Federal Reserve Predicts No Rate Increase Until End Of 2023

On Wednesday the Federal Reserve said it won’t be raising interest rates from their near-zero level for years. After a two-day policy meeting, the Fed released new projections in which 13 of 17 officials said they expect to keep rates near zero until 2023. A statement from the Fed said that it will maintain rates near zero until it sees evidence of a tight labour market and inflation on track to exceed 2% for a significant length of time. “They set an enormously high bar to raise rates here. That’s the bottom line,” former Fed economist Roberto Perli told The Wall Street Journal. US stocks fell back marginally later in the session following the news.

The Fed’s latest projections coincided with new data released on its trade situation with China. The country remains embroiled in a messy trade war with China instigated by President Trump which has been made worse by the spread of coronavirus, and investment flows between China and the US have now fallen to their lowest level in almost a decade in the first half of the year.

A report from consultancy Rhodium Group and the National Committee on United States-China Relations, a non-governmental organisation, said capital flows between the two countries amounted to $10.9bn in the first six months of 2020, lower than any period since 2011.

In other headlines, the Trump administration is reportedly pushing for American investors to be the majority owner of the US arm of TikTok, after news of a deal with Oracle (ORCL) that would leave control in the hands of Chinese firm ByteDance.

Cloud and software firm Snowflake’s IPO was another significant event on Wednesday, as it became the biggest software public offering of all time. The firm’s share price quickly doubled from its initial $120 list price, closing the day above $250.

