EUR/USD: Time To Take Profits? Three Reasons Why The Euro Could Fall From Here

Will Donald Trump be found guilty or be acquitted? While the political world is focused on the trial in the Senate, markets are not culpable for forgetting about critical US stimulus and selling the dollar. Yet that may change quickly. Pushing speculation of a gargantuan relief bill has been allowing money to flow back to bonds, resulting in lower yields and making the greenback less attractive. EUR/US has benefitted from the decline in returns on US debt and also from the cheerful market mood.

Is it time for a reversal? There are three reasons to suspect a correction is coming.

1) Powell power

Jerome Powell, Chairman of the Federal Reserve,. is set to deliver a speech on the labor market later in the day. The latest Nonfarm Payrolls report has shown that job growth is meager and the powerful central banker may use his public appearance to urge lawmakers to act. Investors may respond to such a reminder by selling bonds in expectations of higher debt issuance, boosting the dollar.

Ahead of Powell’s speech, America’s inflation figures for January may edge higher and also build the case for higher bond yields. According to Purchasing Managers’ Indicators, price pressures are mounting. Markets will likely focus on the Core Consumer Price Index rather than the headline figure.

2) Europe’s covid situation looks dire

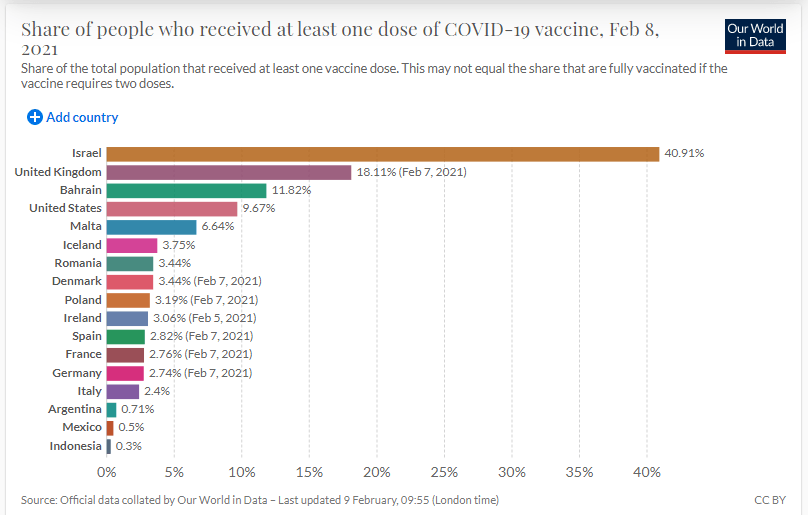

The EU aims to vaccinate 70% of adults through the summer – a goal that looks elusive with every day that passes and immunization figures only slowly climb. Deliveries of doses are scheduled to arrive in the old continent during February, but the quantities are low and distribution sluggish.

European countries are lagging behind the UK and the US:

(Click on image to enlarge)

Source: OurWorldInData

In the meantime, the virus continues taking its health and economic toll/ Germany will likely extend its lockdown well into March, perhaps until the middle of next month, as cases and hospitalizations remain elevated.

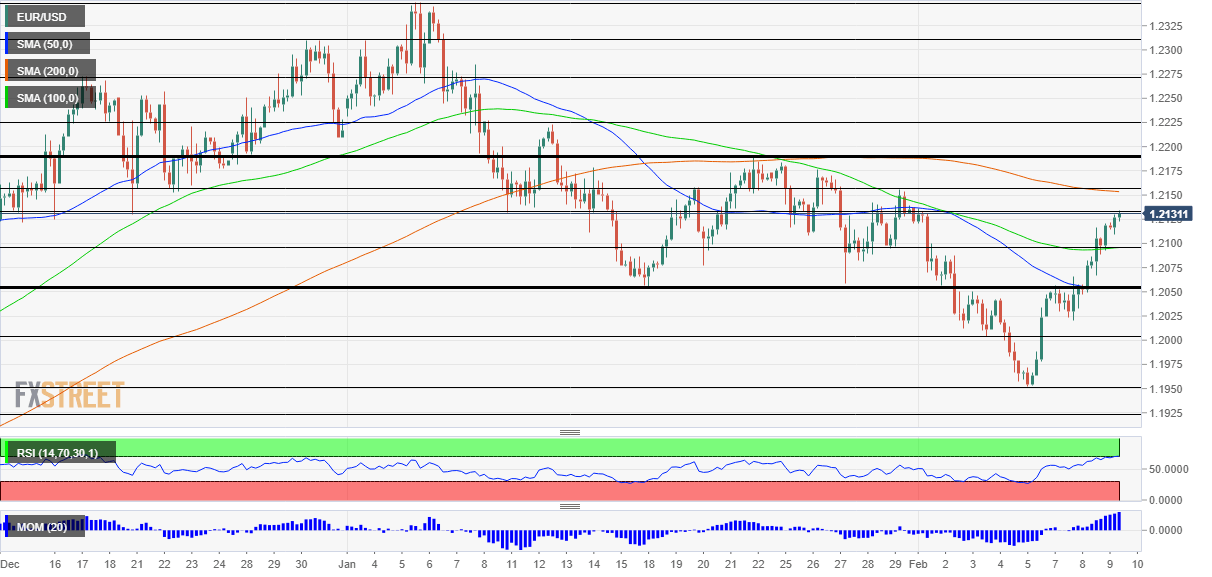

3) EUR/USD looks overbought

(Click on image to enlarge)

The Relative Strength Index is just above 70 – in overbought territory. This development indicates a correction. Moreover, while the currency pair has topped the 50 and 100 Simple Moving Averages, it is capped by the 200 SMA.

Support awaits at 1.2095, which is where the 100 SMA hits the price. It is followed by 1.2050, a robust separator of ranges. Further down, 1.20 and 1.1950 come into play.

Resistance awaits at 1.2145, where the 200 SMA awaits the pair, followed by 1.2190, a stubborn cap from mid’January. Further above, 1.2225 awaits.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more