EUR/USD Re-Tests Confluent Support As USD Grinds At Resistance

LOW LIQUIDITY PLUS HIGH-IMPACT DATA BRINGS POTENTIAL FOR HOLIDAY VOLATILITY

Tomorrow brings the Thanksgiving holiday in the United States and the day after is ‘Black Friday,’ which means we’ll likely be looking at lower-liquidity conditions in global markets into the end of this week. That does not mean, however, that there are no other items of interest as a couple of German releases are on the economic calendar for tomorrow morning; and with less liquidity in markets, the potential for volatility remains, particularly if that data prints far outside of the expected range.

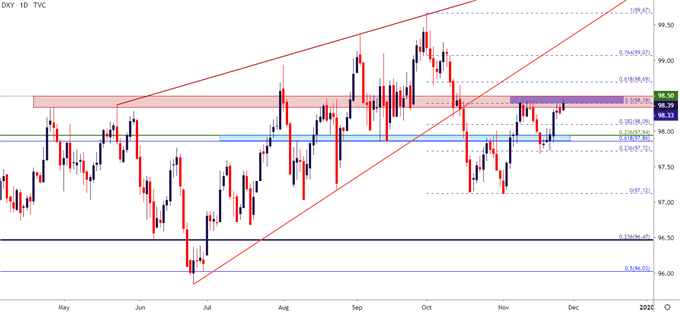

In the US Dollar, price action is in an interesting spot ahead of the holiday. October brought bears into the mix as the USD fell through the bottom of a rising wedge formation, but the first half of November was marked by a return of the USD bull. Buyers pushed up to a key resistance area on the chart, and that held the highs mid-month, but sellers were unable to retain control and USD price action has shot right back up to that key area on the chart running from 98.33-98.50.

US DOLLAR DAILY PRICE CHART

(Click on image to enlarge)

Chart prepared by James Stanley; US Dollar on Tradingview

At this stage, the frequency of those resistance revisits combined with a waning impact from sellers on each recurrent test and a topside break begins to look more likely, especially considering a low-liquidity backdrop that will likely show over the next couple of days.

If a topside break does show, the next area of interest is around the 98.70 level, taken from the 61.8% retracement of the October sell-off combined with a prior swing-low. Beyond that, the next big area on the chart is around the 99.00 level on DXY.

But, for the US Dollar to get there, it’s likely going to need a bit of help from the Euro, which will be looked at below.

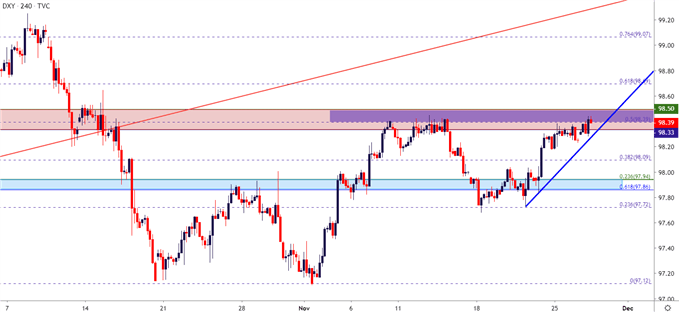

US DOLLAR FOUR-HOUR PRICE CHART

(Click on image to enlarge)

Chart prepared by James Stanley; US Dollar on Tradingview

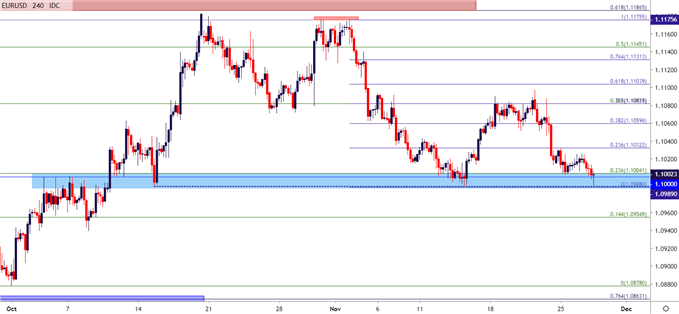

EUR/USD HOLDS SUPPORT AT KEY AREA ON THE CHART – BUT FOR HOW MUCH LONGER?

I had looked at this support zone coming into this week and it did help to hold an early-week test in the EUR/USD pair. But, buyers didn’t exactly take control of matters and price action reverted right back to this very key area on the chart, showing in an approximate 17-pip zone from the November swing low of 1.0988 up to the Fibonacci level at 1.1004. As looked at in yesterday’s webinar, bullish swings or short-term bullish reversals seems the most attractive manner of addressing the pair at this point. But, given the persistence from sellers combined with the headline risk on tomorrow morning’s docket, and bearish scenarios should at least be entertained as a possibility.

EUR/USD FOUR-HOUR PRICE CHART

(Click on image to enlarge)

Chart prepared by James Stanley; EURUSD on Tradingview

EUR/USD BREAKDOWN POTENTIAL

The potent combo of high-impact data with low-liquidity can spell for fast moves in a market, and given the area of support that’s in-play on the EUR/USD pair right now, and breakdown potential remains going into tomorrow.

But, with that said, proximity from recent swing-highs can make anticipation of that scenario a challenge and, instead, traders can look to address the manner with short-side breakout logic, looking for a push below the November low of 1.0988 to open the door for a re-test of the Fibonacci level at 1.0956. At that point, stops can be adjusted to break-even while further targets are sought on the remainder of the lot, and additional target potential exists around 1.0925, 1.0900 and then the two-year-low currently residing at 1.0878.

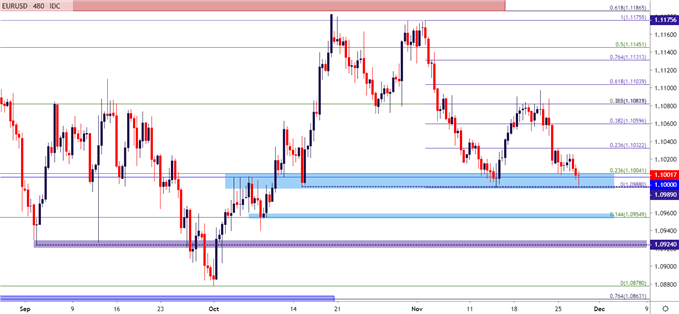

EUR/USD DAILY PRICE CHART

(Click on image to enlarge)

Chart prepared by James Stanley; EURUSD on Tradingview