"Extreme Gamma" - Nomura Exposes The Driver Behind This Week's Market Melt-Up (& What Happens Next)

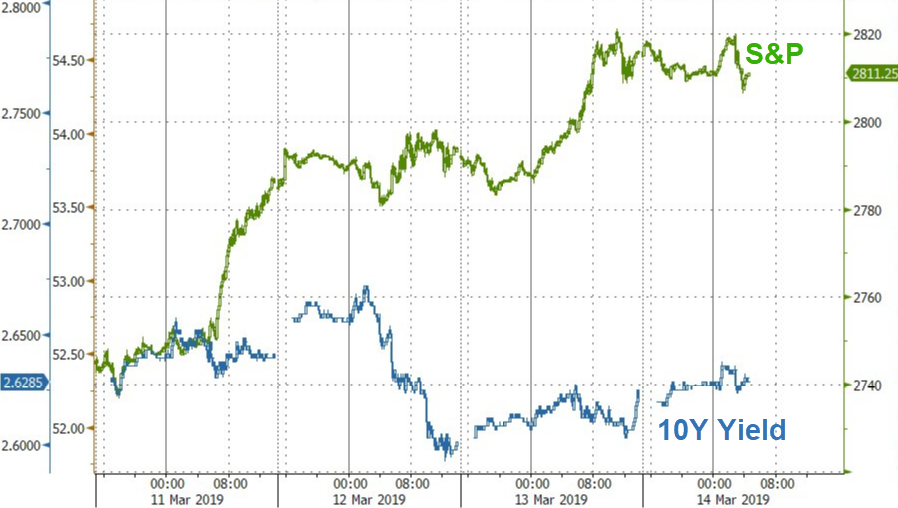

The US equity markets - despite slumping earnings expectations, disappointing macro data, US-China trade deal uncertainty, and Brexit chaos - has surged this week (in the face of total denial by the bond market).

Every dip has been bought and every 'worry' excused - except bonds ain't buying it.

So what is going on?

Nomura's Charlie McElligott, managing director of cross-asset strategy, has the answer. First things first, the catalysts are:

-

Buybacks (Healthcare, Tech, Industrials, and Fins are the top 4 S&P sectors today and are 4 of the top 5 Buyback desk ‘executed’ sectors, with Mutual Fund Overweights / Megacaps +1.4% vs S&P +1.0% and RTY +0.8%, respectively)

-

Overwriters continue to systematically roll-out into Friday’s Quad Witch OpEx, driving a dealer “delta-grab” and further spurring mkt gains

-

Finally, VIX term-structure continues to compress and steepen further into contango, with systematic roll-down strats in “high cotton” again shorting volatility (VIX back to Oct 3rd / pre-Powell “a long way” from neutral on interest rates comment the following day)

But the big driver is more simple - its March Quad Witch Week!

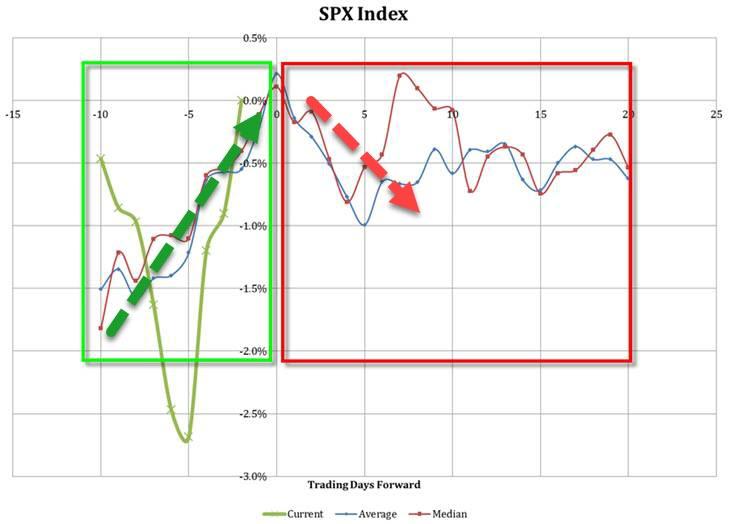

The “March Surprise” window-for-stock-pullback scenario has, of course, anticipated this type of “melt-up” into Friday’s options expiration, as that’s the seasonality of “up into OpEx, down out of OpEx.”

