EUR/USD Rate Forecast: Bearish Series Brings 2019 & 2018 Low On Radar

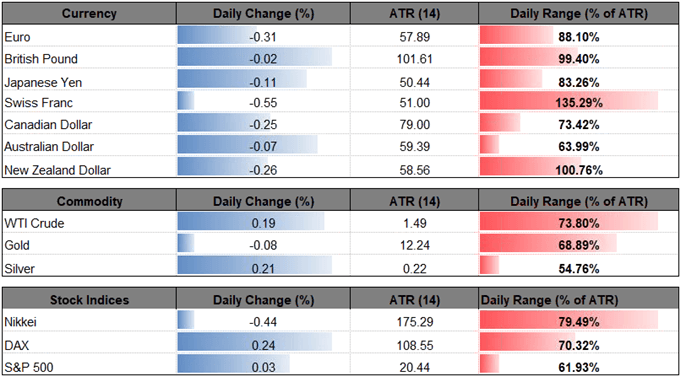

EUR/USD extends the decline from earlier this week as fresh data prints coming out of the U.S. instill an improved outlook for the economy, and the exchange rate may continue to consolidate ahead of the European Central Bank (ECB) meeting on March 7 as it carves a string of lower highs & lows.

EUR/USD RATE FORECAST: BEARISH SERIES BRINGS 2019 & 2018 LOW ON RADAR

(Click on image to enlarge)

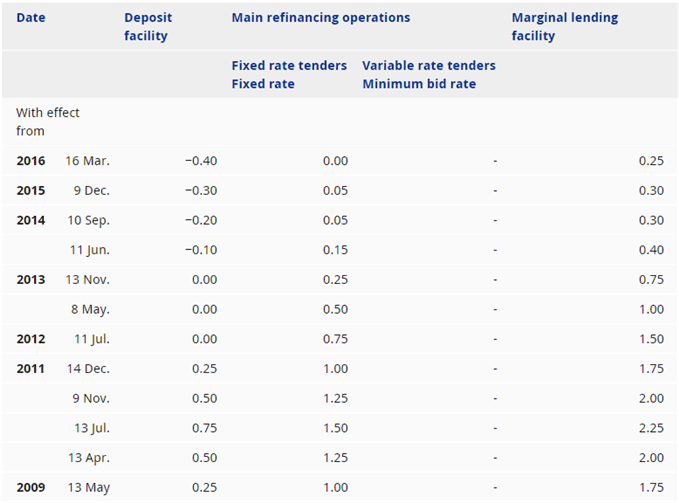

EUR/USD continues to pare the advance from the February-low (1.1234) as the U.S. ISM Non-Manufacturing survey upticks for the first time since November, while New Home Sales unexpectedly increases another 3.7% in December after expanding a revised 9.1% the month prior.

The positive developments may deter the Federal Reserve from abandoning the hiking-cycle as the U.S. economy shows little to no signs of a looming recession, and the central bank may have a difficult time in defending the wait-and-see approach as recent updates to the Gross Domestic Product (GDP) report highlight above-forecast growth along with sticky inflation. In turn, the Federal Open Market Committee(FOMC) may try to squeeze in a rate-hike later this year, and it remains to be seen if Fed officials will continue to project a longer-run interest rate of 2.75% to 3.00% at the next rate decision on March 20 especially as U.S. Non-Farm Payrolls (NFP) are expected to increase another 185K in February.

(Click on image to enlarge)

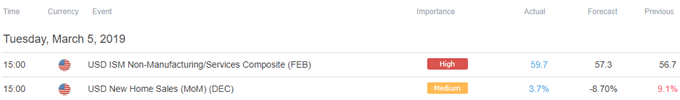

However, the ECB meeting may shake up the near-term outlook for EUR/USD even though the central bank is widely expected to retain the zero-interest rate policy (ZIRP) as officials start to warn that ‘the redemptions of outstanding targeted longer-term refinancing operations (TLTRO) were approaching, which might give rise to “cliff effects.’

In response, President Mario Draghi and Co. may show a greater willingness to further support the monetary union as ‘incoming data had continued to be weaker than expected,’ and fresh comments coming out of the ECB may produce headwinds for the Euro should the central bank hold a growing discussion to roll over its non-standard measures.

