February 2019 Headline Industrial Production Marginally Improved But Year-Over-Year Growth Declined

The headlines say seasonally adjusted Industrial Production (IP) improved month-over-month. Our analysis shows the three-month rolling average insignificantly declined.

Analyst Opinion of Industrial Production

There was upward revision to the last 6 months of data. The best way to view this is the 3-month rolling averages which declined marginally. Industrial production remains in a short term downtrend.

Note that manufacturing significantly declined.

The manufacturing employment rate of growth is accelerating year-over-year.

- Headline seasonally adjusted Industrial Production (IP) was up 0,1 % month-over-month and up 3.5 % year-over-year (YoY was published as 4.0 % last month).

- Econintersect's analysis using the unadjusted data is that IP growth was up 0.1 % month-over-month, and is up 3.9 % year-over-year.

- The unadjusted 3 month rolling average year-over-year rate of growth decelerated 0.1 % from last month, and is up 3.8 % year-over-year.

- The market was expecting (from Econoday):

| Headline Seasonally Adjusted | Consensus Range | Consensus | Actual |

| IP (month over month change) | +0.0 % to 1.1 % | +0.4 % | +0.1 % |

| IP Subindex Manufacturing (month over month change) | +0.1 % to 0.5 % | +0.4 % | -0.4 % |

| Capacity Utilization | 78.3 % to 79.0 % | 78.5 % | 78.2% |

IP headline index has three parts - manufacturing, mining and utilities - manufacturing was down 0.4 % this month (up 1.0 % year-over-year), mining up 0.3 % (up 12.5 % year-over-year), and utilities were up 3.7 % (up 9.0 % year-over-year). Note that utilities are 10.8 % of the industrial production index, whilst mining also is 10.8 %.

Comparing Seasonally Adjusted Year-over-Year Change of the Industrial Production Index (blue line) with Components Manufacturing (red line), Utilities (green line), and Mining (orange line)

Unadjusted Industrial Production year-over-year growth for 2 years has been near or below zero - it is currently trending up and in expansion.

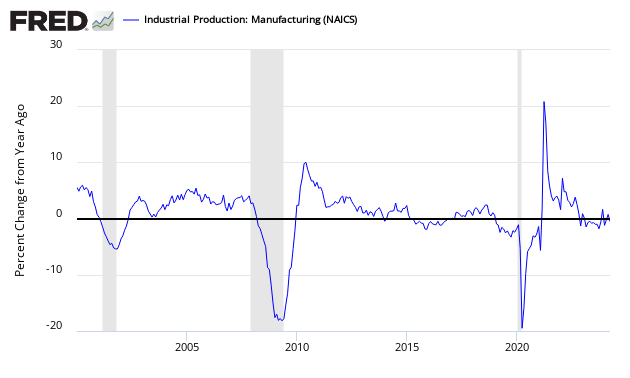

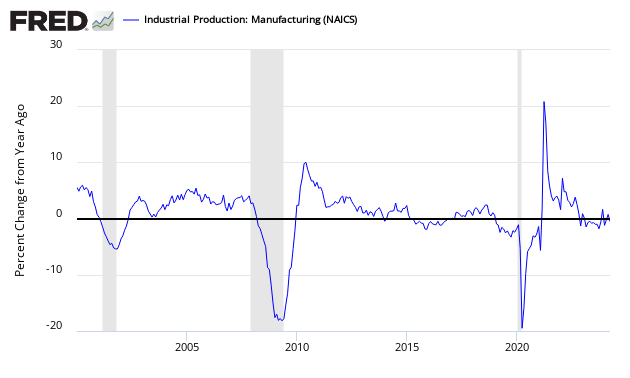

Economic downturns have been signaled by only watching the manufacturing portion of Industrial Production. Historically manufacturing year-over-year growth has been negative when a recession is imminent.

Seasonally Adjusted Manufacturing Index of Industrial Production - Year-over-Year Growth

Seasonally Adjusted Capacity Utilization - Year-over-Year Change - Seasonally Adjusted - Total Industry (blue line) and Manufacturing Only (red line)

Econintersect uses unadjusted data and graphs the data YoY in monthly groups.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

Kansas Fed (hyperlink to reports):

Dallas Fed (hyperlink to reports):

Philly Fed (hyperlink to reports):

New York Fed (hyperlink to reports):

Federal Reserve Industrial Production - Actual Data (hyperlink to report):

Holding this and other survey's Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Dallas Fed survey (light blue bar).

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Caveats in the Use of Industrial Production Index

Industrial Production is a non-monetary index - and therefore inflation or other monetary adjustments are not necessary. The monthly index values are normally revised many months after initial release and are subject to annual revision. The following graphic is an example of the variance between the original released value - and the current value of the index. If the current values are better than the original values - this is normally a sign of an improving economy.

This index is somewhat distorted by including utility production which is noisy, based primarily on weather variations. There is some variance between the manufacturing component of industrial production which monitors production, and the US Census reported Manufacturing Sales. While it is true that these are slightly different pulse points (inventory not accounted in shipments) - they should not have different trends for long periods of time.

Comparing Year-over-Year Change - Unadjusted Manufacturing Industrial Production (blue line) to Unadjusted Manufacturers Shipments (green line)

Econintersect determines the month-over-month change by subtracting the current month's year-over-year change from the previous month's year-over-year change. This is the best of the bad options available to determine month-over-month trends - as the preferred methodology would be to use multi-year data (but New Normal effects and the Great Recession distort historical data).

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more