EUR/USD Set To Tumble Until Markets Throw A Tantrum, Levels To Watch

- EUR/USD has been falling alongside as US yields rally.

- The greenback is set for more gains unless the Fed acts.

- Monday’s four-hour chart is painting a bearish picture.

It seems that only another taper tantrum can halt the dollar’s ascent – but for now, the Federal Reserve is tolerating higher returns on Treasuries, allowing the dollar to rise. Higher returns on ten-year bonds – which soared above 1% – have been supporting the greenback.

Richard Clarida, the bank’s Vice-Chairman, said on Friday that he wants to leave the current pace of bond-buying, Earlier, Raphael Bostic, President of the Atlanta branch of the Federal Reserve, hinted he would be willing to taper the pace of the Fed’s purchases.

Clarida’s comments on Friday came despite the disappointing Nonfarm Payrolls figures – the US lost 140,000 jobs in December, worse than expected. The data was only partially offset by upward revisions to previous months and an increase in wages.

Investors sold off bonds after Democrats won effective control of the Senate, allowing them to pass generous stimulus plans and issue more debt. President-elect Joe Biden is scheduled to present his economic plans on Thursday, the same day that Jerome Powell, Chairman of the Federal Reserve, speaks.

The Fed is seeing through the current hardship and is looking forward toward the vaccine-led recovery. Higher yields reflect optimism, which it welcomes – at least for now.

What will it take for the powerful central bank to boost bond buys and send the dollar down? A stock market sell-off. The Fed seems unwilling to see “financial conditions” – aka equities – suffer. If investors throw a 2013-style tantrum – when shares fell on the mere hint that the Fed would slow Treasury purchases – Powell may change his mind.

Dems’ Georgia victories are behind the significant dollar rise, not the historic mob storming of the Capitol. So far, markets are shrugging off the political drama in Washington, which is set to result in the second impeachment of outgoing President Donald Trump for inciting violence.

In the meantime, COVID-19 continues raging on both sides of the Atlantic, while the vaccination pace remains sluggish. So far, only around 2% of Americans received at least the first jab, while in most European countries the ratio is below 1%. Investors would need to see immunization stats rising and COVID ones falling.

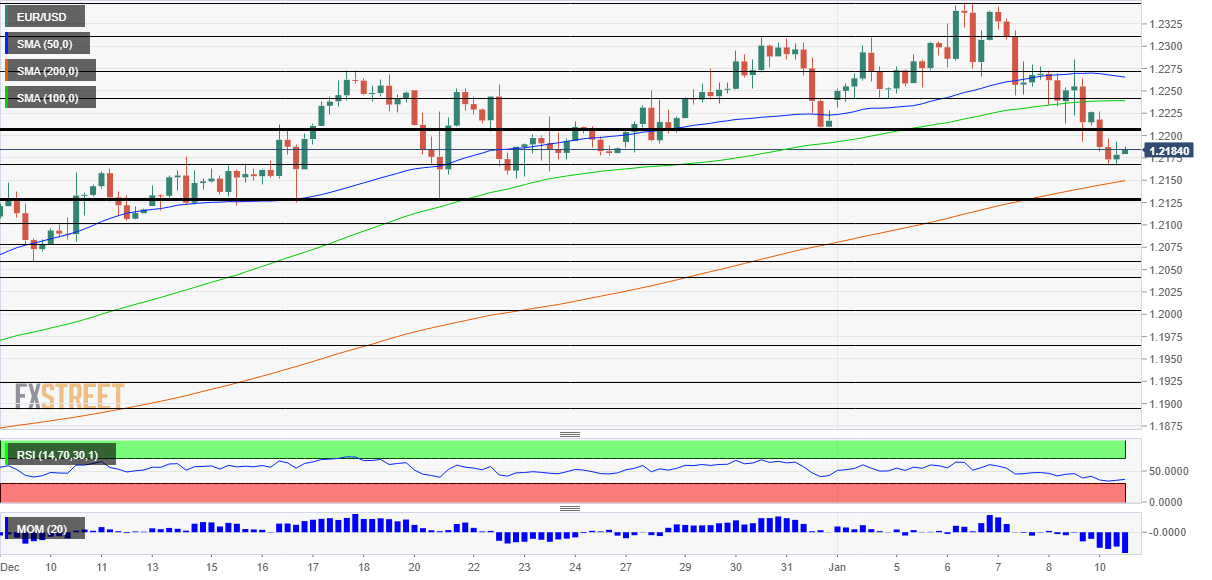

EUR/USD Technical Analysis

Euro/dollar has dropped below the 50 and 100 Simple Moving Averages on the four-hour chart and momentum turned sharply to the downside. The Relative Strength Index remains above 30 – outside oversold conditions and allowing for more falls.

Some support awaits at the daily low of 1.2165 – which is the lowest in three weeks. It is followed by 1.2125 – a critical support line that supported EUR/USD more than once in December. Further below, 1.21, 1.2080, and 1.2160 are eyed.

Robust resistance awaits at 1.2205, which was a swing low in late 2020. It if followed by 1.2240, which is where the 100 SMA hits the price. Further above, 1.2275, 1.2310, and 1.2350 come into play (FXE, UUP).

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more