Forecasting Stocks Long-Term Total Return

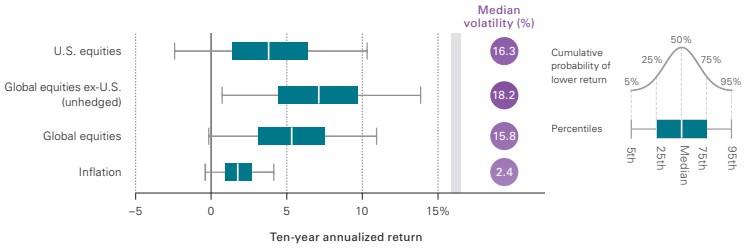

Your portfolio will not achieve precisely median long-term results 99+% of the time – 49+% will be better and 49+% will be worse. Median is merely a point within the spectrum of historical portfolio returns, as this set of 10-year assumptions for domestic and international equities from Vanguard illustrates.

Your US large-cap allocation over 10-years will probably return between about negative 2.5% to positive 10+% with a median of about 4% based on visual inspection of the Vanguard forecast. Global ex US stocks are expected to do materially better. Overall, global stocks are expected to have a median return of 5.3% with a 5% chance of a negative 0.1% return (because of US stocks), and a high (at the 95th percentile) of 11%.

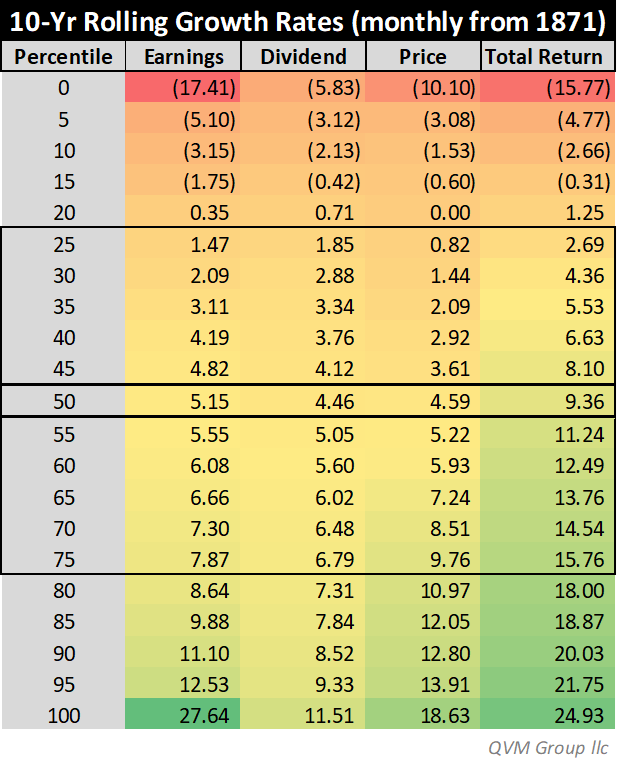

Looking at 148 years of monthly rolling 10-yr returns for US large-cap stocks, the median total return was 9.36%, with a range of 2.69% to 15.76% at the 25th and 75th percentiles, and negative 4.77% to 21.75% at the 5th and 95th percentiles.

Vanguard sees the next 10 years at lower return than historically with a narrower spread from best to worst.

The most recently completed monthly rolling 10-year period growth is way into the above median area for earnings, dividends, price and total return:

- Earnings Growth Rate 27.64% (100th percentile)

- Dividends Growth Rate 7.35% (80th percentile)

- Price Growth Rate 15.59% (97th percentile)

- Total Return Growth Rate 20.02% (90th percentile).

Yes, the latest 10-year growth rate is coming out of the depths of the 2009 earnings crash (and mandated bank dividend cuts), but that is all the more reason not to expect the next 10 years to be as good.

The next 10 years are beginning from the current well above average levels of growth. The mean reversion principle strongly suggests that the next 10 years will be modest compared to the last 10 years.