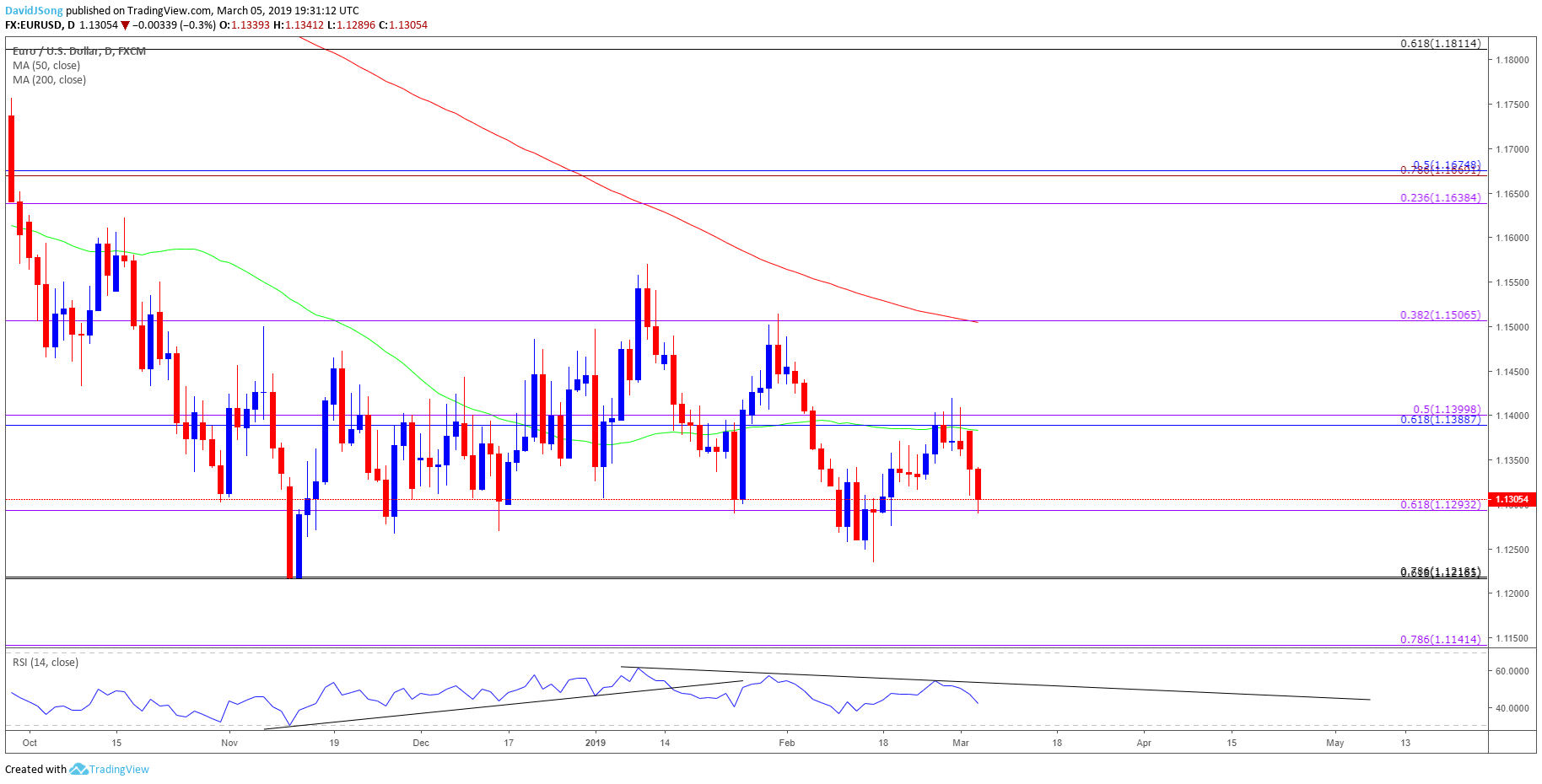

With that said, the range from late-2018 remains on the radar for EUR/USD as both the Fed & ECB endorse a wait-and-see approach for monetary policy, but the rebound from the February-low (1.1234) appears to be unraveling ahead of the key event risks, with the recent string of lower highs & lows bringing the downside targets back on the radar.

EUR/USD DAILY CHART

(Click on image to enlarge)

- EUR/USD is back under pressure following the failed attempt to test the February-high (1.1489), with the recent string of lower highs & lows raising the risk for a move towards the February-low (1.1234).

- In turn, a close below 1.1290 (61.8% expansion) opens up the 1.1220 (78.6% retracement) region, which lines up with the 2018-low (1.1216), with the next downside area of interest coming in around 1.1140 (78.6% expansion).