Fed: Then And Now

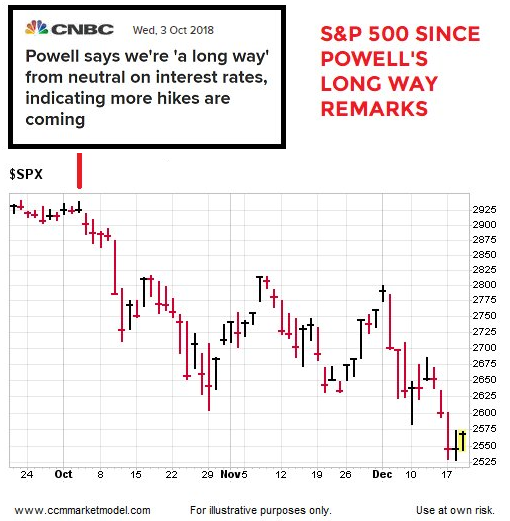

On October 2, the S&P 500 was trading within an eyelash of its all-time high. Then, Jerome Powell made the remark that interest rates were a long way from neutral. The stock market’s reaction to the comment is shown below.

STOCKS TRY TO FIND A BOTTOM ON OCT 29

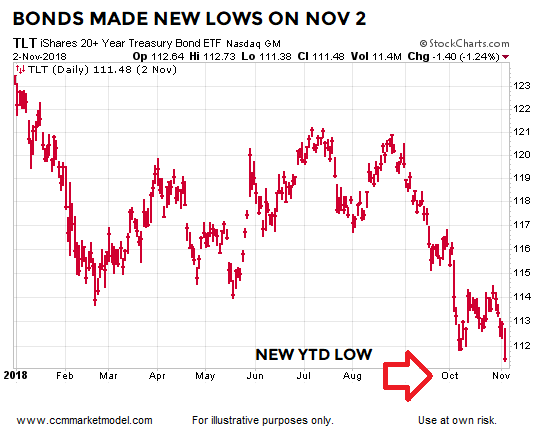

In recent weeks, weekly videos and Short Takes posts have covered concerning shifts in longer-term trends that occurred in the weeks following Powell’s October 2 comments. In terms of assessing shifts in the market’s longer-term economic view, a few charts can illustrate broad concepts. When the S&P 500 was trying to rally off the October 29 low, defensive long-term Treasury bonds subsequently printed a new year-to-date low on November 2, which hardly looks like a market concerned about the economy or a bear market.

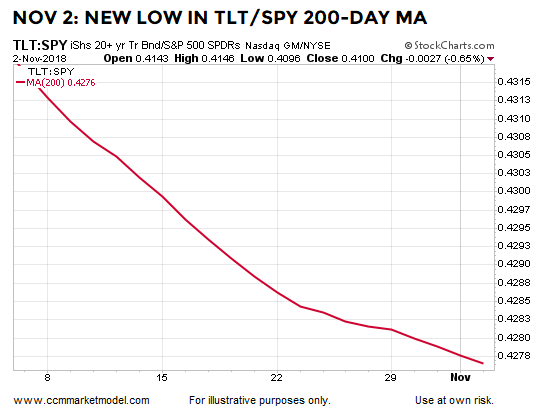

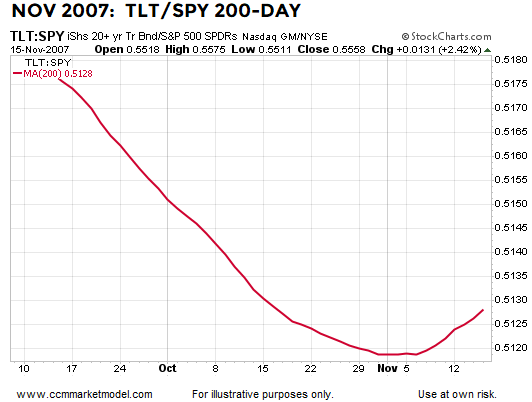

The same can be said for the long-term trend in the relative performance of bonds vs. stocks. After the stock market’s attempt at forming a lasting bottom on October 29, the bond-vs-stock ratio still had a downward-sloping 200-day moving average that was also printing a new YTD low.

