February 2021 Consumer Credit Shows No Year-Over-Year Growth

Headline consumer credit expanded in January and was above expectations. Our analysis of the unadjusted data shows annual growth is non-existant year-over-year.

Analyst Opinion of the Consumer Credit Situation

Student loan year-over-year growth rate was little changed and remains in an overall slowing trend.

Not only does this data set suffer from backward revision (at times moderate to significant enough to change trends -, but the use of compounding (projecting monthly change as annual change) by the Federal Reserve to determine consumer credit growth rates exaggerates the volatility in this data.

- that the amount of consumer credit outstanding relative to consumer expenditures is at 21st-century highs.

- Household Debt Payments As A Percent of Disposable Income remains near all-time lows.

There is little evidence that loan defaults have increased due to the recession and pandemic.

Last month's headline said:

In January, consumer credit decreased at a seasonally adjusted annual rate of 0.4 percent. Revolving credit decreased at an annual rate of 12.2 percent, while nonrevolving credit increased at an annual rate of 3.2 percent.

This month's headlines said:

In February, consumer credit increased at a seasonally adjusted annual rate of 7.9 percent. Revolving credit increased at an annual rate of 10.1 percent, while nonrevolving credit increased at an annual rate of 7.3 percent.

Econintersect's view:

Unadjusted Consumer Credit Outstanding

| Month- over- Month Growth | Year- over- Year Growth | Month- over- Month Growth without Student Loans | Year- over- Year Growth without Student Loans | |

| Total | +0.2 % | 0.0 % | +0.3 % | -2.1 % |

| Revolving | +0.0 % | -11.7 % | n/a | n/a |

| Non- Revolving |

+0.2 % |

+3.9 % | +0.3 % | +3.6 % |

Overall takeaways from this month's data:

- Student loan year-over-year growth rate has been decelerating gradually since the beginning of 2013.

- Student loans growth rate (US Government-owned) accelerated 0.0 % month-over-month and year-over-year growth is 4.4 % year-over-year

- Revolving credit (e.g.credit cards - and this series includes no student loans) continues deep in contraction

The market expected (from Econoday) consumer credit to expand$10.0 B to $15.0 B (consensus = $13.0 B billion) versus the seasonally adjusted headline expansion of $27.6 B billion reported.

Note that this consumer credit data series does not include mortgages. However, most consumer credit is used for retail sales - and the following graph shows the relationship indexed to the end of the Great Recession.

The Econintersect analysis is different than the Federal Reserve:

- an effort is made to segregate student loans from consumer credit to see the underlying dynamics; Note that we are only using 70% of the value of student loans issued as only the US government accounts are up to date - and the Fed's total student loan account (SLOAS) is only issued quarterly. The trend lines are normally representative.

- this analysis expresses growth as a year-over-year change, not one month's change being projected as an annual change which creates significant volatility and distortion.

- where our analysis expresses the change as month-over-month, month-over-month change is determined by subtracting the previous month's year-over-year improvement from the current month's year-over-year improvement.

The commonality between the Fed and Econintersect analysis is that consumer credit is expanding whether one considers student loans or not. The difference is how we determine the RATE of growth.

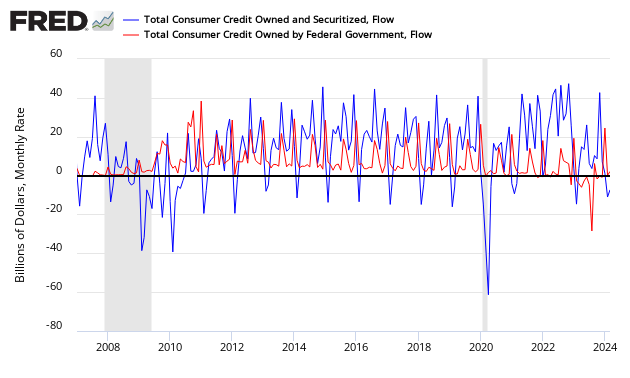

Since the Great Recession, much of the increase in consumer credit had been from student loans. The following graph shows the flow into consumer credit including student loans (blue line) against the flow into student loans alone (red line).

