Expect Helen Of Troy To Crush Analyst Estimates Next Week

Our quantitative earnings model predicts that Helen of Troy's (Nasdaq: HELE) Q1 EPS and revenue numbers will dramatically exceed analyst expectations. The company is expected to release earnings after the market close on Wednesday, July 8th.

We'll start by providing our projections, proceed to an explanation of the rationale behind the projections, and finish with some additional analysis and supplementary charts. Our track record of past quarterly earnings predictions made by the model can be found here.

EPS Projections

On average, Wall Street analysts expect Helen to report $1.06 in EPS for the quarter. Our model projects a 65-75% probability that Helen will beat these projections. It expects a large beat (5-10%) on consensus estimates, implying Q1 EPS will actually be between $1.11 to $1.16.

Revenue Projections

On average, sell-side analysts on Wall Street expect Helen to report sales of $347 million for the quarter. Our model projects a 65-75% probability that Helen will beat these projections. It expects a small beat (0-5%) on consensus estimates, implying that Q1 revenue will actually be between $347m to $364m.

Rationale

Analyst estimates are consistently too conservative as companies beat earnings estimates over 60% of the time. Analysts may do this to stimulate trading (e.g., Hayes 1998), to obtain access to management (e.g., Lim 2001) or to confirm a prior sentiment on a stock (e.g. Hwang 1996). Either way, analysts are incentivized to "play nice" with the companies they cover, and this manifests itself in earnings estimates that are consistently lower than they should be.

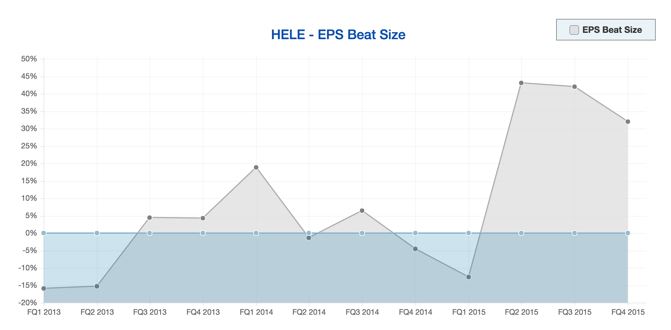

This pattern of earnings estimate manipulation can be taken to the extreme in certain companies. Thus, the most important factor to analyze when predicting whether a company will beat earnings estimates ahead of time is to look at its past track record of estimate beats. Helen's EPS beat history is shown below:

Last quarter, Helen beat the analyst consensus EPS estimate by 32%. This was the third quarter in a row that the company beat EPS estimates and its seventh beat in the last 10 quarters (see Table 1.1 in Appendix). Helen clearly has a history of crushing analyst EPS expectations.

Last quarter EPS was also 92% higher than it was the same quarter the year before. This is important, as companies that are growing their EPS at a high rate are more likely to beat future earnings estimates. For whatever reason, analysts tend to be overly conservative when estimating the EPS of fast-growing companies.

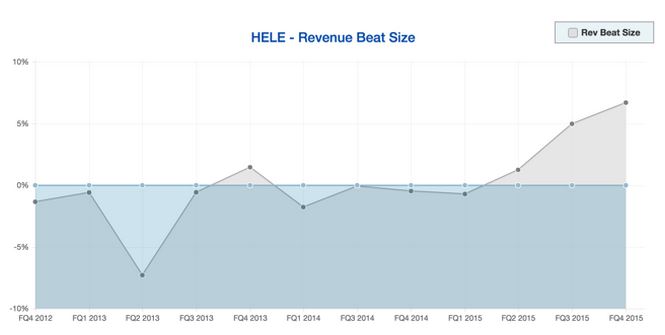

The same logic applies for revenue estimates. Helen's revenue beat history is shown below:

Last quarter, Helen beat the analyst revenue consensus estimate by 6.7%. This was the third quarter in a row that the company beat revenue estimates but just its fourth beat in the last 10 quarters (see Table 1.2 in Appendix). Last quarter revenue was 21% higher than it was the same quarter the year before. Helen's revenue history is not as strong as its EPS track record, but still solid overall.

Another factor that plays a big role in our predictive model is the recent performance of Helen's stock price. We've found through extensive historical back testing that the market tends to anticipate strong earnings ahead of time, and thus stocks are bid up in price ahead of earnings.

