EUR/USD Recovery Emerges With RSI On Track To Threaten Downward Trend

EUR/USD seems to have reversed course ahead of the November low (1.1603) as it initiates a series of higher highs and lows following the limited reaction to the US Non-Farm Payrolls (NFP) report, but the broader outlook remains geared towards the downside as the exchange rate trades back within the downward trending channel from earlier this year.

It remains to be seen if the account of the ECB’s March meeting will influence the near-term outlook for EUR/USD amid the recent slowdown in the pace of the pandemic emergency purchase program (PEPP), but the central bank appears to be on track to retain the current course for monetary policy as Chief Economist Philip Lane argues that “the increase in inflation during 2021 can be best interpreted as the unwinding of disinflationary forces that took hold in 2020 and does not constitute the basis for a sustained shift in inflation dynamics.”

In a recent blog post, Lane warns that “the projected medium-term inflation rate remains subdued amid still-weak demand and substantial slack in labor and product markets,” with the official going onto say that “inflation is projected to reach only 1.4 per cent by 2023, well below the Governing Council’s inflation aim.”

In turn, the account of the ECB meeting may strike a similar tone as the central bank relies on its non-standard tools to achieve its one and only mandate for price stability, and the Euro may face headwinds ahead of the next interest rate decision on April 22 as “the Governing Council expects purchases under the PEPP over the next quarter to be conducted at a significantly higher pace than during the first months of this year.”

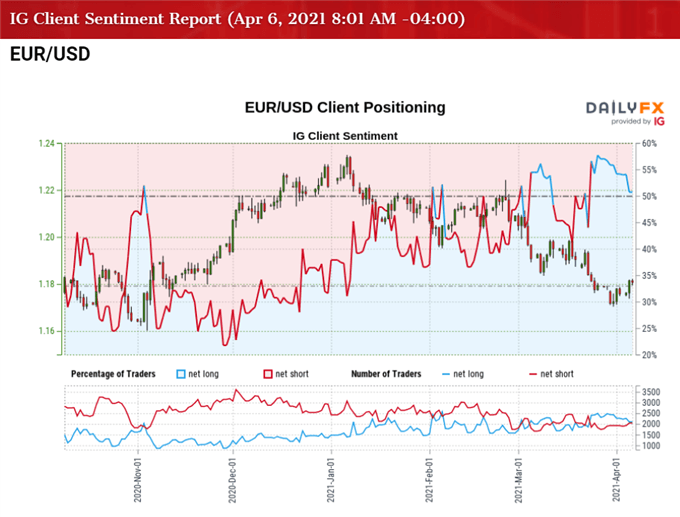

Until then, the Euro stands at risk of facing headwinds as President Christine Lagarde and Co. retain a dovish forward guidance for monetary policy, and the decline from the January high (1.2350) may turn out to be a change in EUR/USD behavior rather than a correction in the broader trend as the depreciation in the exchange rate spurs a shift in retail sentiment, with traders flipping net-long for the fifth time in 2021.

The IG Client Sentiment report shows 50.53% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 1.02 to 1.

The number of traders net-long is 6.55% lower than yesterday and 7.90% lower from last week, while the number of traders net-short is 6.03% higher than yesterday and 5.37% higher from last week. The decline in net-long interest has alleviated the recent flip in retail sentiment 56.39% of traders were net-long EUR/USD during the previous week, while the rise in net-short position comes as the exchange rate trades back within the descending channel from earlier this year.

With that said, the recent rebound in EUR/USD may end up being short-lived as the ECB plans to ramp up the pace of the PEPP throughout the second quarter of 2021, but looming developments in the Relative Strength Index (RSI) may foreshadow a larger rebound in the exchange rate if the oscillator breaks out of the downward trend from earlier this year.

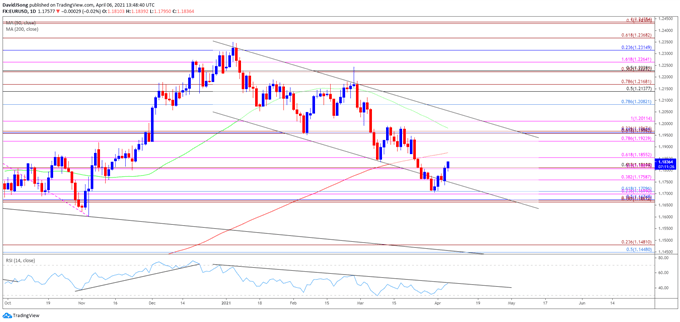

EUR/USD RATE DAILY CHART

Source: Trading View

- Keep in mind, the EUR/USD correction from the September high (1.2011) proved to be an exhaustion in the bullish price action rather than a change in trend following the string of failed attempts to close below the 1.1600 (61.8% expansion) to 1.1640 (23.6% expansion) region, with the Relative Strength Index (RSI) reflecting a similar dynamic as the oscillator broke out of the downward trend to recover from its lowest readings since March.

- However, EUR/USD has reversed course following the failed attempt to test the April 2018 high (1.2414), with the exchange rate extending the decline from the January high (1.2350) to trade below the 200-Day SMA (1.1876) for the first time since May 2020.

- In turn, EUR/USD may continue to track the descending channel from earlier this year as the 50-Day SMA (1.1981) reflects a negative slope, but looming developments in the Relative Strength Index (RSI) may foreshadow a larger rebound in the exchange rate if the oscillator breaks out of the downward trend from earlier this year.

- Lack of momentum to push below the Fibonacci overlap around 1.1700 (23.6% expansion) to 1.1710 (61.8% retracement) has pushed EUR/USD back above the 1.1810 (61.8% expansion) region, with the recent series of higher highs and lows in the exchange rate bringing the 1.1860 (61.8% expansion) area on the radar.

- Next region of interest comes in around 1.1920 (78.6% expansion) followed by the overlap around 1.1960 (61.8% expansion) to 1.1970 (23.6% expansion), which largely lines up with channel resistance.

Disclosure: See the full disclosure for DailyFX here.