The flow of Funds into Consumer Credit - Total Consumer Credit (blue line) vs Student Loans (red line)

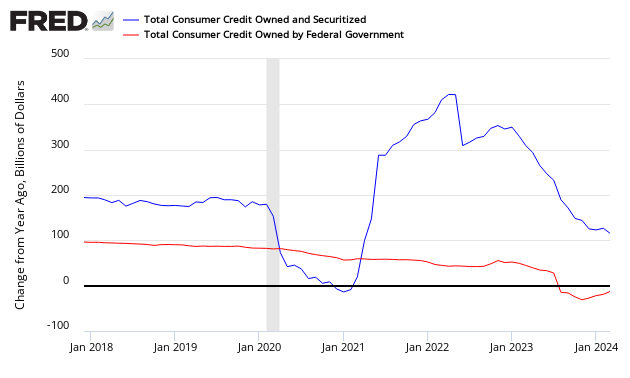

Another way to view the effects of student loans on consumer credit is to view the year-over-year growth in $ billions of student loans as a percent of total consumer credit (including student loans). In short, student loans accounted for all consumer credit growth from 2009 to late 2011. The year-over-year growth of consumer credit is shown as the blue line in the graph below.

Year-over-Year Growth in $ Billions - Total Consumer Credit (blue line) vs Student Loans (red line)

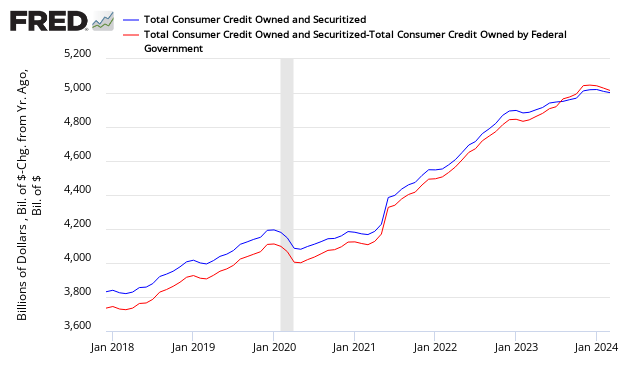

And one final look at total consumer credit and the effect of student loans. The graph below removes student loans from total consumer credit outstanding.

Total Consumer Credit Outstanding - Total Consumer Credit (blue line) vs Total Consumer Credit without Student Loans (red line)

Econintersect spends time on this generally ignored data series because the USA is a consumer-driven economy. One New Normal phenomenon has been the consumer shift from credit towards an electronic payment (current account debit) society - a quantum shift that changes the amount of consumption. Watching consumer credit provides confirmation that this New Normal shift continues.

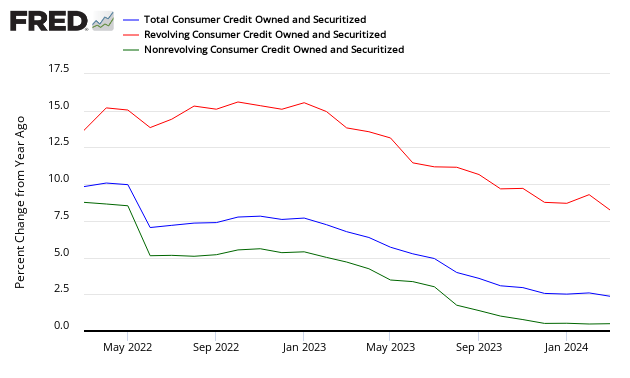

Year-over-Year Growth of Consumer Credit - Total (blue line), Revolving Credit (red line), and Non-Revolving (the green line which includes student loans)

The Federal Reserve reports credit divided between revolving and non-revolving. The majority of revolving credit is from credit cards, while non-revolving credit includes automobile loans, student loans, and all other loans not included in revolving credit, such as loans for mobile homes, boats, trailers, or vacations.

Other Consumer Credit Data from Outside this Report:

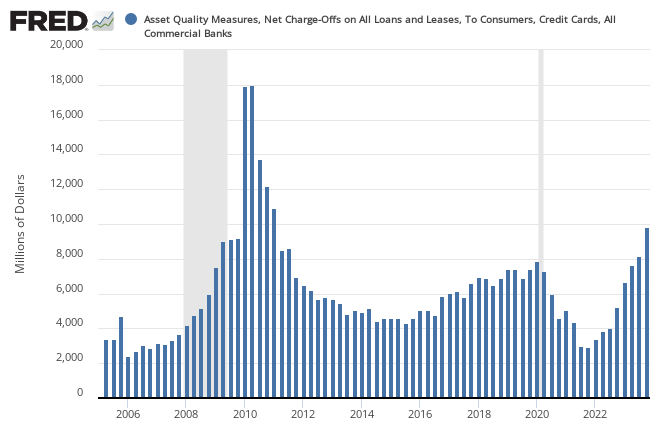

The question remains on the rate of write-downs of consumer loans. The following graph addresses this question:

Net Charge-Offs on Consumer Credit

Consumer Loan Delinquency

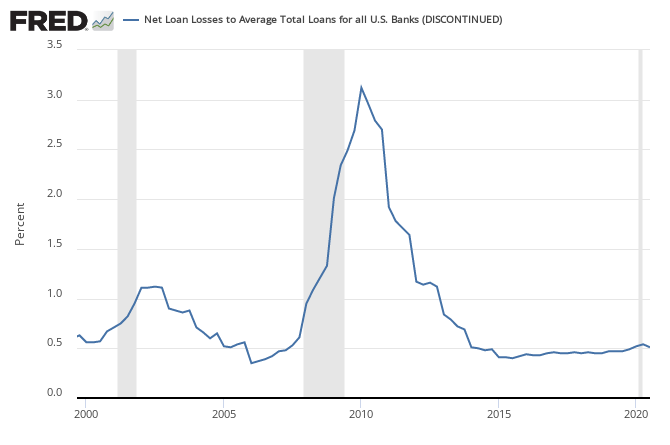

The next graph addresses the question of loan losses by the banks which have returned to historical norms:

Bank Net Loan Losses - Percent of Total Loans

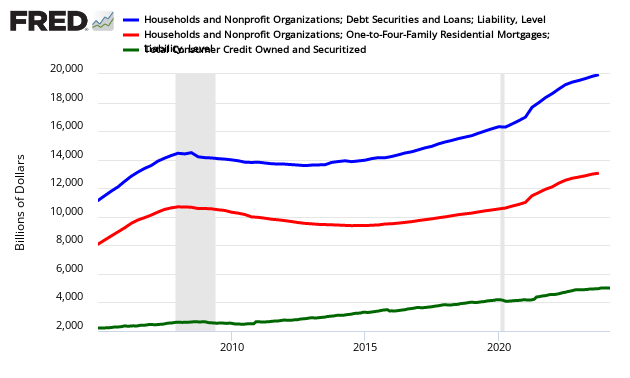

This consumer credit release does not include mortgages. Here is what total household debt looks like. Please note that the mortgage data is not as current as of the consumer credit data in this post.

Total Household Debt (includes mortgages blue line), mortgages (red line), and Consumer Credit talked about in this post (green line)

And the consumer debt repayments (as a percent of income) remain at very low levels.

Household Debt Payments As A Percent of Disposable Income

There is a general correlation that shows consumer credit growth and consumer spending move in the same direction. Since mid-2019, both consumer credit and consumer spending growth have moderated. However, the pandemic is screwing with this historical correlation.

Looking at the ratio between consumer credit and consumer spending - this ratio has little changed over the last 4 years even with the extremely low-interest rates which allow consumers to pay back loans with little charged interest.

Caveats on the Use of Consumer Credit

This data series does not include mortgages and is not inflation-adjusted. This whole series has undergone a major revision with the April 2012 Press Release:

The Federal Reserve Board on Monday announced that it has restructured the G.19 statistical release, Consumer Credit, to reflect regulatory filing changes for U.S.-chartered depository institutions and, in addition to the data currently reported on level of credit outstanding, the release will now report data on the flow of credit. The revised data will be made available with the release of the April report on Thursday, June 7.

Savings institutions now file the same regulatory report as U.S.-chartered commercial banks. The U.S.-chartered commercial banks sector and the savings institution sector, which were previously shown separately, have been combined into a new sector called depository institutions. The previously published series for U.S.-chartered commercial banks and savings institutions will continue to be available as separate series in the Federal Reserve's Data Download Program (DDP).

The new flow data represent changes in the level of credit due to economic and financial activity, rather than breaks in the data series due to changes in methodology, source data, and other technical aspects of the estimation that affect the level of credit. Access to flow data allows users to calculate a growth rate for consumer credit that excludes such breaks.

These changes will be accompanied by revisions to the estimates of outstanding consumer credit back to January 2006 and reflect improvements in methodology and a comprehensive review of the source data.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more