Fears Fading Away As Santa Loads His Sleigh

Unless you've been living in a cave or don't have access to a TV, computer, smartphone, or even a newspaper, you likely know that Presidents Xi Jinping and Donald Trump laid the groundwork for a trade deal Saturday night in Buenos Aires. Generally referred to as a "truce" or cease-fire in the current trade war, the key is that the two sides have agreed to a few things and to keep talking.

As such, no new tariffs will be applied by either side for 90 days. But after that, the details are skimpy at best, and many wonder if a deal involving issues such as forced technology transfers and intellectual property protection can actually get done in such a short period of time.

What we do know is our Negotiator-in-Chief tweeted over the weekend that he and Xi had agreed to what would amount to a "great deal." A deal where China says it will buy a bunch of stuff from the U.S. in order to close the trade gap between the two countries. Importantly, this includes agriculture as well as cars, technology and other industrial products.

We also know that stock markets around the globe like the news - a lot. The bottom line is simple. The second big, near-term fear - the fear that a prolonged trade war would damage the global economy - is now fading. In response, traders appear to be "discounting" the expectations for (1) a trade deal to get done and (2) reduced recession risk in developed markets.

Therefore, within one week, both of the key, near-term fears have been checked off. Recall that last week Jerome Powell eased fears that the Fed would be stubborn and "overshoot" - again hurting the economy in the process. And now we've got significantly reduced fears that China and the U.S. will become stubborn in their trade dispute.

Time For the Year-End Rally?

So, is it time to cue the traditional year-end, aka Santa Claus rally on Wall Street?

From the looks of the futures market, it would appear that Santa has loaded up his sleigh a bit early this year with gifts for stock and commodity market investors. Dow futures are pointing to a gain of over 425 points at the open. Oil is up 5%. Gold, copper, silver, and platinum are all up 1% or more. German's DAX is up 2%. London's FTSE is up 1.6%. France is up 0.8% (this despite the violent protests occurring in Paris). Italy is up 1.8%. Japan rallied 1%. China's Shanghai index rallied 2.57%.

This just in this morning... Treasury Secretary Mnuchin is saying that this deal represents a significant opportunity for economic growth.

Can you say, "risk on?"

On that note, it would be easy to think that everything is all better now and that stocks are heading straight to new highs. However, it might be best to curb the year-end enthusiasm a bit.

Yes, Trump and Powell appear to have delivered a very nice holiday gift to the markets. And I have little doubt that the mood on the street will improve. However, it also important to keep in mind that global economies are slowing and that a great many foreign stock indices are in bear markets.

Yet, the bulls will argue that the removal of the two big, bad fears will go a long way in alleviating the global slowdown. We'll see.

All Clear?

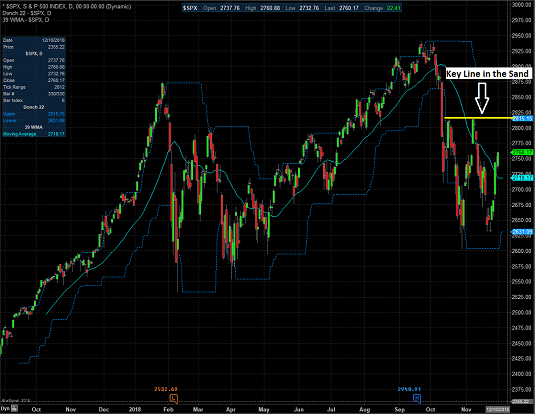

Here at home, the bulls will likely enjoy the day. But from a chart perspective, there is an important line in the sand that needs to be breached - as in the November high.

S&P 500 - Daily

Technicians tell us that if stocks can push through the November highs then the correction is over, and a new uptrend has begun. This should be marked by a series of "higher highs and higher lows" on the charts.

But if the bulls can't break on through to the other side, then our furry friends in the bear camp will contend that stocks will be at best, stuck in a bottoming process or, at worst, embarking on a new leg lower.

Personally, I'll put my money on the former as I would expect the S&P to push higher into the end of the year. A move that would reflect an improving macro environment.

But... As the saying goes, the devil is in the details. Rest assured that at some point - maybe not in December, but definitely within the next 60 days - traders will want to see some details of the trade deal. And more importantly, they will want assurances that a deal is actually going to get done.

But for now, at least, it is time to enjoy the bounce.

Now let's turn to the weekly review of my favorite indicators and market models...

The State of the Big-Picture Market Models

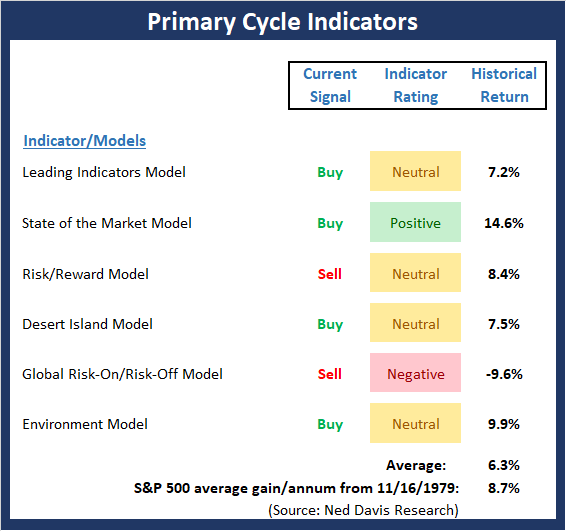

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary trend.

