Fed Hawks Capitulation, China Stimulus Optimism Drive The S&P 500

The third week of January 2019 saw the S&P 500 (Index: SPX) rise sharply, buoyed by the capitulation of the Fed's interest rate hike-loving hawks and the actions the Chinese government is taking to stimulate its economy.

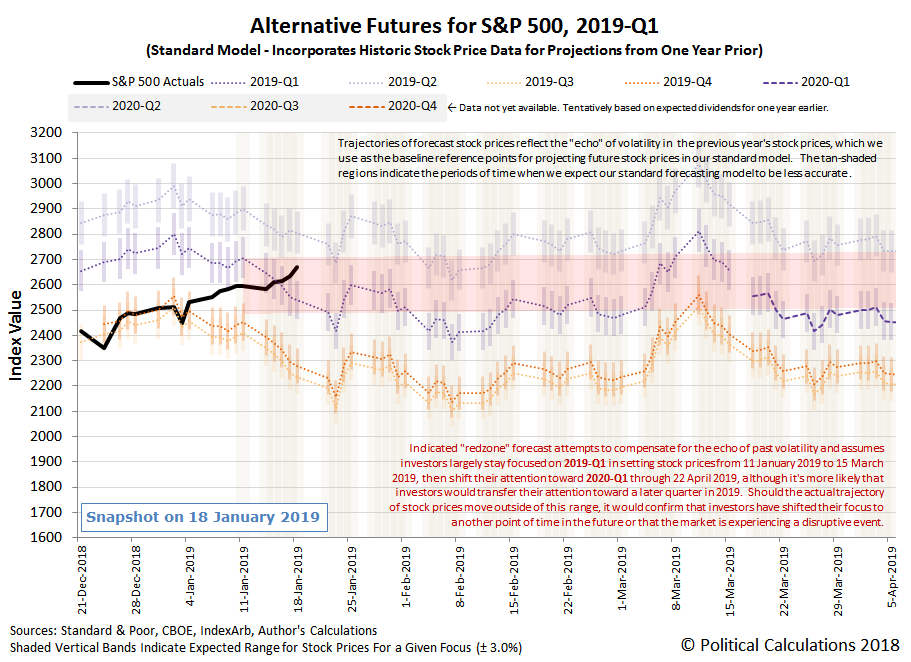

The following chart shows the trajectory of the S&P 500 during the week that was...

In Week 3 of January 2019, the S&P 500 generally tracked upward within the range indicated by the red zone forecast shown on the chart, which assumes that investors will largely maintain their forward-looking focus on the current quarter of 2019-Q1 through much of the quarter.

But what if that changes? We've already completed one Lévy flight event in 2019, which coincided with investors shifting their attention from the distant future quarters of 2019-Q3/Q4 back to the present quarter of 2019-Q1, so what would it mean if investors collectively refocus their attention toward a different point of time in the future and cause a new Lévy flight event to take place?

The dividend futures-based model we use to develop the alternate futures forecast chart gives us an idea of where the ceiling and the floor for the S&P 500 are at this time, assuming no major changes in expectations for future dividends in 2019 and no market-disrupting noise events.

- If investors shift their focus toward 2019-Q2, the S&P 500 has a potential upside of roughly 7% from where it closed on 18 January 2019, give or take 3%. Based on previous Lévy flight rallies, the rise would most likely be powered by a significant short squeeze.

- If investors instead shift their attention toward 2019-Q3 or 2019-Q4, the S&P 500 could see a relatively rapid 10% decline, again give or take a few percent, in a Lévy flight correction. Should this happen, it would likely come through a cascade of sell orders, enabled by buy orders at much lower stock prices placed as hedging strategies.

- If investors remain focused on the current quarter of 2019-Q1, then stock prices are likely to mostly move sideways, tracking with the redzone forecast indicated on the chart above.

- Finally, there's a fourth option, where investors split their focus between two different points of time in the future, in which case, the level of the S&P 500 will fall somewhere in between the three main alternate future trajectories we've described.

What events could prompt investors to shift their forward-looking focus to any of these points of time? The list could be as long as your imagination, but news events regarding more Chinese government stimulus actions, a trade deal between the U.S. and China, upside surprises for future earnings, et cetera. The random onset of market-moving news events is what gives the stock market its quantum random walk characteristics.

Speaking of which, here are the bigger headlines that we noted for the trading week ending 18 January 2019, where next week's list should be shorter because of the market's closure for the Martin Luther King Day holiday.

Monday, 14 January 2019

- Oil falls 1 percent on concerns about China slowdown

- Bigger trouble developing in China: GLOBAL MARKETS-China trade shock hits global stocks, commodities

- Clarida reinforces Fed's mantra of U.S. policy patience

- China worries weigh on Wall Street, earnings expectations fall

Tuesday, 15 January 2019

- Oil rises about 3 percent on economic stability hopes

- Bigger trouble developing in China: China signals more stimulus as economic slowdown deepens

- Six regional Fed banks opposed last month's interest rate hike

- Netflix, China boost Wall Street as investors shrug off Brexit vote

Wednesday, 16 January 2019

- Oil gains with Wall Street, but rising U.S. fuel stocks weigh

- Bigger trouble developing in China:

- Upbeat bank earnings send Wall Street to one-month highs

- Index change:

- PG&E to get pulled out of S&P 500, shares near 2001 lows

Thursday, 17 January 2019

- Oil slides on increased U.S. output and U.S.-China trade fears

- Bigger trouble developing in China: Job jitters mount as China's factories sputter ahead of Lunar New Year

- Goodwill bailout? U.S. Treasury Secretary Mnuchin weighs lifting tariffs on China: WSJ

- Fed's Evans says good time for central bank to pause rate hikes

- Wall Street advances as industrials jump on trade hopes

Friday, 18 January 2019

- Oil jumps 3 percent on OPEC plan details, U.S.-China trade hopes

- Exclusive: U.S. demands regular review of China trade reform

- Fed policymakers leave little doubt: Rate hikes can wait

- Wall Street extends rally on U.S.-China trade optimism

Elsewhere, Barry Ritholtz identified the week's positives and negatives for markets and the economy.

Sharp-eyed readers will recognize that we've adjusted the range of the vertical scale on the alternate futures chart and that the redzone forecast, along with several of the other trajectories, has been angled upward with respect to last week's version. This change has occurred because there was a positive change in the S&P 500's quarterly dividends expected for 2019-Q2, which increased from $14.40 per share to $14.65 per share on 17 January 2019. Let's not forget that the level of stock prices are still primarily driven by basic fundamentals!

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more