Fed Under Pressure As US Inflation Climbs

Yet another big upside surprise for US inflation casts further doubt on the Fed’s claim that this is all “transitory” and monetary policy can be left ultra-loose for the next three years. We expect to hear a shift in the Fed’s language over the late summer.

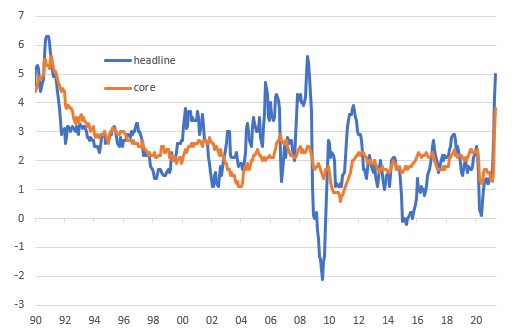

Inflation at 13-year high

US consumer price inflation jumped 0.6%MoM in May after recording 0.8% increases in April and 0.6% in March. Core inflation jumped even more, gaining 0.7%MoM after rising 0.9% in April. The market was expecting both components to rise 0.5%.

There were 0.3% or 0.4%MoM component readings throughout, suggesting broad inflation pressures while the bigger gains were once again seen in used car prices (7.3%MoM) and new vehicles up 1.6% - consumers have cash in their pockets and rental car companies are looking to rebuild fleets at a time when auto output is being constrained by component shortages. Meanwhile, apparel was up 1.2%, gasoline fell 0.7%MoM and medical care fell 0.1%.

In terms of the YoY rate, headline inflation rose to 5% from 4.2%. This is the highest reading since 2008 when inflation peaked at 5.6% on the back of oil prices rising above $140/barrel and gasoline averaging $4.11/gallon nationwide. Meanwhile the core (ex-food and energy) component hit 3.8%, which marks the fastest rate of price increases since 1993.

US annual inflation 1990-2021

Source: Macrobond, ING

Probably at a peak, but the decline will be slow

Of course, the annual comparison is somewhat misleading right now. We are still comparing price levels in a vibrant re-opening economy with those from 12 months ago when the US was still largely in lockdown and many corporates were slashing prices to desperately generate cash flow.

The annual rates should start edging lower as we move through 3Q and the economic extreme of lockdown is no longer included in the calculation. Nonetheless, we are not as optimistic as the Federal Reserve in thinking this is purely “transitory” and we will quickly be back down to 2% and stay there.

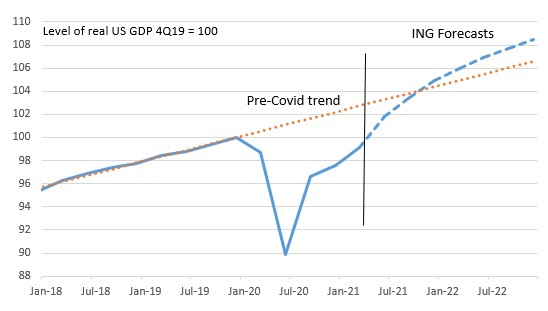

Demand will continue to exceed supply

The key reason is that the stimulus-fueled economy is booming. We are forecasting output will end the year higher than it would have done if there had been no pandemic and the economy had instead continued along its 2014-19 trend. However, the pandemic has led to scarring in the economy which means we are concerned that supply capacity won’t be able to cope with the scale of demand.

US GDP level based on ING forecasts versus pre-Covid trend

Source: Macrobond, ING

Rising costs, rising corporate pricing power, rising wages equals more persistent inflation

Rising commodity and freight charges, combined with supply chain disruption and component shortages have obviously put up costs. Labour shortages are also on the rise as homeschooling requires many parents to focus on childcare rather than go to work while extended and uprated unemployment benefits mean firms are having to pay higher salaries to attract staff.

This was illustrated by the fact that the “quit rate” published by the Bureau for Labour Statistics– the proportion of people leaving their job to move to a new employer - jumped to a new all-time high of 3.1% in April. Fortunately for business, a strong demand environment means these higher costs can be passed onto consumers.

The effects of this can be seen in a number of other surveys, including the National Federation of Independent Businesses reporting the fourth consecutive new all-time high for the proportion of businesses that have vacancies they cannot fill – now at 48%. At the same time price hike intentions are at their highest since 1980.

Watch housing costs in the coming months

This could be compounded by housing costs since primary rents and owners’ equivalent rent account for a third of the CPI basket. Movements in these components tend to lag 12-18 months below house price developments, as the chart below shows, since rents are only typically changed once a year. This means that the housing components may well be the story to watch through the second half of this year.

House prices and the relationship with housing CPI costs

Source: Macrobond, ING

Risks of earlier rate rises

Putting it all together we think US headline inflation will stay above 4% through until 1Q 2022 with core inflation unlikely to get below 3% until the second quarter of next year. The Fed will likely continue to talk about “transitory” inflation at next week’s FOMC meeting, but with doubts starting to creep in from various Fed officials we suspect the Jackson Hole Conference in late August could be very interesting. This could see a shift in language that really opens the door much wider to a December QE taper announcement.

With the economy roaring back, jobs returning and inflation likely to remain higher for longer we continue to see the risks skewed towards an earlier interest rate rise. The Fed is still saying early 2024, but we think early 2023 is more likely and it could come even sooner.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more