General Electric jumps 10% after positive signs on cash flow

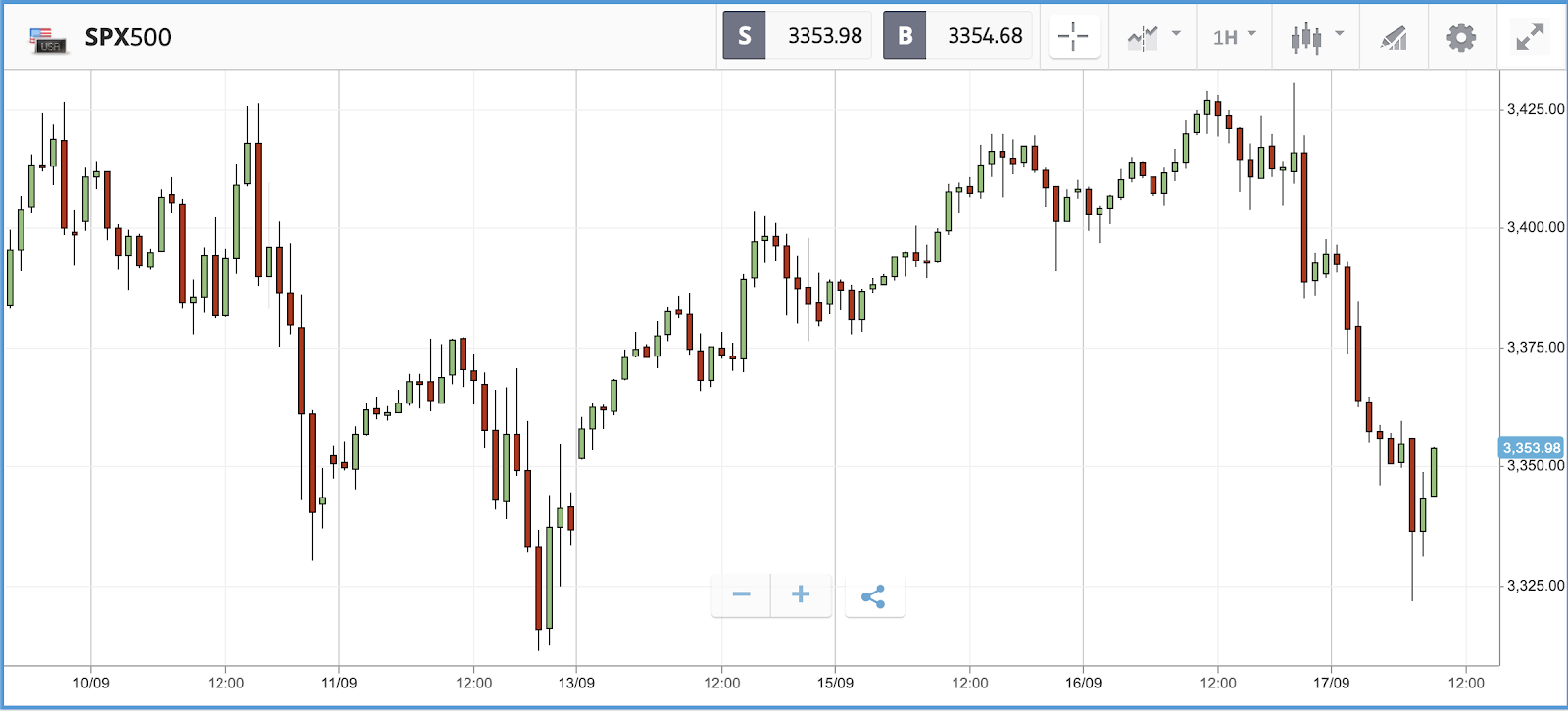

Two of the three major US stock indices were in the red on Wednesday, with the Nasdaq Composite falling furthest at a 1.3% loss. Illumina (ILMN) was among the names dragging the Nasdaq down, closing 8.4% lower after reports that it is in acquisition talks with Grail Inc, which makes a cancer detection test. Grail is approaching its IPO, and Illumina may be about to stump up $8bn for the firm. In the S&P 500, which closed 0.5% lower, General Electric (GE) was the biggest winner of the day. The conglomerate gained 10.6% after CEO Larry Culp spoke at a Morgan Stanley (MS) investor event, where he revealed that cash flow should turn positive in the second half of the year after the firm burned through $3bn in the first six months of 2020. The Dow Jones Industrial Average was the only major index in the green, adding 0.1%, boosted by 2% plus gains from Chevron (CVX), Walgreens Boots (WBA) and Boeing (BA).

S&P 500: -0.5% Wednesday, +4.8% YTD (SPX, SPY)

Dow Jones Industrial Average: +0.1% Wednesday, -1.8% YTD (DIA)

Nasdaq Composite: -1.3% Wednesday, +23.2% YTD (COMP)

Rolls Royce sinks after clarifying funding speculation

London-listed shares fell on Wednesday, with the FTSE 100 down 0.4% and the FTSE 250 off by 0.1%. Brexit news dominated headlines, as the Government accepted a compromise that will allow MPs a vote before powers are used that would break international law. Having recovered back to the $1.30 mark from a recent $1.27 low, the news sent the value of sterling back down to $1.29. Rolls Royce (RYCEY) was the biggest faller in the FTSE 100, closing the day 5.4% down after it responded to media speculation about funding options to strengthen its balance sheet, clarifying that no final decisions have yet been made. Rolls Royce’s share price is down 72% year-to-date, and 42% over the past three months. In the FTSE 250, travel operator Tui (TUIFY) also fell after reports about a plan to raise capital to help it navigate the pandemic. Tui stock ended the day 6% down.

FTSE 100: -0.4% Wednesday, -19.4% YTD

FTSE 250: -0.1% Wednesday, -18.7% YTD

What to watch

Initial jobless claims: Weekly initial jobless claim reports, which track the number of new unemployment benefit claimants, will be released in the US on Thursday. Expectations are for a figure of around 850,000, versus last week’s 884,000. Continuing jobless claims are expected to come in at 13 million versus 13.4 million the week before. “Don’t be fooled by seasonally adjusted first-time jobless claims remaining below 1 million for the second consecutive week,” Chris Rupkey, chief financial economist for MUFG Union Bank, said in a September 11 note - as reported by Yahoo Finance. “The labor market may not be sinking but it sure isn’t getting any better either.”

UK retail sales: After positive figures for July, which showed that UK consumers flocked back to stores as lockdowns eased, August retail sales data will be released on Friday. In July, the Office for National Statistics said retail sales volumes jumped 3.6% between June and July, with sales 3% higher than February before the World Health Organization declared a pandemic. Expectations are for a sub-1% month-over-month gain between August and July.

Crypto corner: Cryptoasset platform Kraken becomes a bank

Kraken, the San Francisco-based cryptoasset exchange established in 2011, has received a banking licence from the Wyoming Banking Board.

According to reports, Kraken has been given special purpose depository institution (SPDI) charter status, becoming the first such SPDI bank in Wyoming. According to the Wyoming Division of Banking’s general counsel, Chris Land, Kraken will also be the first newly chartered (de novo) bank in the state since 2006.

“By becoming a bank we get direct access to federal payments infrastructure, and we can more seamlessly integrate banking and funding options for customers,” said David Kinitsky, managing director at Kraken and the CEO of the newly formed Kraken Financial.

In addition to more products, Kraken Financial will give Kraken the ability to operate in more jurisdictions, Kinitsky said. As a state-chartered bank, Kraken now has a regulatory passport into other states without having to deal with a patchwork state-by-state compliance plan.

All data, figures & charts are valid as of 17/09/2020.

Disclaimer: eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS ...

more