EUR/USD Price Analysis: A Pennant Breakout In The Offing, Eyes On 1.2200

EUR/USD is prepping up for an upside break from its choppy trend around 1.2150, as the bulls regain control in the European session.

The risk sentiment hanging in balance amid US stimulus hopes, renewed coronavirus concerns while investors await the FOMC decision for fresh directives.

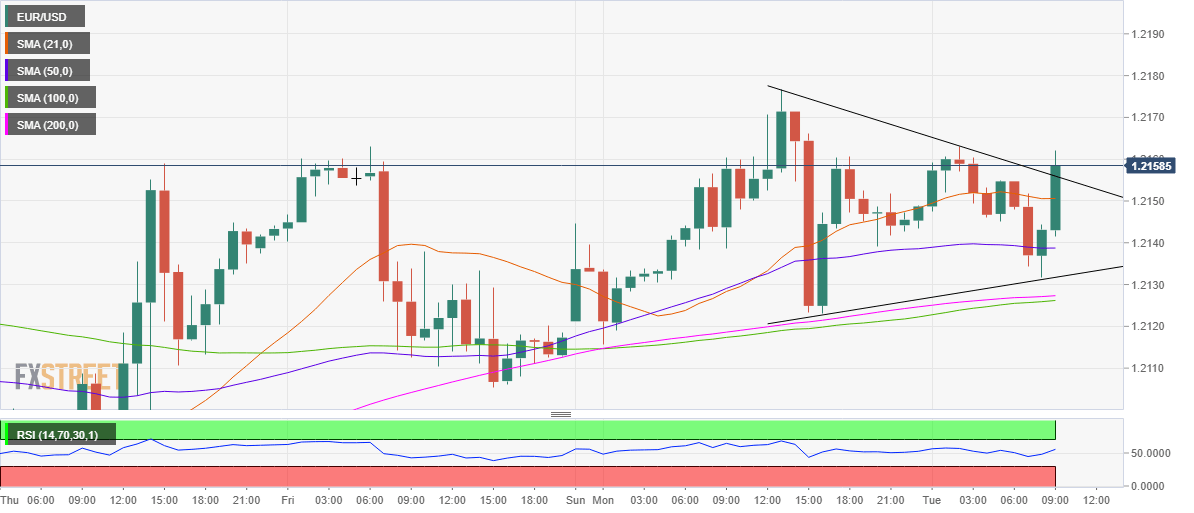

From a near-term technical perspective, the main currency pair is on the verge of confirming a pennant breakout if it manages to close the hour above the falling trendline resistance at 1.2156.

The Relative Strength Index (RSI) looks north above the 50.00 level, backing the case for the additional upside. Meanwhile, the price has managed to regain the horizontal 21-hourly moving average (HMA) at 1.2150.

The next stop for the bulls is seen at the 2020 tops of 1.2178, above which a test of the 1.2200 level is inevitable.

On the flip side, the 21-HMA could offer immediate support. A breach of the last could bring the 50-HMA resistance now support at 1.2139 back in play.

An hourly closing below the rising trendline support at 1.2131 could revive the EUR bears, exposing the critical support at 1.2127, where the 100-HMA coincides with the 200-HMA.

EUR/USD: Hourly chart

(Click on image to enlarge)

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more