A NOTICEABLE SHIFT

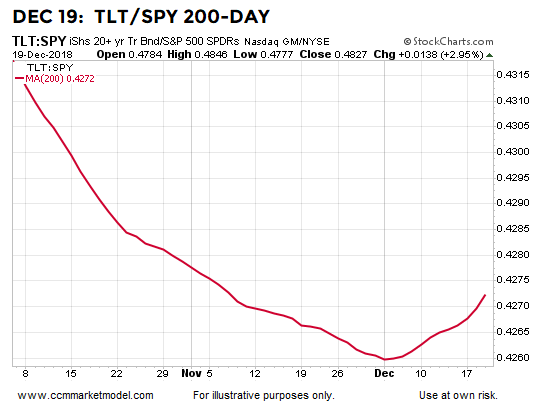

Our approach makes decisions based on the hard data related to longer-term trends. As shown above, the hard data on November 2 still favored the trend in stocks relative to bonds and the tepid conviction to own TLT relative to the conviction to sell TLT was producing lower lows. If we fast forward to the close on December 19, 2018, we see a noticeable and measurable shift in the hard data.

ANECDOTAL EXAMPLE OF SHIFT IN MARKET’S RISK TOLERANCE

We can make a comparison to an extreme historical case via a similar shift that took place in November 2007. The 2007 chart below and the 2018 chart above both reflect increasing concerns about the economy, earnings, and the stock market.

BIGGER PICTURE - ANECDOTAL CASE

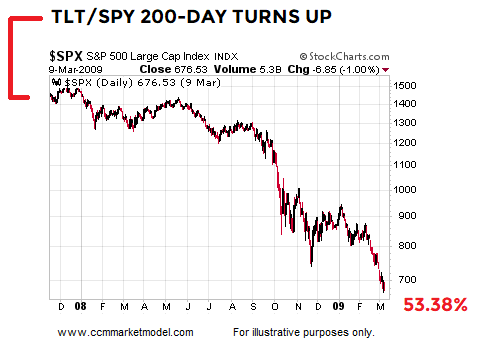

While we know every correction does not morph into a bear market and not every bear market morphs into a crisis, understanding what happened next in 2007 helps put some context around the model’s recent allocation decisions. Between the day the 200-day moving average for the TLT/SPY ratio had noticeably turned up to the final bear market low in 2009, the S&P 500 lost an additional 53.38%.

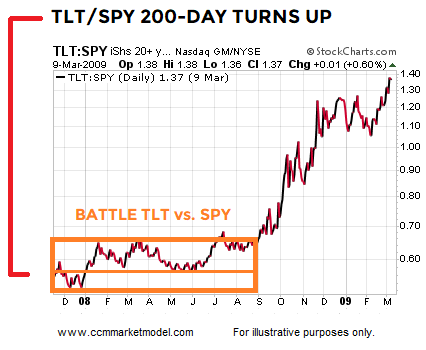

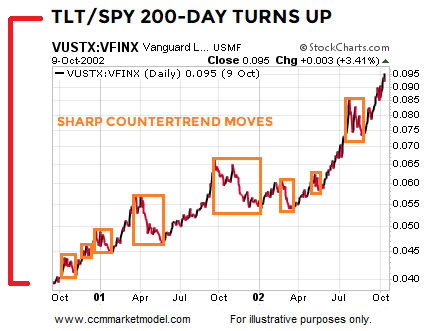

History tells us stock market corrections, and especially bear markets, can experience sharp oversold countertrend rallies. We also know stock market corrections/bear markets can end at anytime. Thus, the model moves in an incremental manner. Notice after the 200-day moving average turned up in the TLT/SPY ratio, bonds did not begin to clearly outperform stocks for many months (see orange boxes). Therefore, a bond/stock mix remained prudent for some time before bonds clearly separated themselves in late August 2008.