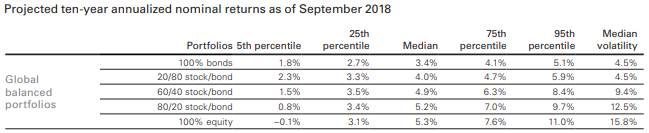

Combining Vanguard’s 10-year view of US Aggregate bonds with their view of global equities into key strategic allocation levels, they view the next 10 years this way:

They forecast the popular 60/40 Own/Loan allocation to have a 10-year median probability of 4.9%, with a 5th percentile to 95th percentile range of 1.5% to 8.4%. However, that is for the cumulative 10-year period. Individual years are expected to have wider ranges,

Because the 60/40 global balanced portfolio has a 9.4% expected volatility (standard deviation), individual years might be expected to have a 67% probability of a range from negative 4.5% to 14.3% (+/- 1 standard deviation); and a 96% probability of a range from negative 13.9% to 23.7% (+/- 2 standard deviations). Then there is always the small possibility of a Black Swan. That might go negative 3 standard deviations with a return of negative 23.3%.

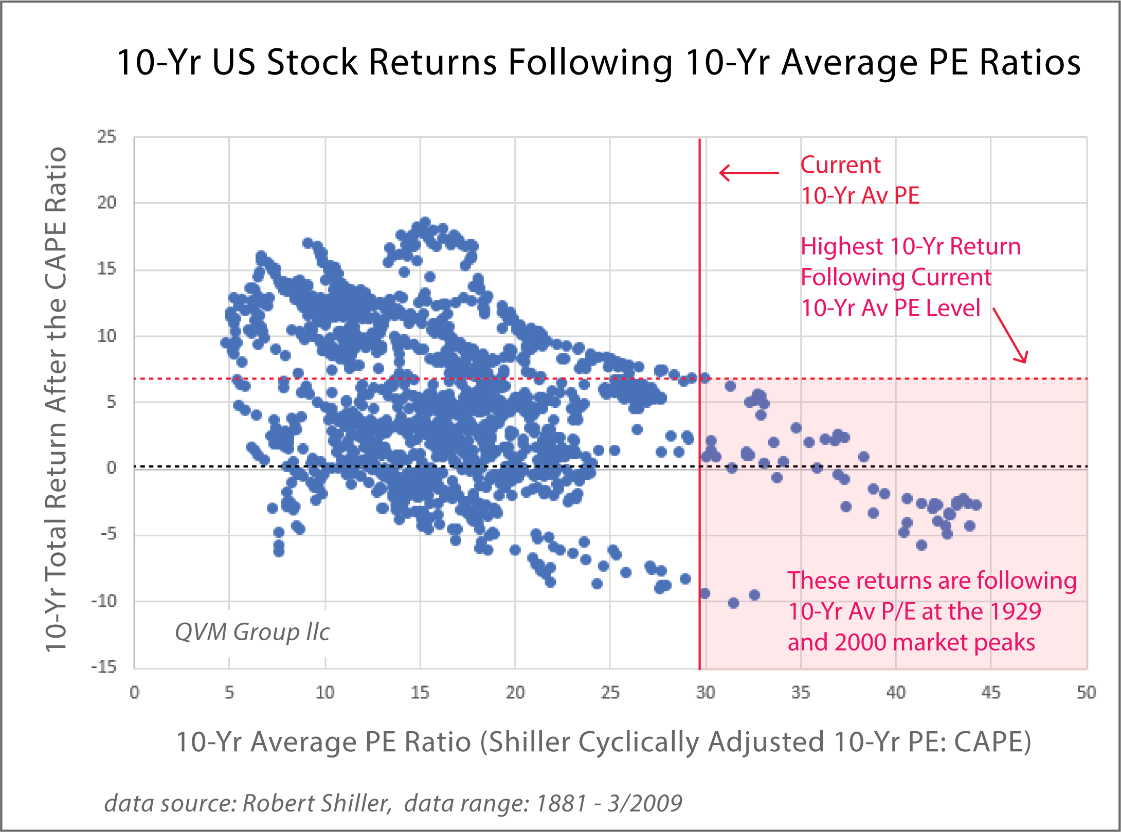

The current CAPE Ratio (price to 10-year average inflation-adjusted earnings) is very high; currently at the 95th percentile of its history since 1881.

This chart of month-end CAPE Ratios versus subsequent 10-year stocks total return are not encouraging.

At the current CAPE level a little more than ½ of the subsequent 10 years were positive, and a little bit less were negative with an average near zero return.

There may be low-interest rate conditions, and a historical trend toward higher valuation multiples that partially support an above average CAPE ratio, but probably not enough to fully support it as high as it is now.

