Foreign Holdings, Pain And S&P 1600

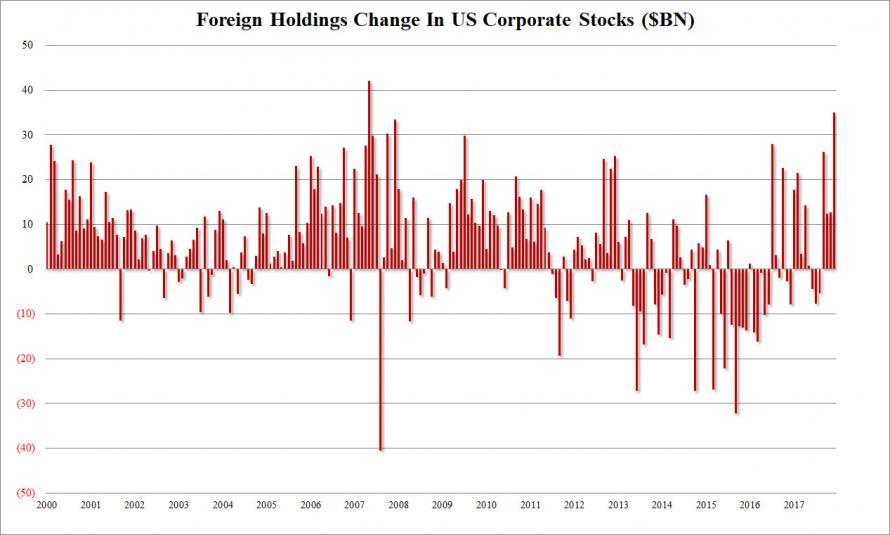

In one of the earlier articles leading up to my volatility and mini-correction call, I mentioned that the run up in stocks could have been due to foreign direct investment spiking. Turns out, that's exactly what it was:

Turns out that a lot of foreign money is pouring into the U.S. stock market right now. I don't expect that to last.

Read this over at Zerohedge and remember, they're wired a little weird.

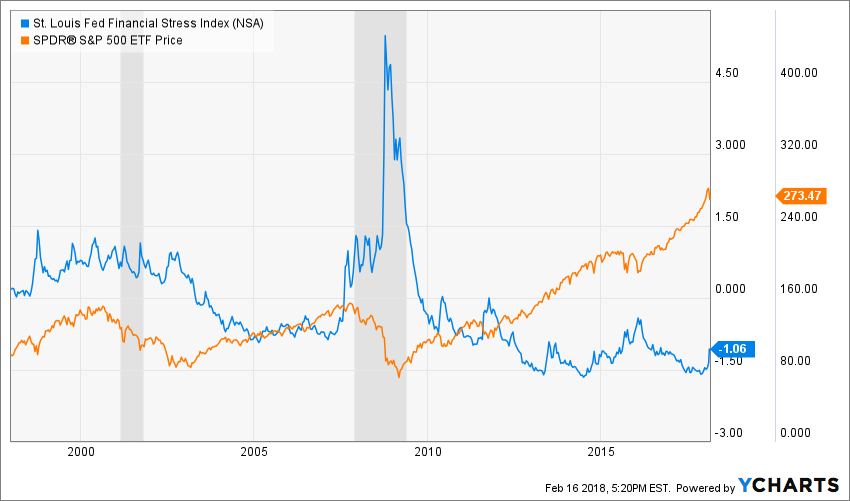

Here's another chart worthy of thought.

Anything jump out at you?

Yeah, that orange line sure is running away. With inflation hinting at resurging, and if oil goes up inflation will go up for sure, what happens to the stock market when the Fed has to react to inflation with higher interest rates?

The answer is pretty simple, stocks get competition and unemployment probably rises enough to offset all those 401k inflows to stocks.

It's important to remember that we live in an environment where even when things are good, they are fragile. It's important to understand when the ice starts to melt.

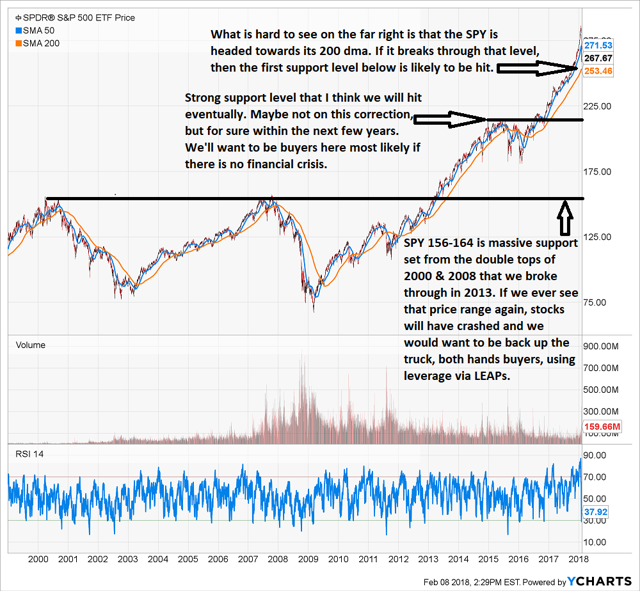

While I don't see the next "big one" this year or even next, the markets are almost sure to get more choppy. The options strategy I outline is a good one. Buy and hold forever without maintenance, set it and forget it, well, it just won't work in a choppy market.

