of this gold back to Frankfurt (slowly) over a five year period between 2013-2017. Now that the Banque de France is offering ‘gold services’ to other central banks, will the Bundesbank be transferring gold back to Paris? Unlikely, but stranger things have happened.

The Banque de France gold vault is also one of the four ‘designated depositories’ of the International Monetary Fund (IMF), and the IMF probably still holds some of its gold in Paris, assuming it hasn’t been sold or leased out long ago without being disclosed. In 1980, the last time the positions and locations of the IMF gold can be calculated, the held between 250 tonnes and 300 tonnes in Paris.

The ECB also has about 160 tonnes of gold held at the Banque de France, being part of France’s transfer to the ECB in January 1999 at the birth of the Euro.

Historically in the 1970s and early 1980s, a number of countries’ central banks held gold accounts at the Banque de France, including Libya, Iran, Iraq, Morocco, and some French West African states such as Benin, Guinea, Ivory Coast, and Niger. Some of these countries most likely still hold some gold in the Paris vaults. Now that the Banque de France along with JP Morgan is facilitating central bank gold lending and gold deposit placing via Paris, a number of additional central banks may begin transferring some of their gold there.

A few months ago, the World Gold Council reported that the central bank of Iraq had been active in the gold market, buying gold with the help of the Banque de France. Whether this newly purchased gold is stored in Paris was not mentioned, but it probably is. So overall, there is a ready supply of gold bars, owned by both France and other central banks, with which to ramp up gold lending if the customer central banks so choose.

Conclusion – JP Morgan – The omnipresent gold Heavyweight

What exactly is the partnership between JP Morgan and the Banque de France in the gold lending market? Given that the gold lending market is ultra secretive, we will most likely never know the specifics. But by partnering with JP Morgan, the Banque de France is partnering with one of the heavyweight bullion banks of the gold industry, a bullion bank with a finger in every pie.

JP Morgan has its own gold vault in the City of London under one of its buildings on John Carpenter Street, very near the Bank of England gold vaults. JP Morgan has its own gold vault in Manhattan, New York, under its Chase Plaza building, that is adjacent to the gold vaults of the New York Fed, and that is said to be linked by tunnel to the NY Fed gold vaults. JP Morgan is one of the most powerful banks in the LBMA and the London Gold and Silver Markets. JP Morgan is a member of the London gold clearing cartel, London Precious Metals Clearing Limited (LPMCL), a private company. JP Morgan is a direct participant in the LBMA Gold Price and LBMA Silver Price daily auctions in London. JP Morgan has gold storage facilities at the Bank of England. JP Morgan has a board member position on the LBMA Board and has always had a seat on this Board. JP Morgan also has very strong historical connections with the BIS in Basle.

JP Morgan also benefits from the Banque de France’s presence in the relationship since the BdF has the vault, has the clients, and also plays the role of ‘principal’ in the gold lending deals standing between central bank clients and the bullion bank. As Goulard said in her Alchemist article, this mitigates counterparty risk and reassures central bank clients.

As to whether Paris will “gradually re-emerge as a key marketplace for gold” as Sylvie Goulard claims, is unclear. But more importantly, it seems that if bullion banks (including JP Morgan) are engaging with the Banque de France on expanding gold lending out of Paris, then this is a sign that the bullion banks are having to look further afield for physical gold with which to continue to supply gold centres such as the Far East.

If there was full transparency in both the London Gold Market and now in the Paris Gold Market, we would be able to ascertain the true extent of how much physical gold the central banks have really lent out and how much of their gold remains unencumbered in the vaults in London and Paris. But without such transparency and without calls for transparency from regulators and media editors (such as at Bloomberg and Reuters), we will probably never know.

Note: For a full overview of the Banque de France’s involvement with gold, see BullionStar’s Gold University article “ more