Everyone’s Talking Bubbles. Is It Time To Act?

A leading Chinese financial official is doing it. Market columnists in the US are doing it too. Perhaps the only question left: Who’s not chattering, worrying and otherwise obsessing over market bubbles these days?

You may have to dig deep to find a bubble-free discussion. To be fair, the US stock market appears stretched. Deciding if it’s in a bubble is another matter. Even harder: If there is a bubble, is it in imminent danger of bursting? The stock answer, as always: Maybe.

There’s plenty of intelligent things to say about market bubbles – but there’s even more dross. Let’s save you some time. Perhaps the single-most useful observation comes from Barry Ritholtz of Ritholtz Wealth Management: “Bottoms are easier to spot and harder to act on; It is easy to see a ‘false top,’ and much easier to act on it.”

Most observers agree that there’s a glut of data suggesting that if the market isn’t in a bubble, it’s certainly expensive. Or perhaps it’s safer to say the market’s not cheap. Whatever the appropriate label, the numbers speak clearly, as Bloomberg columnist John Authers helpfully points out with several charts profiling the market’s ascendance of late in relative terms.

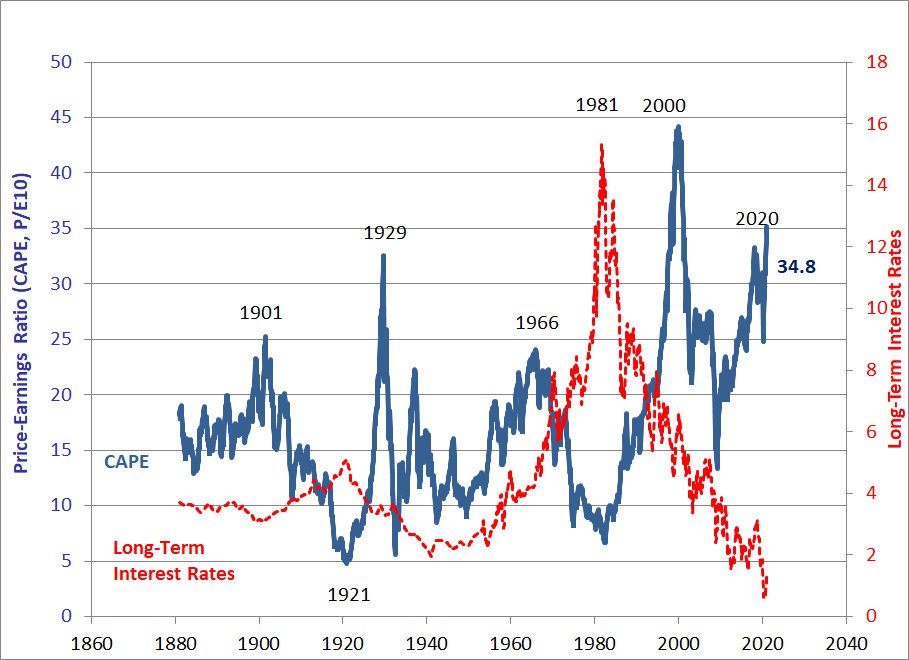

For example, the cyclically adjusted price-earnings multiple (CAPE) designed by Professor Robert Shiller is flying high these days. “By my back-of-the-envelope calculation, the CAPE is back above 35 for only the second time in history, a figure that is hard to ignore,” Authers observes.

(Click on image to enlarge)

