Thursday, December 10, 2020 6:08 AM EDT

Last October, the United States Department of Justice sued Google (GOOGL) accusing the company of illegally using its market dominance to weaken its rivals. During the day yesterday, the Attorney General of New York announced a lawsuit against Facebook (FB) for maintaining a monopoly, in a joint lawsuit by the Federal Trade Commission and 48 of the 50 states that make up the United States.

This investigation has lasted more than 18 months and accuses the company chaired by Mark Zuckerberg of harming competition and exercising a monopoly after the purchase of Instagram and WhatsApp, asking the courts to force the social network to sell both companies and having to receive approval for future acquisitions, which would give exit difficulties to its liquidity.

It should be remembered:

- Facebook bought Instagram in 2012 for 1 billion dollars

- Two years later, it acquired WhatsApp for 19 billion dollars

- This was done in an operation in which Facebook paid 4 billion in cash

- The rest of the amount was paid in shares and both investments boosted Facebook both in its results and in its positioning

This led it to reach a value of more than 800 billion dollars.

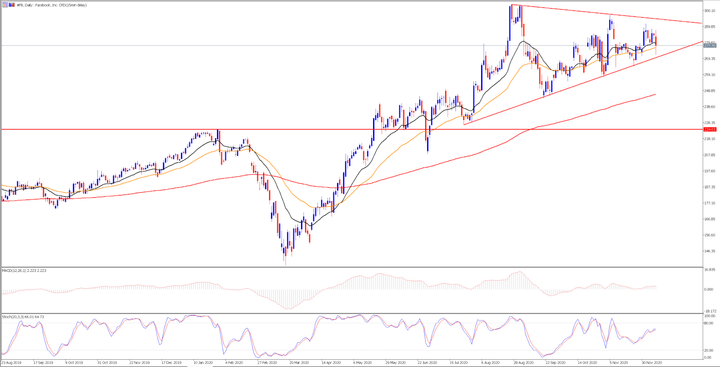

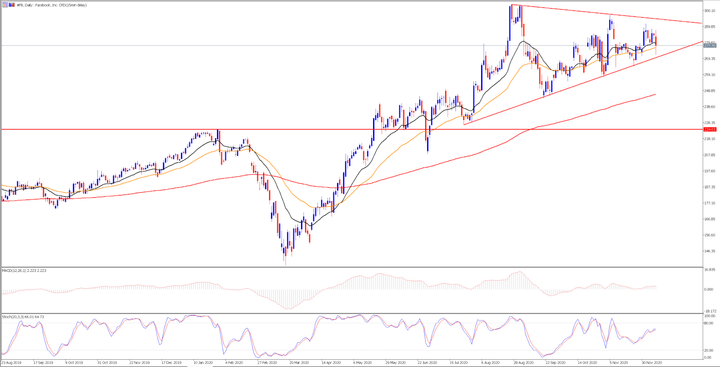

Technically speaking, this demand could generate uncertainty, since legal battles tend to generate suspicions among investors. Facebook is currently in a lateral consolidation in a triangular shape with an upward bias (red), based on its moving averages of short and medium term (black and orange). After setting all-time highs on August 27, this uncertainty may push the price back.

Therefore, it is important to keep an eye on the price action over the next few days and see if it is able to sustain the lower band of this triangle formation. The loss of this level could cause its falls to shift to its moving average in red. The next level of support would be its previous maximum at around $224 a share.

Source: Admiral Markets MetaTrader 5 Supreme Edition, Facebook daily chart (from July 30, 2019, to December 10, 2020).

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter "Analysis") ...

more

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter "Analysis") published on the website of Admiral Markets. Before making any investment decisions please pay close attention to the following:

This is a marketing communication. The content is published for informative purposes only and is in no way to be construed as investment advice or recommendation. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Any investment decision is made by each client alone whereas Admiral Markets Group AS investment firms (Admiral Markets) shall not be responsible for any loss or damage arising from any such decision, whether or not based on the content.

The Analysis is prepared by an independent analyst (hereinafter "Author") based on the Author's personal estimations.

To ensure that the interests of the clients would be protected and objectivity of the Analysis would not be damaged Admiral Markets has established relevant internal procedures for prevention and management of conflicts of interest.

Whilst every reasonable effort is taken to ensure that all sources of the content are reliable and that all information is presented, as much as possible, in an understandable, timely, precise and complete manner, Admiral Markets does not guarantee the accuracy or completeness of any information contained within the Analysis.

Any kind of past or modeled performance of financial instruments indicated within the content should not be construed as an express or implied promise, guarantee or implication by Admiral Markets for any future performance. The value of the financial instrument may both increase and decrease and the preservation of the asset value is not guaranteed.

Leveraged products (including contracts for difference) are speculative in nature and may result in losses or profit. Before you start trading, you should make sure that you understand all the risks.

less

How did you like this article? Let us know so we can better customize your reading experience.