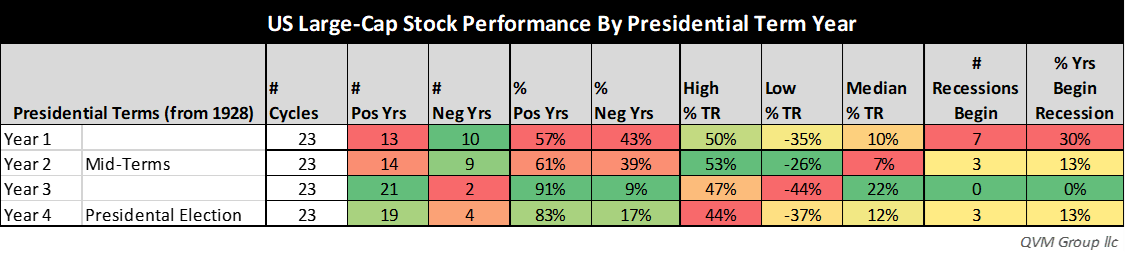

There is a presidential term year pattern that may be supportive of a positive year in 2019. Of the last 23 presidential term cycles, the 3rd presidential term year (also the year after mid-terms) has had 21 positive years – a higher historical incidence of positive years than the other three presidential term years.

In terms of the recession forecasts, this political/stocks calendar tends to suggest that 2019 will not have a recession and that 2021, the first year of the next presidential term, may have a high likelihood of a recession.

No recession since 1928 has begun in the 3rd presidential term years, and 21 of 23 such years had positive returns. However, the worst price decline since 1928 did occur in one of the 3rd years of the presidency.

A simple model for forecasting stocks long-term total return is:

![]()

Dividend yield is about 1.89%. JP Morgan estimates 10-year to 15-year average earnings growth at 4.1% before the effect of net share buybacks of 0.4%, for total earnings growth of 4.5%. Median long-term earnings growth since 1881 is 5.15% and median dividend growth is 4.46%.

Without change in the P/E, the long-term total return would be expected to be 6.39%. They expect a decline in the P/E multiple to take away 1.4% from the total return, which would suggest a total return of 4.99%.

Research Affiliates’ 10-yr forecast is less optimistic. They assume a 3.5% earnings growth with a 2.6% negative adjustment for a P/E reduction, plus dividend yield, which suggests a 2.94% total return for US stocks.

Vanguard (through magnifying glass interpretation of their graphic) sees US large-cap stocks generating a 4% total return over the next 10-years.

BlackRock forecasts 7.3% for US stocks over 10 years. State Street Global Advisors forecasts 6.7%. Callan Associates (large pension fund advisor) forecasts 7.15% total return. Bank of New York/Mellon forecasts 6.2%.

Forecasts vary widely from below 3% to over 7%. All of those are below ultra-long-term median returns. Given the late stage of the current Bull, and the mounting evidence of a recession in the next 1-3 years, the more conservative forecast built with the formula (return = yield + (earnings growth X P/E change) seems the prudent way to look at the prospects for returns; instead of a momentum continuation perspective.

Dividends and dividend growth, unlike earnings, are a management decision based on a long-term view of sustainability. They are less cyclical, or at least less volatile and with milder maximum declines, than earnings and prices. It is reasonable to look to median dividend growth rates as a more reliable indicator of long-term earnings growth potential consistent with mean reversion (barring changes in market-wide payout ratios).

Looking at a 4% to 5% median return forecast, and adding in 11% to 14% volatility (standard deviation of return), it is reasonable to expect individual calendar years to be in the +/- 1 standard deviation range (negative 7% to plus 18%) about 67% of the time (say 6-7 of the next 10 years); and +/- 2 standard deviations in the range (negative 18% to positive 26%) about 96% of the time (9+ of the next 10 years); with an outside chance of a 3 standard deviation Bear market which could take a single year down to about negative 29%.

Even though most forecasts are for a good year in 2019 and no recession until sometime in 2020 or 2021, certain key indicators of approaching recession are accumulating.

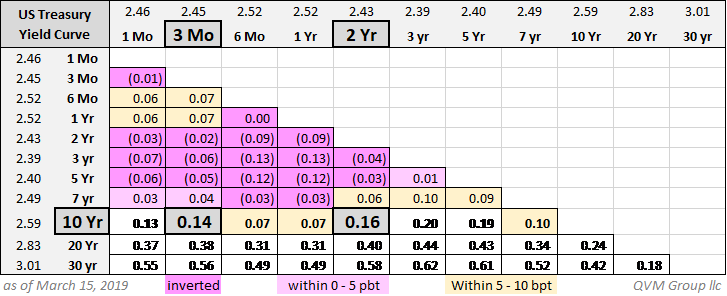

Yield curve inversion (shorter rates with a higher yield than longer rates) is one of the most watched recession indicators – one that the New York Fed has validated as a strong indicator.