The Bottom Line:

- There was one minor changes to the Primary Cycle board this week. My "Desert Island" model, which, as the name implies would be the one model I could rely on to manage money if stranded on a desert island without any other market inputs, slipped into the neutral zone. The good news is the model remains on a buy signal.

Note: We have added a new model to the Primary Cycle board. Since most big moves in the market tend to be global in scope, we've added a "risk-on/risk-off" model based on global markets. Unfortunately, this indicator remains negative at this time.

This week's mean percentage score of my 6 favorite models declined to 57.9 (from 64.5%) while the median fell to 52.5% (from 65%).

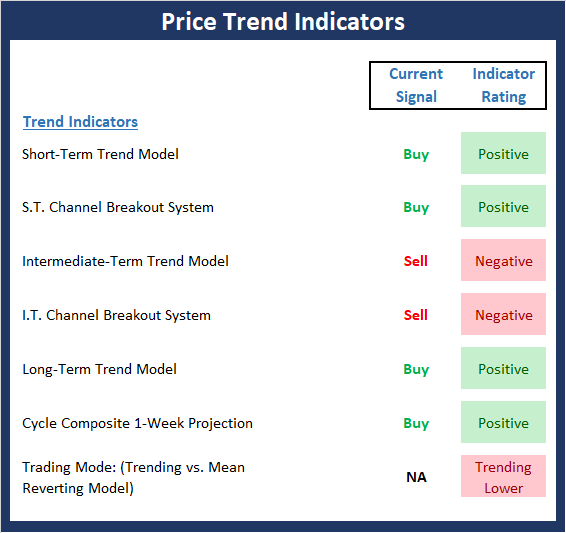

The State of the Trend

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

The Bottom Line:

- As you might surmise from the strong rally seen last week, the Trend board perked up a bit -, especially the short-term indicators. The bad news is that there was a fair amount of damage done to the longer-term indicators and our trading mode model is now in its "trending lower" mode. However, it is positive that the Cycle Composite points higher from now until the end of the year.

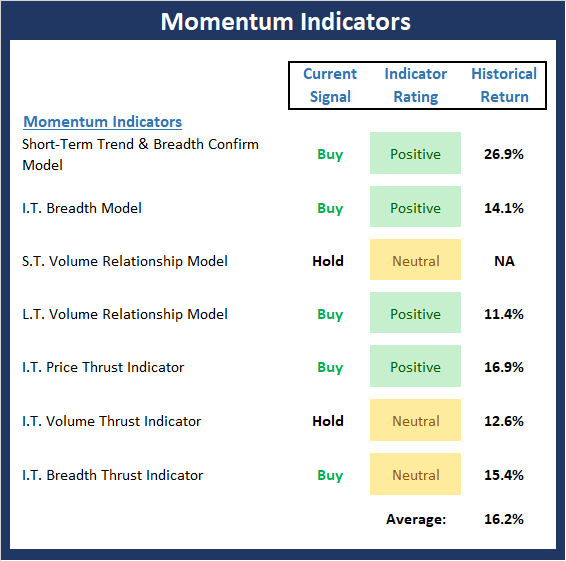

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

The Bottom Line:

- While this is a rarity, every indicator on the Momentum board improved last week. In addition, we saw two indications of "thrust" signals, which, if confirmed tend to be an "all clear" signal for the ensuing 12 months. And with the historical return upticking nicely, the bulls now have hope that the worst of the corrective phase is over.

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

The Bottom Line:

- The "Early Warning" board did a good job recently of indicating that the bulls, at the very least, had the winds at their backs for a rally try. While the board is nowhere near negative at this time, some of the strong signals have now "timed out." The bottom line is the board is now more neutral.

The State of the Macro Picture

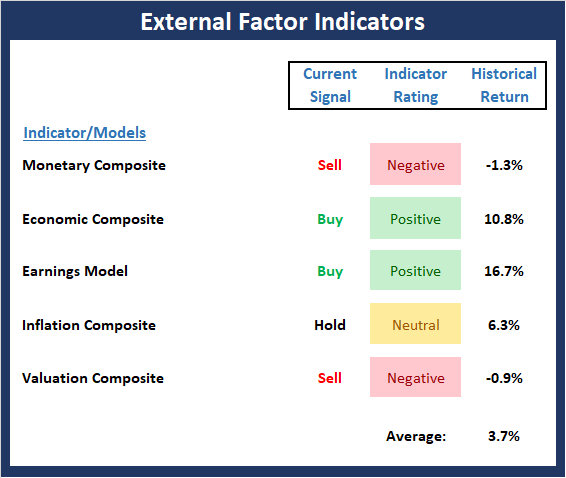

Now let's move on to the market's "environmental factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

The Bottom Line:

- While the indices have bounced and the bulls argue that the worst of the correction is over, the External Factors board continues to suggest that from a big-picture standpoint, risk factors remain elevated and return expectations are uninspiring. However, it is worth noting that the valuation components of our model are improving.

Thought For The Day:

Train people well enough so they can leave. Treat them well enough so they don't want to. - Richard Branson

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any ...

more