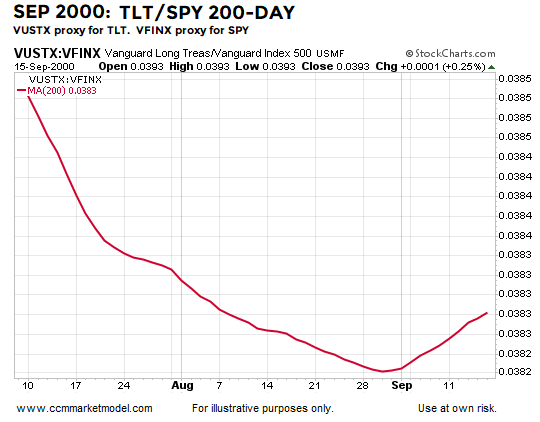

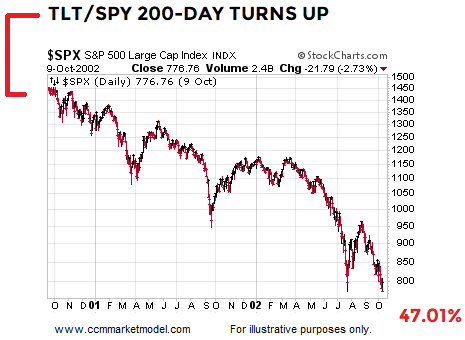

SIMILAR CONCEPTS - 2000 CASE

We are using these examples to illustrate basic concepts. There is nothing magical about making decisions based solely on the slope of the TLT/SPY ratio. We have noted in weekly videos numerous times the real ugly portion of the 2000-02 bear market in stocks did not begin until September 2000. Did concerns about the economy/earnings/stocks show up in the TLT/SPY ratio? Yes, in this case we are using VUSTX and VFINX as proxies for the ETFs.

What happened in the stock market after the TLT/SPY 200-day clearly turned up in September 2000? Even though the S&P 500 peaked in March, migrating to a more defensive allocation still paid big dividends given the S&P 500 dropped an additional 47.01%.

Given the oversold nature of the S&P 500 in December 2018, we have to respect violent countrend moves can come at any time. Notice after the TLT/SPY 200-day clearly turned up in September 2000, bonds did beat stocks, but there were also lengthy countertrend moves when stocks significantly outperformed bonds. Hence, the incremental approach to allocation shifts.

DEC 19: MARKET’S INITIAL REACTION TO FED

The Fed appeared to play a role in the stock market’s rapid descent that began in earnest in early October of this year. Based on early returns, the Fed seemed to once again greatly underestimate the market’s concerns related to the economy and monetary policy. From a Bloomberg opinion piece regarding the December 19 Fed statement/rate decision/press conference:

The first big shock came at 2 p.m. New York time, as the Fed statement was released. That eliminated the slight hope that the Fed might decide not to hike at all. Also, the statement was just barely more dovish than the previous one from the Fed.

Implicit in this response was Powell’s belief that the steady move to reduce the Fed’s balance sheet assets and, hence, mop up liquidity, was not going to roil the markets.

As for the accompanying “dot plot” of economic projections, it was more dovish than its predecessor, but still suggested that policy makers fully expected to boost rates two more times next year.

But the underlying message of the stock market is still emphatically that the Fed is wrong, and that the chances of an imminent downturn are increasing.

THIS IS NOT A FORECAST/PREDICTION OF GLOOM AND DOOM

The intent here is not to imply the S&P 500 will drop an additional 50% from present-day levels. As noted above, history tells us:

-

Every correction does not morph into a bear market.

-

Every bear market does not morph into a crisis.

-

Stock market corrections/bear markets can end at any time.

-

Bear markets/corrections often produce sharp/large countertrend moves.

The point of the exercise is to demonstrate what can happen when long-term trends from multiple areas of the market begin to reflect concerns about the economy and/or monetary policy. The charts above speak to probabilities, which is quite a bit different than certainty. Comments and concepts from December 16 still apply.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more