The yield spread between the 10-year Treasury and the 2-year Treasury is the most talked about, but the spread between the 10-year and 3-month Treasuries is also key. Neither has yet inverted, even though the spreads are quite small.

Noteworthy, however, as this table shows, most maturities below 10 years have inverted, seemingly suggesting the 10-yr/2-yr and 10-yr/3-mo spreads are not far behind.

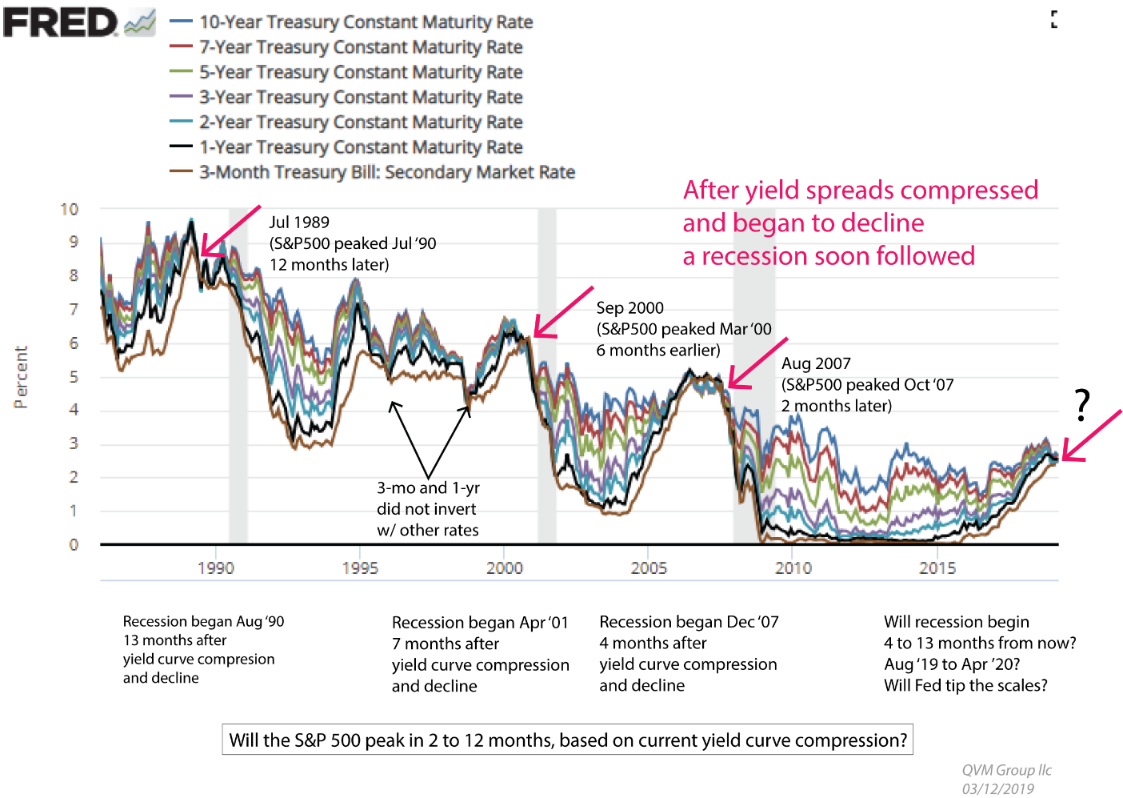

Another way to look at this is through a time series overlaid on a chart of past recessions.

Another way to look at this is through a time series overlaid on a chart of past recessions.

When all the rates for various maturity Treasuries squeeze together as they are now, that has tended to precede a recession.

Maybe it is different this time, but that is one of the more dangerous assumptions for investors.

The OECD and other supra-national banks such as the IMF and World Bank have been lowering global economic growth assumptions; and US securities analysts have been lowering 2019 earnings growth forecasts (from 10+% in December 2018 down to 3.8% as of March 15; compared to actual 20+% for all of 2018).