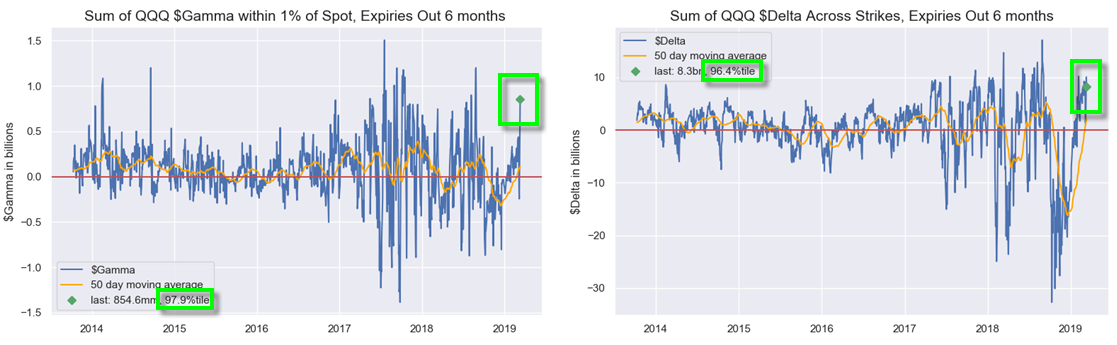

There is ‘extreme’ gamma and delta - the sum of QQQ (Nasdaq) $Gamma within 1% of spot currently 98th %ile, while the sum of QQQ $Delta across strikes is 96th %ile), especially as the forced dealer delta grab via overwriter roll-outs CEASE and aligns with the buyback blackout commencement...

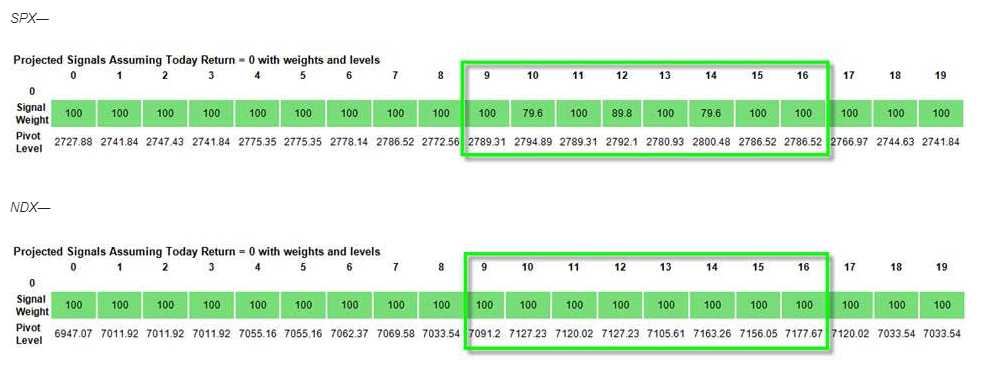

...On top of our systematic trend “sell trigger” levels being mechanically “pulled-higher” looking-out the next ~9-16 days which means only a modest move lower could risk of a repeat of last week’s “flip sellers” behavior from CTAs

In the interest of being 'fair and balanced' however, McElligott lays out the current consensus "Goldilocks narrative"

-

In Rates, the US yield curve is again attempting to steepen post the slightly tailing 30Y auction earlier...but still struggling to break meaningfully higher without either 1) a ‘bad data’ acceleration which would see the mkt “pull-forward” / grow Fed easing expectations (bull-steepener)…or from the opposite side of the spectrum, 2) a further ‘reflationary’ impulse (bear-steepener), whether driven from an actual inflation data upside surprise, an escalation of Chinese easing / stimulus or a “hard shift” in the Fed inflation framework

-

This then again speaks to the current ‘goldilocks’ stasis (today’s CapEx (+) US Durable Goods “Orders” and “Shipments for Non-Defense,” versus misses again in PPI after today's CPI whiff as well) of “slowing-but-still-expansive US econ with decelerating inflation,” but still with the ongoing support of the strong consumer and labor mkts—which then reiterates the rationale behind the multi-year legacy US Equities portfolio positioning “long Growth, short Value” which remains a “Seculars over Cyclicals” bet into an increasingly “end-of-cycle”- looking economy

-

These “Growth Longs” are known / high-conviction names which are “comfort blankets” for Equities PM’s due to their past performance and thanks to their ability to grow profits without a “hot” economy and their “quality-like” high cash levels (which come via a funding-advantage vs Cyclicals—thus Growth’s positive correlation to a flattening yield curve)…and thus are de facto “long-duration” assets as they benefit from lower-yields, which justify their valuations

-

This “low rates supporting current market valuations” then has become a common refrain from the Equities buy-side, which realizes that thus far in 2019, US stock markets are up because of multiples, not earnings

So what happens next week is clear - and returning to the first chart above, what will The Fed's reaction be if stocks catch down to bonds' pessimistic perspective?