Flattening Yield Problem & Death By Low Volatility

Friday, another "meh" moment for the U.S. economy. The June Markit PMI manufacturing composite declined to 52.1, its weakest reading in 9-months.

The service sector index also declined to 53.0, below economists' expectations of 53.7. With both sectors in decline, the net-composite output index fell to a 3-month low.

Where do we go from here?

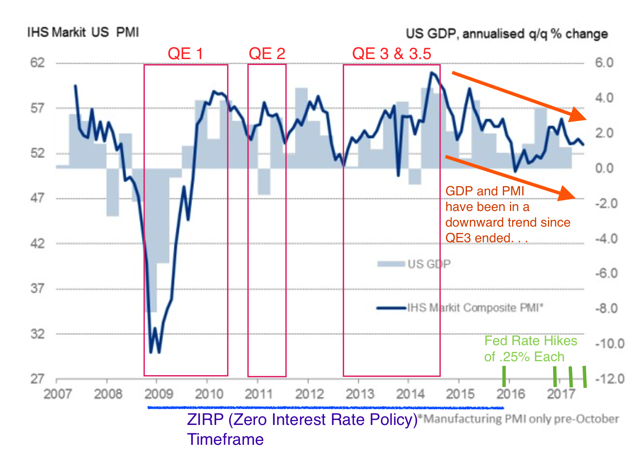

There is an interesting correlation between the IHS Market PMI Composite and the United States GDP. . .

A weakening Markit PMI isn't a good sign for GDP. And when you look closely at the economy's past growth, paired with and without the Fed's accommodations, it is worrisome for what lays ahead.

Although anemic, the U.S. had upwards trending growth since 2009 to mid-2014. But since ending QE-3, the economy is trending weaker. . .

A strong dollar hasn't helped the economy boom either.

What's striking is that the last three times GDP and the PMI was this low, the Fed actually upped their accommodations.

But Janet Yellen is clearly not "Helicopter Ben", the nickname given to Former Fed Chairman Ben Bernanke for his easy money policies. Instead of easing, she is tightening. Not only has she hiked rates four times, but last week she laid out plans for her "Quantitative Tightening." This is reversing the $4.5 trillion in bond purchases on the Fed's balance sheet, and now dumping them into an already weak economy.

But I think this is all wishful thinking by the Fed. . .

I wrote last week that the bond market isn't buying the Fed's optimism either. The lack of confidence is pushing longer-term yields down because the bond market is predicting deflation and recession. All while the Fed is busy raising short term yields aggressively.

This is flattening the curve yield, and I believe soon it will invert.

The Fed is tightening in a time where the data isn't looking good. If they even can get rates up to their targeted 3%, they'll have to cut them immediately soon after because of a recession and deflation.

This is the 'Fed Paradox'. By hiking rates simply to have ammo for when the next recession does arrive, they will end up causing that very recession themselves. This would be from the excessive tightening while the economy is already anemic and in decline.

At least, this is what the bond market is telling us. . .

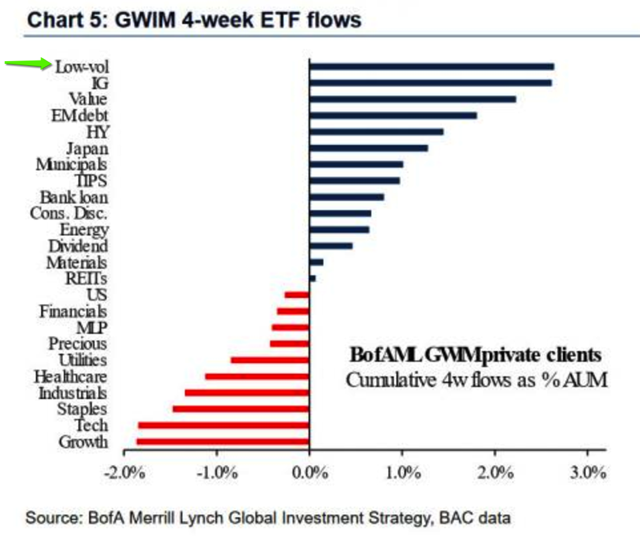

Looking further, Bank of America & Merrill Lynch's client inflow/outflow supports this thesis that investors are expecting deflation. Thus the rotation out of "growth" related and into "bonds".

But another troubling thing caught my eye . . .

... it's the substantial inflows into the "low volatility" investments.