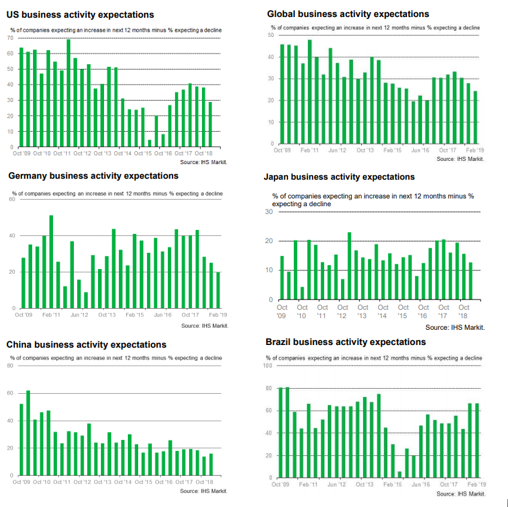

Surveys of businesses are also an important source of a sense of direction in the economy, which sooner than later is translated into valuation multiples, and thereby to stock prices.

One such survey available through Markit is the Business Activity Expectations survey. Here is the data for the US, the world, Germany, Japan, China, and Brazil. All have declining expectations over the past year, with the exception of Brazil which has been buoyed by the election of a business-friendly president.

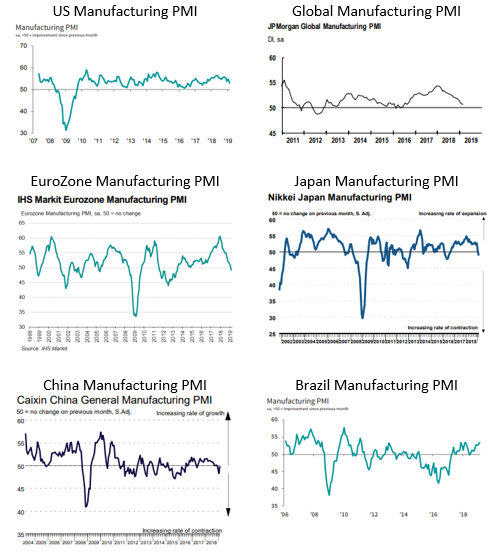

Another key business survey, also available at Markit, is the manufacturing Purchasing Manager’s Index.

Levels above 50 indicate growing manufacturing, and levels below 50 indicate shrinking manufacturing. The direction of the plot indicates the trend.

US, world, Europe, Japan, and China each have a downward sloping trend. Brazil has an upward sloping trend, only recently recovered from shrinking manufacturing activity.

US manufacturing is still growing, but at a slowing pace (level above 50), and the world is holding up in great part due to US manufacturing. EuroZone, Japan and China all have levels below 50 indicating shrinking manufacturing activity.

