Federal Reserve: A Nod Of Confidence

The Federal Reserve's decision to remove a Covid-crisis-induced emergency measure for banks has important ramifications. It shows that the Fed is confident on US banks, and the system. It also suggests comfort on the rise in market rates to date. It in fact could be construed as a moderate tightening in policy. Here, we explore SLR reversion implications.

The Fed makes a bold statement by removing a key emergency measure employed to support the banks and the system

A year ago the Federal Reserve gave US banks a break by allowing them to exclude holdings of Treasuries and excess deposits from the supplementary reserve ratio (SLR), a ratio that places a limit on bank balance sheet extensions (relative to capital). That was good through to 31 March 2021. Logically, the thought process was that the Fed would extend this. This was based on the clear preference of the Fed to date to keep emergency policies in place, as a precautionary measure. In the event the Fed has decided to let the SLR break roll off, so that from 1 April onwards we revert to the pre-crisis state.

Ahead of this, there were soundings from across Wall Street alluding to concern that the Fed was considering an adjustment to the SLR break. There were warnings in some quarters that if the Fed did so that US banks would have to stop taking deposits. While this is indeed technically a possible outcome, it is unlikely to be an actual outcome. Some anticipation of the Fed’s decision can also be gleaned from the selling of Treasuries from banks seen in recent weeks. In that sense the outcome was not a complete surprise. We had thought that the Fed would extend, but we were also quite clear that this was far from a conviction view, because of the many nuances surrounding the measure.

This is quite an important move from the Fed on a couple of counts. First, it must go down as the first easing of exceptional policy undertaken by the Fed off their own bat. We know that they wound down various emergency facilities at end 2020, but this was as a result of the US Treasury taking capital underpinnings away from them. In fact the Fed objected to this, even though many of the facilities were in decline anyway, as things were very much on the mend. Second, it is a signal that the Fed is quite comfortable with the workings of the system, and the banks. In fact, the 3mth Libor rate as a catch-all measure of banking stress tells the same story, as it remains comfortably in sub-20bp territory (below the Fed’s 25bp fund rate ceiling).

By extension, the Fed also went into this decision in the knowledge that the banks could take it. Existing supplementary reserve ratios across US banks were comfortable, and so re-including Treasuries and reserves back into the calculation was not going to trip any significant triggers. It still left US banks in a good place. For this reason, there need not necessarily be a mass exodus from Treasuries purely on the back of this change.

But there are consequences on market rates and on liquidity, with the latter longer lasting

At the same time, there are consequences. We calculate that US banks went into this decision holding some $600bn of US Treasuries in excess of their normal run-rate of holdings. That’s some 15% of total holdings (around $4trn). While there is no mad panic to offload these, it would be natural for banks to push in that direction over time, and at least be net sellers of Treasuries for a period.

On top of that, there is a liquidity risk here. Treasury liquidity works best when banks are fully engaged in the market. In fact one of the reasons behind allowing banks to exclude Treasuries from the SLR calculation was to help improve Treasury market liquidity. By definition, a reversal risks the opposite effect, the outcome of which would become more apparent when the market is one way biased, for whatever reason. In fact the liquidity aspect may well prove the most lasting impact from the Fed’s move.

There is a directional outcome too, as Treasury yields are pushed higher. The impact effect on the day has been 6bp, but the underlying effect is more, as there was some bank selling of Treasuries ahead of the Fed’s decision.

Ahead, the directional impact will be there, but will likely be subsumed by uppity macro prints and vaccine euphoria impacts on market rates. Even without this, we have a 2-handle targeted for the 10yr Treasury yield, pushed there by an ongoing unwind of the large 10yr negative real yield (now -60bp). The SLR reversion from 1 April pushes in the same direction, but does not dominate it.

A zero rate floor on the Fed's reverse repo window has in consequence become a focal point

With respect to bank reserves, it is interesting as an important aside to note the increase in the reverse repo counterparty limit by the Fed announced after this week’s FOMC meeting, from $30bn to $80bn. The Fed noted it as an overdue technical adjustment, as one had not been made since 2014. But in fact, we think it has a link with this SLR announcement. Any deposit that banks can’t post at the Fed can be channeled into money market funds, which can then show up at this window.

As another aside, it also solidified the notional zero rate at this window as the anchor for rates in the US. So close to negative, but not negative (just about).

FX markets – waiting for the bond storm to pass

News that the US Treasury SLR exemption is not being extended has given the dollar a little support – again largely via the rise in US Treasury yields. The near disorderly rise in US Treasury yields at some points this year have certainly undermined a market biased to buy activity currencies on dips. The SLR news certainly adds an element of caution here.

Within the FX space, EUR/USD looks one of the most vulnerable $ crosses. The reality of a third wave of virus cases in continental Europe and a failure to develop an effective vaccine roll-out plan certainly leaves the EUR vulnerable to a faster advance in UST yields. Having recently bounced off the 200-day moving average, that technical support, now at 1.1850, looks vulnerable.

Better insulated should be the G10 commodity currencies of NOK and CAD, both backed by central banks inching towards reducing policy accommodation. And as an asset class, EMFX may be better insulated too now that Brazil, Turkey and Russia have all hawkishly surprised markets this week.

US bank lending - an area where intended consequences were expected

(Click on image to enlarge)

Source: Macrobond

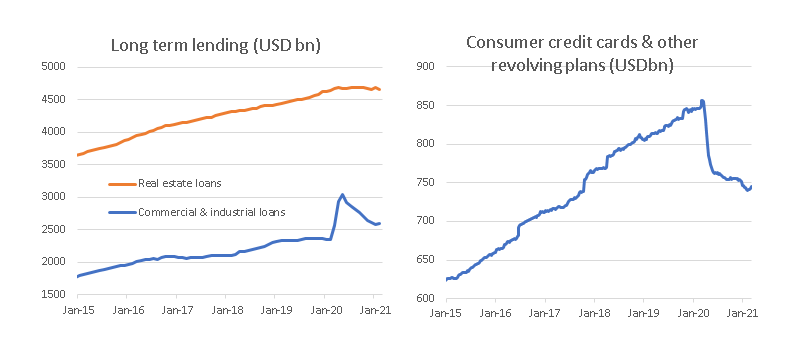

The Fed’s decision to relax the rules last year was to “provide flexibility for depository institutions to provide credit to households and businesses in light of the COVID-19 event”. It appears that this has not been needed with other Fed measures already helping to improve market functioning and boosting access to credit, be it through the bond market or other avenues while unprecedented fiscal support providing direct financial assistance. Consequently after an initial spike, we have seen outstanding commercial & industrial loans drop back significantly and real estate lending plateau. Outstanding credit card balances and other revolving facilities have actually fallen sharply.

In terms of the household sector the massive scale of fiscal support, while boosting consumer spending has also allowed a significant improvement in balance sheets. In addition to the paying down of credit card balances, household savings in the form of cash, checking and time deposits increased by $3trn between the end of 3Q19 and 4Q20. With another stimulus cheque hitting bank accounts right now and with enhanced Federal unemployment benefits being extended through to September this will further reduce the need for near-term household borrowing.

At the same time, an economic re-opening will support business activity and improve corporate profitability, which should ease the financial pain in heavily impacted business sectors such as leisure, entertainment and hospitality.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more