February 2018 CPI: Year-Over-Year Inflation Rate 2.2%

According to the BLS, the Consumer Price Index (CPI-U) year-over-year inflation rate was 2.2 % - up 0.1 % from last month. The year-over-year core inflation (excludes energy and food) rate was unchanged at 1.8 %, and is below the target set by the Federal Reserve.

Analyst Opinion of the Consumer Price Index

Shelter, apparel, and motor vehicle price changes remained the driver for inflation. Core inflation remain below 2.0 % year-over-year.

The market expected (from Bloomberg / Econoday):

| Consensus Range | Consensus | Actual | |

| CPI-U - month-over-month (MoM) | 0.3 % to 0.4 % | +0.2 % | +0.2 % |

| CPI-U year-over-year (YoY) | 2.1 % to 2.3 % | +2.2 % | +2.2 % |

| CPI less food & energy (MoM) | 0.1 % to 0.3 % | +0.2 % | +0.2 % |

| CPI less food & energy (YoY) | 1.8 % to 2.0 % | +1.9 % | +1.8 % |

z cpi1.png

As a generalization - inflation accelerates as the economy heats up, while inflation rate falling could be an indicator that the economy is cooling. However, inflation does not correlate well to the economy - and cannot be used as a economic indicator.

The major influence on the CPI was again energy prices.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in February on a seasonally adjusted basis after rising 0.5 percent in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.2 percent before seasonal adjustment. The indexes for shelter, apparel, and motor vehicle insurance all rose and contributed to the 1-month seasonally adjusted increase in the all items index. The food index was unchanged in February, as a decline in the index for food at home offset an increase in the food away from home index. The energy index increased slightly, with its component indexes mixed. The index for all items less food and energy increased 0.2 percent in February following a 0.3-percent increase in January. Along with shelter, apparel, and motor vehicle insurance, the indexes for household furnishings and operations, education, personal care, and airline fares also increased in February. In contrast, the indexes for communication, new vehicles, medical care, and used cars and trucks declined over the month. The all items index rose 2.2 percent for the 12 months ending February, a slightly larger increase than the 2.1-percent rise for the 12 months ending January. The index for all items less food and energy rose 1.8 percent over the past year, while the energy index increased 7.7 percent and the food index advanced 1.4 percent.

Historically, the CPI-U general index tends to correlate over time with the CPI-U's food index. The current situation is putting an upward pressure on the CPI.

CPI-U Index compared to the Food sub-Index of CPI-U

(Click on image to enlarge)

Notice the gap in the above graphic between the CPI and Food - historically this gap has always closed when the knock-on effect from higher food prices into other CPI components moderates.

Recently, medical care too has been accelerating faster than costs in general. The graphs below compare health care to the CPI-U.

Month-over-Month Change CPI-U Index (red line) compared to the Medical Care sub-Index of CPI-U (blue line)

(Click on image to enlarge)

Year-over-Year Change CPI-U Index (red line) compared to the Medical Care sub-Index of CPI-U (blue line)

(Click on image to enlarge)

The Federal Reserve has argued that energy inflation automatically slows the economy without having to intervene with its monetary policy tools. This is the primary reason the Fed wants to exclude energy from analysis of consumer price increases (the inflation rate).

(Click on image to enlarge)

z cpi2.png

In the above chart - the green boxes are significant elements moderating inflation, while the red boxed items are significant elements fueling inflation.

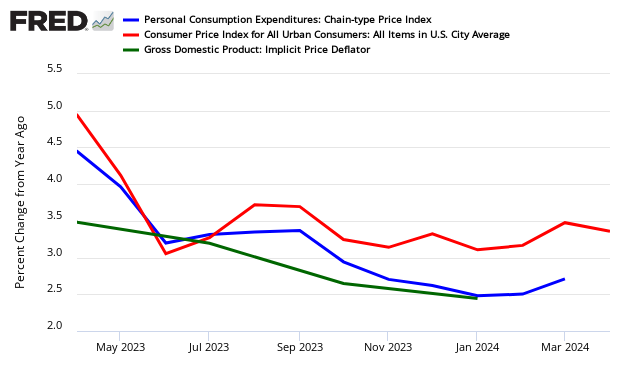

The graph below looks at the different price changes seen by the BEA in this PCE release versus the BEA's GDP and BLS' Consumer Price Index (CPI).

Year-over-Year Change - PCE's Price Index (blue line) versus CPI-U (red line) versus GDP Deflator (green line)

(Click on image to enlarge)

Caveats on the Use of the Consumer Price Index

Econintersect has performed several tests on this series and finds it fairly representative of price changes (inflation). However, the headline rate is an average - and will not correspond to the price changes seen by any specific person or on a particular subject.

Although the CPI represents the costs of some mythical person. Each of us need to provide a multiplier to the BLS numbers to make this index representative of our individual situation. This mythical person envisioned spending pattern would be approximately:

(Click on image to enlarge)

The average Joe Sixpack budgets to spend his entire paycheck or retirement income - so even small changes have a large impact to a budget.

(Click on image to enlarge)

The graph above demonstrates that fuel costs, medical care, and school costs are increasing at a much faster pace than the headline CPI-U.

The Bureau of Labor Statistics (BLS) has compiled CPI data since 1913, and numbers are conveniently available from the FRED repository (here). Long-term inflation charts reach back to 1872 by adding Warren and Pearson's price index for the earlier years. The spliced series is available at Yale Professor (and Nobel laureate) Robert Shiller's website. This look further back into the past dramatically illustrates the extreme oscillation between inflation and deflation during the first 70 years of our timeline. Click here for additional perspectives on inflation and the shrinking value of the dollar.

(Click on image to enlarge)

Because of the nuances in determining the month-over-month index values, the year-over-year or annual change in the Consumer Price Index is preferred for comparisons.

Econintersect has analyzed both food and energy showing that food moves synchronously with core.

Disclosure: None.