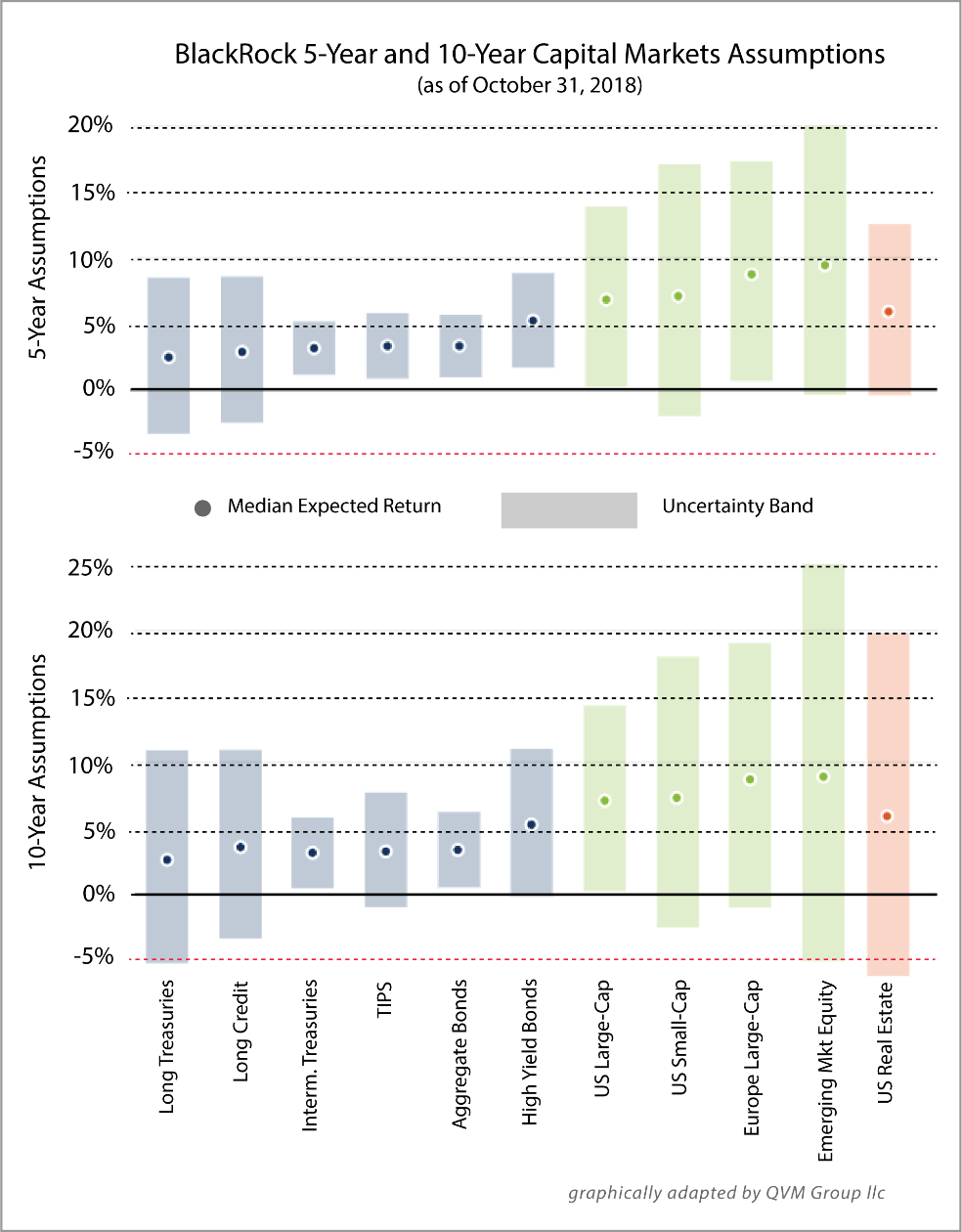

With the foregoing information and a lot more in perspective, BlackRock (the largest money manager in the world), makes these 5-year and 10-year return forecasts for key asset categories. These forecasts and similar ones from other institutions provide a guide to us in our work with you.

Note the dots which are the median expected returns, and the shaded columns they call the “uncertainty band” around the median forecast. They obviously agree with Yogi Berra who said, “It's tough to make predictions, especially about the future”.

Uncertainty, notwithstanding, it is clear from this chart (similar to ones from other noted institutions) that emerging markets stocks are expected to do well relative to US stocks but within a wider range of uncertainty.

Over 5 years, US stocks are seen as having some cumulative negative return potential, that they do not see in developed markets ex US or in emerging markets. Farther out to 10 years, their crystal ball gets cloudier about emerging markets, so they assign a wider return range with the possibility of negative cumulative returns.

One thing that BlackRock does not address in terms of real estate, which they see as having some possible negative cumulative returns in the second half of the next 10 years, is tax shelter. While public real estate funds offer little tax shelter through depreciation, direct ownership of investment real estate, and investment in private real estate funds can produce significant depreciation shelter of cash flow distributions. That makes the current after-tax return (at least the cash-in-pocket) feel larger than the 5+% return they forecast.

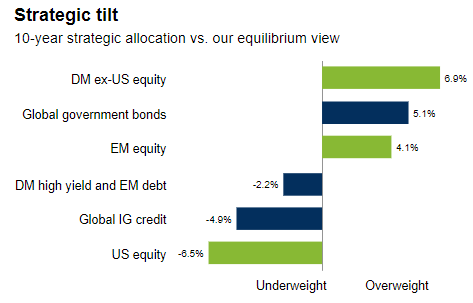

Given their forecasts, BlackRock currently suggests tilting strategic allocation levels toward developed markets excluding US stocks, emerging markets stocks, and global government bonds. They suggest tilting strategic allocations away from developed markets high yield debt, and emerging markets debt, and away from US stocks.

We share this view and have been tilting more toward emerging markets than developed markets but are definitely tilting that general way.

Disclaimer: "QVM Invest”, “QVM Research” are service marks of QVM Group LLC. QVM Group LLC is a registered investment advisor.

Important Note: This report is for ...

more