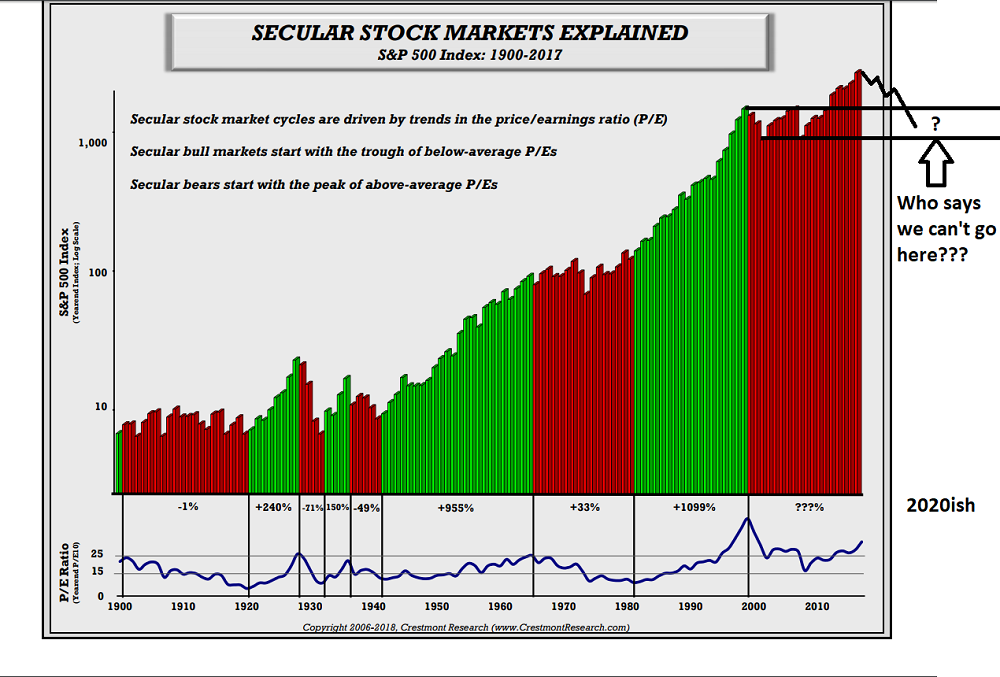

Take a look at this from Crestmont Research:

That lower line I have put into the chart would represent a round trip to the lows of the financial crisis. I don't actually think we go there. I think the money that has been created prevents that. Why? Because if we do start to fall into that range, the central banks won't do QE again, which is borrowing to create money, they'll just print the money next time - called "helicopter money."

Remember "Helicopter Ben," well that is a reference to helicopter money which was posited by Milton Friedman years ago. In short, during a deflationary crisis, a one time massive drop of money could be used to solve the problems. I do believe that is coming someday as there is no way to bail out pensions, students, bad loans and secure employment for millions by borrowing anymore, the national credit card is about tapped. I'll talk about that more later.

As for the stock market now, we're likely to see that top line approached. It's the one I showed in:

How Low Can The Stock Market Go?

Here's what I think. It is becoming very likely we test that 2200 something level on the S&P 500 as the Fed continues to pull in their balance sheet and raise interest rates. The Foreign Direct Investment won't hold up forever and the impact of the repatriation on earnings will be short-lived.

Here's what I think. It is becoming very likely we test that 2200 something level on the S&P 500 as the Fed continues to pull in their balance sheet and raise interest rates. The Foreign Direct Investment won't hold up forever and the impact of the repatriation on earnings will be short-lived.

My guess is we hit that 2200ish and then rebound on the stimulative impact of tax cuts and deregulation and some other stimulus short-term. However, by about 2020, we could see that lower line hit on the S&P 500. A couple years ago, I suggested around 1600 on the S&P 500 would happen again someday. I still say so.

You can hide for several years or have a plan for dealing with this. Remember, some stocks aren't correlated to the stock market. Some companies just do their own thing. Our job is to find the low debt, high growth companies of tomorrow, as well as, some great niches that will do well for other reasons, like maybe India.

Volatility is an opportunity.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am ...

more

Good, but have anything more recent?