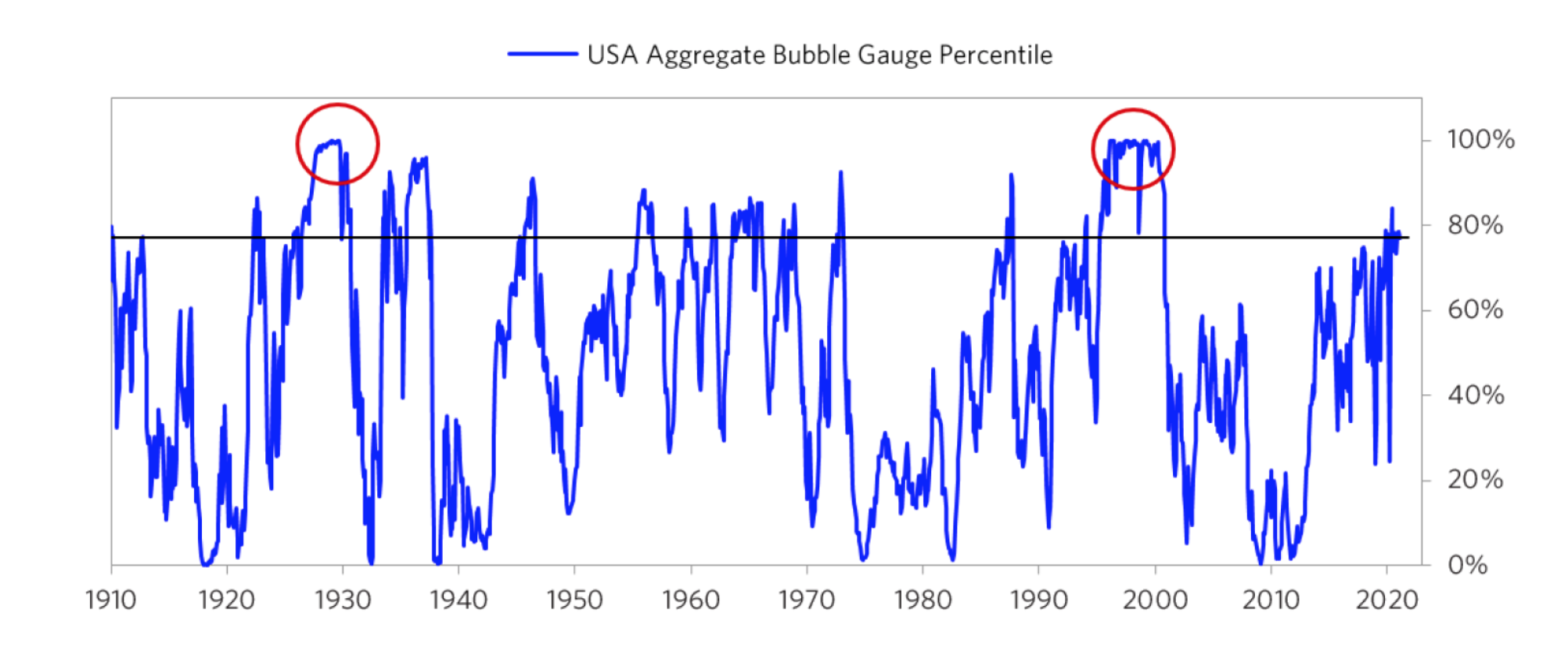

Ray Dalio, who runs the hedge fund giant Bridgewater Associates, recently outlined six tests for assessing bubbles in our midst:

1. How high are prices relative to traditional measures?

2. Are prices discounting unsustainable conditions?

3. How many new buyers (i.e., those who weren’t previously in the market) have entered the market?

4. How broadly bullish is sentiment?

5. Are purchases being financed by high leverage?

6. Have buyers made exceptionally extended forward purchases (e.g., built inventory, contracted forward purchases, etc.) to speculate or protect themselves against future price gains?

By Dalio’s estimate, “the aggregate bubble gauge is around the 77th percentile today for the US stock market overall. In the bubble of 2000 and the bubble of 1929 this aggregate gauge had a 100th percentile read.”

(Click on image to enlarge)

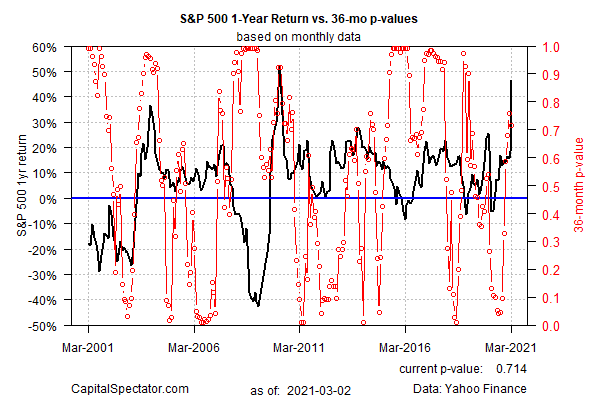

The Capital Spectator’s econometric estimate of S&P 500 bubble risk is telling a similar story (see this background piece on the model). The basic approach here is to calculate the rolling 12-month percentage change in the monthly average of the S&P 500 Index and search for a unit root (or the absence of one) via the Augmented Dickey-Fuller test. In short, use a statistical test to identify periods when the one-year return looks unusually high (with indicator values ranging from 0 to 1.0). On this basis, the current reading is roughly 0.71 — elevated but not extremely so.

Perhaps the critical question is whether we should even filter market activity through a bubble lens for investment management purposes? An alternative framework is to analyze market trends in terms of fluctuating expected return.

On this basis, bubble talk isn’t helpful. To be sure, there is a relationship between ex ante results and current valuation and on that basis investors should be lowering expectations for the US equity market. What does that mean in practice? It depends on the investor.

You don’t have to be a rocket scientist to recognize that softer expected returns imply taking some risk exposure off the table. How that unfolds in practice depends on many details that are unique to each investor – time horizon, risk tolerance, and other factors.

There are some investors who can and should ignore low expected returns; for others, low return projections are a warning to run for cover. For the majority of investors, however, prudent portfolio adjustment falls within the countless shades of gray between those two extremes.

Accordingly, the most important bit of analysis an investor should focus on with regards to bubbles has nothing to do with the current state of affairs. Rather, ask yourself a simple question: How should you adjust risk exposure in your portfolio through time as expected return fluctuates across the major asset classes? If you know the answer, you can leave bubble talk to the columnists.

Disclosures: None.