If there is anything we should have learned from 2008, it was the old teachings from Hyman Minsky (he has been deceased since 1996).

Minsky had taught that years of prosperity and extended periods of low volatility are what breed excessive risk-taking and speculation. Thus prolonged low volatility today sets the foundation for extreme volatility in the future.

Or otherwise said, when you feel safest and most confident things won't change, you undertake more risk because you feel secure.

And today the market has the volatility index (VIX) at multi-year lows. . .

Bank of America's strategist Michael Hartnett recently touched on this. He said:

"Central banks, the reason behind high asset prices and lowVol, are now in desperate dilemma: politically unacceptable for bubble on Wall St, but central banks will be tightening into deflation; inflection point for volatility is upon us and we recommend investors buy volatility. . . Fed tightening in 2017 could easily be followed by easing in 2018, in our view."

I couldn't agree more. . .

And with the crowd piling into 'lowVol' investments, this means discounts for the contrarian brave enough to buy 'highVol' investments.

I like gold (GLD) and a handful of select junior gold miners to gain from volatility. But I also like going long, or buying CALL options, on the VanEck Mining Junior Fund (GDXJ) as a way to leverage gold during volatility.

Taking it a step further, it is time to use the forgotten technique of "tail-hedging."

This is simply going long ETFs, like the SP500 ETF (SPY) or other individual stocks you like. All while simultaneously buying PUT options on select ETFs or individual stocks that are long dated, 1 & 2 years, and are "out of the money" i.e. the strike price is 30-40% away from the current share price.

For instance, I could be long the SP&500 and tech stocks while also using 5-10% of my funds for long dated GDXJ call options and put options on Tesla (TSLA), or other cheap money induced equities.

Going long and also buying PUTs for the same investment even works.

This lets investors get those small weekly gains while protecting themselves from sudden spike in volatility or chaos. A favorite investor and iconoclast of mine, Mark Spitznagel, uses this strategy for his fund, Universa.

I'm sure everyone remembers the blood bath which was 'Black Monday' on August 24, 2015. The Dow fell over 1,000 points at the open ... But Universa netted over $1 billion, or 20% profits, in that day. How? Because he was 'tail-hedging'.

According to a Wall Street Journal source, Universa Investments was up close to 20% on the recent Black Monday, a trading session where the Dow Jones Industrial Average was off over 1,000 points, before recovering to finish down 588 points on the day.

You can read more here in an interview with Mark and how and why his strategy paid off so handsomely and suddenly.

With the Fed hiking and yields inverting, I think there could be a sudden shake up in the crowd's consensus, which will have these 'lowVol' investors panicking as their investments take them off a cliff.

We are definitely approaching a "Minsky Moment" after years of cheap debt and low rates. Markets are becoming more expensive and illiquid. Especially if the Fed will attempt to unwind its bloated balance sheet.

Instead of only focusing on a 2% inflation objective and low unemployment rate, they really should address what else is going on and all the unintended consequences they've conjured.

I see more downside optionality than any upside going forward for the economy. I don't see any catalysts which will suddenly spike, sending GDP and the Markit PMI or inflation higher.

Do you?

I look for investments that have the positive asymmetry (see-saw analogy) and that give favorable optionality. I use tail-hedging when the opportunity arises I normally use Long dated options for ...

more

The issue is that many run ups in the past were driven by excessive risk taking whereas this market run up is more a case of putting money in one of the few last asset classes that make decent returns more than a desire to take on risk. Because of this the move has been longer and more sustained and the risk has stayed hidden far too long.

It takes a trigger event to unwind it. For now, an obvious and predictable trigger has not presented itself. We will see if one appears on the near term horizon the next 12 months.

Adem makes reference to Hyman Minsky who "taught that years of prosperity and extended periods of low volatility are what breed excessive risk-taking and speculation. Thus prolonged low volatility today sets the foundation for extreme volatility in the future. Or, otherwise said, when you feel safest and most confident things won't change, you undertake more risk because you feel secure."

You might be very interested in Minsky's 5 Stages of a Bubble - Where Are We Now? (www.munknee.com/minskys-5-stages-of-a-bubble-where-are-we-now/) which identifies the 5 stages and concludes that "How much longer and higher stocks and bonds may run in the Everything Bubble, no one can predict, but for those who stay invested in inflated assets, be aware that you are implicitly increasing your risk tolerance well beyond levels which typical risk-averse investors would be comfortable with."

What stage do you think we are in - Boom, Euphoria or Profit-Taking and why?