EUR/USD: Three Reasons Why The Euro Is Set To Extend Its Falls

Time to give back weekly gains? EUR/USD has been retreating from the highs and may have substantially more room to give up previous gains as the week draws to a close.

There are three fundamental downside drivers:

1) US yields have ended their correction

Returns on US debt remain the main market driver – and when they rise, the dollar moves higher as well. The rise in ten-year yields above 1.60% is critical.

The latest trigger came from President Joe Biden’s national address just after signing the $1.9 trillion coronavirus package into law and unleashing stimulus checks to Americans. The most significant headline was that he aims that all Americans will be eligible for vaccines in early May – beating the schedule once again.

The mix of stimulus funds and a quicker reopening joined a minor upside surprise in jobless claims and made safer Treasuries less attractive to investors. The University of Michigan’s preliminary Consumer Sentiment Index for March is set to edge up as well. The greenback remains well bid.

2) ECB – is that it?

While the Federal Reserve sees higher yields as a healthy sign of growth, higher returns on European debt only serve as headwinds for the fragile recovery. The European Central Bank sought to address this by accelerating its bond-buying program “significantly” in the second quarter.

However, the scope of the plan remains unchanged at €1.85 trillion. Moreover, this Pandemic Emergency Purchasing Program (PEPP) is still on course to expire in March 2022. Accompanied by confusing messages from ECB President Christine Lagarde, the euro remains vulnerable.

3) Vaccine issues

Europe’s sluggish growth forecasts are highly correlated with its slow vaccine rollout – and the situation has further worsened. While regulators approved Johnson & Johnson’s single-shot inoculations, only small deliveries are due.

Worse, the EU is heavily reliant on AstraZeneca’s jabs, and additional issues have surfaced. Supplies are delayed once again, and in some countries, they have halted altogether due to concerns that the doses result in blood clots. Reluctant take-up of Astra’s jabs had already caused delays. On the other hand, massive use of the pharma firm’s solution in the UK has proved safe and efficient.

All in all, vaccination remains a substantial Achilles Heel for the old continent and the euro.

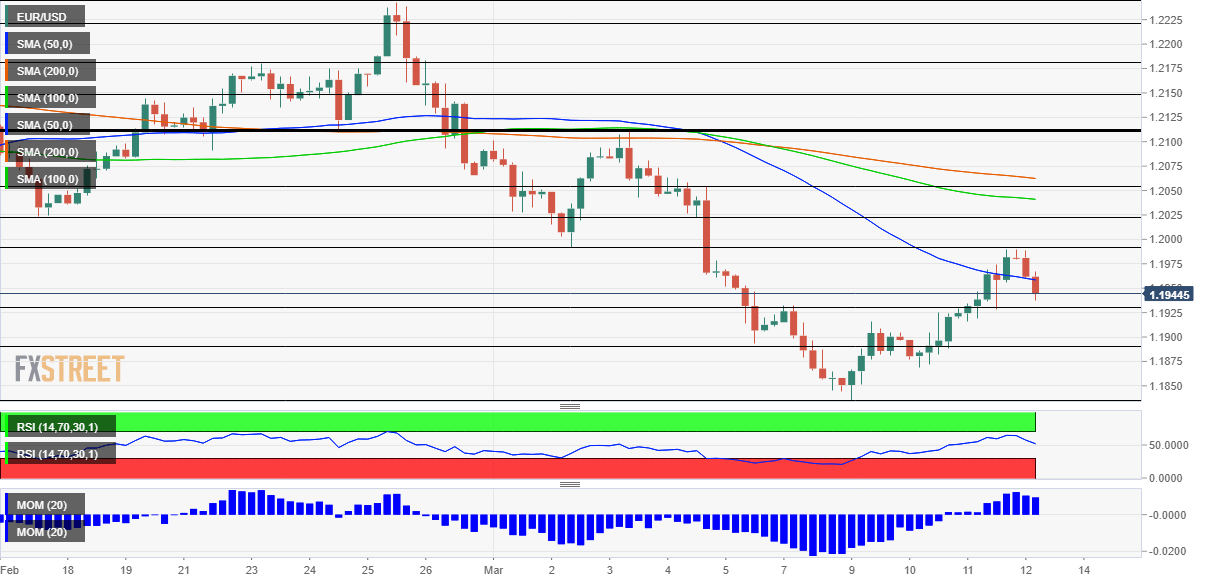

EUR/USD Technical Analysis

(Click on image to enlarge)

While momentum on the four-hour chart remains to the upside, the pair slipped below the 50 Simple Moving Average on the four-hour chart – a bearish sign.

Support awaits at 1.1925, which capped the pair early in the week. It is then followed by 1.1895, a temporary cushion and finally by 1.1836, the 2021 trough.

Resistance awaits at 1.1990, the weekly high and also a support line seen early in March. It is followed by 1.2025 and 1.2050.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more