The chart below shows Helen's price performance the last six months, and compares it to the average six-month performance of stocks in the household durables industry group, the consumer discretionary sector, and the overall market. It also includes the top five household durables stocks ranked by six-month price performance for comparison:

Over the last six months, Helen's stock price has gained 51.58%. This is compared to the industry group average of 11.05%, the sector average of 2.95%, and the overall market average of 1.94%. Only 2 (BSET & HOFT) out of the 47 stocks that make up the household durable industry group has gained more in price the last six months, having gained 77.17% and 55.12%, respectively. The market is clearly optimistic on Helen at the moment, and this type of price momentum heading into earnings is a very good sign.

Conclusions

While we're confident that Helen will beat analyst estimates on July 8th, that does not necessarily mean we advise buying the stock before the release. On average, stocks that beat analyst estimates will rise in stock price by around 1-2%, but there is a huge amount of variation around these averages. Many stocks will actually decrease in price after strong earnings releases, because the market can have much higher expectations than Wall St. analysts.

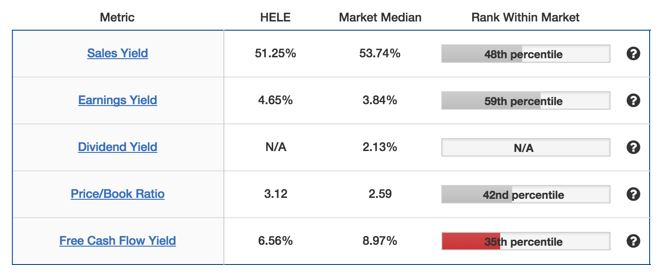

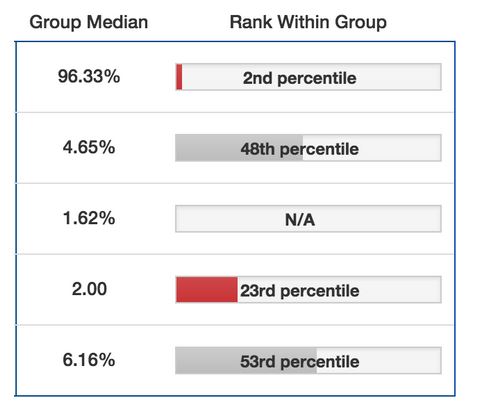

Valuation is the best factor available when determining post-earnings announcement price changes. Cheap value stocks increase in price by a larger margin than expensive stocks after beating earnings estimates (e.g., Zhao 2009). The chart below shows how Helen ranks within the market on five crucial valuation ratios:

Helen falls in the middle of pretty much every valuation metric, implying that the stock is neither expensive nor cheap relative to the market.

The chart below shows the same metrics, but ranks them within the household durables group to get a more relevant comparison:

Helen's valuation within its industry group is less impressive. Its sales yield of 51% (inverse of Price/Sales ratio) ranks near bottom of the group. Its price/book ratio of 3.12x is high relative to the industry median of 2x.

It's tough to say that Helen is undervalued at current prices, though the stock does not look particularly expensive either. Short interest is low at less than 3% of the total float, which means there won't be many forced sellers should the stock beat estimates by a wide margin.

In conclusion, we expect Helen to beat analyst earnings and revenue estimates but for the price reaction to be modest. The stock's relatively fair valuation and low short interest implies that the market's reaction should be mild barring a major revision on projections. We will release a follow up report after the earnings release to detail our long-term expectations for the stock.

Appendix & Supplementary Charts

Table 1.1 - HELE's Quarterly EPS Surprise %

Table 1.2 - HELE's Quarterly Revenue Surprise %

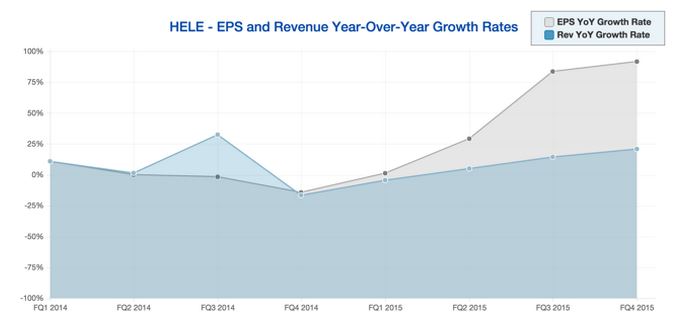

Table 1.3 - HELE's Quarterly EPS & Revenue YoY Growth Rate %

Disclosure: The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company ...

more